Agriculture remains one of the world’s most essential yet unpredictable industries, with farmers facing constant threats from weather-related disasters that can destroy entire seasons of work in a matter of hours. From devastating droughts that wither crops to floods that wash away fertile soil, extreme weather events have become increasingly frequent and severe due to climate change. Traditional insurance systems, while offering some protection, often fall short in providing timely, affordable, and accessible coverage to the farmers who need it most, particularly smallholder farmers in developing regions.

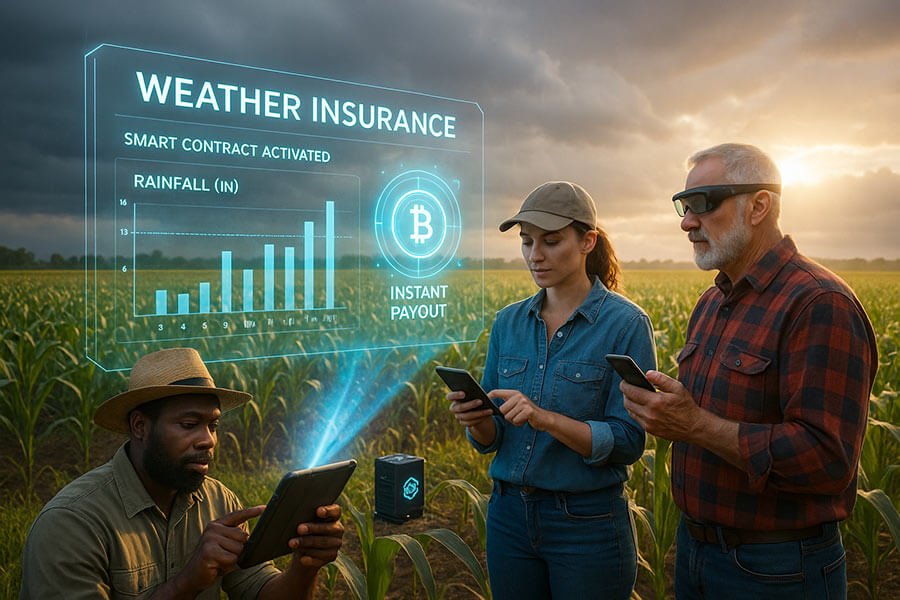

The emergence of cryptocurrency and blockchain technology is revolutionizing how we approach agricultural risk management, creating innovative solutions that address the fundamental limitations of conventional weather insurance. By leveraging digital currencies, smart contracts, and decentralized systems, a new generation of weather insurance products is making protection against climate risks more transparent, efficient, and globally accessible than ever before.

This transformation is particularly significant for the world’s 2 billion people who depend on small-scale subsistence farming for survival. Traditional insurance models have historically excluded these vulnerable populations due to high administrative costs, complex claim processes, and lack of infrastructure in rural areas. Cryptocurrency-powered weather insurance eliminates many of these barriers by automating claim processing, reducing operational overhead, and enabling direct peer-to-peer transactions without intermediaries.

The integration of cryptocurrency into weather insurance represents more than just a technological upgrade; it embodies a fundamental shift toward financial inclusion and climate resilience. These systems use real-world weather data fed through secure oracle networks to automatically trigger insurance payouts when predetermined conditions are met, ensuring farmers receive compensation quickly when they need it most. This approach not only reduces the risk of delayed or denied claims but also builds trust between farmers and insurance providers through transparent, immutable records of all transactions.

The economic implications of cryptocurrency-powered weather insurance extend beyond individual farm protection to encompass broader development objectives including poverty reduction, food security enhancement, and rural economic stabilization. When farmers have reliable access to weather risk protection, they are more likely to make productive investments in improved seeds, fertilizers, and farming techniques that increase yields and incomes. This investment behavior creates positive feedback loops that strengthen entire agricultural communities and contribute to sustainable economic development in rural areas.

The technology also enables new forms of financial innovation that were previously impossible under traditional insurance models. Decentralized risk pools allow farmers to collectively share weather risks without relying on large insurance corporations, creating community-based solutions that keep resources within local economies. Tokenized insurance products enable global investors to participate in agricultural risk management while providing measurable social and environmental returns, creating new funding sources for climate adaptation and resilience building in vulnerable farming regions.

Understanding Weather Insurance Fundamentals

Weather insurance serves as a critical financial safety net for agricultural operations, protecting farmers against losses caused by adverse weather conditions that are beyond their control. Unlike traditional crop insurance that compensates for actual yield losses, weather insurance operates on predetermined meteorological triggers such as rainfall levels, temperature extremes, wind speeds, or drought indices. This parametric approach eliminates the need for costly field inspections and complex loss assessments, making it particularly suitable for remote or hard-to-reach farming communities.

