The cryptocurrency market has evolved far beyond Bitcoin’s original vision of peer-to-peer digital cash, transforming into a complex ecosystem of interconnected blockchain networks, each offering unique technological innovations and value propositions. At the heart of this evolution lies the concept of Layer-1 blockchains, independent networks that process and finalize transactions on their own chains without relying on another network for security or consensus. These foundational protocols, ranging from Ethereum’s smart contract platform to newer entrants like Solana and Avalanche, represent the infrastructure layer of the decentralized internet, each with its native token serving as the economic lifeblood of its respective ecosystem.

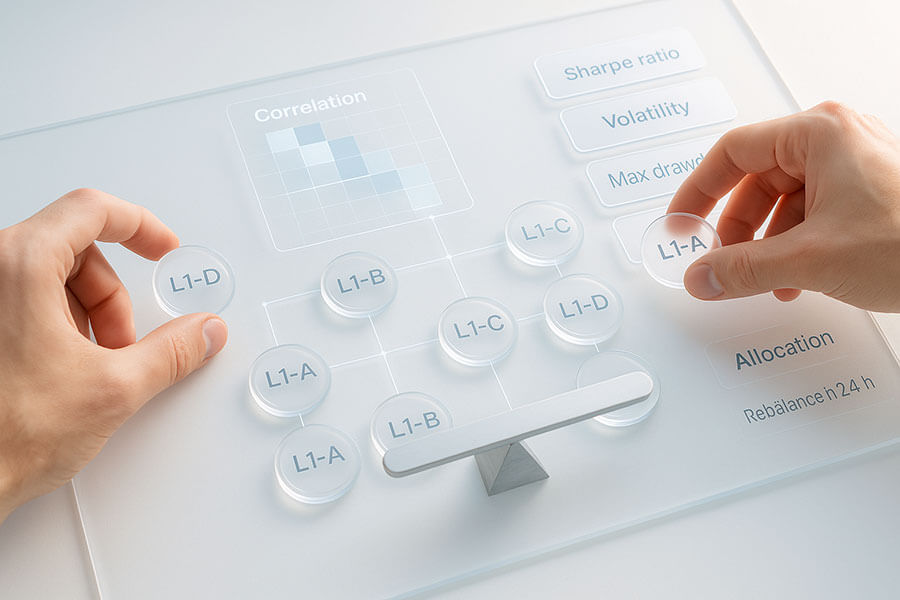

Portfolio diversification across Layer-1 tokens has emerged as a sophisticated investment strategy that goes beyond simply holding multiple cryptocurrencies. This approach recognizes that different blockchain platforms serve distinct market segments, employ varying consensus mechanisms, and attract different types of developers and users, creating opportunities for investors to balance risk and reward across multiple technological bets. Understanding how to construct a diversified portfolio of L1 tokens requires not only knowledge of traditional portfolio theory but also deep insights into blockchain technology, ecosystem dynamics, and the unique correlation patterns that characterize cryptocurrency markets.

The importance of diversification in cryptocurrency investing cannot be overstated, particularly given the notorious volatility that characterizes this asset class. While traditional financial markets have established correlation patterns developed over decades, the cryptocurrency space presents a unique challenge where correlations can shift dramatically based on market sentiment, regulatory developments, or technological breakthroughs. Layer-1 tokens offer a particularly compelling opportunity for diversification because they represent ownership stakes in the fundamental infrastructure of Web3, similar to how technology stocks in the 1990s represented bets on the internet’s future. By spreading investments across multiple L1 platforms, investors can potentially capture the upside of blockchain adoption while mitigating the risk that any single platform fails to achieve widespread adoption or faces technical challenges that limit its growth potential.

Understanding Layer-1 Blockchains and Their Native Tokens

Layer-1 blockchains form the foundational tier of blockchain architecture, operating as independent networks capable of validating and finalizing transactions without external dependencies. These protocols maintain their own consensus mechanisms, whether proof-of-work like Bitcoin, proof-of-stake like Ethereum 2.0, or alternative approaches like Solana’s proof-of-history, each designed to solve the blockchain trilemma of achieving scalability, security, and decentralization simultaneously. The native tokens of these platforms serve multiple critical functions beyond simple value transfer, including paying for transaction fees, participating in network governance, staking for consensus participation, and serving as the base currency for entire ecosystems of decentralized applications. Understanding these multifaceted roles is essential for evaluating the investment potential of different L1 tokens and their likelihood of long-term value appreciation.

The economic models underlying Layer-1 tokens vary significantly across platforms, creating diverse investment profiles that respond differently to market conditions and adoption trends. Ethereum’s native token ETH, for instance, combines utility as gas for transactions with a deflationary mechanism introduced through EIP-1559, which burns a portion of transaction fees, potentially creating upward price pressure during periods of high network activity. Meanwhile, newer platforms like Avalanche implement more complex tokenomics with separate tokens for different functions, while others like Cardano emphasize fixed supply caps similar to Bitcoin’s model. These varying economic designs mean that L1 tokens can exhibit different price behaviors during market cycles, with some acting more like productive assets that generate yield through staking, while others function more like digital commodities whose value derives from scarcity and network effects.

