The decentralized finance ecosystem has fundamentally transformed how individuals interact with financial markets, creating opportunities that were once exclusive to institutional investors and sophisticated traders. Among these revolutionary developments, leveraged yield farming has emerged as one of the most compelling yet complex strategies for generating enhanced returns through the strategic use of borrowed capital. This sophisticated approach to yield generation combines the fundamental principles of traditional leverage with the innovative mechanisms of decentralized protocols, creating a unique landscape where participants can potentially amplify their returns while navigating an intricate web of risks and opportunities.

The concept of leveraged yield farming represents a significant evolution from traditional yield farming practices, introducing an additional layer of complexity through the incorporation of borrowed funds to increase position sizes and potential returns. Unlike conventional yield farming where participants use only their own capital to provide liquidity or stake assets in various protocols, leveraged yield farming enables users to borrow additional funds against their collateral, effectively multiplying their exposure to both the rewards and risks inherent in these strategies. This mechanism has attracted considerable attention from both retail and institutional participants seeking to maximize their capital efficiency in the rapidly evolving DeFi space, though it demands a sophisticated understanding of risk management principles and the various factors that can impact leveraged positions.

Understanding the delicate balance between potential returns and the associated risks becomes paramount for anyone considering leveraged yield farming strategies. The amplification effect of leverage works bidirectionally, meaning that while profits can be significantly enhanced during favorable market conditions, losses can accumulate just as rapidly when markets move against leveraged positions. This reality necessitates a comprehensive approach to risk management that goes beyond simple position monitoring and requires participants to understand liquidation mechanics, implement hedging strategies, and maintain disciplined position management practices. The journey through leveraged yield farming demands not only technical knowledge of DeFi protocols and their mechanisms but also a deep appreciation for risk assessment, market dynamics, and the psychological aspects of managing leveraged positions during periods of high volatility.

Understanding Leveraged Yield Farming Fundamentals

The foundation of leveraged yield farming rests upon the convergence of several core DeFi primitives that work together to create opportunities for enhanced yield generation through borrowed capital. At its essence, this strategy involves participants depositing collateral into lending protocols, borrowing against that collateral, and then deploying both the original capital and borrowed funds into yield-generating opportunities across various DeFi platforms. This process creates a recursive loop where the yields generated from the enlarged position ideally exceed the borrowing costs, resulting in a net positive return that surpasses what would have been possible with the original capital alone. The sophistication of modern DeFi infrastructure has made this process increasingly accessible, though the underlying complexity requires careful consideration of multiple interconnected factors.

The ecosystem supporting leveraged yield farming has evolved dramatically since the early days of DeFi, with specialized protocols emerging to facilitate more efficient and safer leverage strategies. These protocols range from simple lending platforms that allow manual leverage loops to sophisticated vault strategies that automate the entire process of maintaining leveraged positions. The integration between different protocol layers creates a complex but powerful system where liquidity flows seamlessly between lending markets, automated market makers, and yield aggregators, enabling participants to construct elaborate strategies that would have been impossible in traditional financial markets. This interconnectedness, while creating opportunities, also introduces systemic risks that must be carefully evaluated when engaging in leveraged yield farming activities.

