Corporate governance stands at a critical juncture where traditional voting mechanisms increasingly struggle to meet the demands of modern shareholders and regulatory environments. The conventional proxy voting system, which has served corporations for decades, now faces mounting challenges including vote manipulation concerns, lack of transparency, administrative inefficiencies, and limited shareholder participation. These systemic issues have prompted corporate leaders, regulators, and technology innovators to explore revolutionary solutions that can restore trust and efficiency to the shareholder voting process. The emergence of blockchain technology presents an unprecedented opportunity to fundamentally transform how corporations conduct shareholder votes, making them more secure, transparent, and accessible than ever before.

The integration of blockchain voting systems into corporate governance represents far more than a simple technological upgrade. This transformation addresses fundamental questions about shareholder democracy, corporate accountability, and the mechanics of collective decision-making in publicly traded companies. By leveraging distributed ledger technology, corporations can create voting systems that simultaneously ensure complete transparency in the voting process while maintaining the privacy of individual voters, a balance that has proven elusive with traditional methods. The technology enables real-time vote tracking, instant result tabulation, and immutable record-keeping, all while reducing costs and eliminating many of the intermediaries that currently complicate the proxy voting process. As shareholders increasingly demand greater participation in corporate decisions and regulators push for enhanced governance standards, blockchain voting systems emerge as a compelling solution that satisfies multiple stakeholder requirements.

The journey toward implementing blockchain-based voting in corporate governance involves understanding both the technical foundations of distributed ledger technology and the specific requirements of shareholder voting processes. This comprehensive exploration examines how blockchain technology adapts to meet corporate voting needs, the benefits it delivers to various stakeholders, the challenges organizations face during implementation, and real-world examples of successful deployments. By examining these systems through multiple lenses, from technical architecture to regulatory compliance, we can appreciate both the transformative potential and the practical considerations that shape their adoption in corporate environments.

Understanding Blockchain Technology in Corporate Voting

The application of blockchain technology to corporate voting requires a fundamental understanding of how distributed ledger systems operate and adapt to the specific requirements of shareholder governance. Unlike traditional voting systems that rely on centralized authorities to collect, validate, and tally votes, blockchain-based systems distribute these responsibilities across a network of participants, creating a system where no single entity can manipulate results or compromise the integrity of the voting process. This decentralized approach fundamentally changes the trust model in corporate voting, shifting from trust in institutions to trust in cryptographic mathematics and transparent protocols. The technology creates an environment where every vote becomes a permanent, verifiable entry in a shared ledger, visible to all participants while maintaining voter privacy through sophisticated encryption techniques.

The transformation from paper-based proxy voting to digital blockchain systems represents a paradigm shift in how corporations think about shareholder engagement and decision-making processes. Traditional proxy voting often involves multiple intermediaries, including transfer agents, proxy solicitors, and vote tabulators, each adding layers of complexity, cost, and potential points of failure to the system. Blockchain technology streamlines this process by creating a direct connection between shareholders and the voting mechanism, eliminating many intermediaries while maintaining or enhancing the security and reliability of the voting process. This direct engagement model not only reduces costs but also increases shareholder confidence in the voting process, as they can independently verify that their votes have been recorded correctly and counted in the final tally.

Core Components of Distributed Ledger Systems

The architectural foundation of blockchain voting systems rests on several interconnected components that work together to create a secure, transparent, and immutable voting record. At the most basic level, a blockchain consists of a series of blocks, each containing a collection of transactions or, in this case, votes, that are cryptographically linked to form an unbreakable chain of records. Each block contains a unique identifier called a hash, which is generated based on the block’s contents and the hash of the previous block, creating a mathematical relationship that makes it virtually impossible to alter historical records without detection. This chaining mechanism ensures that once a vote is recorded in the blockchain, it becomes part of a permanent, tamper-proof record that can be audited but never altered retroactively.

The network of nodes that maintain the blockchain plays a crucial role in ensuring the system’s integrity and availability. In a corporate voting context, these nodes might be operated by various stakeholders including the corporation itself, regulatory bodies, auditors, and potentially large institutional shareholders, creating a distributed system where no single party controls the voting infrastructure. Each node maintains a complete copy of the blockchain, constantly synchronizing with other nodes to ensure consensus on the current state of the voting record. This redundancy means that even if multiple nodes fail or attempt to introduce fraudulent votes, the network as a whole maintains its integrity, with honest nodes rejecting any attempts to manipulate the voting record.

The cryptographic elements that secure blockchain voting systems go beyond simple encryption to include sophisticated mechanisms for identity verification, vote privacy, and result transparency. Public-key cryptography enables shareholders to prove their identity and voting rights without revealing personal information, while zero-knowledge proofs and other advanced cryptographic techniques allow the system to verify vote validity without exposing vote content. These cryptographic tools create a system where votes can be counted and audited publicly while maintaining complete voter privacy, resolving the longstanding tension between transparency and confidentiality in corporate voting. The implementation of these cryptographic protocols requires careful consideration of key management, with corporations developing secure methods for distributing and managing shareholder cryptographic credentials while ensuring accessibility for users with varying levels of technical expertise.