The technical architecture choices made by different Layer-1 platforms profoundly impact their economic models and investment characteristics. Sharding implementations, as seen in Near Protocol and MultiversX (formerly Elrond), enable horizontal scaling that can theoretically support millions of transactions per second, creating economic models where token value correlates more closely with network usage than scarcity. Directed Acyclic Graph (DAG) based platforms like Hedera Hashgraph and IOTA employ fundamentally different data structures that eliminate traditional blockchain limitations, though these novel approaches introduce new economic considerations around node incentives and value accrual mechanisms. The choice between account-based models used by Ethereum and UTXO models employed by Cardano affects not only technical capabilities but also how value flows through the ecosystem and how transaction fees are calculated and distributed. These architectural decisions create distinct risk-reward profiles that sophisticated investors must understand when constructing diversified portfolios, as platforms optimized for different use cases may perform differently under various market conditions and adoption scenarios.

Core Characteristics and Value Propositions of L1 Tokens

The fundamental characteristics that distinguish Layer-1 tokens from other cryptocurrency assets stem from their integral role in network operations and ecosystem development. These tokens represent more than speculative assets; they embody ownership stakes in decentralized computing platforms that could potentially reshape entire industries. Network security represents perhaps the most critical function, as L1 tokens incentivize validators or miners to maintain the integrity of the blockchain through economic rewards and penalties. This security budget, measured by the total value staked or hash power deployed, directly correlates with the network’s resistance to attacks and its credibility as a settlement layer for high-value transactions. The larger the market capitalization of an L1 token, the more expensive it becomes to attack the network, creating a self-reinforcing cycle where security attracts usage, which drives token value, which enhances security.

Beyond security, L1 tokens serve as the primary medium for ecosystem transactions, creating constant demand pressure that correlates with network activity and adoption. This utility value provides a fundamental floor for token prices, as users must acquire and hold tokens to interact with applications built on the platform. The emergence of decentralized finance protocols on platforms like Ethereum and BNB Chain has dramatically expanded this utility function, with billions of dollars locked in smart contracts requiring the native token for every interaction, from simple transfers to complex financial operations. Additionally, governance rights embedded in many L1 tokens allow holders to participate in protocol decisions, from technical upgrades to economic parameter adjustments, creating a form of digital democracy that aligns stakeholder interests with network success.

The value proposition of L1 tokens extends into their role as platforms for innovation and developer activity. Each successful Layer-1 blockchain creates a gravitational pull for developers, users, and capital, forming network effects that become increasingly difficult for competitors to replicate. Ethereum’s first-mover advantage in smart contracts has created an enormous ecosystem of tools, libraries, and skilled developers that continues to attract new projects despite higher transaction costs compared to newer alternatives. This ecosystem moat represents a significant competitive advantage that translates into token value, as the success of applications built on a platform drives demand for the native token. Newer L1 platforms attempt to overcome this advantage through various strategies, including compatibility layers that allow Ethereum applications to migrate easily, generous grant programs to attract developers, and technical innovations that offer superior performance for specific use cases.

The integration of Layer-1 blockchains with traditional financial systems has accelerated dramatically since 2022, with major financial institutions launching tokenization projects and central banks exploring blockchain infrastructure for digital currencies. JPMorgan’s Onyx platform, built on a permissioned version of Ethereum technology, processes over $1 billion in daily transactions as of late 2024, demonstrating institutional confidence in blockchain infrastructure. Similarly, the Monetary Authority of Singapore’s Project Guardian has involved multiple major banks testing tokenized assets across various Layer-1 platforms, including Avalanche and Polygon. These real-world implementations validate the long-term value proposition of L1 tokens as ownership stakes in critical financial infrastructure, moving beyond speculative narratives toward concrete utility in global finance.

Following the exploration of L1 token characteristics, it becomes clear that these assets represent a unique investment class that combines elements of technology stocks, commodities, and currencies. Their multifaceted utility, from network security to ecosystem governance, creates complex value dynamics that require sophisticated analysis beyond traditional financial metrics. The growing integration with institutional finance and real-world assets further reinforces the importance of understanding these platforms as foundational infrastructure investments rather than purely speculative vehicles.

Portfolio Diversification Principles for Cryptocurrency Assets

Modern portfolio theory, developed by Harry Markowitz in the 1950s, provides the theoretical foundation for understanding diversification benefits, though its application to cryptocurrency markets requires significant adaptation. The core principle remains valid: by combining assets with imperfect correlation, investors can achieve a more favorable risk-return profile than holding individual assets alone. However, cryptocurrency markets challenge traditional assumptions about return distributions, correlation stability, and market efficiency, necessitating new frameworks that account for extreme volatility, rapidly evolving technology, and regulatory uncertainty. The young age of cryptocurrency markets means historical data spans barely more than a decade for Bitcoin and even less for most Layer-1 platforms, making long-term statistical analysis challenging and requiring investors to balance quantitative models with qualitative assessment of technological and adoption trends.

The unique characteristics of cryptocurrency markets create both opportunities and challenges for portfolio diversification. Unlike traditional assets where correlations tend to be relatively stable over time, crypto correlations can shift dramatically during different market regimes. During bull markets, most cryptocurrencies tend to move together as risk-on sentiment drives broad-based buying, while bear markets often see flight to quality where established platforms like Bitcoin and Ethereum outperform newer, more speculative Layer-1 tokens. This regime-dependent correlation structure means that diversification benefits may be reduced precisely when they’re needed most, during market downturns. Additionally, the 24/7 nature of crypto markets, combined with their global accessibility and lower barriers to entry, creates price dynamics that can differ significantly from traditional markets, including weekend effects, timezone-based trading patterns, and rapid sentiment shifts driven by social media.