Core Concepts and Mechanics

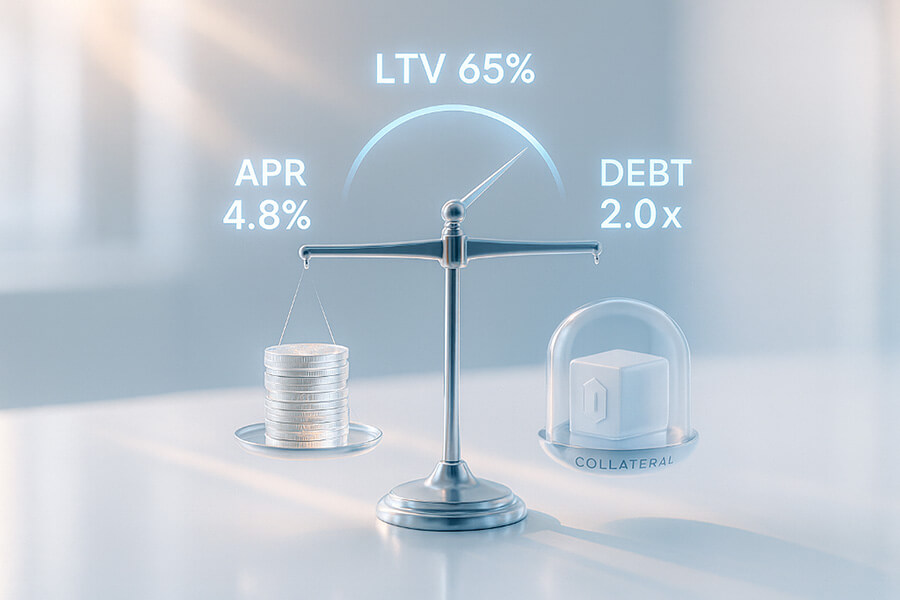

The mechanical foundation of leveraged yield farming begins with the interaction between lending protocols and yield-generating opportunities, creating a system where capital efficiency can be maximized through strategic borrowing. When a participant deposits assets into a lending protocol as collateral, they receive the ability to borrow against that collateral up to a certain loan-to-value ratio, which varies depending on the perceived risk of both the collateral and borrowed assets. This borrowed capital can then be deployed into various yield farming strategies, such as providing liquidity to automated market makers, participating in liquidity mining programs, or engaging in more complex strategies involving multiple protocols. The key to successful leveraged yield farming lies in maintaining a careful balance between the yields generated from the deployed capital and the interest costs associated with the borrowed funds, while simultaneously managing the risk of liquidation.

The role of automated market makers in leveraged yield farming cannot be overstated, as they serve as the primary venue for deploying leveraged capital in search of yields. These protocols operate on mathematical formulas that automatically determine asset prices based on the ratio of assets in liquidity pools, creating opportunities for liquidity providers to earn fees from trading activity. When leverage is applied to liquidity provision, participants can amplify their share of trading fees and liquidity mining rewards, though they also increase their exposure to impermanent loss, a phenomenon where the value of assets in a liquidity pool diverges from simply holding the assets. Understanding the mechanics of impermanent loss becomes even more critical in leveraged positions, as the amplified exposure can lead to significant losses if not properly managed through careful asset selection and position monitoring.

The collateralization process in leveraged yield farming introduces another layer of complexity that participants must navigate carefully. Different protocols implement varying collateralization requirements and liquidation thresholds, creating a diverse landscape of risk-return profiles. Some protocols offer isolated lending markets where the risk of one position doesn’t affect others, while cross-margin systems allow for more capital efficiency but introduce additional systemic risks. The health factor, a metric that represents the safety of a leveraged position relative to its liquidation threshold, becomes a critical parameter that must be constantly monitored and managed. Participants must understand how changes in asset prices, interest rates, and protocol parameters can affect their health factor and potentially trigger liquidation events that could result in significant losses.

The Leverage Multiplier Effect

The mathematical relationship between leverage ratios and potential returns forms the cornerstone of understanding how borrowed capital amplifies both profits and losses in yield farming strategies. When a participant employs 2x leverage, they essentially double their exposure to the underlying yield opportunity, meaning that a 10% return on the deployed capital translates to a 20% return on their initial investment, minus borrowing costs. However, this same multiplier effect applies to losses, where a 10% decline in the value of the farming position results in a 20% loss on the original capital. This bidirectional amplification becomes increasingly pronounced at higher leverage ratios, where even small market movements can have dramatic impacts on the overall position value and potentially trigger liquidation events.

The relationship between leverage ratios and liquidation risk follows a non-linear progression that many participants underestimate when initially engaging with leveraged yield farming. As leverage increases, the margin for error decreases exponentially, meaning that the price movement required to trigger liquidation becomes progressively smaller. For instance, a position with 2x leverage might withstand a 40% decline in collateral value before liquidation, while a 5x leveraged position might face liquidation with just a 15% adverse price movement. This mathematical reality underscores the importance of selecting appropriate leverage ratios based not only on expected returns but also on the volatility characteristics of the underlying assets and the participant’s risk tolerance. The optimization of leverage ratios requires sophisticated modeling that accounts for historical volatility, correlation between assets, and the probability of extreme market events.

Real-world applications of leverage in DeFi protocols demonstrate the diverse ways in which the multiplier effect can be utilized across different yield farming strategies. Platforms like Alpaca Finance and Tarot Finance have pioneered leveraged yield farming products that allow users to borrow assets specifically for liquidity provision, with some positions achieving effective leverage ratios of up to 6x or higher. These protocols implement sophisticated liquidation mechanisms and risk parameters to maintain system stability while enabling participants to maximize capital efficiency. The success stories of traders who have effectively utilized leverage during trending markets are balanced by cautionary tales of positions liquidated during market corrections, highlighting the critical importance of understanding not just the potential rewards but also the inherent risks of leverage multiplication in yield farming contexts.

The integration of leveraged yield farming strategies has evolved significantly with the introduction of delta-neutral approaches that aim to minimize directional market risk while capturing yield opportunities. These sophisticated strategies involve carefully balancing long and short positions to maintain market neutrality while using leverage to amplify the yield component of the strategy. For example, a participant might provide liquidity to a stablecoin pair with leverage while simultaneously hedging any residual exposure to volatile assets through perpetual futures or options markets. This approach demonstrates how the leverage multiplier effect can be harnessed in more nuanced ways that go beyond simple directional bets, though it requires a deep understanding of multiple DeFi protocols and their interactions.

