The cryptocurrency markets never sleep, operating around the clock with price movements that can swing dramatically within minutes. For investors holding diversified portfolios across multiple digital assets, this constant volatility creates a persistent challenge: maintaining desired asset allocations amid relentless market fluctuations. Traditional portfolio management approaches that worked in legacy financial markets prove inadequate in this hyperactive environment, where optimal asset ratios can drift substantially during a single business day, let alone over weeks or months.

Manual rebalancing of cryptocurrency portfolios presents formidable obstacles that discourage even experienced investors. The process demands continuous market monitoring, precise timing decisions, and execution of multiple transactions across different platforms. Each rebalancing action incurs trading fees, blockchain gas costs, and potential tax consequences that accumulate rapidly with frequent adjustments. Beyond these financial burdens, the psychological toll of constant vigilance and decision-making fatigue leads many investors to neglect rebalancing entirely, allowing their portfolios to drift dangerously far from intended risk profiles.

Enter decentralized finance protocols that automate portfolio rebalancing through sophisticated smart contract systems. These platforms eliminate human intervention from the rebalancing process, executing trades algorithmically based on predefined rules and market conditions. By leveraging blockchain technology and automated market makers, DeFi rebalancing protocols maintain target asset allocations continuously without requiring investor attention or action. The automation extends beyond simple trading to encompass tax optimization strategies, cost minimization techniques, and intelligent routing mechanisms that enhance overall portfolio performance.

The implications of automated rebalancing reach far beyond mere convenience. Traditional wealth management services offering similar portfolio maintenance capabilities typically remain accessible only to high-net-worth individuals who meet substantial minimum investment thresholds. DeFi protocols democratize these sophisticated strategies, making professional-grade portfolio management available to anyone with an internet connection and cryptocurrency holdings. This accessibility transformation represents a fundamental shift in financial services, removing institutional gatekeepers and empowering individual investors with tools previously reserved for the privileged few.

The technical innovations enabling automated rebalancing showcase the transformative potential of blockchain-based financial systems. Smart contracts execute complex trading strategies with mathematical precision, eliminating the emotional biases and execution errors that plague human traders. Decentralized exchanges provide liquidity for automated rebalancing without counterparty risk or centralized control points. Oracle networks supply real-time price data that triggers rebalancing actions according to predefined thresholds. These components work seamlessly together, creating self-executing financial infrastructure that operates autonomously around the clock.

Understanding automated portfolio rebalancing in DeFi requires examining both the fundamental principles underlying rebalancing strategies and the specific technical mechanisms that enable their automated execution. The journey explores how traditional portfolio theory translates into decentralized protocols, what challenges arise in implementing automated systems, and how leading platforms address tax efficiency alongside cost minimization. This comprehensive analysis reveals not just how these systems work, but why they represent an essential evolution in cryptocurrency investment management that promises to reshape how millions of people maintain and grow their digital asset portfolios.

Understanding Portfolio Rebalancing in DeFi

Portfolio rebalancing stands as one of the fundamental disciplines in investment management, predating modern financial markets by centuries. The core principle remains elegantly simple: periodically adjusting asset holdings to maintain desired allocation percentages. When certain investments outperform others, their increased value naturally causes them to occupy larger portfolio proportions than intended. Rebalancing involves selling appreciated assets and purchasing underperforming ones to restore original target weights. This systematic approach forces investors to buy low and sell high, implementing the most basic yet often neglected wisdom in investing.

In traditional finance, portfolio rebalancing typically occurs quarterly or annually based on calendar schedules or threshold-based triggers. An investor might establish a target allocation of sixty percent stocks and forty percent bonds, then rebalance whenever actual allocations drift beyond predetermined bands such as five percentage points above or below targets. The rebalancing process requires contacting brokers, placing orders, and waiting for settlement periods that can span several days. Transaction costs remain relatively modest in traditional markets thanks to deep liquidity and competitive brokerage fees, though large trades can still face significant price impact when moving substantial capital.

DeFi environments introduce unique considerations that fundamentally alter rebalancing dynamics. Cryptocurrency markets exhibit volatility levels that dwarf traditional asset classes, with double-digit daily price swings occurring regularly even in established tokens. This extreme volatility causes portfolio drift at accelerated rates, potentially requiring rebalancing multiple times daily to maintain target allocations. The twenty-four-seven nature of crypto markets means optimal rebalancing opportunities can arise at any hour, penalizing investors who cannot monitor positions continuously. Gas fees on blockchain networks add variable costs to each transaction, with fees spiking during network congestion and creating unpredictable expense burdens.

The composition of DeFi portfolios also differs markedly from traditional investment accounts. Instead of holding stocks and bonds, DeFi portfolios typically contain diverse cryptocurrencies, governance tokens, stablecoins, and liquidity provider positions. Many of these assets generate yield through staking rewards, lending interest, or liquidity mining incentives that must be considered alongside price appreciation when calculating true portfolio values. The decentralized nature means investors maintain direct custody of assets across multiple protocols and blockchains, requiring sophisticated coordination to execute rebalancing trades efficiently.