The fundamental principle behind weather insurance lies in risk transfer, where farmers pay a premium to shift the financial burden of weather-related losses to an insurance provider. When specific weather events occur that exceed predefined thresholds, the insurance policy automatically triggers a payout regardless of actual crop damage. This system provides predictable compensation based on objective, measurable data rather than subjective damage assessments, reducing disputes and accelerating the claims process.

Weather insurance products typically cover a range of meteorological events including drought conditions, excessive rainfall, temperature fluctuations, hail damage, and wind-related losses. The coverage periods are carefully aligned with critical stages of crop development, ensuring protection during the most vulnerable phases of the growing season. Premium calculations incorporate historical weather patterns, climate projections, and regional risk assessments to create financially sustainable products that balance affordability for farmers with profitability for insurers.

Traditional Weather Insurance Models

Conventional weather insurance systems rely heavily on centralized institutions, extensive paperwork, and human intervention at every stage of the process. These traditional models typically require farmers to purchase policies through licensed agents or brokers, who assess individual risk profiles and determine appropriate coverage levels and premium rates. The application process often involves detailed farm inspections, historical yield data analysis, and complex underwriting procedures that can take weeks or months to complete.

When weather events occur, traditional systems require farmers to file claims by submitting extensive documentation, including meteorological reports, damage assessments, and supporting evidence. Insurance adjusters must then visit affected areas to verify losses, a process that can be particularly challenging in remote rural locations with limited transportation infrastructure. This human-intensive approach creates significant delays between the occurrence of weather events and the receipt of compensation, often leaving farmers without resources during critical recovery periods.

Traditional weather insurance models also struggle with transparency and trust issues, as farmers have limited visibility into how premiums are calculated, claims are assessed, and payouts are determined. The involvement of multiple intermediaries adds layers of complexity and cost, resulting in higher premiums and reduced coverage amounts. Additionally, these systems often exclude smallholder farmers due to minimum policy requirements and administrative costs that make small-scale coverage economically unviable.

Current Market Limitations and Gaps

The existing weather insurance landscape faces numerous structural challenges that limit its effectiveness and accessibility, particularly for vulnerable farming populations. High administrative costs represent one of the most significant barriers, as traditional insurers must maintain extensive networks of agents, adjusters, and processing staff to handle policy sales, claims management, and customer service. These overhead expenses are ultimately passed on to farmers through higher premiums, making coverage unaffordable for many smallholder operations.

Geographic limitations pose another substantial challenge, as traditional insurance companies often concentrate their services in economically attractive markets while neglecting remote or underserved rural areas. The lack of reliable infrastructure, including roads, telecommunications, and financial services, makes it difficult and expensive for insurers to operate in many developing regions where weather insurance is most needed. This geographic bias leaves millions of vulnerable farmers without access to essential risk management tools.

Claims processing delays represent a critical gap in traditional weather insurance systems, as farmers typically wait months to receive compensation after filing claims. These delays occur due to manual verification processes, bureaucratic procedures, and the need for physical inspections in remote locations. During this waiting period, farmers may lack the resources needed to prepare for the next planting season, perpetuating cycles of poverty and food insecurity. Trust and transparency issues further compound these problems, as farmers often view traditional insurance companies with suspicion due to histories of delayed payments, denied claims, and opaque decision-making processes.

The Role of Cryptocurrency in Modern Insurance

Cryptocurrency technology is fundamentally reshaping the insurance landscape by introducing decentralized, transparent, and programmable financial systems that eliminate many traditional barriers to coverage. Digital currencies enable direct peer-to-peer transactions without the need for traditional banking intermediaries, making insurance accessible to populations that lack access to conventional financial services. This technological revolution extends beyond simple payment processing to encompass automated contract execution, transparent record-keeping, and global accessibility through internet connectivity.

The programmable nature of cryptocurrency systems allows for the creation of sophisticated insurance products that can automatically adjust terms, calculate premiums, and process claims based on real-world data inputs. Smart contracts, which are self-executing programs stored on blockchain networks, can encode complex insurance logic and automatically trigger payouts when predetermined conditions are met. This automation reduces human error, eliminates bias, and ensures consistent application of policy terms across all participants.

Blockchain technology, the underlying infrastructure supporting most cryptocurrencies, provides immutable record-keeping that creates unprecedented transparency in insurance transactions. Every policy purchase, premium payment, and claim settlement is permanently recorded on a distributed ledger that can be independently verified by all participants. This transparency builds trust between farmers and insurance providers while reducing the potential for fraud and disputes.

Blockchain Technology in Insurance

Blockchain technology serves as the foundational infrastructure enabling cryptocurrency-powered weather insurance by providing a secure, transparent, and decentralized platform for managing insurance contracts and transactions. The blockchain operates as a distributed ledger that maintains identical copies of all transaction records across multiple computers, ensuring that no single entity can manipulate or corrupt the data. This decentralized approach eliminates the need for trusted intermediaries and creates a system where all participants can independently verify the integrity of insurance operations.

