The blockchain revolution promised a new era of decentralized finance and peer-to-peer transactions, yet as adoption grew, fundamental limitations emerged that threatened to constrain its potential. Network congestion, rising transaction fees, and processing delays have created significant barriers for everyday users and businesses seeking to leverage blockchain technology for routine payments. These challenges become particularly acute when considering micropayments, where transaction fees often exceed the value being transferred, rendering small-value transfers economically unfeasible on traditional blockchain networks.

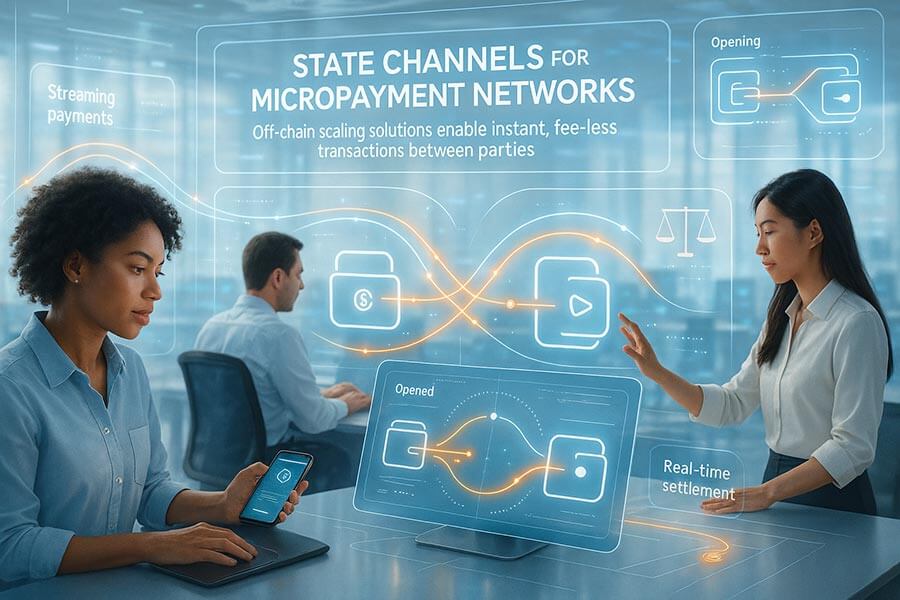

State channels represent a groundbreaking solution to these scalability challenges, offering a sophisticated yet elegant approach to conducting thousands or even millions of transactions off the main blockchain while maintaining the security and trustlessness that make distributed ledgers valuable. By moving the bulk of transaction processing away from the main chain, state channels enable instant settlements, eliminate per-transaction fees, and dramatically increase throughput without sacrificing the fundamental principles of blockchain technology. This innovative approach transforms how we think about blockchain scalability, opening doors to applications previously considered impossible due to technical and economic constraints.

The concept of state channels extends far beyond simple payment transfers, encompassing a broad spectrum of state updates between parties that can be conducted privately and efficiently off-chain. From streaming micropayments that enable new content monetization models to high-frequency trading applications that require sub-second settlement times, state channels are reshaping the landscape of blockchain applications. Understanding how these systems work, their benefits and limitations, and their potential impact on various industries is crucial for anyone seeking to grasp the future direction of blockchain technology and digital payments infrastructure.

Understanding the Fundamentals of State Channels

The emergence of state channels as a scaling solution represents a fundamental shift in how blockchain networks handle transactions and state updates between parties. Unlike traditional on-chain transactions that require global consensus and permanent storage on every node in the network, state channels create private corridors for interaction that operate with minimal blockchain involvement. This architectural approach addresses the inherent trade-off between decentralization, security, and scalability that has long plagued blockchain networks, offering a path forward that preserves the essential properties of distributed systems while dramatically improving performance and reducing costs.

At their core, state channels leverage the blockchain’s role as an arbiter of last resort rather than a processor of every transaction, fundamentally reimagining how distributed systems can achieve both efficiency and trustlessness. The blockchain serves as an anchor point for opening and closing channels, establishing the rules of engagement, and resolving disputes if they arise, but the vast majority of interactions occur directly between participants without touching the main chain. This separation of concerns allows for unprecedented transaction throughput while maintaining the cryptographic guarantees and game-theoretic incentives that make blockchain systems secure and reliable.

What Are State Channels and How Do They Work

State channels function as temporary, private communication pathways between two or more participants who wish to conduct multiple transactions or state updates without repeatedly interacting with the blockchain. The process begins when participants lock funds or state into a smart contract on the blockchain, creating a shared pool of resources that can be redistributed through off-chain agreements. These participants then exchange signed messages directly with each other, updating the distribution of locked resources according to their interactions, whether these involve simple payments, complex contract executions, or game moves in a decentralized application.

The security of state channels derives from cryptographic signatures and carefully designed incentive mechanisms that ensure honest behavior even without constant blockchain oversight. Each state update within a channel requires signatures from all participants, creating an auditable trail of agreements that can be presented to the blockchain if disputes arise. The smart contract governing the channel includes provisions for challenge periods and dispute resolution, allowing any participant to submit the latest signed state to the blockchain if their counterparty attempts to cheat or becomes unresponsive. This combination of cryptographic proofs and economic incentives creates a system where cooperation is the optimal strategy, enabling trustless interactions between parties who may not know or trust each other.