Core Concepts and Mechanics

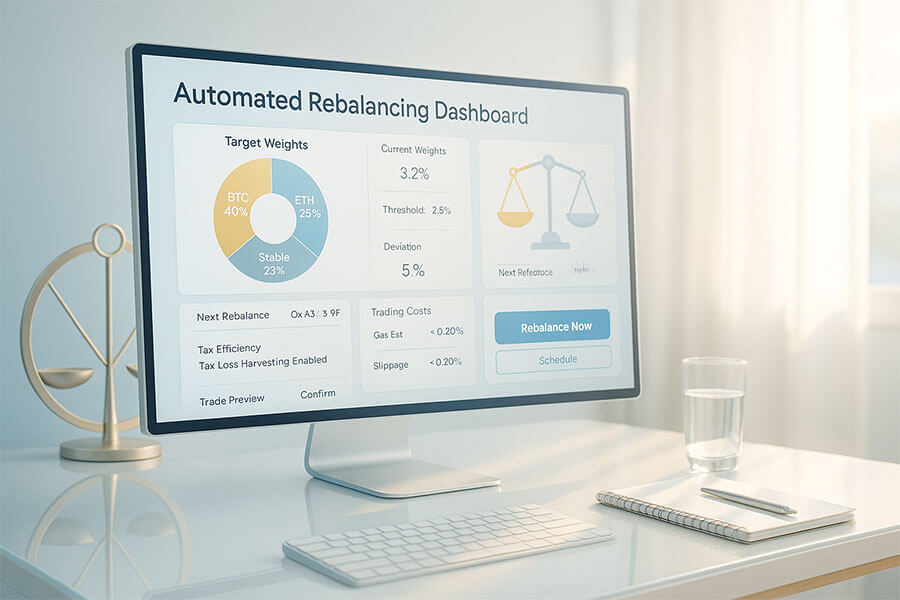

Target allocations form the foundation of any rebalancing strategy, representing ideal percentage distributions across portfolio components. A DeFi investor might establish targets of forty percent Ethereum, thirty percent Bitcoin, twenty percent stablecoins, and ten percent altcoins. These targets reflect individual risk tolerance, market outlook, and investment objectives. Conservative allocations might emphasize stablecoins and established cryptocurrencies, while aggressive strategies could concentrate on high-volatility assets with greater growth potential but corresponding downside risk.

Drift describes the deviation between current portfolio weights and target allocations resulting from differential asset performance. When Ethereum appreciates twenty percent while Bitcoin remains flat, the Ethereum position grows beyond its target weight while Bitcoin falls below its intended allocation. Drift magnitude determines rebalancing urgency, with larger deviations indicating greater divergence from intended risk exposure. Some investors tolerate modest drift to avoid excessive trading costs, while others maintain tight bands requiring frequent rebalancing to preserve precise target weights.

Rebalancing triggers determine when portfolio adjustments occur, falling into two primary categories: calendar-based and threshold-based approaches. Calendar rebalancing executes on fixed schedules such as monthly or quarterly intervals regardless of portfolio drift magnitude. This predictable timing simplifies planning and tax management but may cause unnecessary rebalancing when portfolios remain close to targets or delay needed adjustments when significant drift occurs between scheduled dates. Threshold-based rebalancing monitors portfolio composition continuously and triggers trades only when allocations exceed predetermined deviation limits. This responsive approach ensures rebalancing occurs precisely when needed but requires constant monitoring infrastructure and can generate unpredictable transaction timing.

The mathematical mechanics underlying rebalancing calculations involve determining exact trade quantities needed to restore target weights. Starting with current portfolio values and desired allocations, algorithms calculate required purchases and sales across all positions. These calculations must account for trading fees, slippage expectations, and minimum trade sizes while optimizing execution order to minimize costs. In DeFi contexts, additional complexity arises from the need to route trades across multiple decentralized exchanges, manage gas fee optimization, and potentially bridge assets across different blockchain networks.

Traditional Finance vs. DeFi Approaches

Traditional portfolio rebalancing relies heavily on trusted intermediaries who execute trades on behalf of clients. Investors communicate desired allocation changes to brokers or financial advisors, who then execute necessary transactions through established market channels. Custodians hold assets in client accounts, maintaining records and providing reporting but retaining ultimate control over holdings. This intermediated structure introduces counterparty risk, requires investors to trust service providers with asset custody, and creates opacity around exact execution timing and pricing.

Regulatory frameworks governing traditional finance impose disclosure requirements, fiduciary duties, and consumer protections that shape rebalancing practices. Registered investment advisors must document their rebalancing methodologies, justify allocation decisions, and maintain compliance with suitability standards. These regulations provide investor protections but also introduce administrative overhead and limit flexibility in strategy implementation. The regulatory structure effectively restricts sophisticated portfolio management techniques to accredited investors or those meeting minimum account balances that justify the compliance costs.

DeFi rebalancing protocols eliminate intermediaries entirely through trustless smart contract execution. Investors maintain direct custody of assets in self-controlled wallets rather than depositing funds with third parties. Smart contracts encode rebalancing logic transparently on-chain where anyone can verify the exact algorithms governing portfolio adjustments. When rebalancing conditions trigger, smart contracts execute trades automatically through decentralized exchanges without requiring human approval or intervention. This autonomous operation removes counterparty risk, eliminates custodial relationships, and provides complete transparency into rebalancing mechanics.

The permissionless nature of DeFi protocols dramatically expands accessibility compared to traditional services. Anyone can interact with rebalancing smart contracts regardless of net worth, geographic location, or identity verification status. No minimum account balances restrict participation, allowing investors with modest capital to access professional-grade portfolio management tools. The composability of DeFi protocols enables seamless integration across platforms, allowing investors to build custom rebalancing strategies by combining different protocol primitives in novel ways.

Cost structures also differ fundamentally between traditional and DeFi rebalancing approaches. Traditional advisors typically charge annual management fees calculated as a percentage of assets under management, along with potential trading commissions and fund expense ratios. These recurring costs accumulate substantially over time even when minimal rebalancing activity occurs. DeFi protocols replace recurring fees with transaction-based costs including blockchain gas fees and decentralized exchange swap fees that accrue only when actual rebalancing trades execute. This pay-per-use model can prove more economical for investors who require infrequent rebalancing or maintain smaller portfolios where percentage-based fees become prohibitively expensive.

The transparency enabled by public blockchains allows DeFi investors to verify exactly how rebalancing algorithms operate and audit all historical transactions. Traditional portfolios require trusting service providers to execute rebalancing honestly and optimally, with limited ability to verify actual execution quality. DeFi’s open architecture enables third-party analysis tools to measure rebalancing performance objectively, compare different protocols, and identify optimization opportunities. This transparency fosters competition among protocols to deliver superior performance while building user confidence through verifiable results.