The immutable nature of blockchain records ensures that once insurance policies, claims, and payouts are recorded, they cannot be altered or deleted without broad network consensus. This permanence creates an auditable trail of all insurance activities, enabling farmers, insurers, and regulators to verify the fairness and accuracy of transactions. The transparency provided by blockchain technology helps build trust in insurance systems, particularly in regions where traditional institutions may lack credibility or reliability.

Blockchain networks also enable the creation of decentralized autonomous organizations that can operate insurance pools without centralized management. These systems allow multiple participants to contribute funds to shared risk pools and automatically distribute payouts based on predefined rules encoded in smart contracts. This approach reduces administrative costs and enables the creation of insurance products specifically tailored to the needs of underserved farming communities.

Smart Contracts for Automated Claims

Smart contracts represent the technological core of cryptocurrency-powered weather insurance, functioning as self-executing programs that automatically implement insurance policies without human intervention. These digital contracts contain predefined rules and conditions that specify when payouts should be triggered, how much compensation should be provided, and how funds should be distributed to affected farmers. Once deployed on a blockchain network, smart contracts operate autonomously, executing their programmed functions whenever specific conditions are met.

The automation provided by smart contracts eliminates many sources of delay and dispute in traditional insurance systems. When weather events occur that meet the criteria defined in an insurance smart contract, the system automatically calculates appropriate payouts and transfers funds directly to farmers’ digital wallets. This process typically occurs within hours or days of the triggering event, compared to months in traditional systems, providing farmers with immediate access to resources needed for recovery and replanting.

Smart contracts also ensure consistent and fair application of insurance terms across all policyholders. Unlike human-administered systems that may be subject to bias, errors, or corruption, smart contracts apply identical logic to all claims, ensuring that farmers in similar situations receive equivalent treatment. The programmable nature of these contracts allows for sophisticated risk modeling and dynamic pricing that can adjust to changing conditions while maintaining transparency in how decisions are made.

How Cryptocurrency-Powered Weather Insurance Works

The operational mechanics of cryptocurrency-powered weather insurance represent a seamless integration of blockchain technology, real-world data feeds, and automated financial systems that work together to provide farmers with transparent, efficient, and reliable coverage. The process begins when farmers purchase insurance policies using cryptocurrency payments, typically through user-friendly mobile applications that require minimal technical knowledge. These applications guide farmers through policy selection, premium calculation, and payment processing while providing clear explanations of coverage terms and payout conditions.

Once purchased, insurance policies are automatically converted into smart contracts that are deployed on blockchain networks, creating immutable records of coverage terms, premium payments, and policyholder information. These smart contracts continuously monitor weather data from multiple sources, including satellite observations, ground-based weather stations, and meteorological databases, through specialized oracle systems that securely connect real-world information to blockchain networks.

The system operates through predetermined trigger mechanisms that specify exactly when payouts should occur based on meteorological conditions. For example, a drought insurance policy might trigger automatic payouts when rainfall measurements fall below specified thresholds for consecutive days during critical growing periods. Temperature-based policies might activate when extreme heat or frost conditions persist beyond defined limits, while flood insurance could trigger when precipitation exceeds certain levels within specified timeframes.

When triggering conditions are met, smart contracts automatically calculate appropriate payout amounts based on the severity and duration of weather events, the coverage levels selected by farmers, and the premium amounts paid. These calculations occur instantly using predefined formulas encoded in the smart contracts, ensuring consistent and transparent determination of compensation amounts. Payouts are then automatically transferred to farmers’ cryptocurrency wallets, typically completing the entire process from event occurrence to fund receipt within 24 to 48 hours.

Weather Data Integration and Oracle Systems

Oracle systems serve as critical bridges connecting real-world weather information to blockchain-based insurance contracts, enabling smart contracts to access and verify meteorological data needed for automated claim processing. These systems continuously collect weather information from diverse sources including government meteorological agencies, private weather services, satellite observations, and local sensor networks to create comprehensive and reliable datasets for insurance applications.

Leading oracle providers like Chainlink have developed specialized infrastructure for weather data integration, working with established meteorological services such as AccuWeather and NOAA to deliver high-quality, verified weather information to blockchain networks. These partnerships ensure that insurance smart contracts receive accurate, timely, and tamper-proof weather data that can be trusted for high-stakes financial decisions affecting farmers’ livelihoods.

The oracle systems employ multiple data validation mechanisms to ensure accuracy and prevent manipulation of weather information. Data feeds typically aggregate information from multiple independent sources and use consensus mechanisms to verify the authenticity of reported conditions. Cryptographic signatures ensure that weather data originates from authorized sources and has not been altered during transmission to smart contracts. This multi-layered approach to data integrity creates robust systems that farmers and insurers can trust for automated insurance operations.