Critical Risk Factors and Assessment

The landscape of risks associated with leveraged yield farming extends far beyond simple market volatility, encompassing a complex matrix of technical, operational, and systemic factors that can impact position safety and profitability. Understanding these multifaceted risks requires a comprehensive framework that accounts for both the obvious dangers of price movements and liquidations, as well as the more subtle risks embedded in smart contract interactions, oracle dependencies, and protocol governance decisions. The interconnected nature of DeFi protocols means that risks can cascade across multiple platforms, creating scenarios where a vulnerability in one protocol can trigger widespread liquidations and losses across the entire ecosystem.

The assessment of risk in leveraged yield farming must consider both quantifiable metrics and qualitative factors that can influence position outcomes. While traditional financial risk metrics such as value-at-risk and maximum drawdown provide useful frameworks for understanding potential losses, the unique characteristics of DeFi introduce additional considerations such as smart contract risk, oracle manipulation vulnerabilities, and the potential for governance attacks. The rapid pace of innovation in the DeFi space means that new risk vectors emerge regularly, requiring participants to maintain constant vigilance and adapt their risk assessment frameworks to account for evolving threats. This dynamic environment demands a proactive approach to risk management that goes beyond reactive measures and incorporates forward-looking analysis of potential vulnerabilities and systemic risks.

Liquidation and Market Volatility

The mechanics of liquidation in leveraged yield farming represent one of the most immediate and impactful risks that participants face, with the potential for complete loss of collateral if positions are not properly managed during volatile market conditions. Liquidation occurs when the value of collateral falls below a predetermined threshold relative to the borrowed amount, triggering an automatic process where liquidators repay the debt in exchange for purchasing the collateral at a discount. This mechanism, while necessary for maintaining protocol solvency, can result in significant losses for users who find themselves on the wrong side of market movements. The speed at which liquidations can occur in automated systems means that positions can be closed out within minutes or even seconds of crossing liquidation thresholds, leaving little time for manual intervention or adjustment.

The relationship between market volatility and liquidation risk becomes particularly pronounced during periods of extreme price movements, where cascading liquidations can create self-reinforcing cycles of selling pressure. The May 2022 Terra Luna collapse provides a stark example of how leveraged positions across multiple protocols were systematically liquidated as the price of LUNA and UST spiraled downward. According to data from various DeFi analytics platforms, over $500 million in leveraged positions were liquidated within a 48-hour period, with many users losing their entire collateral despite initially conservative leverage ratios. The event highlighted how correlations between assets can increase dramatically during market stress, causing supposedly diversified positions to experience simultaneous losses that trigger liquidation cascades across multiple protocols.

Understanding health factors and their relationship to liquidation thresholds requires careful attention to the specific parameters implemented by different lending protocols. Compound Finance, for instance, uses a collateral factor system where different assets have varying borrowing power based on their perceived risk, while Aave implements a more granular approach with separate loan-to-value ratios and liquidation thresholds for each asset. These differences mean that identical positions across different protocols can have vastly different risk profiles, requiring participants to carefully consider where and how they deploy leveraged strategies. The dynamic nature of these parameters, which can be adjusted through governance proposals, adds another layer of complexity to risk management, as changes to protocol parameters can suddenly alter the safety margin of existing positions.

The impact of gas prices and network congestion on liquidation risk represents an often-overlooked factor that can significantly affect position outcomes during volatile periods. During the March 2024 Ethereum network congestion event triggered by a popular NFT mint, gas prices spiked to over 500 gwei, making it economically unviable for many users to adjust their leveraged positions or add additional collateral to avoid liquidation. Several participants reported losses exceeding $100,000 as they watched their positions approach liquidation thresholds but were unable to execute transactions due to prohibitive gas costs. This scenario underscores the importance of maintaining adequate safety margins and having contingency plans that account for potential network congestion during critical moments.

Protocol-Specific Risks

The vulnerability of smart contracts to exploits and bugs represents a fundamental risk in leveraged yield farming that can result in complete loss of funds regardless of market conditions or position management. The complexity of leveraged yield farming protocols, which often involve multiple interacting smart contracts and cross-protocol integrations, creates an expanded attack surface that malicious actors can potentially exploit. The April 2023 Euler Finance hack, where an attacker exploited a vulnerability in the protocol’s donation mechanism to steal $197 million, demonstrated how even well-audited protocols can contain critical vulnerabilities. The incident particularly impacted leveraged yield farmers who had positions across multiple protocols that relied on Euler for borrowing, highlighting how smart contract risks can propagate across the DeFi ecosystem.

Oracle manipulation attacks pose a particularly acute threat to leveraged positions, as they can trigger artificial liquidations by temporarily distorting the price feeds that protocols use to determine position health. The October 2022 Mango Markets exploit on Solana, where an attacker manipulated the price of the MNGO token to borrow and withdraw $114 million from the protocol, illustrates how oracle vulnerabilities can be weaponized against leveraged positions. The attacker used a relatively small amount of capital to artificially inflate the price of MNGO through coordinated trades, then used the inflated collateral value to borrow against other assets in the protocol. This type of attack is particularly dangerous for leveraged yield farmers because it can trigger liquidations based on false price information, resulting in permanent losses even after prices return to normal levels.