How Automated Rebalancing Protocols Function

Automated rebalancing protocols represent sophisticated financial engineering achievements that combine smart contract programming, economic mechanism design, and integration with decentralized exchange infrastructure. These systems must operate autonomously without human intervention while maintaining security, optimizing costs, and executing trades at favorable prices. The architecture typically separates concerns across multiple smart contract components that handle different aspects of the rebalancing process, from monitoring portfolio composition to executing trades and managing gas costs.

The fundamental challenge in designing automated rebalancing systems involves achieving trustless operation without sacrificing performance. Smart contracts execute deterministically based on blockchain state, but optimal rebalancing requires responding to off-chain price information and dynamic market conditions. Protocols must bridge this gap by incorporating oracle systems that feed external data onto the blockchain in tamper-resistant ways. The timing of rebalancing actions must balance responsiveness to market movements against the costs of excessive trading and blockchain transaction fees.

Security considerations dominate automated rebalancing protocol design since smart contract vulnerabilities can result in permanent fund loss. The autonomous nature means protocols cannot rely on human intervention to prevent or reverse malicious transactions. Comprehensive security audits, formal verification of critical code paths, and careful access control mechanisms help protect user funds. Many protocols implement additional safeguards such as time-locked operations, multisignature requirements for critical functions, and gradual rollout strategies that limit potential damage from undiscovered vulnerabilities.

Performance optimization in automated rebalancing extends beyond simple execution speed to encompass sophisticated strategies for minimizing costs and maximizing value capture. Protocols must route trades intelligently across multiple decentralized exchanges to achieve best execution prices while managing gas costs across potentially complex multi-step transactions. Advanced systems implement techniques like transaction batching, flash loan utilization, and aggregator integration to reduce costs while maintaining the precision required for accurate portfolio rebalancing.

Smart Contract Architecture and Logic

The core rebalancing smart contract serves as the central coordinator orchestrating all portfolio management operations. This contract stores target allocation parameters, monitors current portfolio composition, determines when rebalancing triggers activate, and executes necessary trades to restore target weights. The contract architecture must balance flexibility to accommodate diverse rebalancing strategies against simplicity to maintain security and minimize gas costs. Most implementations separate configuration data from execution logic, allowing parameter updates without modifying core contract code that handles critical operations.

Portfolio composition monitoring requires continuous tracking of asset values and calculation of current percentage allocations. Smart contracts query balances across all positions within managed portfolios, including tokens held directly in wallets and assets deployed in various DeFi protocols earning yield. Price information comes from oracle systems that aggregate data from multiple sources to provide reliable valuations resistant to manipulation. The contract compares current allocations against target weights to calculate drift magnitude and determine whether rebalancing should execute.

Trigger evaluation logic implements the specific rules determining when rebalancing actions initiate. Threshold-based systems calculate allocation deviations and compare them against configured tolerance bands. When any asset allocation exceeds its band, the system flags the portfolio for rebalancing. Time-based triggers maintain counters tracking blocks or timestamps since the last rebalancing event, initiating new rebalancing cycles when configured intervals elapse. Hybrid approaches combine multiple trigger types, requiring both sufficient time passage and minimum drift thresholds before executing rebalancing trades.

Trade calculation algorithms determine exact quantities to buy and sell across all portfolio positions to achieve target allocations. These calculations must account for transaction costs including swap fees and gas expenses while optimizing execution order to minimize price impact. The algorithms typically start by identifying which assets require selling due to overweight positions and which need purchasing to address underweight allocations. The calculations must balance precision against gas cost efficiency, as achieving perfectly exact target weights may require multiple small trades that accumulate prohibitive transaction fees.

Access control mechanisms protect rebalancing contracts from unauthorized modifications while enabling necessary administrative functions. Role-based permissions grant different capabilities to various actors within the system. Portfolio owners maintain authority to adjust target allocations and trigger manual rebalancing when desired. Protocol administrators may hold emergency pause capabilities to halt operations if vulnerabilities are discovered. Governance systems enable token holders to propose and vote on protocol upgrades or parameter changes through decentralized decision-making processes.

Algorithmic Trading Mechanisms

Decentralized exchange integration forms the foundation enabling automated trade execution within rebalancing protocols. Smart contracts interact directly with DEX liquidity pools to swap tokens at current market prices without requiring counterparties or order book matching. The automated market maker model employed by most DEXs provides continuous liquidity for any token pair based on mathematical formulas that determine prices from pool reserve ratios. Rebalancing contracts can execute swaps instantly by calling DEX smart contract functions that transfer tokens and update pool reserves atomically.

Price impact calculations help rebalancing algorithms optimize trade execution by predicting how swap sizes affect realized prices. Large trades relative to liquidity pool sizes experience price slippage as the automated market maker formula increases prices for each incremental token purchased from the pool. Sophisticated rebalancing systems calculate expected price impact for different trade sizes and potentially split large rebalancing transactions across multiple smaller swaps executed over time to reduce slippage. This trade-off between achieving target weights quickly and minimizing price impact represents a key optimization challenge.

Smart order routing enhances execution quality by finding optimal paths across the complex landscape of decentralized exchanges and liquidity pools. Rather than trading all assets through a single DEX, routing algorithms analyze liquidity availability, swap fees, and expected price impact across multiple venues to determine the best execution path for each trade. Advanced routing can chain multiple swaps together, potentially exchanging Asset A for Asset B through an intermediate Asset C if that path provides better pricing than direct A-to-B swaps. DEX aggregator protocols specialize in this routing optimization, and many rebalancing systems integrate with aggregators to leverage their sophisticated algorithms.

Gas optimization techniques reduce the Ethereum blockchain transaction fees required to execute rebalancing operations. Simple optimizations include batching multiple trades into single transactions when possible rather than submitting separate transactions for each swap. More advanced approaches use specialized smart contract patterns that minimize computational complexity and storage operations that drive gas costs. Some protocols implement off-chain calculation of optimal rebalancing trades with on-chain execution handling only the final swap instructions, reducing expensive on-chain computation.