Oracle networks also provide granular geographic resolution that enables insurance products to cover specific farm locations rather than broad regional areas. Advanced weather modeling and satellite technology allow oracles to deliver weather data for individual farm plots, enabling more precise risk assessment and fairer payout calculations. This granular approach ensures that farmers receive compensation only when their specific locations experience adverse weather conditions, rather than being subject to payouts based on regional averages that may not reflect local conditions.

Premium Payments and Cryptocurrency Wallets

Cryptocurrency-powered weather insurance systems enable farmers to pay premiums using various digital currencies, making insurance accessible to populations that lack access to traditional banking services but have mobile phone connectivity. Farmers typically use mobile wallet applications to store and manage their cryptocurrency holdings, which can be acquired through various methods including direct purchase, peer-to-peer exchanges, or receipt of payments for agricultural products sold in digital markets.

The premium payment process is designed to be simple and intuitive, often integrated with mobile money systems that are already widely used in many developing regions. Farmers can pay premiums in small installments, sometimes as low as fifty cents, making insurance affordable for smallholder operations with limited cash flow. The flexibility of cryptocurrency payments allows farmers to adjust their coverage levels and payment schedules based on seasonal income patterns and changing risk exposures.

Cryptocurrency wallets also serve as the destination for insurance payouts, enabling farmers to receive compensation directly without the need for traditional banking infrastructure. These digital wallets can be accessed through basic smartphones and provide farmers with immediate access to funds when insurance claims are triggered. The programmable nature of cryptocurrency systems allows for sophisticated payout mechanisms, such as gradual fund release over time or automatic conversion to local currencies through integrated exchange services.

Advanced wallet systems often include features specifically designed for agricultural applications, such as integration with farm management tools, connection to agricultural marketplaces, and access to educational resources about weather risk management. These comprehensive platforms create ecosystems that support farmers beyond basic insurance coverage, providing tools and services that enhance overall agricultural productivity and financial resilience.

Benefits for Different Stakeholders

The implementation of cryptocurrency-powered weather insurance creates substantial value across the entire agricultural ecosystem, delivering benefits that extend far beyond simple risk transfer to encompass financial inclusion, economic development, and climate resilience. Farmers gain access to affordable, transparent, and reliable protection against weather risks while participating in global financial systems that were previously inaccessible. Insurance providers benefit from reduced operational costs, expanded market reach, and improved risk management capabilities that enable sustainable business models even for small-scale coverage.

The broader agricultural value chain also experiences positive impacts through increased stability and predictability in food production systems. When farmers have reliable protection against weather risks, they are more likely to invest in improved seeds, fertilizers, and farming techniques that increase productivity and food security. This ripple effect extends to agricultural suppliers, food processors, and consumers who benefit from more stable food supplies and prices.

Financial institutions and investors find new opportunities to participate in agricultural risk management through cryptocurrency-powered insurance systems that offer transparent, data-driven investment vehicles. The programmable nature of these systems enables the creation of sophisticated financial products that can attract capital from global markets while providing measurable social and environmental benefits. Governments and development organizations also benefit from reduced demands for disaster relief and agricultural subsidies as effective insurance systems provide alternative mechanisms for supporting farmer resilience.

Advantages for Smallholder Farmers

Smallholder farmers represent the primary beneficiaries of cryptocurrency-powered weather insurance systems, gaining access to financial protection that was previously unavailable or unaffordable through traditional insurance channels. The automated nature of these systems eliminates many barriers that have historically excluded small-scale farmers, including high minimum premiums, complex application processes, and requirements for extensive documentation that many smallholders cannot provide.

The speed of automated claim processing represents a transformative advantage for smallholder farmers who often operate with minimal financial reserves and cannot afford extended delays in receiving compensation. Traditional insurance systems may require months to process claims, leaving farmers without resources during critical periods when they need to prepare for the next planting season. Cryptocurrency-powered systems typically complete the entire process from triggering event to fund receipt within days, enabling farmers to quickly recover and continue their operations.

Transparency in policy terms and payout calculations builds trust and confidence among smallholder farmers who may have been skeptical of traditional insurance products due to unclear terms or unreliable claim processing. Smart contracts provide immutable records of coverage conditions and automatically execute payouts according to predetermined rules, eliminating the possibility of arbitrary claim denials or payment delays. This transparency helps farmers make informed decisions about coverage levels and understand exactly when and how they will receive compensation.