Impermanent loss in leveraged liquidity positions represents a unique risk factor that becomes significantly amplified when borrowed capital is involved. Unlike traditional liquidity provision where impermanent loss is offset by trading fees over time, leveraged positions must generate enough additional yield to cover both impermanent loss and borrowing costs. The November 2023 case of leveraged liquidity providers in the ETH-USDC pool on Uniswap V3 during Ethereum’s rally from $1,800 to $2,400 provides a concrete example of this risk. Participants who had employed 3x leverage on their liquidity positions experienced effective impermanent losses exceeding 15% of their position value, which, when combined with borrowing costs averaging 8% annually, resulted in net losses despite earning significant trading fees. The concentrated liquidity feature of Uniswap V3 exacerbated these losses, as positions went out of range more quickly than anticipated, requiring costly rebalancing that further eroded returns.

The risk of protocol insolvency and contagion effects became starkly apparent during the June 2023 Curve Finance exploit, where a vulnerability in certain Curve pools led to approximately $70 million in losses. The incident had ripple effects across multiple lending protocols where Curve LP tokens were used as collateral for leveraged positions. Frax Finance and Alchemix, both of which had significant exposure to affected Curve pools, faced potential insolvency scenarios that were only avoided through rapid community response and white-hat hacker interventions. Leveraged yield farmers with positions involving Curve LP tokens faced uncertainty about the value of their collateral, with some positions being preemptively liquidated by risk-averse protocols despite the eventual recovery of most funds. This event underscored how protocol-specific risks can quickly become systemic, affecting participants across multiple platforms and strategies.

The comprehensive examination of these protocol-specific risks reveals that successful leveraged yield farming requires not only an understanding of market dynamics but also deep technical knowledge of the protocols being utilized. Participants must evaluate the security practices of protocols, including audit history, bug bounty programs, and incident response procedures, while also considering the economic security of the protocol through metrics such as total value locked and the distribution of governance tokens. The integration risks between protocols add another dimension to this analysis, as the composability that makes DeFi powerful also creates interdependencies that can amplify protocol-specific vulnerabilities across the ecosystem.

Risk Management Framework and Strategies

The development of a robust risk management framework for leveraged yield farming requires a systematic approach that integrates multiple defensive strategies while maintaining the flexibility to capitalize on favorable market conditions. Successful practitioners in this space understand that risk management is not simply about avoiding losses but rather about optimizing the risk-reward ratio of their positions through careful planning, continuous monitoring, and disciplined execution. The framework must account for both predictable risks that can be quantified and modeled, as well as black swan events that fall outside normal statistical distributions but can have catastrophic impacts on leveraged positions.

The evolution of risk management strategies in DeFi has been accelerated by the lessons learned from various market crises and protocol failures over the past several years. These experiences have led to the development of sophisticated approaches that combine traditional financial risk management principles with novel techniques specific to the blockchain environment. Modern risk management frameworks incorporate elements such as automated position adjustments, multi-signature security for large positions, and the use of decentralized insurance protocols to protect against smart contract failures. The integration of these various components creates a comprehensive defense system that can help protect leveraged positions from the multitude of risks present in the DeFi ecosystem.

Position Management Techniques

The cornerstone of effective position management in leveraged yield farming lies in the careful calibration of position sizes relative to overall portfolio exposure and risk tolerance. Professional yield farmers typically employ a tiered approach to position sizing, where the amount of leverage and capital allocated to each strategy is determined by a combination of factors including historical volatility, liquidity depth, and protocol risk assessment. This approach prevents any single position from having the potential to cause catastrophic losses to the overall portfolio, while still allowing for meaningful returns from successful strategies. The implementation of position limits requires discipline and the ability to resist the temptation to over-leverage during periods of strong performance, as these are often the times when risk accumulates most rapidly.

The process of setting appropriate leverage ratios demands a nuanced understanding of the relationship between different risk factors and their potential impact on position safety. Rather than applying uniform leverage across all strategies, sophisticated practitioners adjust their leverage based on the specific characteristics of each opportunity. Stablecoin farming strategies might support higher leverage ratios due to lower volatility, while positions involving volatile assets require more conservative approaches. The January 2024 implementation of dynamic leverage limits by Kamino Finance on Solana provides an instructive example of how protocols are evolving to help users manage leverage more effectively. The protocol automatically adjusts maximum leverage ratios based on real-time volatility metrics and liquidity conditions, with some users reporting a 40% reduction in liquidation events after the feature was implemented.