Flash loans represent an advanced technique used by some rebalancing protocols to enhance capital efficiency. These uncollateralized loans borrow large amounts of cryptocurrency within single transactions, use the borrowed funds to execute rebalancing trades, and repay the loans before the transaction completes. Flash loans enable protocols to access liquidity without maintaining large token reserves, potentially improving execution pricing by trading larger sizes. The loans must be repaid within the same transaction or the entire operation reverts, ensuring lenders face no default risk despite the absence of collateral.

Timing strategies optimize when rebalancing transactions submit to the blockchain to minimize costs and maximize execution quality. Gas price monitoring systems track current network congestion and submit transactions when fees are relatively low, typically during off-peak hours. Market condition analysis can delay rebalancing when high volatility suggests prices may move favorably in the near term, allowing natural market movements to reduce required trade sizes. However, excessive delays risk allowing portfolio drift to increase beyond acceptable thresholds, requiring careful balance between patience and responsiveness.

Leading Protocols and Real-World Implementation

The DeFi ecosystem has produced several notable protocols implementing automated portfolio rebalancing with different architectural approaches and target user bases. These platforms demonstrate various solutions to the technical and economic challenges inherent in automated portfolio management while serving diverse investor needs ranging from simple index tracking to sophisticated algorithmic strategies. Examining specific implementations reveals both the maturity of rebalancing technology and the ongoing innovation as protocols compete to deliver superior performance and user experience.

Balancer emerged as one of the pioneering protocols introducing automated rebalancing concepts to DeFi through its programmable liquidity pool architecture. Launched in March 2020, Balancer allows creation of liquidity pools containing up to eight different tokens in customizable weight ratios. These pools function simultaneously as automated market makers providing trading liquidity and self-rebalancing index funds for liquidity providers. When traders swap tokens through Balancer pools, they naturally rebalance the pools back toward target weights by purchasing underweight assets and selling overweight ones. Liquidity providers earn trading fees while maintaining their desired asset allocation without active management.

Balancer V2, launched in May 2021, introduced significant architectural improvements including the Protocol Vault that manages all assets centrally while separating token accounting from pool logic. This design dramatically reduced gas costs for multi-pool trades and enabled novel pool types optimized for specific use cases. The vault architecture allows pools to implement arbitrary rebalancing strategies through customizable smart contract logic while leveraging shared infrastructure for security and efficiency. Balancer V2 has processed billions of dollars in trading volume across Ethereum mainnet and Layer 2 networks including Polygon and Arbitrum.

Index Coop represents another major player in automated rebalancing, focusing on creating cryptocurrency index products that maintain target allocations through systematic rebalancing. The organization launched the DeFi Pulse Index in September 2020, tracking major DeFi protocols through a market-cap-weighted methodology that rebalances monthly. Index Coop products are built on Index Protocol, a fork of Set Protocol that provides infrastructure for managing tokenized portfolios. The protocol automatically rebalances index constituents to maintain target weights while enabling instant redemption of index tokens for underlying assets.

In January 2024, Index Coop implemented a groundbreaking innovation through its Auction Rebalance Module that revolutionized how rebalancing trades execute. Rather than trading directly against decentralized exchange liquidity pools and accepting associated price impact, the auction module enables index products to offer their rebalancing trades through Dutch auctions where prices gradually improve until arbitrageurs find them attractive enough to fill. The first public auction rebalancing of the dsETH product on January 12, 2024 resulted in a slight net asset value increase of approximately zero point zero one percent, demonstrating superior execution compared to traditional DEX trading approaches. This auction mechanism eliminates rebalancing drag that previously caused gradual NAV erosion in index products while dramatically reducing gas costs that Index Coop had previously borne to execute numerous small trades through illiquid pools.

The auction rebalancing innovation attracted immediate adoption across Index Coop’s product suite. The gtcETH product underwent successful auction rebalancing shortly after dsETH, with an unknown arbitrage bot competing with known liquidity providers to fill auction orders. This demonstrated the open and permissionless nature of the auction system where anyone can participate in providing liquidity for rebalancing trades. Index Coop subsequently announced plans to rebalance all products built on Index Protocol using the auction module, positioning it as the standard rebalancing mechanism going forward.

Beyond these established protocols, numerous specialized platforms address specific rebalancing use cases. Enzyme Finance provides comprehensive on-chain asset management infrastructure enabling portfolio managers to create investment funds with customizable rebalancing strategies, fee structures, and access controls. The platform supports integration with dozens of DeFi protocols, allowing fund managers to deploy capital across lending markets, liquidity pools, and yield farming opportunities while maintaining automated rebalancing. Enzyme has processed over five billion dollars in cumulative volume since its launch, demonstrating demand for sophisticated on-chain portfolio management tools.

Token Sets, the consumer-facing product of Set Protocol, offers pre-configured trading strategies that automatically rebalance based on technical indicators or allocation schedules. Strategies range from simple portfolio rotation between cryptocurrencies and stablecoins to complex systematic trading systems implementing momentum or mean reversion strategies. Each strategy tokenizes as an ERC-20 token that investors can purchase, hold, and redeem, providing exposure to the underlying strategy without requiring manual execution. Token Sets democratizes algorithmic trading by packaging sophisticated strategies into simple-to-use investment products.

Research by One Click Labs in 2024 examined how different rebalancing frequencies affect DeFi yield farming portfolio performance. The study analyzed twelve months of data comparing weekly, biweekly, and monthly rebalancing strategies against a fixed portfolio without rebalancing across multiple liquidity pools on Arbitrum. The research incorporated realistic gas fee costs and found that more frequent rebalancing generally improved risk-adjusted returns despite higher transaction costs, though optimal frequencies varied based on portfolio composition and market conditions. This empirical analysis demonstrates the real-world importance of rebalancing parameter selection and provides data-driven guidance for investors configuring automated rebalancing systems.

Tax Efficiency and Cost Optimization

The economic viability of automated portfolio rebalancing depends critically on managing both explicit costs including transaction fees and implicit costs arising from tax consequences of trading activity. While rebalancing delivers portfolio risk management benefits, excessive trading can generate substantial tax liabilities that overwhelm performance improvements if not carefully optimized. DeFi protocols must balance the competing objectives of maintaining precise target allocations against minimizing the total costs associated with rebalancing activities. Sophisticated systems implement multiple optimization strategies simultaneously to achieve favorable outcomes across these different dimensions.