The global accessibility of cryptocurrency-powered insurance systems enables smallholder farmers in remote locations to access the same high-quality coverage available to farmers in developed markets. Geographic limitations that have traditionally excluded rural farming communities are eliminated through digital distribution channels that require only basic mobile phone connectivity. This democratization of insurance access helps level the playing field between smallholder and commercial farmers, providing essential risk management tools that support agricultural productivity and food security.

Benefits for Insurance Providers and Investors

Insurance providers and investors benefit significantly from cryptocurrency-powered weather insurance systems through reduced operational costs, expanded market opportunities, and improved risk management capabilities that create sustainable business models for serving previously unprofitable market segments. The automation provided by smart contracts eliminates much of the human labor required for policy administration, claim processing, and customer service, resulting in operational cost reductions of up to 40% compared to traditional insurance systems.

The elimination of geographic constraints enables insurance providers to access global markets without establishing physical infrastructure in each region, creating opportunities to serve millions of underserved farmers while achieving economies of scale. Digital distribution channels and automated operations allow providers to offer small-denomination policies that would be economically unviable under traditional models, opening vast new markets in developing regions where agricultural insurance has been largely unavailable.

Risk management capabilities are enhanced through access to high-quality, real-time weather data and sophisticated modeling tools that enable more accurate pricing and improved portfolio diversification. The granular data available through oracle systems allows providers to assess risks at individual farm levels rather than relying on broad regional estimates, leading to more precise pricing and reduced adverse selection. The transparency of blockchain systems also provides investors with unprecedented visibility into insurance operations, enabling informed investment decisions and improved portfolio management.

The programmable nature of cryptocurrency-powered insurance systems enables the creation of innovative financial products that can attract capital from global markets while providing measurable social and environmental benefits. Investors can participate in agricultural risk management through tokenized insurance pools, catastrophe bonds, and other instruments that offer competitive returns while supporting climate resilience and food security objectives. These systems also enable the development of parametric insurance products for other applications beyond agriculture, creating opportunities for portfolio expansion and diversification.

Real-World Applications and Case Studies

The practical implementation of cryptocurrency-powered weather insurance has achieved significant milestones across multiple regions, demonstrating the viability and effectiveness of these innovative systems in addressing real-world agricultural challenges. Leading implementations have emerged in East Africa, where organizations like ACRE Africa and Etherisc have successfully deployed blockchain-based crop insurance solutions that serve thousands of smallholder farmers. These pioneering projects provide valuable insights into the operational realities, farmer adoption patterns, and outcomes achieved through cryptocurrency-powered insurance systems.

In Kenya, the collaboration between Etherisc, ACRE Africa, and the Lemonade Crypto Climate Coalition has created one of the world’s most successful blockchain-based agricultural insurance programs. This initiative, supported by Chainlink oracles running on the Avalanche blockchain, has provided coverage to over 22,000 farmers who can purchase comprehensive crop insurance policies for as little as one dollar. The program demonstrates how cryptocurrency-powered systems can achieve the scale and affordability needed to serve vulnerable farming populations while maintaining financial sustainability.

The Sri Lanka pilot program implemented by Etherisc in partnership with Oxfam and Aon represents another significant milestone in cryptocurrency-powered weather insurance, successfully processing the first automated payouts through blockchain-based smart contracts in 2019. This implementation focused on paddy farmers and demonstrated the technical feasibility of connecting real-world weather data to automated payout systems while building trust among farmers who had previously been skeptical of insurance products.

Successful Implementation Examples

The Kenya blockchain crop insurance program operated by Etherisc and ACRE Africa has achieved remarkable success in demonstrating the practical viability of cryptocurrency-powered weather insurance at scale. Since its launch in 2020, the program has expanded coverage to over 22,000 smallholder farmers across multiple regions, providing protection against drought and excessive rainfall during critical growing seasons. Farmers participate by purchasing scratch-card policies attached to seed packages, enabling seamless integration of insurance with agricultural inputs and distribution systems.

The program’s success is evidenced by measurable outcomes including successful automated payouts to approximately 6,000 farmers during adverse weather events, with compensation delivered directly to farmers’ mobile money accounts within one week of triggering conditions. This rapid payout timeline represents a dramatic improvement over traditional insurance systems that typically require months to process claims. The integration with M-Pesa mobile payment systems demonstrates how cryptocurrency-powered insurance can leverage existing digital financial infrastructure to reach farmers who lack access to traditional banking services.

The Sri Lanka implementation provides another compelling example of successful cryptocurrency-powered weather insurance deployment, focusing on rice farmers who face significant risks from irregular monsoon patterns and extreme weather events. The pilot program covered 200 farmers during its initial phase and successfully processed the world’s first automated insurance payouts through blockchain smart contracts. Weather data from multiple sources was integrated through Chainlink oracles to trigger automatic compensation when predetermined rainfall and temperature thresholds were exceeded during critical growing periods.