The application of diversification principles to Layer-1 tokens requires understanding both systematic risks that affect the entire crypto market and idiosyncratic risks specific to individual platforms. Systematic risks include regulatory changes, macroeconomic factors affecting risk assets broadly, and technological challenges like quantum computing threats to current cryptographic methods. These risks cannot be diversified away and affect all cryptocurrencies to varying degrees. Idiosyncratic risks, however, vary significantly across Layer-1 platforms and include technical failures, governance disputes, competitive displacement, and ecosystem-specific challenges like developer exodus or major protocol exploits. By carefully selecting L1 tokens with different risk profiles, consensus mechanisms, target markets, and development philosophies, investors can reduce exposure to platform-specific failures while maintaining exposure to the broader blockchain adoption trend.

Behavioral finance considerations play a crucial role in cryptocurrency portfolio management, as the extreme volatility and media attention surrounding crypto markets can trigger powerful psychological biases that undermine rational investment decisions. The fear of missing out (FOMO) during bull markets often leads investors to concentrate positions in trending tokens just as they reach peak valuations, while panic selling during downturns crystallizes losses that patient investors might have recovered. Anchoring bias causes many crypto investors to fixate on previous all-time highs, leading them to hold underwater positions far longer than prudent risk management would suggest, or to sell recovering positions too early based on arbitrary price targets. The recency bias particularly affects crypto markets, where investors overweight the importance of recent price action, leading to momentum chasing during uptrends and excessive pessimism during downturns. Understanding these behavioral patterns and implementing systematic portfolio rules that override emotional impulses proves essential for long-term success in L1 token investing, with strategies like predetermined rebalancing schedules and position size limits helping maintain discipline during periods of market extremity.

Risk Management and Correlation Analysis in Crypto Markets

Correlation analysis in cryptocurrency markets reveals complex patterns that evolve with market maturity and changing investor composition. Historical data from 2022 through 2024 shows that correlations between major Layer-1 tokens typically range from 0.6 to 0.9 during normal market conditions, significantly higher than correlations between traditional asset classes like stocks and bonds. However, these correlations exhibit substantial time-variation, with periods of decoupling often occurring around platform-specific events such as major upgrades, ecosystem launches, or technical incidents. The Ethereum Merge in September 2022, for example, caused temporary correlation breakdown as ETH’s transition to proof-of-stake created unique price dynamics independent of broader market movements. Understanding these correlation patterns requires sophisticated analysis tools including rolling correlation windows, regime-switching models, and careful attention to the drivers of correlation changes.

Risk management for L1 token portfolios extends beyond simple correlation analysis to encompass multiple dimensions of risk including volatility, liquidity, operational, and regulatory risks. Volatility in crypto markets routinely exceeds that of traditional assets by factors of three to five, with individual L1 tokens experiencing daily moves of 10-20% even during relatively calm periods. This extreme volatility necessitates position sizing strategies that account for potential drawdowns of 50% or more, even for established platforms. Liquidity risk varies significantly across L1 tokens, with newer or smaller platforms potentially experiencing severe price impact from large trades, particularly during market stress. Operational risks include smart contract vulnerabilities, consensus mechanism failures, and key person dependencies in development teams, while regulatory risks encompass potential securities law violations, tax treatment changes, and outright bans in certain jurisdictions.

Advanced risk management techniques adapted from traditional finance provide tools for managing L1 token portfolios more effectively. Value at Risk (VaR) models, modified to account for fat-tailed distributions common in crypto markets, help quantify potential losses under normal and stressed conditions. Conditional Value at Risk (CVaR) provides additional insight into tail risks, particularly important given crypto’s propensity for extreme moves. Portfolio optimization techniques including mean-variance optimization, risk parity, and maximum diversification approaches can be applied with appropriate modifications for crypto market characteristics. Dynamic hedging strategies using derivatives, where available, or correlation-based hedges using more liquid tokens, can help manage downside risk during market turmoil. The key lies in recognizing that traditional risk models often underestimate crypto market risks and require conservative parameter choices and regular recalibration.

The evolution of institutional-grade risk management tools for cryptocurrency has accelerated significantly, with firms like Galaxy Digital and NYDIG developing sophisticated risk frameworks specifically designed for digital assets. These frameworks incorporate machine learning models trained on high-frequency crypto market data to predict short-term correlation changes and identify regime shifts early. Real-world application of these techniques was demonstrated during the March 2023 banking crisis, when professional crypto funds using advanced correlation models successfully navigated the depegging of USDC by dynamically adjusting L1 token allocations based on changing correlation structures. This institutional adoption of sophisticated risk management techniques is gradually filtering down to retail investors through improved portfolio management platforms and educational resources.

The comprehensive understanding of portfolio theory applied to cryptocurrencies, combined with practical risk management techniques, forms the foundation for constructing robust L1 token portfolios. The unique challenges of crypto markets, from unstable correlations to extreme volatility, require adaptive strategies that blend quantitative analysis with qualitative judgment about technological and adoption trends. This balanced approach to risk management ensures that diversification strategies can withstand the various market conditions that characterize the dynamic cryptocurrency landscape.