Transaction costs in DeFi environments include blockchain gas fees, decentralized exchange swap fees, and price impact from trading through liquidity pools with finite depth. Gas fees vary dramatically based on network congestion, with costs spiking during high activity periods and creating unpredictable expense burdens. Swap fees typically range from zero point zero three to zero point three percent of trade value depending on the specific DEX and liquidity pool. Price impact increases nonlinearly with trade size, causing larger rebalancing transactions to experience worse average execution prices than smaller trades distributed over time.

Tax considerations add substantial complexity to rebalancing optimization since trading activity triggers capital gains or losses under most jurisdictions’ tax codes. Each sale of appreciated assets realizes taxable capital gains that investors must report and pay taxes on, with rates varying based on holding periods and local regulations. Frequent rebalancing can generate numerous taxable events throughout the year, creating administrative burdens for tax reporting and potentially pushing investors into higher tax brackets. Strategic tax optimization can significantly enhance after-tax returns compared to naive rebalancing approaches that ignore tax consequences.

Tax-Loss Harvesting and Optimization Strategies

Tax-loss harvesting involves strategically selling assets trading below their purchase price to realize capital losses that offset capital gains from other profitable trades. These realized losses reduce taxable income, providing immediate tax benefits while allowing investors to maintain desired portfolio exposure by purchasing similar assets. In traditional markets, wash sale rules prevent investors from claiming losses if they repurchase substantially identical securities within thirty days before or after the sale. Cryptocurrency tax treatment remains evolving and somewhat unclear regarding wash sale applicability, though prudent investors may choose to apply similar principles voluntarily.

Automated rebalancing protocols can implement tax-loss harvesting systematically by identifying opportunities to sell underwater positions during routine portfolio adjustments. When rebalancing requires selling an overweight asset trading below its cost basis, the transaction generates both portfolio rebalancing benefits and tax loss realization. The protocol can simultaneously purchase the needed underweight assets, potentially including similar but not identical cryptocurrencies that maintain equivalent portfolio exposure while avoiding wash sale concerns. This integration of tax optimization into routine rebalancing operations maximizes tax efficiency without requiring separate trading decisions.

Holding period optimization seeks to minimize short-term capital gains that face higher tax rates than long-term gains in many jurisdictions. Protocols can track individual token purchases and their holding periods, preferentially selling tokens held longer than the threshold for long-term capital gains treatment when rebalancing requires position reductions. This selective selling strategy reduces effective tax rates on realized gains while maintaining portfolio allocations close to targets. The complexity increases when managing portfolios for multiple investors with different cost bases and holding periods, requiring sophisticated tracking systems.

Strategic timing of rebalancing transactions around tax year boundaries provides opportunities to optimize total tax liabilities. Delaying rebalancing that would generate short-term capital gains until after the tax year-end can defer tax payments and potentially qualify gains for long-term treatment. Conversely, accelerating loss realization before year-end allows investors to claim deductions in the current tax year. Automated systems can incorporate these timing considerations into their rebalancing algorithms, dynamically adjusting trigger thresholds based on proximity to tax year transitions and the tax implications of pending rebalancing trades.

Stablecoin utilization offers potential tax benefits in certain jurisdictions where swapping between cryptocurrencies may not trigger taxable events or receives favorable treatment compared to selling for fiat currency. Rebalancing protocols can use stablecoins as intermediate assets when exchanging between different cryptocurrencies, potentially simplifying tax reporting or deferring tax consequences. However, tax treatment of cryptocurrency-to-cryptocurrency exchanges varies substantially across jurisdictions, requiring careful consideration of applicable laws and potential consultation with tax professionals to ensure compliance.

Minimizing Trading Costs and Slippage

Gas fee optimization represents a critical focus area for DeFi rebalancing protocols given the significant costs associated with Ethereum mainnet transactions. Protocols implement multiple strategies to reduce gas consumption including batching operations, optimizing smart contract code efficiency, and timing transactions during low-congestion periods. Batching combines multiple rebalancing operations for different portfolios into single transactions that amortize fixed gas costs across many users. Code optimization involves carefully designing smart contract logic to minimize expensive storage operations and computational complexity that drive gas costs.

Transaction timing strategies monitor real-time gas prices and submit rebalancing transactions when network fees are relatively low. Historical analysis shows gas prices following predictable patterns with lower costs during nighttime hours in major time zones and weekends when business activity decreases. Automated systems can queue rebalancing transactions and execute them opportunistically when favorable gas price windows open. However, excessive delays risk allowing portfolio drift to increase beyond acceptable levels, requiring careful balance between gas cost savings and maintaining adequate rebalancing responsiveness.

Layer 2 scaling solutions provide alternative execution environments with dramatically lower transaction costs than Ethereum mainnet. Protocols deploying on Layer 2 networks like Arbitrum, Optimism, or Polygon can execute rebalancing transactions for a fraction of mainnet costs while maintaining similar security properties through various technical mechanisms. The reduced costs enable more frequent rebalancing and tighter allocation tolerances that would be economically infeasible on mainnet. Cross-chain bridge technology allows portfolios to hold assets on multiple networks, though bridge security and liquidity fragmentation introduce additional considerations.

Slippage management focuses on minimizing the difference between expected and realized trade execution prices. Rebalancing protocols employ multiple techniques including trade size optimization, time-weighted average price execution, and intelligent routing across multiple liquidity sources. Trade size optimization determines optimal quantities for each swap that balance precision against price impact, potentially splitting large rebalancing transactions into multiple smaller trades executed over time. Time-weighted execution gradually accumulates positions at various prices rather than executing entire rebalancing trades instantaneously.