Smart Contracts and Automated Governance

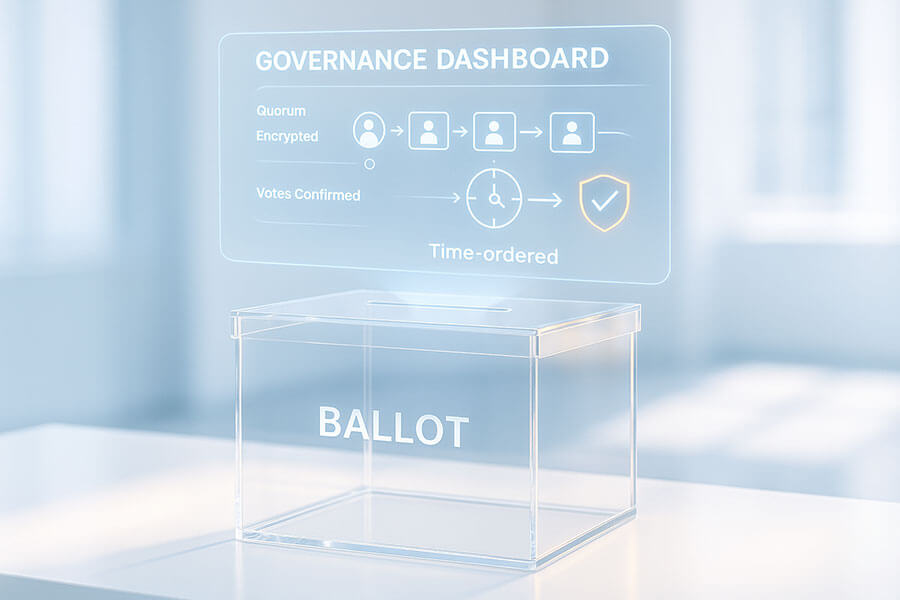

Smart contracts represent the programmable layer of blockchain voting systems, encoding corporate bylaws, voting rules, and governance procedures directly into self-executing code that runs on the blockchain. These digital agreements automatically enforce voting parameters such as quorum requirements, voting windows, and eligibility criteria without human intervention, ensuring consistent and impartial application of corporate governance rules. When a shareholder submits a vote, the smart contract automatically verifies their eligibility based on share ownership records, checks that the vote complies with applicable rules, and records it in the blockchain, all within seconds and without the need for manual processing. This automation dramatically reduces the administrative burden on corporate secretaries and governance teams while eliminating human error and potential bias in vote processing.

The flexibility of smart contracts enables corporations to implement complex voting scenarios that would be difficult or impossible to manage with traditional systems. Multi-class share structures with different voting rights, cumulative voting for board elections, and contingent voting arrangements can all be encoded into smart contracts that automatically calculate and apply the appropriate voting weights and rules. Smart contracts can also implement sophisticated governance features such as proxy delegation, where shareholders can assign their voting rights to representatives with specific limitations or conditions, all enforced automatically by the blockchain. These capabilities enable more nuanced and responsive governance structures that better reflect the diverse interests and preferences of modern shareholder bases.

The integration of smart contracts with external data sources, known as oracles, further extends the capabilities of blockchain voting systems in corporate governance. Oracles can provide smart contracts with real-time information about share ownership from custodians and transfer agents, enabling dynamic voting rights calculation based on the most current ownership data. This integration ensures that voting rights accurately reflect share ownership at the record date, automatically adjusting for stock splits, mergers, or other corporate actions that affect voting rights. The combination of smart contracts and oracles creates a responsive governance system that can adapt to changing circumstances while maintaining the integrity and predictability that shareholders and regulators demand.

As corporations implement smart contract-based voting systems, they must carefully balance automation with flexibility, ensuring that encoded rules can be updated to reflect changes in corporate bylaws or regulatory requirements. This challenge has led to the development of upgradeable smart contract architectures that allow governance rules to evolve while maintaining the integrity of historical voting records. The process of updating smart contracts itself often becomes a matter for shareholder vote, creating recursive governance structures where the voting system’s rules are themselves subject to democratic oversight and modification.

How Blockchain Voting Systems Work

The operational mechanics of blockchain voting systems in corporate governance involve a carefully orchestrated series of steps that transform traditional proxy voting into a streamlined digital process. From the moment a corporation announces a shareholder meeting to the final certification of results, blockchain technology facilitates each stage with enhanced security, transparency, and efficiency. The system begins with the establishment of a voting event on the blockchain, where corporate administrators create a smart contract that defines the proposals to be voted upon, the eligible voter list based on share ownership at the record date, and the rules governing the voting process. This initialization phase sets the parameters for the entire voting event, creating an immutable record of what shareholders are voting on and who is eligible to participate.

The transformation of shareholder records into blockchain-compatible formats represents a critical bridge between traditional corporate infrastructure and distributed ledger technology. Corporations work with transfer agents and custodians to create cryptographically secure digital representations of share ownership, often using tokenization techniques that maintain privacy while enabling verification. Each eligible shareholder receives unique cryptographic credentials that serve as their digital identity within the voting system, allowing them to prove their voting rights without revealing personal information to other participants in the network. This credentialing process must accommodate various shareholder types, from individual retail investors accessing the system through web interfaces to institutional investors integrating blockchain voting with their existing governance platforms.

The Voting Process Flow

The journey of a shareholder vote through a blockchain system begins with authentication, where voters use their cryptographic credentials to access the voting platform and establish their identity to the network. This authentication process employs multiple layers of security, often combining something the shareholder knows, such as a password, with something they have, like a cryptographic key or mobile device, to ensure that only legitimate shareholders can cast votes. Once authenticated, shareholders review the proposals presented for voting, with the blockchain system providing complete documentation and supporting materials stored either on-chain or referenced through cryptographic hashes that ensure document integrity. The interface presents voting options clearly while the underlying smart contracts enforce any restrictions or special conditions that apply to particular shareholders or share classes.