The technical success of the Sri Lanka program demonstrated the reliability of oracle systems for delivering accurate weather data to smart contracts while building farmer confidence in automated insurance systems. Post-pilot surveys indicated high levels of farmer satisfaction with the transparency and speed of the blockchain-based system compared to their previous experiences with traditional insurance products. The program’s success led to expansion planning for additional regions and crop types, validating the scalability potential of cryptocurrency-powered weather insurance systems.

Emerging Pilot Programs and Partnerships

Numerous emerging pilot programs and strategic partnerships are expanding the reach and sophistication of cryptocurrency-powered weather insurance across diverse geographical regions and agricultural contexts. The Lemonade Crypto Climate Coalition, launched in 2022, represents a significant collaborative effort involving major technology and insurance organizations working to scale blockchain-based crop insurance for subsistence farmers globally. This coalition brings together expertise from Lemonade Foundation, Avalanche, Chainlink, and other leading organizations to create comprehensive insurance solutions that can be rapidly deployed across multiple countries.

Recent developments include the expansion of Etherisc’s Kenya program to cover an additional 7,000 farmers during the 2023 short rains season, demonstrating the scalability of successful implementations. These farmers accessed coverage through simple feature phone interfaces, highlighting how cryptocurrency-powered systems can operate effectively even with basic technology infrastructure. The continued growth of this program provides valuable data on farmer adoption patterns, claim frequencies, and system performance under diverse conditions.

Innovative partnerships between technology providers and traditional agricultural organizations are creating new opportunities for cryptocurrency-powered insurance deployment. The collaboration between AccuWeather and Chainlink established in 2021 exemplifies how established weather data providers are integrating with blockchain infrastructure to support parametric insurance applications. This partnership enables insurance smart contracts to access AccuWeather’s premium meteorological data through cryptographically verified oracle feeds, ensuring high-quality weather information for automated claim processing.

Development finance institutions and international organizations are increasingly supporting cryptocurrency-powered weather insurance initiatives through grants and technical assistance programs. The Chainlink Community Grant program has provided funding for multiple agricultural insurance projects, while organizations like the Global Innovation Lab for Climate Finance have recognized blockchain-based crop insurance as a promising solution for climate adaptation. These institutional endorsements and funding sources are accelerating the development and deployment of cryptocurrency-powered insurance systems worldwide.

Challenges and Considerations

Despite the significant potential and demonstrated successes of cryptocurrency-powered weather insurance, several challenges and considerations must be addressed to achieve widespread adoption and long-term sustainability. Technical infrastructure requirements pose immediate barriers in many rural areas where farmers most need weather insurance but may lack reliable internet connectivity, smartphone access, or digital literacy skills necessary to navigate cryptocurrency systems. These digital divides create equity concerns as the most vulnerable farming populations may be excluded from systems designed to serve them.

Regulatory uncertainty represents another significant challenge as governments worldwide grapple with how to classify, oversee, and integrate cryptocurrency-based financial products into existing legal frameworks. Insurance regulations vary widely between countries and often have not been updated to address blockchain-based products, creating compliance challenges for organizations seeking to deploy cryptocurrency-powered insurance systems across multiple jurisdictions. The evolving nature of cryptocurrency regulations adds complexity to long-term planning and investment decisions for insurance providers and technology developers.

The technical complexity of cryptocurrency-powered systems also creates challenges for user adoption, particularly among farming populations that may have limited experience with digital financial products. While mobile applications can simplify user interactions, farmers still need to understand concepts like digital wallets, private keys, and cryptocurrency transactions to effectively participate in these systems. Educational initiatives and user support systems are essential for successful adoption but require significant investment and ongoing commitment from program implementers.

Technical and Infrastructure Barriers

Internet connectivity limitations represent a fundamental challenge for cryptocurrency-powered weather insurance deployment in many rural farming communities where coverage is most needed. While mobile phone penetration has increased dramatically in developing regions, reliable data connectivity remains sporadic in remote agricultural areas. Weather insurance systems require consistent internet access for policy purchases, premium payments, and payout receipts, creating barriers for farmers in areas with poor connectivity infrastructure.

The technical complexity of blockchain systems and cryptocurrency management poses significant challenges for farmer adoption, particularly among populations with limited digital literacy. Concepts such as private key management, wallet security, and transaction confirmation can be overwhelming for farmers who may be using smartphones for the first time. Lost private keys or improper wallet management can result in permanent loss of access to insurance policies and payouts, creating risks that may outweigh the benefits for some farmers.

Weather data quality and availability represent critical technical challenges that can affect the accuracy and fairness of automated insurance systems. Oracle networks require access to reliable, high-resolution weather data for specific farm locations, but such data may not be available in all regions where insurance is needed. Gaps in weather monitoring infrastructure can lead to inaccurate payout triggers or coverage gaps that undermine farmer confidence in cryptocurrency-powered insurance systems.

