The decentralized finance landscape has evolved dramatically, transforming from simple token swaps into a sophisticated ecosystem of interconnected financial protocols. Yet despite these advances, users face persistent challenges that limit practical utility. Executing complex financial strategies requires dozens of separate transactions across multiple protocols, each incurring gas fees that can exceed hundreds of dollars during network congestion. Manual coordination introduces execution risks, exposes users to price slippage, and creates opportunities for front-running by sophisticated actors monitoring transaction mempools.

The fundamental issue stems from the fragmented nature of DeFi protocols, each operating as independent smart contracts with their own interfaces. A user seeking to optimize yield might need to swap tokens on a decentralized exchange, deposit them into a lending protocol, borrow against that collateral, convert the borrowed assets, and deposit those into a yield farming protocol. Performing these operations sequentially means paying gas fees for each transaction, waiting for confirmations between steps, and accepting price changes during execution. The complexity restricts sophisticated DeFi strategies to technical users while leaving casual participants with suboptimal outcomes.

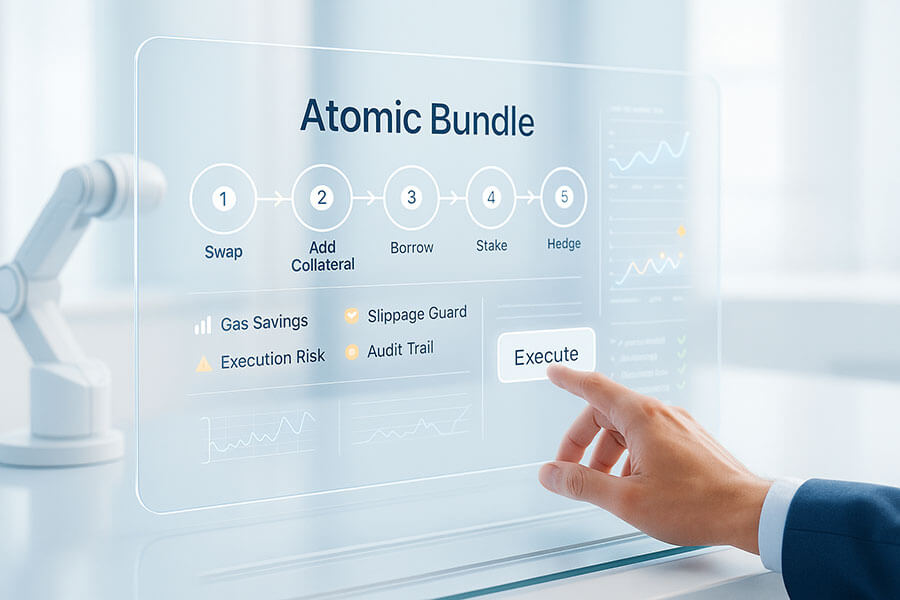

Composability and automation emerge as transformative solutions, enabling protocols to chain multiple DeFi operations into single atomic transactions. This capability allows users to execute complex strategies that would otherwise require extensive manual intervention, multiple approvals, and significant gas expenditure. By leveraging smart contract composability, automated protocols can perform sequences like borrowing funds, swapping across multiple exchanges, providing liquidity, and staking rewards all within a single transaction that either completes entirely or reverts without any state changes.

The implications extend beyond convenience. Composable DeFi strategies democratize access to sophisticated financial techniques previously available only to institutional traders or technically proficient users. Automated protocols handle the complexity of optimal route finding, gas optimization, and execution timing, delivering professional-grade performance to retail users through simple interfaces. This democratization aligns with DeFi’s core mission of creating open, permissionless financial systems accessible to all participants.

The emergence of specialized protocols focused on composability represents a maturation of the DeFi ecosystem. Rather than each project attempting to provide every financial service, protocols now specialize in specific functions while maintaining standardized interfaces that enable seamless integration. This modular architecture mirrors successful software development practices, creating building blocks that developers can combine in novel ways to deliver innovative financial products. The resulting ecosystem exhibits network effects where each new protocol increases the potential combinations and strategies available to users.