When a shareholder submits their vote, the blockchain voting system initiates a complex but rapid series of operations that transform their selection into a permanent record on the distributed ledger. The vote is first encrypted using the shareholder’s private key, creating a digital signature that proves the vote’s authenticity while maintaining its confidentiality. The smart contract governing the vote then validates this submission, checking that the shareholder has not already voted, that they possess the requisite voting rights, and that the vote complies with all applicable rules and restrictions. Upon passing these validation checks, the vote is bundled with other transactions into a new block, which is then proposed to the network for inclusion in the blockchain through the consensus mechanism.

The recording and confirmation of votes on the blockchain occurs through a consensus process where network nodes work together to agree on the legitimate state of the voting record. Different blockchain platforms employ various consensus mechanisms, from proof-of-authority systems suitable for permissioned corporate networks to more complex Byzantine fault-tolerant algorithms that can withstand malicious actors. Once consensus is achieved, the new block containing the votes becomes part of the permanent blockchain record, and confirmations are sent to voters providing cryptographic proof that their votes have been recorded. This proof allows shareholders to independently verify their vote’s inclusion in the official record without relying on trust in any central authority, fundamentally changing the relationship between shareholders and the voting process.

Verification and Consensus Mechanisms

The verification mechanisms employed in blockchain voting systems create multiple layers of assurance that prevent fraud while maintaining the integrity of the democratic process. Each vote undergoes cryptographic validation that confirms the voter’s identity and eligibility without revealing how they voted, using techniques such as ring signatures or homomorphic encryption that allow mathematical verification of vote validity while preserving privacy. The network nodes independently verify each vote against the established rules encoded in smart contracts, checking share ownership records, voting restrictions, and other eligibility criteria to ensure only legitimate votes enter the blockchain. This distributed verification process means that attempting to introduce fraudulent votes would require compromising multiple independent nodes simultaneously, a feat that becomes exponentially more difficult as the network grows.

The consensus mechanisms that govern blockchain voting systems must balance the need for finality in corporate decision-making with the requirement for thorough validation of results. Unlike cryptocurrency blockchains that can tolerate occasional forks or reorganizations, corporate voting blockchains must provide definitive results within specified timeframes to meet regulatory requirements and enable timely business decisions. This requirement has led to the adoption of deterministic consensus algorithms that provide immediate finality once a certain threshold of nodes agrees on a block’s validity. These algorithms often incorporate elements of traditional Byzantine Fault Tolerance protocols, modified to suit the specific needs of corporate governance where the identity of participants is known and the threat model differs from public blockchains.

The role of validators or authority nodes in permissioned blockchain voting systems introduces a governance layer that bridges traditional corporate structures with decentralized technology. These validators, which might include representatives from the corporation, regulatory bodies, major shareholders, and independent auditors, bear responsibility for maintaining the network’s integrity while remaining accountable to stakeholders. The selection and management of validators becomes itself a matter of corporate governance, with procedures for adding or removing validators based on performance, compliance, or changes in stakeholder representation. This meta-governance structure ensures that the voting system remains responsive to stakeholder needs while maintaining the security and reliability that blockchain technology promises.

The implementation of consensus mechanisms in corporate voting must also address the unique challenges of shareholder democracy, including the need to accommodate different voting methods such as cumulative voting, plurality voting, and supermajority requirements. Smart contracts work in conjunction with consensus mechanisms to ensure that these various voting methods are correctly implemented and that results accurately reflect the will of shareholders as expressed through their votes. The system must also handle edge cases such as contested elections, tied votes, and proxy revocations, all while maintaining the transparency and immutability that make blockchain voting attractive to stakeholders.

Benefits for Corporate Stakeholders

The adoption of blockchain voting systems in corporate governance delivers transformative benefits that extend across the entire stakeholder ecosystem, from individual retail shareholders to corporate boards and regulatory authorities. These advantages go beyond simple efficiency gains to fundamentally reshape how stakeholders interact with corporate governance processes, creating new possibilities for engagement, oversight, and democratic participation in corporate decision-making. The technology addresses longstanding pain points in traditional proxy voting while introducing capabilities that were previously impossible or prohibitively expensive to implement. By examining these benefits through the lens of different stakeholder groups, we can understand how blockchain voting systems create value throughout the corporate governance ecosystem while aligning interests that have historically been in tension.

The economic implications of blockchain voting systems extend beyond direct cost savings to include broader market effects such as improved price discovery, reduced information asymmetry, and enhanced corporate accountability. When shareholders can easily and reliably exercise their voting rights, corporate decisions better reflect owner preferences, potentially leading to improved resource allocation and strategic decision-making. The transparency and auditability of blockchain voting records provide investors with greater confidence in corporate governance processes, potentially reducing risk premiums and improving valuations for companies with strong governance practices. These market-level benefits create positive feedback loops that encourage broader adoption of blockchain voting systems, as companies seek to differentiate themselves through superior governance practices.

Advantages for Shareholders

The empowerment of shareholders through blockchain voting technology represents a fundamental shift in the balance of power within corporate governance structures. Individual retail investors, who have historically faced significant barriers to participation in corporate voting, gain unprecedented access to governance processes through user-friendly interfaces that make voting as simple as using a banking app. The elimination of complex proxy forms, mailing delays, and unclear confirmation processes removes friction from the voting experience, encouraging greater participation from shareholders who previously found the process too cumbersome or confusing. Real-time vote confirmation provides immediate feedback that votes have been counted, addressing the uncertainty that has long plagued proxy voting and discouraged shareholder engagement.