The energy consumption associated with some blockchain networks raises sustainability concerns, particularly for systems designed to support environmentally focused applications like climate adaptation insurance. While newer blockchain platforms like Avalanche have addressed energy efficiency concerns, the environmental impact of cryptocurrency-powered insurance systems remains a consideration for organizations with sustainability mandates.

Regulatory and Legal Framework Issues

The regulatory landscape for cryptocurrency-powered weather insurance remains fragmented and uncertain across most global jurisdictions, creating significant challenges for organizations seeking to deploy these systems at scale. Insurance regulations typically require specific licensing, capital reserves, and operational procedures that may not align with the decentralized nature of blockchain-based systems. The cross-border nature of cryptocurrency transactions adds complexity when serving farmers in multiple countries with different regulatory requirements.

Legal questions surrounding smart contract enforceability and dispute resolution create additional challenges for cryptocurrency-powered insurance systems. Traditional insurance contracts are governed by established legal frameworks that provide clear mechanisms for resolving disputes and enforcing contract terms. Smart contracts operate according to programmed logic that may not align with legal interpretations of contract terms, potentially creating gaps in legal protection for farmers and insurance providers.

Data privacy and protection regulations present additional compliance challenges for cryptocurrency-powered insurance systems that collect and process farmer information across blockchain networks. Regulations such as GDPR in Europe require specific data handling procedures that may conflict with the immutable nature of blockchain records. The global accessibility of cryptocurrency systems means that data protection requirements from multiple jurisdictions may apply simultaneously, creating complex compliance obligations.

Consumer protection regulations in many countries require specific disclosures, cooling-off periods, and complaint resolution procedures for insurance products that may be difficult to implement in automated cryptocurrency-powered systems. The technical nature of smart contracts and cryptocurrency transactions may make it challenging to provide the clear, understandable disclosures required by consumer protection laws. Additionally, the automated nature of these systems may limit the ability to provide traditional customer service and complaint resolution mechanisms.

Final Thoughts

Cryptocurrency-powered weather insurance represents a transformative innovation that addresses fundamental inequities in global agricultural risk management while demonstrating the potential for blockchain technology to create meaningful social impact. The convergence of cryptocurrency systems, real-world data integration, and automated smart contracts has produced insurance solutions that are more transparent, efficient, and accessible than traditional alternatives, particularly for underserved farming populations who have historically been excluded from formal risk management systems.

The demonstrated successes in Kenya, Sri Lanka, and other emerging markets provide compelling evidence that cryptocurrency-powered insurance can operate effectively at scale while delivering measurable benefits to vulnerable farmers. These implementations have shown that technology alone is not sufficient; successful deployment requires careful attention to user experience design, local partnership development, and integration with existing agricultural value chains. The lessons learned from these pioneering programs provide valuable blueprints for expanding cryptocurrency-powered insurance to additional regions and agricultural contexts.

Beyond immediate risk management benefits, cryptocurrency-powered weather insurance contributes to broader objectives of financial inclusion and climate resilience by connecting smallholder farmers to global financial systems and providing tools for adaptation to changing climate conditions. The transparency and accessibility of these systems help build trust in financial institutions while demonstrating that technology can be deployed in service of social good rather than merely commercial interests.

The intersection of technology and social responsibility exemplified by cryptocurrency-powered weather insurance highlights the potential for innovative financial products to address pressing global challenges including food security, poverty reduction, and climate adaptation. As extreme weather events become more frequent and severe due to climate change, the need for effective agricultural risk management tools will only increase. Cryptocurrency-powered systems offer scalable, sustainable solutions that can evolve with changing conditions while maintaining affordability and accessibility for vulnerable populations.

Looking forward, the continued development of cryptocurrency-powered weather insurance will likely drive innovations in oracle technology, smart contract design, and user interface development that benefit the broader blockchain ecosystem while serving humanitarian objectives. The success of these systems in agricultural applications creates precedents for applying similar approaches to other social challenges including disaster relief, healthcare access, and education financing. As regulatory frameworks evolve to accommodate blockchain-based financial products, cryptocurrency-powered insurance systems will likely become increasingly integrated into formal economic systems while maintaining their core advantages of transparency, efficiency, and global accessibility.

The scalability potential of cryptocurrency-powered weather insurance systems positions them to address global challenges at unprecedented scale, with the technical infrastructure capable of serving millions of farmers simultaneously across diverse geographic and economic contexts. The modular nature of blockchain-based systems enables rapid deployment and customization for different crops, climates, and local conditions while maintaining operational efficiency and cost effectiveness. This scalability advantage becomes increasingly important as climate change accelerates and more farming communities require sophisticated risk management tools.