Major Layer-1 Tokens for Portfolio Construction

The landscape of Layer-1 blockchains has expanded dramatically beyond Bitcoin and Ethereum to encompass dozens of platforms, each targeting specific use cases, technical trade-offs, and market segments. Established platforms like BNB Chain, formerly Binance Smart Chain, have captured significant market share by offering Ethereum compatibility with lower transaction costs, processing over 4 million daily transactions as of early 2025 and hosting thousands of decentralized applications. Solana has positioned itself as the high-performance alternative, achieving transaction speeds of up to 65,000 transactions per second through its unique proof-of-history consensus mechanism, though this performance comes with trade-offs in terms of hardware requirements for validators and periodic network instabilities that have raised questions about its reliability. Avalanche has taken a different approach with its subnet architecture, allowing customized blockchains for specific applications while maintaining interoperability, attracting enterprise users like Deloitte and institutional trading platforms seeking regulatory compliance.

The newer generation of Layer-1 platforms emerging since 2023 reflects lessons learned from earlier blockchain implementations and changing market demands. Aptos and Sui, both developed by teams from Meta’s discontinued Diem project, utilize the Move programming language designed specifically to prevent common smart contract vulnerabilities that have plagued Ethereum-based applications. These platforms have attracted significant venture capital investment and developer interest, with Aptos processing over 20,000 transactions per second in testing environments and partnering with major Web2 companies like Google Cloud and Microsoft for infrastructure support. Sei Network has optimized specifically for trading applications with built-in order matching engines and frontrunning prevention, while Celestia pioneered the modular blockchain approach, separating consensus and data availability from execution to enable more scalable and customizable blockchain deployments. Each platform represents a different vision for blockchain architecture and targets distinct market niches, creating opportunities for diversification across technological approaches and use cases.

The competitive dynamics among Layer-1 platforms have intensified with the emergence of specialized chains targeting specific industry verticals and use cases. Ronin Network’s focus on gaming has proven successful with over 2 million daily active users playing Pixels and other blockchain games as of early 2025, demonstrating the value of platform specialization over generalist approaches. The platform’s recovery from a $600 million hack in 2022 to become a leading gaming blockchain illustrates both the risks and resilience potential of specialized L1 platforms. Flow blockchain’s partnership with the NBA for Top Shot moments generated over $1 billion in transaction volume, though subsequent market cooling highlighted the volatility of consumer-focused platforms. Cosmos Hub’s inter-blockchain communication protocol has enabled an ecosystem of over 50 interconnected blockchains, including major platforms like the BNB Chain and Cronos, creating value through interoperability rather than isolated platform dominance. These specialized approaches suggest that portfolio diversification should consider not just technical metrics but also the strategic positioning and target markets of different platforms, as success in specific verticals can drive outsized returns even for smaller platforms that capture dominant positions in their niches.

Evaluating Established Platforms Versus Emerging Ecosystems

The decision between allocating portfolio weight to established Layer-1 platforms versus emerging ecosystems requires careful consideration of risk-return trade-offs, adoption metrics, and technological maturity. Established platforms like Ethereum offer the security of battle-tested code, extensive developer ecosystems, and clear product-market fit, with Ethereum alone securing over $400 billion in total value locked across DeFi protocols as of January 2025. The network effects of established platforms create powerful moats, as developers benefit from existing tooling, documentation, and user bases, while users benefit from deeper liquidity, more applications, and greater interoperability options. However, these advantages come with potentially limited upside compared to earlier-stage platforms, as much of the growth potential may already be priced into token valuations. Additionally, technical debt and governance inertia can make it difficult for established platforms to implement necessary improvements quickly, as demonstrated by Ethereum’s multi-year journey to implement proof-of-stake and ongoing challenges with scalability.

Emerging Layer-1 ecosystems offer higher potential returns but with correspondingly higher risks and uncertainty about long-term viability. These platforms can iterate quickly on technical innovations, implement cutting-edge research, and target underserved market segments without the constraints of existing user bases or technical debt. The success of platforms like Arbitrum and Optimism, which grew from zero to billions in total value locked within two years, demonstrates the potential for rapid adoption when platforms address real market needs. However, the cryptocurrency landscape is littered with once-promising Layer-1 platforms that failed to achieve sustainable adoption, including EOS, which raised $4 billion in its ICO but has largely faded from relevance, and Terra Luna, which collapsed spectacularly in May 2022, destroying $60 billion in value. Evaluating emerging platforms requires deep technical due diligence, assessment of team capabilities and funding runway, analysis of go-to-market strategies, and understanding of competitive dynamics within target market segments.

Real-world case studies illuminate the trajectories of both established and emerging Layer-1 platforms. Polygon’s evolution from a simple Ethereum sidechain to a comprehensive scaling solution ecosystem demonstrates successful platform evolution, with the network processing over 3 million daily transactions and securing partnerships with major corporations including Disney, Reddit, and Starbucks for NFT initiatives throughout 2023 and 2024. The platform’s ability to adapt its technology stack while maintaining backward compatibility showcases the advantages of established platforms that continue innovating. Conversely, the rapid rise of Base, Coinbase’s Layer-2 solution that launched in August 2023, illustrates how new platforms with strong distribution channels can quickly achieve adoption, reaching over $2 billion in total value locked within six months of launch. The platform leveraged Coinbase’s 100 million user base and regulatory compliance to attract both retail and institutional users, demonstrating that emerging platforms with unique advantages can compete effectively against established incumbents.