Understanding composable DeFi strategies requires examining both the technical foundations that enable this functionality and the practical applications that demonstrate its value. The journey toward truly automated, gas-efficient, and risk-minimized DeFi strategies involves smart contract innovations, economic incentive design, and user experience improvements that collectively push decentralized finance toward mainstream viability.

Understanding DeFi Fundamentals

Decentralized finance represents a paradigm shift in how financial services operate, replacing traditional intermediaries with blockchain-based smart contracts that execute automatically based on predefined rules. This foundation enables financial activities without banks, brokerages, or other centralized institutions, instead relying on transparent code running on public blockchains that anyone can verify and access. The system operates continuously without business hours, geographic restrictions, or discriminatory access policies.

The fundamental building blocks of DeFi include several core protocol types serving specific financial functions. Decentralized exchanges enable peer-to-peer token trading through automated market makers using mathematical formulas to determine prices based on supply and demand within liquidity pools. Lending protocols allow users to deposit assets to earn interest or borrow against collateral, with smart contracts automatically managing interest rates and liquidating positions when collateral values fall below required thresholds. Yield aggregators optimize returns by automatically moving funds between protocols to capture the highest yields while managing gas costs.

Traditional DeFi operations, despite their technological sophistication, operate in isolation that creates inefficiencies for users pursuing multi-step financial strategies. Each protocol interaction requires users to initiate separate transactions, approve token spending permissions, wait for blockchain confirmations, and pay gas fees that compensate network validators for computational resources. These individual transactions expose users to price movements between steps, as asset values can fluctuate significantly during the minutes or hours required to execute complex strategies manually.

What is Decentralized Finance

Decentralized finance encompasses a broad ecosystem of blockchain-based financial applications that operate without centralized control or intermediaries. At its core, DeFi leverages smart contracts deployed on programmable blockchains like Ethereum to create financial primitives that execute automatically based on transparent, immutable code. These smart contracts hold funds in escrow, enforce agreement terms, and distribute assets according to predefined rules without requiring trust in human operators or institutional guarantees.

The major categories of DeFi protocols each address different financial needs while maintaining interoperability through standardized token formats and interfaces. Decentralized exchanges facilitate asset trading through various mechanisms including automated market makers that maintain liquidity pools where users trade against algorithmic pricing curves, or order book exchanges that match buyers and sellers directly. Lending and borrowing protocols enable users to earn interest on deposited assets while allowing others to borrow those funds by posting collateral, with interest rates adjusting dynamically based on supply and demand for different assets.

Stablecoin protocols create digital assets that maintain stable values relative to fiat currencies through various mechanisms including fiat-backed reserves, cryptocurrency collateralization, or algorithmic supply adjustments. Derivatives platforms enable users to gain exposure to asset price movements, create synthetic assets, or hedge risks through perpetual swaps, options, and other financial instruments. Yield farming protocols incentivize liquidity provision by distributing governance tokens or protocol revenue shares to users who supply capital to various pools and strategies.

The composability of these protocols stems from their shared technical foundations. Most DeFi applications use standardized token formats like ERC-20 that ensure consistent interfaces for transferring and managing assets across different protocols. This standardization means that any token created for one protocol can be seamlessly used with any other protocol that supports the same standard, creating an interconnected ecosystem where protocols function as building blocks that developers can combine in unlimited configurations.

Traditional DeFi Operations and Their Limitations

Users interacting with DeFi protocols through traditional methods face numerous challenges limiting practical utility. The typical workflow requires navigating to each protocol’s individual website, connecting a cryptocurrency wallet, approving smart contracts to spend specific tokens, and executing transactions separately. This fragmented experience demands substantial technical knowledge, constant attention to transaction statuses, and tolerance for complexity inherent in managing multiple protocol interactions.

Gas fees represent one of the most significant barriers to efficient DeFi usage. Each blockchain transaction requires users to pay fees to network validators, with costs varying based on network congestion and transaction complexity. During high activity periods on networks like Ethereum, individual transactions can cost tens to hundreds of dollars. Users executing multi-step strategies might spend more on gas fees than they earn from the activities themselves, making sophisticated strategies economically viable only for users with substantial capital.