The lifecycle of a state channel follows a predictable pattern that begins with channel opening, proceeds through numerous off-chain updates, and concludes with channel closure. During the opening phase, participants deploy or interact with a smart contract that defines the rules of the channel, including dispute resolution mechanisms, timeout periods, and the initial distribution of assets. Throughout the channel’s active period, participants can conduct unlimited transactions by exchanging signed state updates, with each new state superseding previous ones. When participants wish to conclude their interactions, they can cooperatively close the channel by submitting the final agreed-upon state to the blockchain, or unilaterally initiate closure if cooperation breaks down, triggering the dispute resolution process defined in the channel contract.

The Evolution from On-Chain to Off-Chain Solutions

The journey from purely on-chain transactions to sophisticated off-chain solutions like state channels reflects the blockchain industry’s maturation and its response to real-world scalability demands. Early blockchain networks like Bitcoin operated under the assumption that every transaction needed to be broadcast to and validated by every node in the network, ensuring maximum security and decentralization but severely limiting throughput. As transaction volumes grew and use cases expanded beyond simple value transfers, the limitations of this approach became increasingly apparent, with network congestion leading to unpredictable fees and confirmation times that made many applications impractical.

The recognition that not every interaction requires immediate global consensus led to the development of various Layer 2 solutions, with state channels emerging as one of the most promising approaches for specific use cases. Early implementations like Bitcoin’s Lightning Network demonstrated that payment channels could dramatically increase transaction capacity while maintaining the security guarantees of the underlying blockchain. These pioneering efforts revealed both the potential and challenges of off-chain scaling, spurring innovation in channel design, routing protocols, and user experience improvements that have made modern state channel implementations increasingly practical for mainstream adoption.

The evolution of state channels has been marked by successive generations of improvements addressing initial limitations and expanding functionality beyond simple payments. Modern state channel implementations support generalized state transitions, enabling complex smart contract interactions, multi-party channels that accommodate more than two participants, and virtual channels that allow transactions between parties without direct channel relationships. These advances have transformed state channels from a specialized scaling solution for payments into a versatile framework for building scalable decentralized applications across various domains, from gaming and content distribution to decentralized exchanges and prediction markets.

The transition from on-chain to off-chain processing represents more than just a technical optimization; it reflects a fundamental rethinking of how blockchain networks can best serve their users while maintaining their core value propositions. By acknowledging that different types of interactions have different security and finality requirements, state channels enable a more nuanced approach to blockchain architecture where the main chain serves as a secure foundation while specialized layers handle high-volume, low-value transactions efficiently. This layered approach mirrors successful scaling strategies in traditional computing and networking, suggesting a sustainable path forward for blockchain technology as it seeks to serve billions of users globally.

Technical Architecture and Implementation

The technical architecture of state channels represents a sophisticated interplay between on-chain smart contracts and off-chain protocols that together create a secure and efficient system for conducting transactions outside the blockchain’s constraints. This architecture must carefully balance multiple competing requirements, including security against malicious actors, efficiency in normal operation, robustness in the face of network failures or unresponsive participants, and flexibility to support diverse use cases. The resulting systems employ advanced cryptographic techniques, game-theoretic incentive structures, and carefully designed state machines that ensure correct operation even in adversarial conditions.

Modern state channel implementations build upon foundational cryptographic primitives and distributed systems concepts while introducing novel mechanisms specifically designed for blockchain environments. The architecture must account for the unique properties of blockchain networks, including their probabilistic finality, potential for chain reorganizations, and the high cost of on-chain operations. These considerations drive design decisions throughout the stack, from the structure of commitment transactions to the format of state updates and the mechanisms for dispute resolution, creating systems that are both theoretically sound and practically efficient.

Opening and Closing Channel Mechanics

The channel opening process establishes the foundational parameters and security guarantees that will govern all subsequent interactions within the state channel. Participants begin by deploying or interacting with a channel contract on the blockchain, which serves as an escrow agent and dispute resolver for the channel’s lifetime. This contract must be carefully designed to handle various edge cases and attack vectors, including situations where one party becomes unresponsive, attempts to submit outdated states, or tries to manipulate the closure process to their advantage. The opening transaction typically includes the initial deposit of funds or assets from each participant, the specification of channel parameters such as dispute timeout periods, and the establishment of initial state that may include more complex allocations or conditions beyond simple balance distributions.

The smart contract deployed during channel opening embodies the rules and mechanisms that ensure security without requiring constant blockchain interaction. These contracts implement sophisticated state verification logic that can validate signatures, check state transitions against predefined rules, and adjudicate disputes based on cryptographic proofs submitted by participants. The contract must be efficient enough to minimize gas costs during normal operation while being comprehensive enough to handle complex dispute scenarios. Modern channel contracts often include features like watchtower support, allowing third parties to monitor channels and respond to fraudulent closure attempts on behalf of offline participants, and upgrade mechanisms that enable channel parameters to be modified through mutual agreement without requiring channel closure.