The cost reductions achieved through blockchain voting systems particularly benefit smaller shareholders for whom the transaction costs of participating in governance have traditionally been prohibitive. Without the need for physical mail, manual processing, or multiple intermediaries, the marginal cost of casting a vote approaches zero, making it economically viable for shareholders with even modest holdings to participate in corporate governance. This democratization of voting access helps address concerns about the concentration of voting power among large institutional investors, creating a more representative governance process that better reflects the diverse shareholder base of modern public companies. The ability to delegate voting rights through smart contracts also enables shareholders to participate indirectly when they lack the time or expertise to evaluate complex proposals, while maintaining transparency about how their votes are being cast.

The enhanced transparency provided by blockchain voting systems gives shareholders unprecedented visibility into governance processes and outcomes. Unlike traditional systems where vote tallies might be opaque until final results are announced, blockchain systems can provide real-time insights into voting trends while maintaining individual privacy through cryptographic techniques. Shareholders can track their own votes through the entire process, from submission to final tally, using blockchain explorers that provide cryptographic proof of their vote’s inclusion in the official record. This transparency extends to the broader governance process, with immutable records of past votes, proposals, and outcomes creating an auditable history that shareholders can analyze to understand governance patterns and hold boards accountable for their decisions.

Benefits for Corporate Management

Corporate management teams and boards of directors realize substantial operational and strategic benefits from implementing blockchain voting systems that extend well beyond simple cost savings. The automation of vote processing through smart contracts eliminates the extensive manual labor currently required to manage proxy campaigns, freeing corporate secretaries and governance teams to focus on strategic governance initiatives rather than administrative tasks. The reduction in proxy solicitation costs, which can run into millions of dollars for contested elections or controversial proposals, directly improves corporate profitability while ensuring that resources are allocated to value-creating activities rather than administrative overhead. The speed and efficiency of blockchain voting also enable more agile governance, allowing corporations to respond quickly to changing circumstances or opportunities that require shareholder approval.

The enhanced legitimacy and defensibility of voting results obtained through blockchain systems provide management teams with stronger mandates for implementing strategic decisions. The immutable audit trail created by blockchain technology makes it virtually impossible for losing parties to credibly challenge election results or claim irregularities in the voting process, reducing litigation risk and providing certainty for corporate planning. This increased confidence in voting outcomes enables boards to move forward decisively with approved strategies, knowing that the shareholder mandate is clear and incontestable. The transparency of the voting process also helps management teams better understand shareholder sentiment, providing valuable feedback that can inform future proposals and strategic decisions.

The integration of blockchain voting systems with broader corporate governance infrastructure creates opportunities for management teams to innovate in how they engage with shareholders and structure governance processes. Real-time voting capabilities enable dynamic governance models where shareholders can be consulted more frequently on key decisions without the prohibitive costs of traditional proxy campaigns. The programmability of smart contracts allows for sophisticated governance structures that automatically adapt to changing circumstances, such as emergency decision-making procedures that activate under specific conditions or graduated voting thresholds that adjust based on proposal types. These capabilities position companies at the forefront of governance innovation, potentially attracting investors who value responsive and transparent governance practices.

The comprehensive data generated by blockchain voting systems provides management teams with valuable insights into shareholder behavior, preferences, and engagement patterns that can inform investor relations strategies and governance practices. Analytics derived from voting patterns, participation rates, and proposal outcomes help management teams understand their shareholder base more deeply, enabling more effective communication and engagement strategies. The ability to segment voting data by shareholder type, geography, or other characteristics, while maintaining individual privacy, provides nuanced understanding of how different stakeholder groups view corporate initiatives. This intelligence enables more targeted and effective shareholder engagement, potentially increasing support for management proposals and reducing the cost of building consensus around strategic initiatives.

Implementation Challenges and Solutions

The path to implementing blockchain voting systems in corporate governance encounters numerous technical, regulatory, and organizational challenges that require careful navigation and innovative solutions. While the benefits of blockchain voting are compelling, the transition from established proxy voting systems to distributed ledger technology involves complex considerations that span from technical infrastructure to regulatory compliance and stakeholder adoption. Organizations must address these challenges systematically, developing comprehensive implementation strategies that account for the diverse needs of stakeholders while ensuring compliance with existing regulations and governance standards. The solutions to these challenges often require collaboration between technology providers, corporations, regulators, and other stakeholders to create frameworks that enable innovation while maintaining the integrity and reliability of corporate governance processes.

The technical challenges of implementing blockchain voting systems begin with the fundamental question of which blockchain platform to utilize, a decision that involves tradeoffs between decentralization, scalability, privacy, and regulatory compliance. Public blockchains offer maximum transparency and decentralization but may struggle with the privacy requirements of corporate voting and the need for permissioned access. Private or consortium blockchains provide greater control and privacy but may sacrifice some of the trust and transparency benefits that make blockchain technology attractive. Hybrid approaches that combine elements of public and private blockchains are emerging as potential solutions, using public blockchains for transparency and auditability while maintaining private channels for sensitive voting data. The choice of platform must also consider factors such as transaction throughput, as corporate votes often involve millions of shares being voted simultaneously, and the ability to integrate with existing corporate infrastructure such as transfer agent systems and custodian platforms.