Execution risks multiply when strategies require multiple sequential transactions. Asset prices can move significantly between steps, causing strategies to execute at worse prices than anticipated or fail when price movements invalidate strategy assumptions. Sophisticated traders monitoring blockchain mempools can front-run transactions by submitting their own with higher gas fees, extracting value from users who reveal trading intentions before execution completes.

The time delays between transaction steps create additional complications. Users must wait for blockchain confirmations before proceeding to the next step, with confirmation times varying based on network congestion and the gas fees paid. During volatile market conditions, the minutes required to execute multi-step strategies can see asset prices move substantially, turning profitable opportunities into losses or requiring users to cancel partially completed strategies at additional cost. The manual monitoring required to track strategy execution and respond to changing conditions demands constant attention that limits DeFi’s accessibility to users with limited time or technical sophistication.

Slippage represents another persistent challenge in traditional DeFi operations. When users trade assets on decentralized exchanges, the actual execution price often differs from the quoted price due to the mathematical properties of automated market makers and the depth of liquidity in specific pools. Large trades relative to pool sizes experience greater slippage, effectively reducing the tokens received or increasing the tokens paid compared to initial expectations. Users executing multi-step strategies face compounding slippage across each trading operation, with the cumulative impact potentially eroding a substantial portion of expected returns.

These limitations collectively restrict sophisticated DeFi strategies to technically proficient users with substantial capital and time to manage complex operations. The fragmented nature of protocol interactions, combined with high costs and execution risks, creates barriers that prevent DeFi from achieving its potential as an accessible, efficient alternative to traditional financial systems. The recognition of these challenges has driven innovation in composability and automation technologies that address these fundamental inefficiencies.

Composability in DeFi Explained

Composability represents one of the most powerful properties of decentralized finance protocols, enabling them to function as interchangeable building blocks that developers can combine in novel configurations. This capability emerges from the open, permissionless nature of blockchain smart contracts that any other contract or user can interact with directly without requiring approval from protocol operators. The resulting ecosystem exhibits emergent properties where total value and functionality exceed the sum of individual protocols.

The technical foundations enabling composability rest on several key characteristics of blockchain-based smart contracts. All smart contract code and state exist transparently on public blockchains where any party can read current values, verify logic, and interact with functions according to programmed rules. This transparency eliminates information asymmetries and access restrictions that prevent integration in traditional financial systems, where institutions maintain proprietary systems behind authentication barriers.

Standardized interfaces play crucial roles in enabling seamless protocol composition. When protocols implement common standards for representing and managing assets, any new protocol can immediately interact with existing tokens and contracts without custom integration work. The ERC-20 token standard, for instance, defines a consistent set of functions that all compliant tokens must implement, ensuring that any protocol designed to work with ERC-20 tokens can automatically support thousands of different assets without modification. Similarly, newer standards like ERC-4626 define consistent interfaces for tokenized vaults, enabling automated strategies to interact with different yield-bearing assets through uniform methods.

Automation through smart contracts transforms composability from a theoretical possibility into practical functionality that users can leverage without technical expertise. Rather than manually executing each step of a multi-protocol strategy, users can interact with smart contracts that programmatically call functions across multiple protocols in sequence, handling approvals, error checking, and state management automatically. These automated strategies execute atomically, meaning all operations either complete successfully or the entire transaction reverts without any state changes, eliminating risks of partially executed strategies leaving users with unexpected asset positions.

The Concept of Composability

The “money legos” metaphor aptly captures how DeFi protocols can be snapped together in various configurations to create new financial products and strategies. Just as physical Lego bricks use standardized connectors that enable unlimited combinations while maintaining structural integrity, DeFi protocols expose standardized interfaces that enable other protocols to build upon their functionality. This architectural approach contrasts sharply with traditional finance, where proprietary systems use incompatible data formats and require extensive custom integration work to enable even basic interoperability between institutions.