Channel closure represents the final reconciliation between off-chain state and on-chain reality, requiring careful orchestration to ensure fairness and prevent loss of funds. In the ideal case, participants cooperate to close the channel by jointly signing a final state update and submitting it to the blockchain, allowing for immediate settlement without waiting periods or additional transactions. However, the system must also support unilateral closure where one party can initiate the closing process independently, triggering a challenge period during which other participants can dispute the submitted state if it doesn’t represent the latest agreed-upon distribution. This dual-path closure mechanism ensures that channels can always be closed even if participants become uncooperative or unavailable, while the challenge period protects against attempts to close channels with outdated or fraudulent states.

State Updates and Cryptographic Signatures

The state update mechanism forms the heart of state channel operations, enabling participants to conduct numerous transactions efficiently while maintaining cryptographic proof of each agreement. Each state update involves participants exchanging messages that contain the new proposed state along with cryptographic signatures that prove agreement to this state. These signatures serve multiple purposes, providing non-repudiation that prevents participants from denying their agreement to a particular state, enabling third-party verification if disputes arise, and creating a chronological record of state evolution that can be used to determine the most recent valid state. The signature schemes employed must be carefully chosen to balance security, efficiency, and compatibility with the underlying blockchain’s verification capabilities.

The format and content of state updates vary depending on the channel’s purpose and complexity, ranging from simple balance updates in payment channels to complex state transitions in generalized state channels supporting arbitrary smart contract logic. Payment channels typically use lightweight state updates that simply specify new balance distributions, while more complex channels may include merkle trees of state data, commitment to future states, or conditional state transitions that depend on external events or timeouts. The state update protocol must ensure that all participants have consistent views of the current state and that any participant can prove the latest state to the blockchain if necessary, requiring careful attention to message ordering, acknowledgment mechanisms, and recovery procedures for handling network failures or message loss.

Modern state channel protocols incorporate sophisticated mechanisms for managing state updates efficiently and securely, including techniques borrowed from distributed systems and database theory. These include vector clocks or logical timestamps to establish ordering between concurrent updates, snapshot mechanisms that allow participants to checkpoint states periodically to reduce storage requirements, and differential updates that transmit only changes rather than complete states to minimize bandwidth usage. The protocols must also handle edge cases such as conflicting updates, race conditions where participants simultaneously propose different states, and recovery from partial failures where some but not all participants have acknowledged a state update.

Dispute Resolution and Security Protocols

The dispute resolution mechanism serves as the ultimate guarantee of security in state channels, ensuring that honest participants can always recover their rightful assets even when faced with malicious counterparties or technical failures. The dispute process typically begins when one participant submits a state to the blockchain claiming it represents the final channel state, initiating a challenge period during which other participants can contest this claim by submitting proof of a more recent state. The smart contract must be able to determine which state is more recent based on cryptographic evidence such as sequence numbers, timestamps, or hash chains, and must do so efficiently to minimize gas costs and reduce the attack surface for denial-of-service attempts.

Security protocols in state channels must defend against a variety of attack vectors that could potentially allow malicious actors to steal funds or deny service to honest participants. These include replay attacks where old states are resubmitted to claim outdated balances, griefing attacks where malicious actors force unnecessary on-chain disputes to impose costs on others, and bribery attacks where miners or validators might be incentivized to censor or reorder transactions to facilitate theft. Defense mechanisms include punishment mechanisms that penalize participants who submit outdated states by forfeiting their deposits, watchtower services that monitor channels on behalf of participants who may be offline, and timeout mechanisms that ensure channels can always be closed even if some participants become permanently unavailable.

The security analysis of state channels must consider not only technical attacks but also economic and game-theoretic considerations that influence participant behavior. The incentive structure must be carefully calibrated to ensure that honest behavior is always the most profitable strategy, taking into account factors such as the value locked in channels, the cost of on-chain transactions, the probability of successful attacks, and the potential for collusion between participants or with miners. This analysis becomes particularly complex in multi-party channels or channel networks where the interactions between multiple bilateral relationships create additional attack surfaces and require more sophisticated security protocols to maintain safety and liveness guarantees across the entire system.

The ongoing evolution of dispute resolution and security protocols reflects the continuous arms race between attackers seeking to exploit vulnerabilities and developers working to strengthen channel security. Recent innovations include fraud proofs that allow compact representation of invalid state transitions, optimistic rollup techniques that reduce the cost of dispute resolution, and zero-knowledge proofs that enable privacy-preserving disputes where channel state remains confidential even during challenges. These advances are gradually making state channels more robust, efficient, and suitable for a wider range of applications, though careful security analysis remains essential for any production deployment.

Applications in Micropayment Networks

The application of state channels to micropayment networks has unlocked entirely new economic models and use cases that were previously impossible due to transaction cost constraints on traditional payment systems and blockchains. These applications span diverse industries from digital content and entertainment to IoT and machine-to-machine payments, each leveraging the unique properties of state channels to enable granular, real-time value exchange. The ability to conduct thousands of transactions per second with sub-cent values and instant finality has created opportunities for innovation in business models, user experiences, and economic interactions that were previously confined to theoretical discussions.