Decentralized exchange aggregators provide sophisticated routing algorithms that analyze liquidity across multiple DEXs to find optimal execution paths. Rebalancing protocols integrate with aggregators like 1inch, Paraswap, or Matcha to leverage their specialized routing capabilities rather than building redundant optimization systems. Aggregators can split individual swaps across multiple DEXs simultaneously, routing portions of trades through different liquidity pools to minimize overall price impact. Some aggregators implement advanced features like optimistic execution and private transaction pools that further enhance execution quality.

Dutch auction rebalancing, pioneered by Index Coop, represents an innovative approach to achieving superior execution prices by eliminating reliance on DEX liquidity pools entirely. Rather than taking liquidity from automated market makers and accepting associated fees and slippage, auction rebalancing makes liquidity available by offering trades through gradually improving price auctions. Arbitrageurs compete to fill these orders at prices that converge to fair market value, often providing better execution than DEX trading while eliminating swap fees. The auction mechanism fundamentally inverts the traditional rebalancing model, transforming protocols from liquidity takers into liquidity makers.

The cumulative impact of these optimization strategies can dramatically improve rebalancing economics. Analysis of Index Coop’s auction rebalancing versus traditional DEX execution showed elimination of previously persistent NAV decay while simultaneously reducing gas costs borne by the protocol. Research on yield farming portfolios demonstrated that more frequent rebalancing remained economically viable when transaction costs were minimized through optimization, enabling tighter risk management without prohibitive expense burdens. These real-world results validate the importance of comprehensive cost optimization in automated rebalancing system design.

Benefits and Challenges

Automated portfolio rebalancing in DeFi delivers transformative advantages that reshape cryptocurrency investment management while simultaneously introducing unique challenges requiring ongoing innovation and risk mitigation. Understanding both dimensions provides essential context for investors evaluating whether automated rebalancing aligns with their needs and for protocol developers designing next-generation systems. The technology’s benefits extend beyond individual convenience to encompass broader implications for financial accessibility and market efficiency.

The most immediate benefit of automated rebalancing involves eliminating the cognitive burden of constant portfolio monitoring and manual decision-making. Cryptocurrency markets operate continuously without weekends or holidays, creating relentless demands on investors attempting to maintain target allocations. Automated protocols handle this monitoring and execution autonomously, freeing investors from the time commitment and psychological stress of active portfolio management. This liberation proves particularly valuable for investors with limited time or expertise who lack the resources to monitor positions around the clock.

Emotional discipline represents another crucial advantage provided by systematic automation. Human investors frequently make suboptimal decisions driven by fear during market declines or greed during rallies, deviating from planned strategies at precisely the wrong times. Automated rebalancing enforces discipline by executing predefined rules regardless of prevailing market sentiment or recent price movements. The systematic buying of declining assets and selling of appreciated positions implements the fundamental principle of buying low and selling high despite the psychological difficulty of these actions when executed manually.

Cost efficiency emerges as a significant benefit compared to traditional financial services offering similar portfolio management capabilities. Conventional wealth management firms typically charge annual fees ranging from one to two percent of assets under management, creating substantial drag on investment returns over time. DeFi rebalancing protocols replace these recurring fees with transaction-based costs that accrue only when actual rebalancing trades execute. For investors maintaining relatively stable allocations requiring infrequent rebalancing, this pay-per-use model dramatically reduces total costs compared to percentage-based fee structures.

Accessibility democratization stands as perhaps the most profound benefit of automated DeFi rebalancing, removing traditional barriers that restricted sophisticated portfolio management to wealthy investors. Minimum account balance requirements at wealth management firms often start at hundreds of thousands of dollars, excluding the vast majority of individual investors from professional portfolio services. DeFi protocols impose no such minimums, allowing anyone with modest cryptocurrency holdings to access the same automated rebalancing capabilities available to high-net-worth individuals. This dramatic expansion of accessibility represents a fundamental shift toward more equitable financial services.

Transparency and auditability provide confidence benefits that exceed what traditional opaque financial services can offer. DeFi rebalancing protocols operate through public smart contracts where all code logic remains visible for inspection and verification. Every historical rebalancing transaction records permanently on the blockchain, enabling comprehensive auditing of protocol behavior and performance. This transparency allows investors to verify that protocols operate exactly as documented, eliminating the trust requirements inherent in traditional managed account relationships where investors must rely on periodic statements without visibility into underlying operations.

Composability enables integration of rebalancing protocols with the broader DeFi ecosystem to create sophisticated investment strategies combining multiple protocols. Rebalanced portfolios can simultaneously earn yield through lending protocols, participate in liquidity provision, or stake governance tokens for additional rewards. This seamless interoperability allows investors to optimize portfolio returns across multiple dimensions simultaneously rather than treating rebalancing as an isolated activity. The permissionless nature of DeFi means new integrations and strategies can emerge organically without requiring coordination among protocol developers.

Despite these substantial benefits, automated DeFi rebalancing faces significant challenges that limit current adoption and effectiveness. Smart contract risk represents the most severe concern, as vulnerabilities in protocol code can result in permanent loss of user funds with no possibility of recovery. Unlike traditional financial institutions protected by insurance and regulatory oversight, DeFi protocols operate autonomously without safety nets. While security audits and formal verification can reduce vulnerability risks, they cannot eliminate them entirely. Several high-profile DeFi hacks have resulted in hundreds of millions of dollars in losses, demonstrating that smart contract security remains an unsolved challenge.

Market manipulation vulnerabilities arise from the decentralized and often shallow liquidity characterizing many cryptocurrency trading pairs. Malicious actors can potentially manipulate oracle price feeds that trigger rebalancing actions, causing protocols to execute trades at disadvantageous prices. Flash loan attacks can temporarily distort asset prices to trigger unintended rebalancing or exploit protocol logic in unexpected ways. Defending against these sophisticated attacks requires robust oracle design, manipulation-resistant trigger mechanisms, and comprehensive testing across diverse market conditions.