The integration of artificial intelligence and machine learning capabilities into blockchain platforms represents a new frontier for differentiation among Layer-1 tokens. Near Protocol’s partnership with Alibaba Cloud to provide blockchain infrastructure for AI applications, announced in late 2024, exemplifies how platforms are positioning themselves for the convergence of AI and blockchain technologies. Similarly, Internet Computer’s integration of AI models directly on-chain through its canister smart contracts enables decentralized AI applications that maintain data privacy and computational integrity. These developments suggest that portfolio construction should consider not just current metrics like transaction volume and total value locked, but also positioning for future technological trends that could drive the next wave of blockchain adoption.

The maturation of Layer-1 ecosystems has revealed distinct patterns in how platforms achieve and maintain competitive advantages. Ethereum’s transition to proof-of-stake in September 2022 reduced energy consumption by 99.95% while maintaining its position as the dominant smart contract platform, demonstrating how established platforms can evolve to address criticisms while preserving network effects. The subsequent implementation of proto-danksharding through EIP-4844 in March 2024 reduced Layer-2 transaction costs by 90%, showing how base layer improvements can strengthen entire ecosystems. Solana’s recovery from the FTX collapse, which saw SOL token prices fall from $35 to $8 in November 2022 before recovering to over $100 by late 2024, illustrates the resilience of platforms with strong technical foundations and active developer communities. The platform’s introduction of state compression for NFTs, reducing minting costs to fractions of a cent, enabled new use cases like Dialect’s messaging protocol and DRiP’s art distribution platform, which onboarded over 3 million users to Web3. These evolution patterns suggest that evaluating L1 platforms requires assessing not just current capabilities but also the team’s ability to innovate and adapt to changing market demands while maintaining backward compatibility and ecosystem stability.

The evaluation of Layer-1 platforms for portfolio inclusion requires a multifaceted approach that balances quantitative metrics with qualitative assessment of technological innovation, team execution, and market positioning. Established platforms offer stability and proven use cases but may have limited upside potential, while emerging platforms provide higher growth potential at the cost of increased risk and uncertainty. A well-constructed portfolio typically includes both categories, with allocation weights determined by individual risk tolerance, investment timeline, and conviction in specific technological approaches or market themes.

Strategic Approaches to L1 Token Diversification

Strategic diversification across Layer-1 tokens requires a systematic approach that goes beyond simply buying multiple cryptocurrencies, incorporating factors such as technological diversity, geographic distribution, use case differentiation, and market capitalization tiers. A well-constructed L1 portfolio might include exposure to different consensus mechanisms, from Bitcoin’s energy-intensive but highly secure proof-of-work to newer proof-of-stake variants like Ethereum’s Gasper consensus and Cardano’s Ouroboros protocol, each offering different security guarantees and economic models. Geographic diversification has become increasingly important as regulatory frameworks diverge globally, with some portfolios specifically including Asian-focused platforms like Klaytn in South Korea or Conflux in China, European projects like Internet Computer from the DFINITY Foundation in Switzerland, and US-based platforms to hedge against regional regulatory risks. This geographic spread not only provides regulatory diversification but also exposure to different market dynamics, user behaviors, and application preferences across regions.

The implementation of thematic strategies within L1 token portfolios allows investors to express views on specific technological or market trends while maintaining diversification benefits. One approach involves creating buckets for different blockchain use cases: financial infrastructure platforms like Ethereum and Avalanche, high-performance trading chains like Solana and Sei, gaming and metaverse-focused chains like Immutable and Flow, and enterprise-oriented platforms like Hedera and VeChain. This thematic diversification ensures exposure to multiple growth drivers within the blockchain ecosystem while reducing concentration risk in any single application area. Another strategic approach involves diversification across the blockchain scalability trilemma, balancing holdings between platforms prioritizing decentralization like Bitcoin, those emphasizing scalability like Solana, and those focusing on security through formal verification like Cardano, recognizing that different trade-offs may prove optimal for different use cases and market conditions.

Allocation Models and Dynamic Rebalancing Strategies

Portfolio allocation models for Layer-1 tokens range from simple equal-weighting approaches to sophisticated factor-based strategies that incorporate multiple variables in determining position sizes. Market capitalization weighting, the default approach in traditional index investing, tends to concentrate holdings in Bitcoin and Ethereum, which together represent over 70% of total crypto market capitalization as of early 2025. While this approach benefits from liquidity and momentum effects, it may underweight smaller platforms with higher growth potential. Alternative weighting schemes include square root of market cap weighting, which reduces concentration while maintaining some size bias, and fundamental weighting based on metrics like transaction volume, active addresses, or total value locked. Each approach implies different risk-return characteristics and rebalancing requirements, with more complex strategies typically requiring more frequent adjustment and incurring higher transaction costs.