The regulatory landscape for blockchain voting in corporate governance remains complex and evolving, with different jurisdictions taking varied approaches to the technology’s use in shareholder voting. While some countries have explicitly authorized blockchain voting for corporate governance, others maintain regulatory frameworks designed for paper-based systems that create uncertainty for digital implementations. Companies must navigate securities regulations, corporate law, and data protection requirements, ensuring that blockchain voting systems comply with rules regarding proxy solicitation, shareholder communications, and vote verification. The challenge is compounded by the cross-border nature of many public companies’ shareholder bases, requiring systems that can accommodate different regulatory requirements simultaneously. Solutions include working with regulatory bodies to develop new frameworks that acknowledge the unique characteristics of blockchain technology while maintaining investor protections, as well as designing systems with sufficient flexibility to adapt to evolving regulatory requirements.

The integration of blockchain voting systems with existing corporate infrastructure presents significant technical and organizational challenges that require careful planning and execution. Legacy systems at transfer agents, custodians, and corporations themselves were not designed to interface with blockchain technology, necessitating the development of middleware solutions and APIs that can bridge the gap between traditional databases and distributed ledgers. The synchronization of shareholder records between multiple systems while maintaining data integrity and preventing double-voting requires sophisticated reconciliation mechanisms and real-time data feeds. Organizations must also address the challenge of managing cryptographic keys for potentially millions of shareholders, developing secure yet user-friendly solutions for key generation, distribution, and recovery that don’t create new vulnerabilities or barriers to participation.

The human factors involved in blockchain voting adoption present perhaps the most complex challenges, as success requires changing behaviors and building trust among diverse stakeholder groups with varying levels of technical sophistication. Retail shareholders may be intimidated by concepts like cryptographic keys and distributed ledgers, requiring extensive education and user experience design to make blockchain voting accessible. Institutional investors must integrate blockchain voting with their existing governance workflows and systems, potentially requiring significant changes to established processes. Board members and corporate executives need to understand and trust the technology sufficiently to advocate for its adoption, while internal audit and compliance teams must develop new frameworks for overseeing blockchain-based processes. Solutions include comprehensive education programs, phased rollouts that allow stakeholders to build familiarity gradually, and the development of intuitive interfaces that hide technical complexity while maintaining security and transparency.

The scalability and performance requirements of corporate voting create unique technical challenges that differ from other blockchain applications. Unlike cryptocurrency transactions that can be processed over time, corporate votes often have strict deadlines and require near-simultaneous processing of millions of votes. The system must handle peak loads during proxy season when multiple companies hold votes simultaneously, while maintaining consistent performance and reliability. Solutions include the development of layer-two scaling solutions that process votes off-chain before committing results to the main blockchain, sharding techniques that distribute voting across multiple parallel chains, and optimized consensus mechanisms designed specifically for voting applications. These technical solutions must be implemented without sacrificing the security and immutability that make blockchain voting attractive.

The question of dispute resolution in blockchain voting systems requires careful consideration, as the immutability that provides security also makes it difficult to correct errors or resolve disputes after votes are recorded. While traditional voting systems allow for recounts and challenges, blockchain systems must implement dispute resolution mechanisms that respect the technology’s immutable nature while providing necessary safeguards against errors or fraud. Solutions include implementing grace periods during which votes can be changed before final commitment to the blockchain, creating formal challenge procedures that can trigger additional verification steps, and maintaining off-chain evidence that can be used to verify on-chain records in case of disputes. These mechanisms must balance the need for finality in corporate decision-making with the requirement for fairness and accuracy in the voting process.

Real-World Applications and Case Studies

The practical implementation of blockchain voting systems in corporate governance has moved beyond theoretical proposals to real-world deployments that demonstrate both the technology’s potential and the practical considerations involved in its adoption. These pioneering implementations provide valuable insights into how organizations navigate technical, regulatory, and organizational challenges while delivering tangible benefits to stakeholders. By examining specific cases where companies and technology providers have successfully deployed blockchain voting systems, we can understand both the current state of the technology and its trajectory toward broader adoption. These real-world applications reveal patterns of success, common challenges, and innovative solutions that inform future implementations while building confidence in blockchain voting as a viable alternative to traditional proxy voting systems.

The evolution of blockchain voting implementations reflects a maturation process where early experiments have given way to production-ready systems that handle real shareholder votes with significant economic consequences. The progression from proof-of-concept demonstrations to systems processing billions of dollars in shareholder voting power demonstrates the technology’s readiness for mainstream adoption. Technology providers and corporations have developed sophisticated frameworks that address the full lifecycle of corporate voting, from shareholder authentication through vote tabulation and audit, while maintaining compliance with existing regulations and governance standards. These implementations showcase how blockchain technology adapts to the specific requirements of corporate governance while delivering the efficiency and transparency benefits that motivate its adoption.

The case of Broadridge Financial Solutions, a major player in the proxy voting infrastructure, demonstrates how established financial service providers are integrating blockchain technology to modernize corporate governance processes. In 2022, Broadridge expanded its distributed ledger repo (DLR) platform to process proxy voting for multiple public companies, handling over 100 million shares voted through blockchain technology during the 2023 proxy season. The platform utilizes a private, permissioned blockchain built on Hyperledger Fabric, enabling real-time vote confirmation while maintaining compatibility with existing proxy voting infrastructure. Broadridge’s implementation showcases a pragmatic approach where blockchain technology enhances rather than replaces existing systems, allowing for gradual migration while maintaining business continuity. The system processes votes from institutional investors through smart contracts that automatically verify eligibility and record votes on the distributed ledger, reducing reconciliation time from days to minutes.