Regulatory uncertainty creates compliance risks that could affect protocol longevity and user protection. The legal status of automated trading systems, the classification of rebalancing tokens as securities, and the tax treatment of rebalancing transactions remain unclear in many jurisdictions. Regulatory developments could potentially restrict protocol operations, impose compliance requirements incompatible with decentralized architecture, or create tax complications for users. The evolving regulatory landscape introduces unpredictable risks that could materially impact protocol viability and user returns.

User experience limitations present barriers to mainstream adoption beyond the technologically sophisticated early adopter community. Interacting with DeFi protocols requires managing cryptocurrency wallets, understanding gas fees, navigating complex interfaces, and accepting responsibility for transaction security. These requirements exceed the capabilities and comfort levels of many potential users accustomed to simple mobile banking applications and customer service support. Improving user experience while maintaining decentralization and security represents an ongoing challenge for protocol developers seeking broader adoption.

Capital efficiency constraints limit the flexibility and responsiveness of some rebalancing implementations. Protocols must maintain adequate token reserves to execute rebalancing trades, tying up capital that could otherwise generate yield. The need to route trades through liquidity pools with finite depth can constrain position sizes and introduce delays when rebalancing large portfolios. Gas costs can render small portfolio rebalancing economically impractical on Ethereum mainnet, effectively imposing minimum portfolio sizes despite the absence of explicit restrictions. These efficiency limitations disproportionately affect smaller investors and reduce the accessibility benefits that DeFi promises.

Final Thoughts

The emergence of automated portfolio rebalancing protocols represents far more than incremental technological advancement in cryptocurrency investment tools. These systems embody a fundamental reimagining of how sophisticated financial services can be delivered in an open, permissionless, and democratically accessible manner. By encoding portfolio management strategies into transparent smart contracts that execute autonomously without intermediaries, DeFi protocols demonstrate the transformative potential of blockchain technology to reshape financial services from exclusive luxuries into universal utilities available to anyone with internet connectivity.

The intersection of automation and decentralization creates unprecedented opportunities for financial inclusion that extend far beyond cryptocurrency enthusiasts in developed nations. Billions of people worldwide lack access to traditional banking services, let alone wealth management capabilities that could help them build and preserve capital over time. Automated DeFi rebalancing eliminates geographic restrictions, identity requirements, and minimum balance thresholds that exclude most of humanity from professional portfolio management. This accessibility revolution promises to empower individuals in emerging economies to participate in global financial markets and employ investment strategies previously available only to the privileged few in wealthy nations.

The social responsibility dimensions of financial democratization deserve particular emphasis. Traditional wealth management systems perpetuate inequality by reserving sophisticated investment tools for those who already possess substantial capital, creating self-reinforcing cycles where the wealthy access superior strategies that further compound their advantages. DeFi protocols challenge this dynamic by providing identical capabilities to small investors and billionaires alike, leveling playing fields that have remained tilted for centuries. While cryptocurrency adoption itself involves barriers including technical knowledge and internet access, the directional movement toward more equitable financial service delivery represents meaningful progress toward fairer economic systems.

Tax efficiency and cost optimization features embedded in automated rebalancing protocols address practical concerns that significantly impact real-world investment outcomes. The integration of tax-loss harvesting, gas optimization, and intelligent routing algorithms demonstrates how technological sophistication can translate directly into improved after-tax returns for everyday investors. These seemingly technical features carry profound implications for wealth accumulation over investment horizons spanning decades, where small efficiency improvements compound into substantial performance differences. Making such optimizations available universally rather than reserving them for high-fee wealth managers represents another dimension of democratization.

Looking forward, the continued evolution of automated rebalancing technology promises even greater capabilities and accessibility. Layer 2 scaling solutions dramatically reduce transaction costs, enabling more responsive rebalancing and expanding viability for smaller portfolios. Cross-chain infrastructure will allow seamless rebalancing across multiple blockchain networks, aggregating liquidity and expanding investment opportunities. Integration with emerging decentralized identity systems could enable compliance with regulatory requirements while preserving privacy and accessibility. These technical advancements will progressively eliminate current limitations while expanding the population that can benefit from automated portfolio management.

The broader implications extend beyond individual investor benefits to encompass market-level effects that improve overall cryptocurrency market efficiency. Systematic rebalancing creates consistent buying pressure for underperforming assets and selling pressure for outperformers, dampening excessive volatility and promoting price discovery. The proliferation of diverse rebalancing strategies increases market liquidity and reduces price impact of individual trades. These network effects suggest that widespread automated rebalancing adoption could contribute to cryptocurrency market maturation and stability, facilitating institutional adoption and mainstream acceptance.

Challenges certainly remain before automated DeFi rebalancing achieves its full transformative potential. Security improvements through formal verification and insurance mechanisms will build confidence among conservative investors currently deterred by smart contract risks. User experience enhancements will make protocols accessible to less technical users through simplified interfaces and abstracted complexity. Regulatory clarity will provide certainty around compliance requirements and tax treatment, removing barriers to institutional and mainstream adoption. These ongoing developments require coordinated efforts across protocol developers, security researchers, regulators, and user communities.

The journey toward ubiquitous automated portfolio management reflects a larger transformation in how society organizes financial services and allocates economic resources. Traditional finance operates through centralized institutions that extract rents for intermediation services while controlling access based on wealth and identity. Decentralized alternatives propose fundamentally different architectures where transparent protocols replace opaque institutions and permissionless participation replaces gatekeeping. While this transition involves significant challenges and uncertainty, the directional movement toward more open, accessible, and efficient financial infrastructure appears both inevitable and profoundly beneficial for humanity’s economic future.

FAQs

- What is automated portfolio rebalancing in DeFi and how does it differ from manual rebalancing?

Automated portfolio rebalancing in DeFi uses smart contracts to maintain desired asset allocation percentages without requiring human intervention. Unlike manual rebalancing where investors must actively monitor their portfolios and execute trades themselves, automated protocols continuously track portfolio composition and execute rebalancing trades based on predefined rules when allocations drift beyond target thresholds. This automation eliminates the need for constant monitoring while ensuring disciplined adherence to investment strategies regardless of market conditions or emotional impulses. The systems operate around the clock across DeFi protocols, executing trades through decentralized exchanges whenever rebalancing conditions trigger. - How do automated rebalancing protocols optimize for tax efficiency?