Smart contract interoperability enables protocols to call functions on other contracts directly within the same transaction. When a smart contract needs to swap tokens, it can invoke functions on a decentralized exchange contract to execute the trade. If that trade needs to occur at a specific price, the contract can include conditional logic that reverts the entire transaction if slippage exceeds acceptable thresholds. This ability to combine operations from multiple protocols atomically within single transactions eliminates many risks associated with multi-step strategies while dramatically reducing gas costs and execution complexity.

The permissionless nature of blockchain protocols means that developers can integrate with existing protocols without requiring approval, licensing agreements, or business development relationships. Any smart contract can call public functions on any other contract, enabling innovation to proceed at the pace of developer creativity rather than institutional coordination. This characteristic has spawned an explosion of protocol combinations that would be impossible to achieve in traditional finance, where similar integrations require months or years of negotiation, compliance review, and technical integration work.

The network effects of composability become increasingly powerful as the ecosystem matures. Each new protocol that enters the DeFi ecosystem potentially increases the value of all existing protocols by creating additional ways to combine functionality. A new lending protocol doesn’t just provide an alternative to existing options but also creates new possibilities for yield strategies, collateral types, and risk management approaches across the entire ecosystem. This dynamic drives continuous innovation and experimentation as developers explore novel combinations of existing protocols to deliver unique value propositions.

Composability also enables specialization where protocols focus on excelling at specific functions rather than attempting to provide comprehensive financial services. A protocol might specialize in optimizing swap routes across multiple decentralized exchanges, relying on those underlying exchanges for liquidity provision while focusing innovation on routing algorithms and execution optimization. This modular approach to protocol design mirrors successful software development practices and enables rapid iteration as protocols can improve specific components without rebuilding entire systems.

Automation and Smart Contracts

Smart contracts enable automated execution of complex multi-step strategies that would be impractical or impossible for users to coordinate manually. These self-executing programs run deterministically on blockchain virtual machines, processing inputs according to predefined logic without requiring human intervention or trusted intermediaries. The automation extends beyond simple conditional statements to encompass sophisticated strategies that optimize parameters dynamically, respond to changing market conditions, and coordinate actions across multiple protocols seamlessly.

Flash loans represent one of the most powerful innovations enabling composable DeFi strategies. These uncollateralized loans exist only within the boundaries of a single transaction, allowing users to borrow millions of dollars worth of assets provided they return the borrowed amount plus fees before the transaction completes. The atomic nature of blockchain transactions ensures that if the loan cannot be repaid, the entire transaction reverts as if it never occurred, eliminating default risk for lenders. This capability enables strategies that would otherwise require substantial capital, democratizing access to arbitrage opportunities and sophisticated trading techniques.

Atomic transactions provide crucial guarantees for composable strategies by ensuring all operations succeed together or fail together without partial execution. When a smart contract executes a strategy involving token swaps, liquidity provision, and staking across multiple protocols, the atomic property ensures that if any step fails, all previous operations reverse automatically. This all-or-nothing execution eliminates risks of strategies leaving users with unexpected asset positions or requiring additional transactions to unwind failed attempts, significantly reducing the complexity and risk of executing sophisticated financial operations.

Transaction batching enables multiple operations to execute within single blockchain transactions, dramatically reducing gas costs compared to separate transaction submissions. Rather than paying base transaction fees and priority fees multiple times, batched operations share these fixed costs across all included actions. For strategies requiring numerous operations, the gas savings can be substantial, often reducing total costs by fifty percent or more compared to sequential execution. This efficiency makes sophisticated strategies economically viable for users with modest capital who would otherwise find gas fees prohibitive.

Automation reduces human error that commonly occurs when manually coordinating complex DeFi strategies. Users might mistakenly approve wrong amounts, send transactions to incorrect addresses, or execute operations in suboptimal sequences that increase costs or reduce returns. Automated smart contracts eliminate these risks by encoding optimal execution logic that runs identically regardless of user expertise or attention levels. The reliability of automated execution enables users to deploy sophisticated strategies confidently without requiring deep technical knowledge or constant monitoring.