The transformation enabled by state channel micropayments extends beyond simply making small payments feasible; it fundamentally changes how value can be captured, distributed, and exchanged in digital ecosystems. Traditional payment systems with their batch processing, settlement delays, and fixed transaction costs created natural boundaries around what types of economic activity were viable. State channels remove these boundaries, enabling continuous rather than discrete payments, real-time settlement rather than delayed clearing, and cost structures that scale with value rather than transaction count. This paradigm shift has profound implications for how digital services are monetized, how creators are compensated, and how machines can engage in autonomous economic activity.

Streaming Payments and Content Monetization

The implementation of streaming payments through state channels has revolutionized content monetization by enabling true pay-per-second billing models where consumers pay only for what they consume and creators receive immediate compensation for their work. This granular approach to payments allows for unprecedented flexibility in pricing models, where content can be priced by the second of video watched, the word of text read, or the megabyte of data consumed, creating perfect alignment between value delivered and payment received. Platforms implementing these models have reported significant improvements in both creator revenue and consumer satisfaction, as the elimination of subscription barriers reduces friction for new users while ensuring creators are fairly compensated for partial consumption of their content.

Real-world implementations of streaming payments have demonstrated the transformative potential of this technology across various content types and platforms. Podcasting platform Podcasting 2.0, launched in 2022, integrated Lightning Network state channels to enable listeners to stream satoshis directly to creators as they listen, with some podcasters reporting 40% increases in revenue compared to traditional donation models. The platform processes millions of micropayments daily, with individual payments as small as one satoshi per minute of listening, demonstrating the scalability and efficiency of state channel infrastructure. Similarly, the video streaming platform Stream (launched in 2023) has utilized state channels to enable pay-per-second viewing of premium content, allowing creators to monetize content that might not justify a full subscription while giving viewers the flexibility to sample content without commitment.

The gaming industry has emerged as another significant beneficiary of streaming payment capabilities, with state channels enabling new models for in-game economies and player rewards. The blockchain gaming platform Mythical Games implemented state channels in their NFL Rivals game in 2023, processing over 5 million microtransactions daily for in-game purchases and player-to-player trades with zero transaction fees for users. This implementation demonstrated how state channels could support high-frequency gaming transactions while maintaining the security and ownership guarantees of blockchain technology. The success of this integration led to a 300% increase in player transaction volume and a 150% increase in average revenue per user, validating the economic benefits of frictionless micropayments in gaming environments.

The technical implementation of streaming payments requires sophisticated integration between content delivery systems and payment channels, ensuring that payment flow remains synchronized with content consumption while handling edge cases like network interruptions or disputed consumption claims. Modern streaming payment systems implement features like payment splitting to automatically distribute revenues among multiple stakeholders, conditional payments that release funds only when certain delivery conditions are met, and reputation systems that help establish trust between parties who may be interacting for the first time. These systems must also handle the complexity of multi-hop payments in channel networks, where payments may need to be routed through intermediate nodes to reach the final recipient, requiring careful attention to routing algorithms, liquidity management, and fee structures.

High-Frequency Trading and Gaming Applications

State channels have emerged as a critical infrastructure component for decentralized exchanges and trading platforms that require high-frequency transaction capability without the latency and cost constraints of on-chain settlement. The ability to execute trades with millisecond latency and zero marginal cost has enabled decentralized exchanges to compete with centralized alternatives on performance while maintaining the security and self-custody benefits of blockchain technology. These platforms utilize state channels not just for simple spot trades but for complex derivatives, options, and algorithmic trading strategies that require rapid position updates and settlement. The elimination of front-running risks through private state channels and the ability to maintain custody of assets until final settlement have attracted sophisticated traders who previously avoided decentralized platforms due to performance limitations.

The implementation of state channels in production trading environments has yielded impressive results in terms of both performance and adoption. DYDX, a decentralized derivatives exchange, integrated StarkWare’s state channel technology in late 2022 to support perpetual contracts trading, achieving throughput of over 10 million trades per day with sub-second settlement times. The platform reported that state channel integration reduced trading costs by 99% compared to on-chain alternatives while maintaining the security guarantees of the underlying blockchain. Another notable implementation is the Injective Protocol, which launched their state channel-based order book exchange in 2023, processing over $500 million in daily trading volume across spot and derivatives markets with average transaction latency under 100 milliseconds, comparable to traditional centralized exchanges.

Gaming applications represent another domain where state channels have proven transformative, enabling real-time multiplayer interactions with economic consequences that would be impossible with traditional blockchain transactions. The requirements of gaming applications, including sub-second response times, high transaction volumes for in-game actions, and the need for fair random number generation, align perfectly with the capabilities provided by state channels. Games can implement complex economic systems where every action has potential value, from movement in virtual worlds to combat outcomes in strategy games, without players experiencing the friction of transaction fees or confirmation delays. The privacy properties of state channels also enable competitive gaming scenarios where players’ strategies remain hidden until revealed through gameplay, maintaining the element of surprise essential to many game mechanics.