The success of Broadridge’s blockchain voting platform stems from its ability to address real pain points in the proxy voting process while maintaining regulatory compliance and stakeholder trust. The platform provides end-to-end encryption of voting data while enabling authorized parties to audit the voting process in real-time, addressing long-standing concerns about vote confirmation and accuracy. By partnering with major custodian banks including J.P. Morgan and Northern Trust, Broadridge created a network effect that accelerated adoption among institutional investors who could leverage existing relationships and infrastructure. The platform’s smart contracts automatically enforce complex voting rules such as share lending restrictions and vote proportionality, eliminating manual errors that have historically plagued proxy voting. During the 2024 proxy season, companies using the platform reported cost savings of up to 30 percent on proxy solicitation and vote tabulation, while achieving faster vote finalization and reduced disputes over voting results.

Nasdaq’s implementation of blockchain voting technology through its Nasdaq Tallinn Stock Exchange in Estonia represents another significant milestone in the adoption of distributed ledger technology for corporate governance. Beginning in 2023, Nasdaq Tallinn enabled Estonian companies to conduct shareholder voting through a blockchain-based e-voting platform that leverages the country’s advanced digital identity infrastructure. The system, which processed votes for over 20 public companies during its first year of operation, demonstrates how blockchain voting can integrate with national digital infrastructure to create seamless governance experiences. Shareholders authenticate using Estonia’s national digital ID system, with their identity verified against share registries maintained by the Estonian Central Securities Depository, creating a trusted foundation for blockchain voting without requiring separate credential management.

The Estonian implementation highlights how supportive regulatory frameworks can accelerate blockchain voting adoption while maintaining appropriate investor protections. Estonia’s forward-thinking electronic signature and digital identity laws provided legal clarity that enabled Nasdaq to deploy blockchain voting with confidence that results would be legally binding and enforceable. The platform utilizes a hybrid architecture where votes are recorded on a private blockchain operated by Nasdaq while cryptographic hashes are periodically anchored to public blockchains for additional security and transparency. This approach balances the performance and privacy requirements of corporate voting with the security and immutability benefits of public blockchain infrastructure. During the 2024 annual meeting season, companies using the platform reported shareholder participation rates increasing by an average of 40 percent compared to traditional voting methods, with particularly strong adoption among younger shareholders who appreciate the digital-first experience.

Santander’s pioneering use of blockchain for proxy voting at its 2024 annual general meeting demonstrates how large financial institutions are leveraging the technology to enhance shareholder engagement while maintaining operational efficiency. The Spanish banking giant, working with technology partner Broadridge, enabled blockchain-based proxy voting for a subset of its institutional investors, processing over 500 million euros worth of share votes through the distributed ledger platform. The implementation required extensive coordination with custodian banks, proxy advisors, and regulatory authorities to ensure compliance with Spanish corporate law and European Union regulations. Santander’s approach involved running blockchain voting in parallel with traditional proxy voting during a transition period, allowing stakeholders to build confidence in the new system while maintaining familiar processes. The bank reported that blockchain-based votes were confirmed and tallied in real-time, compared to the traditional multi-day reconciliation process, while providing cryptographic proof of vote recording that enhanced investor confidence.

The lessons learned from Santander’s implementation provide valuable insights for other organizations considering blockchain voting adoption. The bank discovered that institutional investor adoption accelerated when proxy advisory firms integrated blockchain voting into their recommendation platforms, eliminating the need for investors to learn new systems or change established workflows. The importance of maintaining detailed audit logs became apparent when regulators requested documentation of the voting process, with the blockchain’s immutable record providing comprehensive evidence of compliance with governance requirements. Santander also found that smart contracts needed careful calibration to handle edge cases such as share lending recalls and vote changes, requiring extensive testing with real-world scenarios before production deployment. The success of the 2024 implementation led Santander to announce plans for expanding blockchain voting to all shareholders by 2025, with enhanced mobile interfaces designed to encourage retail investor participation.

The implementation of blockchain voting by Overstock.com through its subsidiary Medici Ventures showcases how companies can use the technology to pioneer new forms of shareholder engagement and corporate governance innovation. In late 2023, Overstock conducted a precedent-setting blockchain-based voting process for its Series A-1 preferred stock holders, utilizing the Ravencoin blockchain platform to enable direct shareholder voting without traditional intermediaries. The implementation required Overstock to work closely with the Securities and Exchange Commission to ensure compliance with federal securities laws while pushing the boundaries of what’s possible with blockchain-based governance. The company issued digital voting tokens to preferred shareholders that could be used to cast votes directly on the blockchain, with results tabulated automatically through smart contracts. This direct-to-blockchain approach eliminated virtually all intermediaries from the voting process, reducing costs while providing unprecedented transparency and shareholder control.

The technical architecture of Overstock’s blockchain voting system demonstrates innovative approaches to solving key challenges in distributed ledger governance. The company implemented a multi-signature wallet system where voting tokens required authorization from both the shareholder and a designated transfer agent to prevent unauthorized transfers while maintaining shareholder autonomy. The use of Ravencoin, a blockchain specifically designed for asset tokenization, provided native support for securities-like features such as restricted transfers and dividend distributions, simplifying the implementation of complex governance rules. Overstock’s system also pioneered the use of atomic swaps for proxy delegation, allowing shareholders to temporarily delegate voting rights without transferring share ownership, maintaining economic interests while enabling flexible governance participation. The successful completion of multiple votes using this system throughout 2024 demonstrated the viability of fully decentralized corporate voting, though the company acknowledged that regulatory uncertainty remains a barrier to broader adoption.