The programmability of smart contracts also enables dynamic optimization where strategies adjust parameters based on real-time market conditions. A yield optimization strategy might automatically rebalance assets between different protocols as interest rates fluctuate, maximizing returns without requiring user intervention. Trading strategies can implement sophisticated logic for managing slippage tolerance, route optimization across multiple liquidity sources, and timing of execution to minimize costs and maximize efficiency. This dynamic behavior delivers professional-grade strategy execution to retail users through simple interfaces that abstract away underlying complexity.

These technical capabilities collectively transform DeFi from a collection of isolated protocols into an integrated ecosystem where sophisticated financial strategies become accessible to users regardless of their technical expertise or capital scale. The automation and composability enabled by smart contracts address fundamental inefficiencies in traditional DeFi operations while unlocking new possibilities for innovation and value creation across the ecosystem.

Leading Composable DeFi Protocols

The maturation of DeFi has produced several specialized protocols that excel at enabling composable strategies through innovative technical approaches and user-focused design. These platforms abstract away the complexity of multi-protocol interactions, providing interfaces where users can execute sophisticated strategies through simple actions while the underlying smart contracts coordinate operations across numerous protocols optimally. The success of these platforms demonstrates both the practical value of composability and the technical feasibility of building reliable, efficient automation systems on blockchain infrastructure.

These composability-focused protocols serve different niches within the DeFi ecosystem, with some specializing in yield optimization, others focusing on trading and exchange aggregation, and still others providing comprehensive portfolio management tools. Despite their different focuses, they share common characteristics including smart contract automation, gas optimization techniques, and abstraction layers that hide technical complexity from end users. The diversity of approaches reflects the ecosystem’s experimentation with various models for delivering composable functionality while the commonalities demonstrate convergence on proven technical patterns.

Evaluating the success and impact of composable DeFi protocols requires examining multiple dimensions including user adoption metrics, total value locked under management, documented performance outcomes, and the sophistication of strategies they enable. The most successful protocols have achieved substantial scale while maintaining security, delivering measurable value to users through gas savings and improved execution quality, and spurring innovation through open-source contributions that advance the entire ecosystem. Real-world case studies from recent years provide concrete evidence of how these protocols translate theoretical benefits of composability into practical advantages for users.

Protocol Examples and Features

Yearn Finance pioneered automated yield optimization through its vault system that pools user capital and deploys it across multiple DeFi protocols to maximize returns. The protocol’s vaults implement strategies that automatically shift assets between lending protocols, liquidity pools, and farming opportunities as yields fluctuate. Users simply deposit assets into vaults and receive shares representing proportional ownership, with vault smart contracts handling all rebalancing and compounding automatically. By socializing gas costs, Yearn makes sophisticated yield strategies economically viable even for users with modest capital.

The protocol demonstrated exceptional performance during the 2023 market recovery, with its yvUSDC vault averaging 8.7 percent annual percentage yield while automatically managing exposure across Aave, Compound, and Curve Finance based on fluctuating interest rates and incentive programs. This represented a 2.3 percentage point improvement over simply depositing USDC into the highest-yielding single protocol at any given time, demonstrating the value of automated rebalancing and optimization. The vault executed over 150 rebalancing transactions throughout the year, managing complexity that would be impractical for individual users while delivering measurably superior returns.

1inch Network operates as a decentralized exchange aggregator that routes trades across multiple liquidity sources to optimize execution prices and minimize slippage. Rather than routing all trades through a single exchange, 1inch’s Pathfinder algorithm analyzes liquidity across dozens of exchanges simultaneously, often splitting orders across multiple routes to achieve better execution. The protocol introduced Fusion Mode in 2023, enabling gasless swaps where specialized resolvers compete to execute trades off-chain before settling final results on the blockchain, eliminating gas fees while maintaining security.

Real-world data from 1inch’s 2024 annual report showed that Fusion Mode users saved an average of 47 dollars per transaction in gas fees compared to standard decentralized exchange swaps, with the savings particularly pronounced during periods of network congestion when base-layer transaction costs spiked. The protocol processed over 8.2 billion dollars in trading volume through Fusion Mode during 2024, demonstrating substantial adoption of this composable approach to trade execution. Users achieved average price improvements of 0.8 percent compared to quoted prices on individual exchanges, with the benefits increasing for larger trades where splitting orders across multiple liquidity sources provided significant slippage reduction.