The evolution of gaming applications on state channels has progressed from simple gambling games to complex virtual worlds with sophisticated economies. Gods Unchained, a trading card game, implemented state channels in 2023 to handle match transactions and card trades, processing over 3 million transactions daily during peak periods with zero gas fees for players. The implementation allowed for complex in-game mechanics like real-time card battles and tournament systems that would have been economically unfeasible on-chain. Another significant implementation is Skyweaver, which launched in 2024 with full state channel integration for both gameplay and marketplace transactions, supporting over 100,000 daily active users conducting millions of micro-transactions for card trades, match wagers, and tournament entries, all settled instantly through state channels while maintaining verifiable fairness through cryptographic commitments.

The technical challenges of implementing state channels for high-frequency applications require careful attention to performance optimization, state management, and failure recovery. Systems must handle thousands of state updates per second while maintaining cryptographic security, requiring optimized signature schemes and efficient state representation. The integration with existing exchange or gaming infrastructure often requires custom adapters and middleware to bridge between traditional system architectures and blockchain-based state channels. Advanced implementations incorporate features like parallel channel processing to increase throughput, state compression to reduce bandwidth requirements, and predictive pre-signing of common state transitions to minimize latency during critical operations.

Benefits and Advantages for Different Stakeholders

The adoption of state channels for micropayment networks creates a complex ecosystem of benefits that extend across multiple stakeholder groups, each experiencing unique advantages that address their specific pain points and requirements. These benefits are not merely incremental improvements over existing systems but represent fundamental enhancements that enable new business models, user experiences, and economic relationships. The value proposition of state channels varies significantly depending on the stakeholder’s role in the ecosystem, their technical sophistication, and their specific use cases, creating a rich tapestry of incentives that drive adoption and innovation across the entire payment landscape.

Understanding how different stakeholders benefit from state channel technology is crucial for evaluating its potential impact and identifying the most promising applications and integration opportunities. The technology’s ability to simultaneously address multiple pain points across different user groups creates network effects that amplify its value as adoption grows. These benefits compound over time as the ecosystem matures, infrastructure improves, and best practices emerge, creating a virtuous cycle of adoption and innovation that continues to expand the boundaries of what’s possible with digital payments and blockchain technology.

For End Users and Consumers

End users and consumers experience the most immediate and tangible benefits from state channel micropayments through dramatically improved user experiences characterized by instant transactions, negligible fees, and enhanced privacy. The elimination of waiting times for payment confirmation transforms digital interactions from asynchronous processes requiring patience and planning to real-time experiences that feel as immediate as handing over cash. This immediacy is particularly valuable in contexts like gaming where delays can disrupt gameplay, content consumption where buffering or payment processing interrupts engagement, or e-commerce where checkout friction leads to cart abandonment. Users no longer need to batch transactions or delay purchases to optimize for fee efficiency, enabling more natural and spontaneous economic behavior that better reflects actual preferences and needs.

The fee structure of state channels fundamentally changes the economics of small-value transactions for consumers, making previously uneconomical purchases viable and attractive. Traditional payment systems with their fixed fee components make small purchases disproportionately expensive, often charging fees that exceed the value being transferred for micropayments. State channels eliminate per-transaction fees within the channel, requiring only the opening and closing fees that can be amortized across thousands of transactions. This creates an environment where users can make penny or even sub-penny transactions without concern for fee efficiency, enabling new consumption patterns like paying for individual articles instead of subscriptions, tipping content creators small amounts frequently, or participating in micro-investment opportunities that aggregate small contributions into meaningful investments.

Privacy represents another significant benefit for end users, as state channel transactions remain private between participants rather than being broadcast to the entire network. Unlike on-chain transactions where every payment is permanently recorded on a public ledger accessible to anyone, state channel transactions are known only to the direct participants unless a dispute requires on-chain settlement. This privacy extends beyond simple anonymity to include transaction patterns, frequency, and relationships that might reveal sensitive information about user behavior or preferences. Users can conduct thousands of transactions without creating a permanent public record, maintaining financial privacy while still benefiting from the security and trustlessness of blockchain technology when needed.

The enhanced control and flexibility provided by state channels empower users to engage with digital services on their own terms rather than being constrained by provider-defined models. Users can start and stop payments instantly without commitment periods, pay exact amounts for actual usage rather than predetermined packages, and maintain custody of their funds until the moment of payment rather than pre-funding accounts or trusting intermediaries. This granular control extends to more sophisticated features like conditional payments that only execute when certain conditions are met, scheduled payments that occur automatically based on predefined triggers, and multi-party payments that coordinate complex value distributions among multiple recipients according to user-defined rules.

For Businesses and Developers

Businesses and developers gain transformative capabilities through state channels that fundamentally alter the economics and possibilities of digital service delivery and application development. The dramatic reduction in transaction costs removes one of the primary constraints on business model innovation, enabling companies to capture value from interactions that were previously too small to monetize. Businesses can now charge for API calls by the request, content by the second, or computing resources by the cycle, creating perfect alignment between resource consumption and payment. This granular monetization capability opens new revenue streams from existing services while enabling entirely new service categories that were economically impossible under traditional payment paradigms.