Diversification across protocols and asset types serves as a critical defense mechanism against both systematic and idiosyncratic risks in leveraged yield farming. This diversification extends beyond simply spreading capital across different farms to include geographic distribution across blockchain networks, temporal diversification through staggered entry and exit points, and strategic diversification across different types of yield opportunities. The March 2024 Arbitrum network outage, which lasted for several hours and prevented users from managing their positions, highlighted the importance of maintaining positions across multiple chains. Yield farmers who had diversified their leveraged positions across Ethereum, Polygon, and Avalanche were able to continue managing the majority of their portfolio despite the temporary loss of access to Arbitrum-based positions.

The maintenance of healthy collateral levels through active management and rebalancing represents an ongoing challenge that separates successful leveraged yield farmers from those who suffer frequent liquidations. This process involves continuously monitoring health factors across all positions and making preemptive adjustments before situations become critical. Advanced practitioners often maintain automated systems that can add collateral or reduce leverage when certain thresholds are approached, though these systems must be carefully calibrated to avoid excessive transaction costs. The implementation of cross-margin systems by protocols like dYdX has introduced new possibilities for collateral management, allowing traders to use unrealized profits from one position to support the margin requirements of another, though this approach also introduces additional complexity and risk considerations.

Hedging and Protection Methods

The integration of derivative instruments into leveraged yield farming strategies has opened new avenues for risk mitigation that were previously unavailable in the DeFi ecosystem. Options protocols such as Dopex and Lyra have made it possible for yield farmers to purchase protective puts on their collateral assets or sell covered calls to generate additional income while capping upside potential. These strategies allow participants to define their maximum loss while maintaining exposure to yield farming opportunities, creating a more predictable risk-return profile. The September 2023 case of a large yield farmer who used Dopex options to hedge a $5 million leveraged position in the ETH-USDC pool demonstrates the practical application of these strategies. By purchasing put options with a strike price 20% below the current market price, the farmer was able to limit potential losses to the option premium plus the 20% drawdown, while maintaining full exposure to the upside potential of the farming strategy.

Delta-neutral farming strategies represent a sophisticated approach to leveraged yield farming that aims to eliminate directional market risk while capturing yield from multiple sources. These strategies typically involve maintaining balanced long and short positions that offset each other’s price movements while generating yield from funding rates, trading fees, or liquidity incentives. The implementation by Polynomial Protocol of automated delta-neutral vaults in January 2024 marked a significant advancement in making these strategies accessible to a broader audience. The protocol’s vaults automatically rebalance positions to maintain delta neutrality while farming yields across multiple protocols, with some vaults achieving annualized returns exceeding 25% with minimal directional risk. Users of these vaults reported significantly lower volatility in their returns compared to traditional leveraged farming strategies, though the complexity and gas costs associated with continuous rebalancing remain challenges.

The utilization of stop-loss mechanisms in DeFi presents unique challenges due to the decentralized nature of these systems and the potential for price manipulation. Unlike traditional markets where stop-loss orders can be placed on centralized exchanges, DeFi requires more creative solutions such as keeper networks or automated position managers that monitor prices and execute protective actions when predetermined thresholds are reached. Gelato Network’s implementation of stop-loss functionality for Uniswap V3 positions provides a practical example of how these systems can work in practice. The service monitors position health and automatically withdraws liquidity and repays loans when specified conditions are met, though users must carefully consider the trade-off between protection and the potential for premature position closure during temporary price spikes.

Insurance protocols have emerged as an important component of comprehensive risk management strategies for leveraged yield farmers, offering protection against smart contract failures, oracle manipulations, and other protocol-specific risks. Nexus Mutual and InsureDAO provide coverage options that can protect against losses from exploits or technical failures, though the cost of insurance must be factored into overall strategy returns. The February 2024 payout by Nexus Mutual to users affected by the Socket Protocol bridge hack demonstrated the value of insurance in protecting leveraged positions. Covered users received compensation for losses within two weeks of the incident, while uninsured participants faced lengthy recovery processes with uncertain outcomes. The integration of insurance into leveraged strategies requires careful consideration of coverage terms, exclusions, and the impact of premium costs on overall profitability.

The evolution of hedging and protection methods in DeFi continues to advance with the introduction of new protocols and strategies that address the unique challenges of leveraged yield farming. The development of on-chain circuit breakers, automated risk assessment tools, and sophisticated hedging algorithms promises to make leveraged strategies more accessible and safer for a broader range of participants. However, these tools require proper understanding and configuration to be effective, and over-reliance on automated systems without understanding their limitations can create false confidence that leads to excessive risk-taking.

Implementation and Monitoring Systems

The successful execution of leveraged yield farming strategies depends heavily on the implementation of robust monitoring and management systems that can track positions across multiple protocols and chains while providing actionable insights for decision-making. The complexity of managing leveraged positions in DeFi, where parameters can change rapidly and opportunities emerge and disappear within hours, necessitates a comprehensive technological infrastructure that goes beyond simple portfolio tracking. Modern implementation systems must integrate real-time data feeds, automated execution capabilities, and sophisticated analytics to help participants navigate the dynamic landscape of leveraged yield farming while maintaining operational security and efficiency.