Instadapp created the DeFi Smart Layer, a middleware protocol that enables one-click execution of complex multi-step DeFi operations across various protocols. The platform’s interface allows users to perform actions like refinancing loans between protocols, building leveraged positions, or executing complex swaps through simple workflows that hide underlying technical complexity. Behind the interface, Instadapp’s smart contracts coordinate multiple protocol interactions atomically, handling approvals, parameter optimization, and error checking automatically. The protocol supports dozens of major DeFi protocols including Aave, Compound, MakerDAO, Uniswap, and others, enabling users to move assets and positions seamlessly across the ecosystem.

During 2024, Instadapp facilitated the migration of over 1.2 billion dollars in lending positions as users refinanced between protocols to optimize interest rates and access different collateral types. The platform’s automation reduced the number of transactions required for complex migrations from an average of eight separate operations to single atomic executions, saving users an estimated 18 million dollars in combined gas fees while eliminating execution risks associated with multi-step manual processes. One notable case involved a user refinancing a 50 million dollar DAI loan from Compound to Aave in a single transaction that would have required twelve separate manual steps and exposed the position to substantial execution risk during the multi-hour process.

Zapper and Zerion provide comprehensive portfolio management interfaces that enable users to interact with their entire DeFi position through unified dashboards. These platforms aggregate data from multiple protocols, display combined holdings and performance metrics, and enable actions across various protocols without navigating to individual websites. Users can enter or exit liquidity positions, claim rewards, stake tokens, or execute swaps through these interfaces, with the platforms coordinating the necessary protocol interactions automatically. The value proposition centers on simplification and efficiency, making DeFi accessible to users who find navigating individual protocol interfaces overwhelming.

Convex Finance built on top of Curve Finance’s liquidity pools to create a yield optimization layer that enables users to earn enhanced returns on stablecoin positions. The protocol accepts deposits of Curve LP tokens and stakes them optimally across Curve’s gauge system while participating in Curve governance to maximize rewards. Users receive cvxCRV tokens representing their share of compounded rewards, with Convex’s smart contracts handling the complexity of claiming, converting, and restaking automatically. This composable approach delivered superior returns compared to directly staking on Curve, with users earning an additional 15-20 percent in yield during 2024.

The success of Convex demonstrated the power of protocol specialization within composable DeFi ecosystems. Rather than attempting to compete with Curve directly, Convex added a optimization layer that benefited both protocols, with Curve gaining a large, engaged stakeholder committed to its governance while Convex users achieved superior returns. By the end of 2024, Convex managed over 3.8 billion dollars in total value locked across its strategies, representing approximately 40 percent of all assets deposited in Curve pools. This scale demonstrated user demand for automated optimization even when base protocols provide robust functionality, validating the value proposition of composable automation.

These protocols collectively demonstrate various approaches to enabling composable DeFi strategies, each addressing different user needs while advancing the ecosystem’s technical capabilities. Their success validates the practical value of automation and composability while their ongoing development continues pushing boundaries of what sophisticated DeFi strategies can achieve through smart contract coordination and optimization.

Composable DeFi Strategies

The practical applications of composable DeFi protocols span a wide range of financial strategies leveraging automation to achieve outcomes impossible through manual execution. These strategies demonstrate how combining multiple protocol interactions within single transactions can optimize returns, reduce costs, and manage risks more effectively. Understanding these applications provides concrete examples of composability’s value while illustrating the sophistication that automated protocols deliver.

Composable strategies typically focus on two primary objectives: maximizing returns through yield optimization or improving trading efficiency through better execution. Yield optimization strategies automatically allocate capital across multiple protocols based on real-time interest rates, farming incentives, and risk parameters, continuously rebalancing to maintain optimal positions as market conditions evolve. Trading strategies leverage composability to execute complex sequences of swaps, leverage adjustments, and portfolio rebalancing within single transactions that minimize slippage, reduce gas costs, and protect against front-running attacks.