Dynamic rebalancing strategies for L1 token portfolios must account for the high volatility and rapid value changes characteristic of cryptocurrency markets. Traditional calendar rebalancing, where portfolios are adjusted monthly or quarterly regardless of market movements, may be insufficient when individual positions can double or halve in value within weeks. Threshold rebalancing triggers adjustments when allocations drift beyond predetermined bands, such as 5% or 10% from target weights, allowing the portfolio to capture some momentum while preventing excessive concentration. More sophisticated approaches incorporate volatility-adjusted rebalancing frequencies, with more volatile assets requiring wider rebalancing bands to avoid excessive trading, and mean-reversion signals that increase rebalancing activity during periods of extreme price movements when mean reversion is more likely.

The practical implementation of rebalancing strategies requires careful consideration of transaction costs, tax implications, and market impact, particularly for larger portfolios. Cryptocurrency exchanges typically charge fees ranging from 0.1% to 0.5% per trade, with additional costs for converting between different tokens that may not have direct trading pairs. Tax implications vary by jurisdiction but often involve realizing capital gains or losses with each rebalancing trade, potentially creating substantial tax liabilities in bull markets. Market impact becomes significant for less liquid Layer-1 tokens, where large rebalancing trades can move prices adversely, particularly during volatile market conditions. Successful rebalancing strategies often incorporate execution algorithms that split orders across multiple venues and time periods, use limit orders to reduce costs, and consider tax-loss harvesting opportunities when adjusting positions.

Tax optimization strategies for L1 token portfolios have become increasingly sophisticated as regulatory frameworks mature and investors gain experience with cryptocurrency taxation. The specific identification method for cost basis calculation allows investors to strategically select which token lots to sell during rebalancing, potentially minimizing tax liabilities by selling higher-cost basis tokens first or harvesting losses from underwater positions. Tax-loss harvesting in cryptocurrency markets can be particularly powerful given the high volatility and frequent drawdowns, though investors must navigate wash sale rules that vary by jurisdiction and may differ from traditional securities regulations. Some jurisdictions offer favorable long-term capital gains rates for positions held over one year, incentivizing buy-and-hold strategies or less frequent rebalancing schedules. The emergence of cryptocurrency-specific tax software like CoinTracker and TokenTax has made it feasible to implement complex tax optimization strategies across multiple exchanges and wallets, though the computational complexity increases exponentially with trading frequency. Institutional investors have developed sophisticated approaches including the use of derivatives for synthetic exposure that avoids taxable events, lending strategies that generate income without triggering sales, and offshore structures that optimize global tax efficiency while maintaining regulatory compliance.

Real-world implementation of these strategies has been validated through the performance of cryptocurrency index funds and systematic strategies. The Bitwise 10 Large Cap Crypto Index, which implements monthly rebalancing with market cap weighting capped at 80% for any single asset, has demonstrated the benefits of systematic diversification, outperforming Bitcoin during several periods since its 2017 inception while reducing portfolio volatility. Galaxy Digital’s institutional strategies, which incorporate factor-based allocation models considering both on-chain metrics and market data, reported risk-adjusted returns superior to simple buy-and-hold strategies during the 2022-2024 period, particularly during the March 2023 banking crisis when dynamic rebalancing captured opportunities in temporarily dislocated markets. These professional implementations provide templates for individual investors while highlighting the importance of disciplined execution and robust risk management in portfolio rebalancing.

The strategic approaches to L1 token diversification culminate in personalized portfolio construction that aligns with individual investment objectives, risk tolerance, and market views. Whether implementing simple equal-weight strategies or sophisticated factor models, the key lies in maintaining discipline, regularly reviewing and adjusting strategies based on changing market conditions, and avoiding emotional decision-making during periods of extreme volatility. The combination of thoughtful allocation models with systematic rebalancing creates a framework for capturing the growth potential of blockchain technology while managing the substantial risks inherent in this emerging asset class.

Risk Assessment and Performance Metrics

Comprehensive risk assessment for Layer-1 token portfolios requires evaluation across multiple dimensions that extend beyond traditional financial metrics to encompass technology risk, regulatory uncertainty, and ecosystem health indicators. Volatility analysis remains fundamental, with 30-day rolling volatilities for major L1 tokens typically ranging from 40% to 120% annually, compared to approximately 15-20% for major equity indices. However, simple volatility measures fail to capture the full risk picture in crypto markets, where tail events occur far more frequently than normal distributions would predict. Advanced risk metrics including maximum drawdown analysis, which measures peak-to-trough declines, reveal that even established L1 tokens routinely experience drawdowns of 70-90% during bear markets, necessitating robust risk management frameworks and appropriate position sizing. Liquidity risk assessment has become increasingly sophisticated, incorporating order book depth analysis, slippage modeling, and cross-exchange arbitrage opportunities to understand the true cost of entering and exiting positions, particularly important for smaller Layer-1 tokens where reported trading volumes may overstate actual liquidity.

Performance measurement for L1 token portfolios extends beyond simple return calculations to incorporate risk-adjusted metrics that account for the unique characteristics of cryptocurrency markets. The Sharpe ratio, measuring excess return per unit of volatility, provides a standardized comparison tool, though its interpretation requires adjustment for crypto’s higher baseline volatility. Sortino ratios, which penalize only downside volatility, often provide more meaningful insights for crypto portfolios given the asymmetric return distributions common in bull markets. Information ratios measure the consistency of outperformance versus benchmarks, though defining appropriate benchmarks remains challenging given the rapid evolution of the L1 landscape. Newer metrics specific to cryptocurrency markets include on-chain value capture ratios, which measure how effectively platforms translate network activity into token value appreciation, and ecosystem momentum scores that incorporate developer activity, application deployment, and user growth metrics to assess platform trajectory beyond price performance alone.