The scalability provided by state channels allows businesses to grow transaction volumes without proportional increases in infrastructure costs or payment processing fees. Traditional payment systems impose significant marginal costs per transaction through processing fees, settlement delays, and operational overhead that limit the viability of high-volume, low-value business models. State channels shift this cost structure to fixed channel management costs that can be amortized across unlimited transactions, enabling businesses to achieve economies of scale that improve with volume rather than degrading. Companies report processing millions of transactions daily through state channels at costs that are orders of magnitude lower than traditional payment processors, fundamentally changing the unit economics of digital services.

The developer experience of building on state channels has improved dramatically with the maturation of tooling, libraries, and infrastructure services that abstract away much of the complexity of channel management. Modern state channel frameworks provide high-level APIs that handle the intricate details of channel lifecycle management, state synchronization, and dispute resolution, allowing developers to focus on application logic rather than low-level protocol implementation. The availability of software development kits for popular programming languages, comprehensive documentation, and reference implementations has reduced the barrier to entry for integrating state channels into existing applications. Developers can now add state channel capabilities to applications with minimal code changes, often requiring just a few hundred lines of integration code to enable millions of micropayments.

The operational benefits of state channels extend beyond simple cost reduction to include improved cash flow management, reduced settlement risk, and enhanced customer relationship capabilities. Real-time settlement eliminates the working capital requirements associated with traditional payment processing where funds may be held for days or weeks before becoming available. The cryptographic certainty of state channel payments removes chargeback risk and fraud concerns that plague traditional payment systems, allowing businesses to recognize revenue immediately with confidence. The direct relationship between businesses and customers enabled by state channels eliminates intermediary dependencies and provides rich transaction data that can inform product development and customer service strategies.

The competitive advantages gained through state channel adoption create powerful differentiation opportunities in crowded markets where user experience and cost efficiency are key differentiators. Businesses that implement state channels can offer instant, free transactions as a core value proposition, attracting users frustrated with the fees and delays of traditional alternatives. The ability to support new interaction models like try-before-you-buy micropayments, granular usage-based pricing, and real-time value distribution creates opportunities to capture market share from incumbents constrained by traditional payment infrastructure. Early adopters of state channel technology report significant improvements in customer acquisition costs, lifetime value, and retention rates compared to traditional payment methods.

Challenges and Limitations

Despite the significant advantages offered by state channels, their adoption and implementation face substantial challenges that must be acknowledged and addressed for the technology to reach its full potential. These challenges span technical, economic, and social dimensions, creating complex interdependencies that require coordinated solutions across multiple stakeholders. Understanding these limitations is essential for setting realistic expectations, identifying areas requiring further research and development, and making informed decisions about when and how to implement state channel solutions. The honest assessment of these challenges should not diminish enthusiasm for the technology but rather inform strategic approaches to overcoming obstacles and building robust, sustainable systems.

The challenges facing state channels are not insurmountable but require continued innovation, investment, and ecosystem coordination to resolve. Many current limitations stem from the relative immaturity of the technology and supporting infrastructure rather than fundamental technical constraints, suggesting that solutions will emerge as the ecosystem matures. However, some challenges reflect deeper trade-offs inherent in the architecture of state channels that may require accepting certain limitations or developing hybrid approaches that combine state channels with other scaling solutions to address different requirements.

Technical and Adoption Barriers

The technical complexity of implementing and managing state channels presents a significant barrier to adoption for many potential users and developers who lack the specialized knowledge required to safely deploy these systems. Understanding the intricacies of channel lifecycle management, cryptographic signatures, dispute resolution mechanisms, and security considerations requires expertise that extends beyond traditional web development or even basic blockchain development. This complexity manifests in multiple ways, from the challenge of correctly implementing channel protocols to the difficulty of debugging issues that arise from the interaction between on-chain and off-chain components. Organizations attempting to implement state channels often underestimate the technical expertise required, leading to failed implementations or security vulnerabilities that can result in loss of funds.

User experience challenges represent another critical barrier that has limited mainstream adoption of state channel technology despite its technical advantages. The current generation of state channel applications often requires users to understand concepts like channel capacity, inbound liquidity, and routing that are foreign to those accustomed to traditional payment systems. Users must manage channel states, monitor for fraudulent closures, and ensure they have sufficient liquidity in the right channels to make payments, creating cognitive overhead that many find overwhelming. The need to be online or have a watchtower service to protect against malicious channel closures adds another layer of complexity that doesn’t exist in traditional payment systems where users can safely ignore their accounts for extended periods.

Infrastructure requirements for state channels create adoption challenges for both service providers and end users who must invest in specialized systems and processes. Running state channel nodes requires reliable internet connectivity, persistent storage for channel states, and computational resources for signature verification and state management. Organizations must implement backup and recovery procedures to protect against data loss that could result in inability to close channels properly, monitoring systems to detect and respond to channel issues, and integration layers to connect channel infrastructure with existing business systems. These requirements create operational overhead and costs that may outweigh the benefits for smaller organizations or those with limited technical resources.