The effectiveness of these strategies depends critically on the technical sophistication of underlying protocols and the quality of optimization algorithms they implement. Successful strategies must balance competing objectives including maximizing returns, minimizing gas costs, managing risk exposures, and maintaining sufficient liquidity for user withdrawals. The best implementations achieve these objectives through careful protocol design, extensive testing, and continuous monitoring that enables rapid response to changing market conditions or emerging opportunities.

Yield Optimization Strategies

Automated yield farming enables users to earn returns on crypto assets through automated allocation across multiple lending protocols, liquidity pools, and farming opportunities. Rather than manually monitoring yields and executing rebalancing transactions as rates change, yield optimization protocols handle these operations automatically through smart contracts that evaluate opportunities continuously and move capital to maximize returns net of gas costs.

The mechanics of automated yield farming involve sophisticated algorithms that evaluate expected returns across numerous protocols while accounting for factors like impermanent loss risk in liquidity pools, withdrawal restrictions on farming positions, and the gas costs associated with moving capital between protocols. Effective strategies consider not just current yields but also historical volatility, protocol security track records, and correlation between different yield sources to construct portfolios that optimize risk-adjusted returns rather than simply chasing the highest nominal rates.

Vault strategies have become the dominant model for delivering automated yield optimization to users, with protocols like Yearn Finance, Beefy Finance, and Harvest Finance offering various vault options targeting different risk profiles and asset types. Users deposit assets into vaults and receive shares representing their proportional ownership of vault holdings. The vault’s smart contracts then deploy capital across multiple protocols according to predefined strategies, with all participants sharing both returns and gas costs proportionally. This pooling approach makes sophisticated strategies economically viable for small users while enabling large depositors to benefit from professional-grade optimization without requiring active management.

Leveraged yield farming takes automation further by using flash loans and protocol composability to create leveraged positions within single transactions. These strategies might borrow assets from lending protocols, swap them for yield-bearing tokens, stake those tokens to earn rewards, and manage the resulting position automatically to maintain safe collateralization ratios. The composability enables strategies that would otherwise require substantial capital and complex manual coordination, democratizing access to leveraged yield opportunities while automating risk management that protects positions from liquidation during market volatility.

Auto-compounding mechanisms represent another crucial application of yield optimization automation. Many DeFi protocols distribute rewards periodically that users must manually claim, convert to desired assets, and reinvest to achieve compound growth. This process incurs gas fees each time and requires constant attention to optimize reinvestment timing. Automated protocols handle claiming, swapping, and reinvesting automatically, with costs socialized across all vault participants. The result is superior compound growth compared to manual management, with the benefits particularly pronounced for smaller users who might find individual compounding transactions economically unviable.

Real-world performance data from yield optimization protocols demonstrates measurable benefits of automated strategies. During 2024, Yearn Finance’s yvDAI vault achieved 9.2 percent annual percentage yield through automated allocation across Aave, Compound, and various liquidity pools, compared to 6.8 percent that users would have earned through the highest-yielding single protocol available at the start of the year. The vault executed 187 rebalancing transactions throughout the year, responding dynamically to changing yields across the ecosystem while maintaining stable returns for depositors. Each rebalancing transaction cost approximately 150 dollars in gas fees, but with these costs shared across hundreds of millions in vault assets, the per-user impact was negligible while delivering substantial return improvements.

Trading and Arbitrage Strategies

Decentralized exchange aggregation represents one of the most immediately valuable applications of composability for users executing trades. Rather than manually checking prices across different exchanges and liquidity pools, aggregation protocols automatically route trades across multiple sources to optimize execution prices and minimize slippage. The sophistication of routing algorithms varies across protocols, with the most advanced implementations splitting orders across numerous paths simultaneously to achieve better execution than any single liquidity source could provide.

The technical implementation of DEX aggregation involves complex optimization problems where protocols must evaluate millions of potential routing combinations to identify optimal paths for specific trades. Factors influencing routing decisions include the depth of liquidity in various pools, the fees charged by different protocols, the potential slippage based on trade size, and the gas costs associated with executing trades through multiple hops. Advanced aggregators use sophisticated algorithms that solve these optimization problems in real-time, often achieving measurably better execution than users could obtain through manual routing.