The integration of on-chain analytics into performance assessment provides unique insights unavailable in traditional markets, enabling real-time monitoring of network health and adoption trends. Network value to transactions ratios (NVT) serve as a blockchain equivalent to price-to-earnings ratios, helping identify overvalued or undervalued L1 tokens based on actual usage. Active address analysis, transaction count trends, and gas fee dynamics provide leading indicators of ecosystem health that often precede price movements. The ratio of long-term holders to short-term speculators, derived from on-chain wallet analysis, indicates the strength of conviction among token holders and potential supply dynamics. Cross-chain bridge volumes and wrapped token supplies reveal inter-ecosystem flows that signal shifting preferences among users and developers. These on-chain metrics, when combined with traditional financial analysis, create a comprehensive framework for assessing both risk and opportunity in L1 token portfolios.

Performance attribution analysis for diversified L1 portfolios helps investors understand the sources of returns and refine their strategies over time. Decomposing portfolio returns into allocation effects, selection effects, and interaction effects reveals whether outperformance stems from overweighting the right sectors, picking winning tokens within sectors, or both. Factor analysis identifies exposure to systematic risk factors including overall crypto market beta, size factors favoring large or small cap tokens, momentum factors capturing trending behavior, and value factors based on fundamental metrics. This attribution framework enables investors to understand whether their returns result from intentional strategic choices or unintended factor exposures, facilitating more informed portfolio adjustments and strategy refinements.

The evolution of institutional-grade performance analytics for cryptocurrency portfolios has accelerated with the entry of traditional asset managers into the space. BlackRock’s analysis framework for its Bitcoin ETF, detailed in SEC filings, incorporates stress testing across multiple scenarios including regulatory shocks, technological failures, and macro environment changes. Fidelity Digital Assets’ institutional reporting includes detailed risk factor decomposition and scenario analysis specifically calibrated to cryptocurrency market dynamics, providing templates for sophisticated portfolio analysis. These institutional approaches to risk assessment and performance measurement establish best practices that enhance the professionalism and credibility of cryptocurrency investing while providing tools for more effective portfolio management.

Stress testing methodologies for L1 token portfolios require adaptation of traditional techniques to account for cryptocurrency-specific risk factors and market dynamics. Historical scenario analysis examines portfolio performance during past crypto market crises, including the 2018 ICO bubble collapse, the March 2020 COVID crash, the May 2021 China mining ban, the 2022 Terra-Luna collapse, and the November 2022 FTX bankruptcy, revealing how different L1 tokens behave under extreme stress. Monte Carlo simulations incorporating fat-tailed distributions and regime-switching volatility models generate thousands of potential future scenarios, helping investors understand the range of possible outcomes and probability of extreme losses. Reverse stress testing identifies scenarios that would cause portfolio failure, working backward from an unacceptable outcome to understand what combinations of events could trigger such losses. Network-specific stress tests examine the impact of technical failures, 51% attacks, or governance crises on individual platforms, while cross-chain contagion analysis models how problems in one ecosystem might cascade through bridge protocols and wrapped assets to affect other platforms. These comprehensive stress testing approaches enable investors to identify portfolio vulnerabilities before they materialize and implement appropriate hedging strategies or position adjustments to enhance resilience.

Final Thoughts

The transformation of Layer-1 blockchains from experimental technologies to foundational infrastructure for the digital economy represents one of the most significant technological shifts of the early 21st century. Portfolio diversification across L1 tokens offers investors a unique opportunity to participate in this transformation while managing the inherent risks of an emerging and volatile asset class. The strategies and frameworks discussed throughout this analysis, from correlation-based diversification to sophisticated rebalancing algorithms, provide the tools necessary to construct robust portfolios that can weather the extreme volatility characteristic of cryptocurrency markets while capturing the substantial growth potential of blockchain adoption. As traditional financial institutions continue integrating blockchain technology and governments worldwide develop regulatory frameworks for digital assets, the importance of thoughtful portfolio construction in this space only grows more critical.

The intersection of technological innovation and financial inclusion through Layer-1 blockchains holds profound implications for global economic development. These platforms enable programmable money and decentralized financial services that can reach the billions of people worldwide who remain unbanked or underbanked, providing access to savings, lending, and investment opportunities previously reserved for those with traditional banking relationships. The success of platforms like Celo in facilitating mobile-based financial services in developing countries, or the adoption of stablecoins on various L1 platforms for cross-border remittances, demonstrates the real-world impact of this technology beyond speculation. Portfolio diversification across L1 tokens thus represents not merely a financial strategy but participation in a technological revolution that could reshape global financial access and economic opportunity.

The evolution of Layer-1 platforms toward specialized use cases and interoperability standards suggests a future where multiple blockchains coexist and complement each other rather than winner-take-all dynamics. This multi-chain future reinforces the importance of diversification strategies that capture value across different platforms and use cases. The emergence of cross-chain protocols, blockchain bridges, and interoperability standards like the Inter-Blockchain Communication protocol indicates that value will likely accrue to multiple platforms that serve different niches effectively. Understanding these dynamics and constructing portfolios that benefit from ecosystem growth across multiple dimensions, from DeFi to gaming to enterprise applications, positions investors to benefit regardless of which specific platforms ultimately dominate their respective segments.