The standardization and interoperability challenges facing state channels limit their network effects and create fragmentation that reduces overall ecosystem value. Different implementations use incompatible protocols, state formats, and dispute mechanisms that prevent channels from different systems from interacting directly. This fragmentation forces users to manage multiple channel implementations to access different services, developers to support multiple protocols to reach all potential users, and service providers to make exclusive technology choices that limit their addressable market. The lack of universally accepted standards for channel construction, state updates, and routing protocols creates uncertainty that discourages investment and slows ecosystem development.

Network Effects and Liquidity Concerns

The liquidity requirements of state channels create significant economic barriers that limit their practical utility for many use cases and participants. Opening a channel requires locking funds for the channel’s duration, creating opportunity costs as these funds cannot be used elsewhere or earn yield while locked. The amount locked must be sufficient to cover all anticipated transactions during the channel’s lifetime, requiring users to predict future payment needs and maintain larger reserves than necessary for immediate transactions. This capital inefficiency becomes particularly problematic for users with limited funds who cannot afford to lock significant amounts across multiple channels or for use cases with unpredictable payment patterns where required capacity is difficult to estimate accurately.

Network topology and routing challenges in multi-hop payment networks create reliability and cost issues that undermine the user experience benefits of state channels. Payments between parties without direct channels must be routed through intermediate nodes that have channels with both sender and receiver, requiring these intermediaries to have sufficient liquidity in the right direction. Finding routes with adequate capacity becomes increasingly difficult as payment size increases or network congestion grows, leading to payment failures that frustrate users and damage confidence in the system. The fees charged by routing nodes for providing liquidity and taking on risk can accumulate across multiple hops, potentially making routed payments as expensive as on-chain transactions for certain payment patterns or network conditions.

The bootstrapping problem faced by state channel networks creates a chicken-and-egg situation where adoption is limited by network effects that only emerge with widespread adoption. Users are reluctant to open channels without a rich ecosystem of other users and services to transact with, while services are hesitant to support state channels without a large user base to justify the implementation effort. This creates a coordination problem where the technology’s benefits only materialize after a critical mass of adoption is achieved, requiring significant investment and coordination to overcome initial adoption hurdles. Early adopters bear disproportionate costs and risks while generating positive externalities for future participants, creating misaligned incentives that slow organic growth.

The concentration of liquidity and routing power in state channel networks raises concerns about centralization that could undermine the decentralization benefits of blockchain technology. Natural economies of scale in routing and liquidity provision tend to concentrate these functions in a small number of well-capitalized nodes that can offer better reliability and lower fees through efficient capital deployment. This concentration creates systemic risks where the failure or misbehavior of key nodes can disrupt the entire network, potential for censorship or discrimination in payment routing, and extraction of economic rents by dominant players that reduce the cost benefits of state channels. These dynamics mirror the centralization pressures seen in traditional payment networks, suggesting that state channels may not fully escape the centralization tendencies of financial systems.

The economic sustainability of state channel networks remains uncertain as the ecosystem struggles to find business models that adequately compensate infrastructure providers while maintaining low costs for users. Routing nodes must lock capital, maintain reliable infrastructure, and bear fraud risk but can only charge small fees that users will accept, creating thin margins that may not justify the investment required. The competition between on-chain and off-chain transactions creates price pressure that limits fee potential while the improving efficiency of base layer blockchains reduces the relative advantage of state channels. These economic challenges raise questions about the long-term viability of state channel networks and whether they can maintain the infrastructure investments necessary for reliable operation.

Final Thoughts

State channels represent far more than a technical solution to blockchain scalability; they embody a fundamental reimagining of how value can flow through digital systems, creating possibilities that extend beyond the current horizons of financial technology. The transformation from batch-processed, fee-heavy transactions to continuous, frictionless value streams mirrors broader shifts in how society conceptualizes and interacts with money, property, and economic relationships. As these systems mature and proliferate, they will likely catalyze changes in economic behavior as profound as those triggered by the introduction of credit cards or digital banking, enabling forms of economic expression and coordination that we are only beginning to envision.

The implications for financial inclusion and global economic participation are particularly profound when considering how state channels can serve populations currently excluded from traditional financial systems. By removing minimum transaction sizes, eliminating account maintenance requirements, and enabling peer-to-peer value transfer without institutional intermediaries, state channels create pathways for economic participation that bypass traditional gatekeepers. Communities in developing nations can build local economic networks that operate independently of unstable national currencies or extractive financial institutions, while refugees and displaced populations can maintain economic agency without formal documentation or banking relationships. The technology’s ability to function with basic internet connectivity and minimal hardware requirements makes it accessible to billions who have smartphones but lack bank accounts.

The intersection between state channels and emerging technologies like artificial intelligence and the Internet of Things suggests even more transformative possibilities as machines gain the ability to engage in autonomous economic activity. State channels provide the transaction infrastructure necessary for AI agents to purchase computational resources, data, or services in real-time without human intervention, enabling new forms of algorithmic commerce and automated value creation. IoT devices can negotiate and pay for resources like bandwidth, storage, or energy on a granular basis, optimizing resource allocation through market mechanisms rather than central planning. These machine-to-machine payment capabilities could fundamentally restructure how digital infrastructure operates, moving from subscription and allocation models to dynamic markets where resources flow to their highest-value uses in real-time.