The evolution of monitoring systems has been driven by the increasing sophistication of DeFi protocols and the growing recognition that manual management of leveraged positions is both inefficient and risky. Professional yield farmers now employ comprehensive dashboards that aggregate data from multiple sources, automated alert systems that notify them of critical changes, and execution infrastructure that can rapidly respond to market conditions. These systems represent a significant investment in both technology and operational processes, but they have become essential for anyone seriously engaged in leveraged yield farming at scale.

Tools and Platforms for Risk Tracking

The landscape of risk tracking tools for leveraged yield farming has expanded dramatically with the introduction of specialized platforms that provide comprehensive visibility into position health across multiple protocols. DeBank, Zapper, and DeFi Saver have emerged as leading solutions that offer unified dashboards for monitoring leveraged positions, with features including real-time health factor tracking, profit and loss calculations, and historical performance analysis. These platforms aggregate data from dozens of protocols across multiple chains, providing users with a consolidated view of their entire leveraged portfolio. The April 2024 upgrade to DeFi Saver’s automation features introduced machine learning algorithms that predict liquidation risks based on historical volatility patterns and current market conditions, with beta testers reporting a 60% reduction in unexpected liquidations compared to manual monitoring.

The implementation of automated alert systems has become crucial for managing the 24/7 nature of DeFi markets where critical events can occur at any time. Platforms like HAL and Tenderly offer customizable notification systems that can alert users via multiple channels including email, SMS, Telegram, and Discord when specific conditions are met. These conditions can range from simple threshold alerts for health factors to complex multi-variable triggers that account for correlation risks across different positions. The May 2024 integration of Tenderly’s alert system with major lending protocols allowed users to receive notifications directly from the protocol level, ensuring faster and more reliable alerts compared to third-party monitoring solutions. Users report that these alert systems have been instrumental in preventing liquidations, with one large farmer crediting automated alerts for saving a $2 million position during a flash crash event that occurred during Asian trading hours.

Portfolio management tools specifically designed for yield farming have introduced sophisticated features that help users optimize their leveraged strategies while maintaining risk within acceptable parameters. Harvest Finance and Yearn Finance have developed comprehensive dashboards that not only track current positions but also provide simulations and projections based on different market scenarios. These tools allow users to model the impact of various market movements on their leveraged positions, helping them understand potential outcomes before committing capital. The June 2024 release of Yearn’s v3 interface included a risk simulator that uses Monte Carlo methods to project probable outcomes for leveraged strategies based on historical volatility data, with users reporting that this feature has helped them better calibrate their leverage ratios and position sizes.

The integration of cross-chain monitoring capabilities has become essential as yield farmers increasingly deploy strategies across multiple blockchain networks to maximize opportunities and diversify risks. Tools like DeFiLlama and Nansen Portfolio have developed sophisticated infrastructure that can track positions across Ethereum, Binance Smart Chain, Polygon, Arbitrum, Avalanche, and other major chains through a single interface. This cross-chain visibility is particularly important for leveraged positions where correlated risks across different chains need to be monitored simultaneously. The March 2024 case of a yield farmer who avoided cascading liquidations across three different chains by using DeFiLlama’s cross-chain monitoring to identify and address correlated risks demonstrates the practical value of these comprehensive monitoring solutions.

Real-time health factor tracking has evolved from simple numerical displays to sophisticated visual systems that provide intuitive understanding of position risk across multiple dimensions. Modern dashboards use color coding, trend indicators, and predictive analytics to help users quickly assess the safety of their positions and identify which positions require immediate attention. The implementation of mobile applications with push notifications has made it possible for yield farmers to monitor their leveraged positions constantly, even when away from their primary trading setups. Instadapp’s mobile application, launched in February 2024, includes features such as one-touch deleveraging and emergency position closure, allowing users to respond to critical situations immediately from their mobile devices.

The development of specialized tools for specific strategies has enabled more precise monitoring and management of complex leveraged positions. For example, Revert Finance has created dedicated tools for Uniswap V3 liquidity providers that track not only position health but also metrics specific to concentrated liquidity such as range positioning, fee accumulation, and impermanent loss calculations. These specialized tools provide insights that generic monitoring platforms cannot offer, enabling more informed decision-making for strategy-specific risks. The successful use of Revert’s tools by a group of institutional yield farmers to manage over $50 million in leveraged Uniswap V3 positions throughout 2024’s volatile market conditions demonstrates the value of specialized monitoring infrastructure.