DeFi rebalancing protocols can incorporate several tax optimization strategies into their automated trading logic. Tax-loss harvesting systematically identifies opportunities to sell assets trading below their cost basis to realize capital losses that offset capital gains from other positions. Holding period optimization preferentially sells tokens held long enough to qualify for favorable long-term capital gains treatment when rebalancing requires reducing positions. Strategic timing of rebalancing transactions around tax year boundaries can defer tax liabilities or accelerate loss recognition for optimal tax impact. Some protocols also track individual cost bases for each token purchase to enable sophisticated tax lot selection strategies that minimize realized gains when selling portions of positions. - What are the main costs associated with using automated rebalancing protocols?

Primary costs include blockchain gas fees for executing rebalancing transactions on networks like Ethereum, decentralized exchange swap fees typically ranging from zero point zero three to zero point three percent of trade value, and price slippage from trading through liquidity pools with finite depth. Gas costs vary based on network congestion and can spike significantly during high activity periods. Some protocols also charge management or performance fees, though these are generally lower than traditional wealth management fees. The total cost depends on rebalancing frequency, portfolio size, network selection, and market conditions. Layer 2 solutions can reduce costs dramatically compared to Ethereum mainnet. - Are automated rebalancing protocols secure and what risks should users be aware of?

While automated rebalancing protocols undergo security audits and testing, they face inherent smart contract risks where code vulnerabilities could potentially be exploited to drain user funds. Other risks include oracle manipulation where attackers distort price feeds to trigger disadvantageous rebalancing, flash loan attacks that temporarily manipulate market conditions, and general DeFi ecosystem risks like liquidity crises or bridge exploits. Users should carefully evaluate protocol security track records, review audit reports, understand risk mitigation mechanisms like insurance coverage, and only invest amounts they can afford to lose. Diversifying across multiple protocols and maintaining appropriate position sizes relative to protocol liquidity helps manage these risks. - How frequently should portfolios be rebalanced and how do protocols determine optimal timing?

Optimal rebalancing frequency depends on market volatility, transaction costs, portfolio size, and individual risk tolerance. Research suggests more frequent rebalancing generally improves risk-adjusted returns despite higher transaction costs, though excessive rebalancing in low-volatility periods may generate unnecessary expenses. Most protocols implement either calendar-based approaches rebalancing on fixed schedules like monthly or quarterly, or threshold-based systems that trigger when allocations deviate beyond predetermined percentages from targets. Hybrid approaches combining time and threshold conditions help balance responsiveness against transaction costs. Lower-cost Layer 2 networks enable more frequent rebalancing that would be economically impractical on Ethereum mainnet. - Can automated rebalancing protocols handle portfolios across multiple blockchains?

Increasingly sophisticated protocols support cross-chain portfolio management through integration with blockchain bridge technologies that enable asset transfers between different networks. However, cross-chain rebalancing introduces additional complexity including bridge security risks, variable transaction times, and fragmented liquidity across chains. Most current implementations focus on single-chain portfolios or specific Layer 2 solutions rather than attempting comprehensive multi-chain management. As cross-chain infrastructure matures and bridge security improves, more protocols will likely expand to handle truly multi-chain portfolios seamlessly. Users should carefully evaluate the security and reliability of any cross-chain functionality before relying on it for significant portfolio management. - What portfolio sizes make automated rebalancing economically viable?

Economic viability depends heavily on the blockchain network and transaction costs. On Ethereum mainnet with high gas fees, portfolios below ten thousand dollars may find rebalancing costs consume excessive portions of returns, though this threshold varies with gas prices and rebalancing frequency. Layer 2 solutions dramatically lower this threshold, potentially making automated rebalancing economical for portfolios as small as one thousand dollars or less. The relationship between portfolio size and cost efficiency is nonlinear, with larger portfolios benefiting from economies of scale where fixed gas costs represent smaller percentages of total value. Protocols implementing gas-efficient designs and auction-based rebalancing can further reduce minimum viable portfolio sizes. - How do automated protocols handle extreme market conditions or flash crashes?

Protocols implement various safeguards against extreme market conditions including circuit breakers that pause rebalancing during periods of excessive volatility, price deviation limits that prevent execution when oracle prices diverge too far from historical averages, and slippage tolerances that reject trades executed at prices worse than specified thresholds. Some systems incorporate time delays or require multiple confirmations before executing large rebalancing trades during volatile periods. However, no system can perfectly protect against all extreme scenarios, and flash crashes or market manipulation can potentially trigger disadvantageous rebalancing. Users should understand these limitations and consider them when selecting protocols and configuring risk parameters. - What tax reporting is required for automated rebalancing transactions?

Tax reporting requirements vary by jurisdiction but generally require reporting each cryptocurrency sale as a taxable event that realizes capital gains or losses. Automated rebalancing can generate numerous transactions throughout the year, creating substantial record-keeping and reporting burdens. Many DeFi protocols do not automatically generate tax reports, requiring users to track their own transaction histories and calculate gains or losses. Several third-party services specialize in cryptocurrency tax reporting and can import blockchain transaction data to generate necessary tax forms. Users should consult with tax professionals familiar with cryptocurrency taxation in their jurisdiction to ensure compliance with reporting requirements and understand specific treatment of rebalancing transactions. - How can users evaluate and compare different automated rebalancing protocols?

Key evaluation criteria include security track record and audit quality, historical performance data showing actual rebalancing execution quality and costs, supported assets and blockchain networks, transparency of rebalancing methodology and fee structure, user interface quality and ease of use, liquidity depth for supported assets, community size and protocol governance mechanisms, and insurance or other risk mitigation features. Users should review smart contract audits, analyze on-chain transaction data to verify claimed performance, test protocols with small amounts before committing significant capital, and consider whether specific features like tax optimization or cross-chain support align with their needs. Independent analysis platforms provide comparative data across protocols to facilitate informed decision-making.