The social implications of widespread state channel adoption extend beyond pure economics to touch on questions of privacy, autonomy, and power distribution in digital societies. The ability to conduct private, censorship-resistant transactions at scale challenges existing models of financial surveillance and control that governments and corporations have built into traditional payment systems. While this raises legitimate concerns about illicit activity and regulatory compliance, it also restores a degree of financial privacy that has been eroded by the digitalization of payments, allowing individuals to make legal purchases without creating permanent records accessible to unknown future authorities or algorithms. The technology forces society to reconsider the balance between transparency and privacy, security and freedom, efficiency and resilience in our financial infrastructure.

Looking toward the future, state channels appear poised to become a foundational layer in the emerging stack of decentralized technologies that could reshape the internet and global economy. As blockchain systems become more interoperable and layer-2 solutions mature, state channels will likely integrate with other scaling solutions like rollups and sidechains to create hybrid systems that leverage the strengths of each approach. The continued development of standards, tools, and infrastructure will lower barriers to adoption while innovations in areas like zero-knowledge proofs and post-quantum cryptography will address current limitations and unlock new capabilities. The trajectory suggests a future where instant, free, private transactions become the default expectation rather than a premium feature, fundamentally altering how we think about money and value exchange.

The journey toward this future will require continued collaboration between technologists, economists, regulators, and society at large to ensure that state channels develop in ways that benefit humanity broadly rather than concentrating power in new forms. The technology itself is neutral, capable of enabling both liberation and oppression depending on how it is implemented and governed. The choices made today about standards, regulations, and infrastructure will shape whether state channels fulfill their potential as tools for economic empowerment and innovation or become another layer of complexity that reinforces existing inequalities. The responsibility lies with current stakeholders to build systems that remain true to the ideals of decentralization, accessibility, and fairness that motivated the creation of blockchain technology while pragmatically addressing the real challenges of security, usability, and sustainability that determine practical adoption.

FAQs

- What exactly are state channels and how do they differ from regular blockchain transactions?

State channels are private, off-chain corridors between two or more parties that enable them to conduct unlimited transactions without touching the blockchain for each one. Unlike regular blockchain transactions that require global consensus and permanent storage on every node, state channels only interact with the blockchain when opening and closing the channel, with all intermediate transactions happening directly between participants through cryptographically signed messages. - How secure are state channels compared to on-chain transactions?

State channels maintain the same security guarantees as on-chain transactions through cryptographic signatures and smart contract enforcement. While transactions occur off-chain, any participant can always fall back to the blockchain for dispute resolution if their counterparty tries to cheat, with the smart contract ensuring the correct final state is enforced based on cryptographic proofs. - What happens if my internet connection fails while I have open state channels?

If your internet connection fails, your channels remain safe but you cannot make new transactions or monitor for fraudulent closure attempts by counterparties. To protect against this risk, you can use watchtower services that monitor your channels and respond to any malicious activity on your behalf, or ensure you come back online before the dispute timeout period expires. - How much does it cost to use state channels for micropayments?

The cost structure of state channels involves only the blockchain fees for opening and closing channels, with all transactions within the channel being free. If you conduct hundreds or thousands of transactions within a channel, the opening and closing fees become negligible per transaction, often reducing costs by 99% or more compared to on-chain transactions. - Can state channels work with any blockchain or are they limited to specific platforms?

While state channels can theoretically be implemented on any blockchain that supports smart contracts and cryptographic signatures, practical implementations exist primarily on platforms like Ethereum, Bitcoin (Lightning Network), and other major blockchains. Each blockchain requires specific adaptations of the state channel concept to work with its particular architecture and capabilities. - What types of applications benefit most from state channels?

Applications requiring high-frequency transactions, instant settlement, or micropayments benefit most from state channels. This includes streaming payments for content, gaming applications with frequent in-game transactions, decentralized exchanges requiring rapid trade execution, IoT device payments, and any use case where transaction fees would otherwise exceed the value being transferred. - How do I know if a state channel payment has been completed successfully?

State channel payments are considered complete as soon as you receive a signed state update from your counterparty, providing instant finality without waiting for blockchain confirmations. The cryptographic signature serves as proof of payment that cannot be reversed unless both parties agree to a new state, giving you immediate certainty about payment completion. - What are the main limitations preventing wider adoption of state channels?

The main limitations include the need to lock liquidity in channels, complexity of channel management for average users, the requirement to be online or have watchtower protection, limited interoperability between different implementations, and the network effect challenges of building sufficient liquidity and routing capacity for reliable multi-hop payments. - Can state channels support smart contracts or only simple payments?

Modern state channel implementations support generalized state transitions that can execute arbitrary smart contract logic, not just simple payments. This enables complex applications like games, prediction markets, and decentralized exchanges to operate through state channels, though the complexity of implementation increases significantly compared to simple payment channels. - How do state channels handle disputes between parties who disagree on the current state?

Disputes are resolved through a challenge-response mechanism where any party can submit what they claim is the latest state to the blockchain, triggering a dispute period during which other parties can contest this claim with cryptographic proof of a more recent state. The smart contract automatically determines the correct state based on signatures and sequence numbers, ensuring the honest party always wins regardless of who initiates the dispute.