The continuous evolution of monitoring and implementation systems reflects the maturing DeFi ecosystem’s recognition that sophisticated tools are essential for safe and profitable leveraged yield farming. The integration of artificial intelligence and machine learning into these platforms promises to further enhance their capabilities, with developments in predictive analytics and automated risk management showing particular promise. However, users must remember that these tools are aids to decision-making rather than replacements for fundamental understanding of the risks and mechanics involved in leveraged yield farming. The most successful practitioners combine sophisticated tooling with deep knowledge and disciplined risk management practices.

Final Thoughts

The emergence of leveraged yield farming as a sophisticated financial strategy within the DeFi ecosystem represents a profound shift in how individuals can access and utilize complex financial instruments that were historically reserved for institutional players. This democratization of advanced trading strategies through blockchain technology and smart contracts has created unprecedented opportunities for retail participants to engage with leveraged positions, sophisticated hedging techniques, and yield optimization strategies that would have been impossible or prohibitively expensive in traditional financial markets. The transformation extends beyond mere access to these tools, fundamentally altering the relationship between individual investors and financial markets by removing intermediaries, reducing costs, and providing transparent, programmable financial services that operate continuously without geographic restrictions.

The intersection of technological innovation and financial engineering in leveraged yield farming showcases the transformative potential of DeFi to reshape global financial systems while simultaneously highlighting the responsibilities that come with this newfound financial freedom. As protocols continue to evolve and mature, the sophistication of risk management tools and strategies has grown in parallel, creating an ecosystem where participants can engage with leveraged strategies while maintaining reasonable safety margins through proper risk management. This evolution reflects a broader trend toward financial inclusion and empowerment, where individuals worldwide can participate in sophisticated financial strategies regardless of their location, wealth, or connections to traditional financial institutions. The development of educational resources, user-friendly interfaces, and automated risk management tools has progressively lowered barriers to entry, though the fundamental requirement for understanding and respecting the risks involved remains paramount.

Looking toward the future, leveraged yield farming stands at the intersection of several powerful trends that promise to further transform the landscape of decentralized finance and potentially influence traditional financial markets. The integration of artificial intelligence and machine learning into risk management systems, the development of cross-chain interoperability protocols, and the emergence of institutional-grade infrastructure all point toward a future where leveraged yield farming becomes more sophisticated, accessible, and integrated into the broader financial ecosystem. These technological advances, combined with regulatory clarity and institutional adoption, suggest that the strategies and tools developed within the DeFi ecosystem may eventually influence and improve traditional financial markets, creating a convergence that benefits all market participants through increased efficiency, transparency, and innovation.

The ongoing maturation of leveraged yield farming strategies reflects the broader evolution of DeFi from experimental protocols to robust financial infrastructure capable of handling billions of dollars in value while maintaining security and efficiency. The lessons learned from various market cycles, protocol failures, and successful implementations have created a body of knowledge that continues to grow and refine, making leveraged strategies progressively safer and more predictable for those who approach them with proper preparation and risk management. This accumulated wisdom, encoded in both protocol improvements and community best practices, represents a valuable resource for future participants and demonstrates the resilience and adaptability of the DeFi ecosystem in response to challenges and opportunities.

The social implications of accessible leveraged yield farming extend beyond individual profit opportunities to encompass broader questions about financial sovereignty, economic empowerment, and the role of technology in creating more equitable financial systems. As these tools become more sophisticated and accessible, they have the potential to provide economic opportunities for underserved populations who lack access to traditional financial services, creating new pathways for wealth creation and financial independence. However, this potential must be balanced with recognition of the risks and responsibilities that come with leveraged trading, emphasizing the importance of education, risk awareness, and the development of protective mechanisms that prevent inexperienced users from taking on excessive risks they don’t fully understand.

FAQs

- What is the minimum amount of capital needed to start leveraged yield farming safely?

The minimum capital required for leveraged yield farming varies significantly depending on the blockchain network and protocols being used. On Ethereum mainnet, the high gas costs typically make strategies unprofitable with less than $10,000 in capital, as transaction fees for entering, managing, and exiting positions can quickly erode returns on smaller amounts. However, on Layer 2 solutions like Arbitrum or Polygon, users can begin with as little as $1,000 to $2,000 while still maintaining reasonable profitability after accounting for transaction costs. The key consideration is not just the absolute amount but ensuring you have enough capital to properly diversify across multiple positions and maintain adequate reserves for collateral management during volatile periods. - How do liquidation penalties work and how much can I lose if my position gets liquidated?

Liquidation penalties typically range from 5% to 15% of the collateral value, depending on the specific protocol and asset type involved. When a position is liquidated, liquidators repay your debt and receive your collateral at a discount, which serves as their incentive for maintaining protocol solvency. For example, if you have $10,000 in collateral and face liquidation with a 10% penalty, liquidators would receive $10,000 worth of your collateral for repaying $9,000 of debt, resulting in a $1,000 loss beyond the normal position losses. Some protocols like Aave implement partial liquidations where only 50% of the position is liquidated at once, potentially allowing users to save the remaining portion if prices recover quickly. - What’s the difference between isolated and cross-margin leverage in yield farming?