Looking forward, the convergence of artificial intelligence, Internet of Things, and blockchain technology through Layer-1 platforms promises to unlock new use cases and value creation mechanisms that we’re only beginning to imagine. The integration of zero-knowledge proofs for privacy, the development of quantum-resistant cryptography, and the evolution toward more sustainable consensus mechanisms all represent technological advances that will reshape the competitive landscape among L1 platforms. Investors who understand these technological trends and incorporate them into their portfolio construction frameworks will be better positioned to identify emerging opportunities and manage evolving risks. The journey of blockchain technology from Bitcoin’s simple value transfer to complex smart contract platforms supporting entire digital economies illustrates the rapid pace of innovation that makes this space both challenging and rewarding for thoughtful investors.

FAQs

- What is the minimum investment amount needed to create a diversified L1 token portfolio?While there’s no absolute minimum, a practical starting point for meaningful diversification across Layer-1 tokens is typically $5,000 to $10,000, which allows for positions in 5-10 different tokens while keeping transaction costs below 2% of portfolio value. Smaller amounts can still achieve diversification through cryptocurrency index funds or tokenized baskets, though direct token ownership provides more control over allocation and rebalancing decisions.

- How many different L1 tokens should I include in my portfolio for optimal diversification?

Research on cryptocurrency portfolios suggests that diversification benefits begin plateauing after 8-12 tokens, with most risk reduction achieved with 5-7 carefully selected L1 tokens representing different technological approaches, use cases, and market segments. Adding more tokens beyond this point may increase complexity and transaction costs without meaningfully reducing portfolio risk, though institutional investors often hold 15-20 positions to express more nuanced market views. - Should I include Bitcoin in my L1 token diversification strategy even though it doesn’t support smart contracts?

Yes, Bitcoin should typically represent 20-40% of a diversified L1 portfolio despite its limited functionality compared to smart contract platforms, as it serves as a digital store of value with the longest track record, highest security budget, and most widespread institutional adoption. Bitcoin often exhibits lower correlation with other L1 tokens during certain market conditions and provides portfolio stability during flight-to-quality episodes common in crypto bear markets. - How often should I rebalance my L1 token portfolio?

The optimal rebalancing frequency depends on your strategy and market conditions, but most successful approaches use either quarterly calendar rebalancing or threshold-based triggers when allocations drift 10-15% from targets. More frequent rebalancing may be necessary during highly volatile periods, while less frequent adjustments reduce transaction costs and tax implications, with many professionals finding monthly rebalancing with 10% threshold bands provides a good balance. - What tools and platforms are best for tracking and managing a diversified L1 token portfolio?

Professional portfolio tracking solutions like CoinTracking, Koinly, and TokenTax provide comprehensive analytics including performance measurement, tax reporting, and rebalancing alerts across multiple exchanges and wallets. For execution, established exchanges like Binance, Coinbase Pro, and Kraken offer the deep liquidity and wide token selection necessary for efficient portfolio management, while decentralized exchanges provide access to newer tokens not yet listed on centralized platforms. - How do I assess the risk of newer L1 platforms that lack extensive historical data?

Evaluating emerging L1 platforms requires focusing on fundamental metrics including team experience and funding runway, technological differentiation and innovation, developer activity measured through GitHub commits and ecosystem grants, partnership quality and institutional backing, and testnet performance data. Comparing these factors against successful historical examples while maintaining smaller position sizes for unproven platforms helps manage risk while capturing upside potential. - Should I stake my L1 tokens for additional yield or keep them liquid for rebalancing?

The staking decision depends on your rebalancing frequency and risk tolerance, with many investors choosing to stake 50-70% of holdings in proof-of-stake tokens to earn 4-10% annual yields while maintaining sufficient liquidity for rebalancing needs. Consider unstaking periods, which range from days to weeks depending on the platform, and evaluate whether staking rewards compensate for reduced flexibility and potential tax complications. - How do I account for airdrops and forks when managing my L1 token portfolio?

Airdrops and forks should be evaluated individually for their merit and either incorporated into existing allocations if they align with portfolio strategy or sold and proceeds redeployed according to target allocations. Document all airdrops carefully for tax purposes, as most jurisdictions treat them as taxable income at fair market value when received, and consider the dilutive effects of new token distributions on existing holdings. - What percentage of my overall investment portfolio should be allocated to L1 tokens?

Financial advisors typically recommend limiting cryptocurrency exposure to 5-10% of total investment portfolios for most investors, with more aggressive allocations of 15-20% appropriate for those with higher risk tolerance and longer time horizons. Within the crypto allocation, L1 tokens might represent 60-80%, with the remainder in stablecoins for liquidity, Bitcoin for stability, or application-specific tokens for targeted exposure. - How do regulatory changes impact L1 token portfolio strategy?

Regulatory developments can significantly impact L1 token values and availability, necessitating geographic diversification across tokens from different jurisdictions and maintaining awareness of evolving frameworks in major markets like the US, EU, and Asia. Building positions in platforms with strong compliance programs and clear regulatory strategies, while avoiding tokens with obvious securities law concerns, helps manage regulatory risk while maintaining exposure to blockchain innovation.