These real-world implementations collectively demonstrate that blockchain voting in corporate governance has progressed from experimental concept to operational reality, with major corporations and financial institutions successfully processing significant voting volumes through distributed ledger technology. The diversity of implementation approaches, from Broadridge’s integration with existing infrastructure to Overstock’s direct-to-blockchain model, illustrates that there is no one-size-fits-all solution for blockchain voting adoption. Success factors that emerge across these cases include the importance of stakeholder education and engagement, the need for regulatory clarity and cooperation, the value of phased implementation approaches that build confidence gradually, and the critical role of ecosystem partnerships in driving adoption. As these early implementations mature and expand, they provide blueprints for other organizations while demonstrating that the benefits of blockchain voting can be realized within existing regulatory and operational constraints.

Final Thoughts

The emergence of blockchain voting systems in corporate governance represents a watershed moment in the evolution of shareholder democracy, fundamentally reimagining how collective decision-making occurs within public companies. This technological transformation extends far beyond simple digitization of existing processes to create entirely new possibilities for stakeholder engagement, corporate accountability, and democratic participation in business governance. The convergence of distributed ledger technology with corporate governance requirements has produced solutions that address decades-old challenges while opening doors to governance models that were previously impossible to implement. As organizations worldwide grapple with demands for greater transparency, inclusivity, and efficiency in corporate decision-making, blockchain voting systems emerge not merely as a technological upgrade but as a catalyst for reimagining the relationship between corporations and their stakeholders.

The implications of widespread blockchain voting adoption ripple through the entire economic ecosystem, potentially reshaping capital markets, corporate behavior, and the fundamental dynamics of public company ownership. When every shareholder can easily and reliably exercise their voting rights, regardless of the size of their holdings or geographic location, the concentration of governance power that has characterized modern corporations begins to dissipate. This democratization of corporate governance could lead to more diverse perspectives influencing corporate strategy, potentially driving companies toward more sustainable and socially responsible practices that reflect the values of their broader shareholder base rather than just large institutional investors. The transparency and immutability of blockchain voting records create new accountability mechanisms that make it harder for corporate boards to ignore shareholder sentiment or pursue strategies that lack broad support.

The intersection of blockchain voting technology with broader trends in financial inclusion and digital transformation suggests that these systems could play a crucial role in expanding access to capital markets and corporate ownership. As blockchain voting reduces the friction and cost of shareholder participation, it becomes economically viable for individuals with modest investments to actively engage in corporate governance, potentially encouraging broader equity ownership among populations that have historically been excluded from capital markets. This expansion of the investor base could provide corporations with more stable, long-term oriented capital while giving more people a stake in corporate success, aligning corporate interests with broader societal goals. The technology thus becomes a tool not just for improving corporate governance but for advancing economic democracy and reducing wealth inequality.

The ongoing evolution of blockchain voting systems reflects the dynamic interplay between technological innovation, regulatory adaptation, and stakeholder needs. As artificial intelligence and machine learning capabilities integrate with blockchain platforms, we can envision voting systems that provide sophisticated analytics and decision support to help shareholders make informed choices about complex proposals. Natural language processing could make corporate proposals more accessible to retail investors, while predictive analytics might help boards understand likely voting outcomes and adjust proposals accordingly. These technological advances must be balanced with concerns about manipulation, privacy, and the need to maintain human agency in corporate governance, requiring continued dialogue between technologists, regulators, and governance practitioners.

The challenges that remain in blockchain voting implementation should not overshadow the remarkable progress made in recent years, but rather should be viewed as opportunities for continued innovation and refinement. Questions about key management, dispute resolution, and regulatory compliance are being addressed through practical experience and collaborative problem-solving among stakeholders. Each successful implementation provides lessons that inform future deployments, gradually building a body of knowledge and best practices that accelerate adoption and reduce implementation risk. The development of industry standards and regulatory frameworks specifically designed for blockchain voting will provide the clarity and confidence needed for mainstream adoption, while technological advances continue to address scalability, usability, and integration challenges.

Looking toward the future, blockchain voting systems appear poised to become standard infrastructure for corporate governance, much as electronic trading transformed capital markets in previous decades. This transformation will not happen overnight but will proceed through waves of adoption as different stakeholder groups recognize the benefits and develop comfort with the technology. The companies that embrace blockchain voting early may find themselves with competitive advantages in attracting investors who value transparent and efficient governance, while those that resist may face pressure from shareholders demanding modernization. As the technology matures and costs decrease, blockchain voting could extend beyond public companies to private firms, non-profit organizations, and other entities that require collective decision-making, fundamentally changing how organizations of all types engage with their stakeholders. The ultimate promise of blockchain voting lies not just in making existing governance processes more efficient but in enabling new forms of organizational structure and stakeholder engagement that better serve the needs of all participants in our increasingly interconnected global economy.

FAQs

- What is blockchain voting in corporate governance and how does it differ from traditional proxy voting?

Blockchain voting in corporate governance utilizes distributed ledger technology to record and tally shareholder votes in a transparent, immutable, and cryptographically secure manner. Unlike traditional proxy voting that relies on paper forms, multiple intermediaries, and centralized vote counting, blockchain voting creates a direct digital connection between shareholders and the voting process. The technology eliminates many intermediaries while providing real-time vote confirmation, cryptographic proof of vote recording, and an immutable audit trail that prevents manipulation or disputes about voting results. - How does blockchain technology ensure both transparency and privacy in shareholder voting?