Isolated margin leverage confines the risk to individual positions, meaning that if one position gets liquidated, your other positions remain unaffected. This approach provides better risk management but requires more capital since you can’t use profits from one position to support another. Cross-margin leverage pools all your positions together, allowing unrealized profits from successful trades to offset losses in others and potentially providing greater capital efficiency. However, cross-margin significantly increases systemic risk since a large loss in one position could trigger liquidations across your entire portfolio, making it more suitable for experienced traders who can actively manage correlated risks. - How often should I rebalance my leveraged yield farming positions?

The optimal rebalancing frequency depends on multiple factors including market volatility, position size, and strategy type. For volatile asset pairs, daily monitoring with weekly rebalancing often provides a good balance between maintaining position health and minimizing transaction costs. Stablecoin strategies might only require monthly rebalancing during normal market conditions. However, during periods of high volatility, you may need to adjust positions multiple times per day to prevent liquidation. Many successful farmers use automated rebalancing tools that trigger adjustments based on specific parameters like health factor thresholds or price deviations rather than fixed time intervals. - Can I use leveraged yield farming strategies during bear markets?

Leveraged yield farming during bear markets is possible but requires significantly different approaches than bull market strategies. Delta-neutral strategies that profit from funding rates or trading fees regardless of price direction become more attractive during downtrends. Shorting volatile assets while longing stablecoins can generate positive returns even as prices decline. The key is to reduce leverage ratios, focus on stablecoin pairs with lower impermanent loss risk, and maintain much larger safety margins than during bullish periods. Many successful farmers actually find bear markets more profitable due to higher yields and funding rates, though the risk of liquidation from volatile price swings requires constant vigilance. - What are the tax implications of leveraged yield farming?

Tax treatment of leveraged yield farming varies significantly by jurisdiction but generally involves multiple taxable events including borrowing, trading, earning yields, and liquidations. In many countries, each swap, harvest, or rebalancing action creates a taxable event that must be tracked and reported. The complexity increases with leverage since borrowed funds and interest payments may have different tax treatments than regular trading. Some jurisdictions treat liquidations as forced sales triggering capital gains or losses. It’s essential to maintain detailed records of all transactions and consult with tax professionals familiar with cryptocurrency taxation in your specific jurisdiction, as improper reporting can result in significant penalties. - How do flash loan attacks affect leveraged yield farming positions?

Flash loan attacks can impact leveraged yield farming positions primarily through price manipulation that triggers artificial liquidations. Attackers borrow large amounts of capital without collateral, use it to manipulate oracle prices or AMM pools, trigger liquidations of leveraged positions at artificial prices, and then repay the loan within the same transaction. Protecting against these attacks involves using protocols with robust oracle systems that aggregate multiple price sources, maintaining conservative leverage ratios that can withstand temporary price spikes, and choosing protocols with time-weighted average price mechanisms that resist manipulation. Protocols have increasingly implemented safeguards like delayed price updates and multi-block confirmation requirements to prevent flash loan exploits. - What’s the difference between APR and APY in leveraged yield farming?

APR represents the simple annual percentage rate without considering compounding effects, while APY factors in compound interest from reinvesting earnings. In leveraged yield farming, this distinction becomes crucial because leverage amplifies both rates. For example, a 30% APR strategy with 3x leverage doesn’t simply yield 90% APR due to borrowing costs and compounding effects. The actual APY depends on how frequently you compound returns, the cost of borrowing, and whether you’re reinvesting yields into the leveraged position. Many farmers mistakenly calculate returns using simple multiplication of APR and leverage, leading to overestimation of actual profits. - Should I use automated yield farming platforms or manage positions manually?

The choice between automated platforms and manual management depends on your expertise level, available time, and strategy complexity. Automated platforms like Yearn, Beefy, or Alpaca Finance offer convenience, professional strategy management, and automatic rebalancing but charge management fees typically ranging from 10% to 30% of yields. Manual management provides complete control, no platform fees, and the ability to implement custom strategies but requires significant time commitment, technical knowledge, and constant monitoring. Many farmers use a hybrid approach, automating stable strategies while manually managing more complex or opportunistic positions. - What emergency procedures should I have in place for protecting leveraged positions?

Comprehensive emergency procedures are essential for protecting leveraged positions during crisis events. This includes maintaining multiple wallet addresses with pre-approved token allowances for quick collateral addition, setting up automated deleveraging triggers through keeper networks or monitoring services, keeping reserve funds in stablecoins on the same chain as your positions for rapid deployment, and having documented action plans for various scenarios like network congestion, protocol exploits, or cascade liquidations. Additionally, establish multiple communication channels for alerts, maintain backup access methods for all platforms, and regularly practice emergency procedures during calm markets to ensure smooth execution during actual crises.