The data generated by widespread adoption of cryptocurrency-powered weather insurance creates valuable insights for climate research, agricultural planning, and policy development that can benefit society beyond immediate risk management objectives. Aggregated weather and payout data from thousands of insurance policies provides researchers with granular information about climate impacts on agriculture while helping governments and development organizations design more effective support programs for vulnerable farming communities.

The ultimate measure of success for cryptocurrency-powered weather insurance will be its ability to improve the livelihoods and resilience of farming communities while contributing to global food security and climate adaptation objectives. Early results suggest that these systems can deliver on their promise, but continued innovation, collaboration, and commitment to social impact will be essential for realizing their full potential in creating a more equitable and sustainable global agricultural system.

FAQs

- What is cryptocurrency-powered weather insurance and how does it differ from traditional crop insurance?

Cryptocurrency-powered weather insurance uses blockchain technology and digital currencies to provide automated protection against weather-related agricultural losses. Unlike traditional crop insurance that requires field inspections and lengthy claim processes, this system uses smart contracts that automatically trigger payouts based on weather data when predetermined conditions are met. Farmers purchase policies using cryptocurrency and receive payouts directly to their digital wallets, typically within days rather than months. - How do farmers with limited technology experience use cryptocurrency-powered weather insurance?

Insurance providers design user-friendly mobile applications that simplify the process of purchasing policies and receiving payouts without requiring deep cryptocurrency knowledge. Farmers can buy insurance through scratch cards attached to seed packages, with premiums as low as fifty cents paid via mobile money systems like M-Pesa. The technical complexity is handled behind the scenes, while farmers interact with familiar interfaces similar to other mobile financial services. - What types of weather events are typically covered by cryptocurrency-powered insurance policies?

These insurance systems commonly cover drought conditions, excessive rainfall, temperature extremes, hail damage, and wind-related losses. Coverage is based on specific meteorological triggers such as rainfall amounts below certain thresholds for consecutive days, temperatures exceeding predetermined limits, or precipitation levels that indicate flooding conditions. Each policy clearly defines the weather parameters that will trigger automatic payouts. - How do oracle systems ensure accurate weather data for automated insurance payouts?

Oracle networks like Chainlink collect weather information from multiple verified sources including AccuWeather, NOAA, satellite observations, and local weather stations. They use consensus mechanisms to validate data accuracy and cryptographic signatures to prevent tampering. This multi-source approach ensures reliable weather information reaches smart contracts, enabling fair and accurate automated payout decisions. - Are cryptocurrency-powered weather insurance systems regulated and legally recognized?

The regulatory landscape varies by country and is still evolving as governments develop frameworks for blockchain-based financial products. Many successful implementations operate through partnerships with licensed insurance providers who ensure compliance with local regulations. Organizations like Etherisc work with established insurers such as ACRE Africa to provide regulatory compliance while leveraging blockchain technology for operational efficiency. - What happens if farmers lose access to their cryptocurrency wallets or private keys?

Most cryptocurrency-powered insurance platforms implement user-friendly wallet solutions with recovery mechanisms such as backup phrases or integration with existing mobile money systems. Some platforms use custodial wallet services that manage technical aspects on behalf of farmers while providing simple interfaces for accessing funds. Educational programs and customer support help farmers understand wallet security and recovery procedures. - How are insurance premiums calculated for cryptocurrency-powered weather insurance?

Premiums are calculated using historical weather data, climate models, and regional risk assessments, similar to traditional insurance but with more granular geographic resolution. The automated nature of blockchain systems allows for dynamic pricing that can adjust to changing risk conditions while maintaining transparency in how rates are determined. Farmers can see exactly how their premiums are calculated based on their specific location and coverage choices. - Can cryptocurrency-powered weather insurance work in areas with poor internet connectivity?

While reliable internet access is necessary for policy management and payout processing, systems can be designed to work with basic mobile phone connectivity and intermittent data access. Some implementations use SMS-based interfaces and offline-capable mobile applications that sync when connectivity is available. Partnerships with mobile network operators can also improve connectivity in rural farming areas. - What are the environmental impacts of using blockchain technology for weather insurance?

Modern cryptocurrency-powered insurance systems typically use energy-efficient blockchain platforms like Avalanche rather than energy-intensive networks like Bitcoin. These newer platforms consume significantly less energy while providing the security and functionality needed for insurance applications. The environmental benefits of improved agricultural resilience and reduced climate risk often outweigh the modest energy consumption of blockchain operations. - How do cryptocurrency-powered insurance systems handle disputes and customer service?

While smart contracts automate most operations, customer service and dispute resolution mechanisms are typically provided through traditional channels managed by insurance partners or platform operators. Clear policy terms encoded in smart contracts reduce disputes by providing transparent, automated claim processing. When disputes do arise, they are handled through established legal frameworks and customer service procedures similar to traditional insurance products.