Blockchain voting systems achieve the seemingly contradictory goals of transparency and privacy through sophisticated cryptographic techniques such as zero-knowledge proofs and homomorphic encryption. These methods allow the network to verify that votes are valid and count them accurately without revealing how individual shareholders voted. The blockchain provides a transparent record showing that votes were cast and counted correctly, while encryption ensures that the content of each vote remains private. Shareholders can verify their own votes using cryptographic proofs while other participants can audit the overall process without accessing individual voting choices. - What are the main costs associated with implementing blockchain voting systems for corporations?

The costs of implementing blockchain voting systems include initial technology development or licensing fees, integration with existing corporate infrastructure, stakeholder education and training, and ongoing operational expenses. While upfront costs can be significant, ranging from hundreds of thousands to several million dollars for large corporations, these investments are typically offset by substantial savings in proxy solicitation, vote tabulation, and dispute resolution costs. Companies report cost reductions of 20 to 30 percent in overall proxy voting expenses after blockchain implementation, with the payback period typically ranging from two to four years depending on voting frequency and shareholder base size. - How do blockchain voting systems handle different types of voting methods such as cumulative voting or supermajority requirements?

Smart contracts within blockchain voting systems are programmed to automatically implement various voting methods and requirements specific to each corporation’s bylaws and governance rules. For cumulative voting in director elections, smart contracts calculate and apply the appropriate vote multiplication based on the number of shares and open positions. Supermajority requirements are encoded into the validation logic, ensuring that proposals only pass when they meet predetermined thresholds. The flexibility of smart contracts allows for complex voting scenarios including class-based voting rights, contingent proposals, and automatic runoff elections, all executed without manual intervention. - What happens if a shareholder loses their cryptographic keys or voting credentials?

Blockchain voting systems implement various recovery mechanisms to address lost credentials while maintaining security. Most systems use hierarchical deterministic key generation that allows shareholders to recover access using secure backup phrases or through identity verification with transfer agents. Some implementations use multi-signature approaches where shareholders can designate trusted parties who can collectively help recover access if primary credentials are lost. Advanced systems are exploring biometric authentication and social recovery mechanisms that balance security with usability, ensuring that technical challenges don’t disenfranchise shareholders from exercising their voting rights. - Are blockchain voting results legally binding and recognized by regulatory authorities?

The legal status of blockchain voting varies by jurisdiction, with some countries explicitly recognizing blockchain records as legally valid while others are still developing regulatory frameworks. In the United States, Delaware and Wyoming have amended their corporate laws to explicitly authorize blockchain-based stock ledgers and voting, providing legal clarity for corporations incorporated in these states. The European Union has implemented regulations that recognize the legal validity of blockchain records under certain conditions. Corporations implementing blockchain voting typically work closely with legal counsel and regulatory authorities to ensure compliance with applicable laws and often run parallel traditional voting processes during transition periods to maintain legal certainty. - How do blockchain voting systems prevent double voting or vote manipulation?

Blockchain voting systems prevent double voting through multiple technical mechanisms including unique token issuance, smart contract validation, and consensus protocols. Each shareholder receives voting tokens or credentials that can only be used once per proposal, with smart contracts automatically rejecting any attempts to vote multiple times. The distributed nature of blockchain means that manipulating votes would require controlling a majority of network nodes simultaneously, which becomes exponentially difficult as the network grows. Additionally, cryptographic techniques such as commit-reveal schemes prevent vote buying or coercion by ensuring that votes cannot be proven to third parties, maintaining the integrity of the democratic process. - What is the environmental impact of blockchain voting compared to traditional paper-based proxy voting?

Blockchain voting systems generally have a lower environmental impact than traditional proxy voting when considering the complete lifecycle of both processes. Traditional proxy voting involves printing and mailing millions of paper documents, transportation emissions, and physical storage requirements. While blockchain systems do consume electricity for computational processing, modern implementations using efficient consensus mechanisms such as proof-of-authority or proof-of-stake consume far less energy than early blockchain systems. Studies indicate that blockchain voting can reduce the carbon footprint of corporate governance by 60 to 80 percent compared to paper-based systems, particularly when powered by renewable energy sources. - Can blockchain voting systems integrate with existing proxy advisory services and institutional investor platforms?

Modern blockchain voting systems are designed to integrate seamlessly with existing proxy advisory services and institutional investor governance platforms through standardized APIs and data formats. Major proxy advisors such as ISS and Glass Lewis have developed capabilities to provide voting recommendations directly through blockchain platforms, allowing institutional investors to implement their voting policies without changing established workflows. Integration protocols enable automatic vote execution based on predetermined policies while maintaining audit trails that satisfy regulatory requirements. This interoperability ensures that blockchain voting enhances rather than disrupts existing governance processes, facilitating adoption among institutional investors who rely on these established services. - What contingency plans exist if a blockchain voting system experiences technical failures during a critical vote?

Blockchain voting implementations include comprehensive disaster recovery and business continuity plans to address potential technical failures. The distributed nature of blockchain provides inherent resilience, as the system can continue operating even if multiple nodes fail. Most implementations maintain backup voting channels that can be activated if the primary blockchain system becomes unavailable, including traditional proxy voting methods or alternative digital platforms. Smart contracts can be programmed with emergency procedures that automatically extend voting deadlines or trigger alternative processes if system availability falls below predetermined thresholds. Regular disaster recovery testing and simulation exercises ensure that contingency plans remain effective and that stakeholders understand their roles in emergency scenarios.