Flash loan arbitrage strategies exemplify the power of composability to enable sophisticated trading techniques without requiring capital. These strategies identify price discrepancies across different exchanges or protocols, borrow assets through flash loans, execute arbitrage trades across multiple venues simultaneously, repay the loans, and pocket the difference all within single atomic transactions. The composability ensures that if profitable arbitrage is impossible due to price movements during transaction execution, the entire operation reverts without cost beyond the failed transaction’s gas fees. This property enables risk-free arbitrage attempts that would otherwise expose traders to substantial losses from adverse price movements.

Liquidation protection strategies use composability to help users maintain healthy collateral ratios on lending positions without manual monitoring. These automated systems monitor collateralization levels continuously and execute defensive actions when ratios approach dangerous levels, potentially adding collateral, partially repaying debt, or adjusting positions across protocols to improve health factors. The automation happens through smart contracts that users authorize to manage their positions within specified parameters, eliminating risks of liquidation during volatile markets when manual intervention might not be fast enough.

Automated portfolio rebalancing maintains desired asset allocations without requiring multiple manual transactions and timing decisions. Users specify target allocations across different assets, and automated protocols execute rebalancing trades periodically or when allocations drift beyond specified thresholds. The composability enables rebalancing across multiple exchanges simultaneously to optimize execution, while automated execution ensures consistent discipline that prevents emotional decision-making or neglect that might leave portfolios misaligned with intended strategies.

The measurable benefits of composable trading strategies appear in execution quality metrics and cost savings. Data from 1inch Network showed that their Pathfinder algorithm achieved average execution prices 0.6 percent better than the best single-source quotes available for trades over 10,000 dollars during 2024, with improvements increasing to 1.2 percent for trades exceeding 100,000 dollars. These execution improvements represent substantial value that compounds over time for active traders, easily exceeding the protocol fees charged for access to optimized routing. Additionally, splitting large orders across multiple sources reduces price impact that would result from executing entire trades through single liquidity pools, effectively increasing the maximum viable trade size before slippage becomes prohibitive.

Gas optimization through batching and efficient execution paths generates significant cost savings for users executing multiple operations. Protocols that batch swaps, enable multi-hop routing through single function calls, and optimize transaction data to minimize gas consumption can reduce total costs by forty to sixty percent compared to executing equivalent operations through separate transactions on individual protocols. For active users executing numerous trades or portfolio adjustments, these savings accumulate to substantial amounts that improve net returns measurably.

These composable trading and arbitrage strategies collectively demonstrate how automation and protocol integration can deliver professional-grade execution quality to retail users while reducing costs and eliminating the technical complexity that traditionally restricted sophisticated trading techniques to institutional participants or highly technical individuals. The democratization of these capabilities represents a fundamental shift in how financial markets can operate when built on composable, permissionless infrastructure.

Benefits and Challenges

The integration of composable automation into DeFi protocols produces multifaceted benefits extending across technical, economic, and user experience dimensions while introducing challenges requiring careful management. Understanding both advantages and limitations provides essential context for evaluating current implementations and anticipating future developments as the technology matures.

The primary benefits center on efficiency gains that emerge from automating multi-step strategies and optimizing execution across multiple protocols simultaneously. Users executing strategies through composable protocols achieve superior outcomes compared to manual approaches, with measurable improvements in returns, cost reductions, and risk management effectiveness. The automation eliminates human error, enables sophisticated optimization that would be impractical manually, and democratizes access to strategies previously available only to institutional participants or highly technical users with substantial capital and expertise.

Economic benefits manifest through reduced gas costs, improved execution quality, and enhanced returns from optimized capital allocation. By batching operations and socializing transaction costs across multiple users, composable protocols make sophisticated strategies economically viable for participants with modest capital who would find individual execution prohibitively expensive. The superior execution quality achieved through optimal routing and timing delivers measurable value that compounds over time, while automated rebalancing and yield optimization capture opportunities that manual management would miss due to time constraints or monitoring limitations.

User experience improvements represent perhaps the most significant long-term benefit as they expand DeFi’s accessible addressable market beyond technical early adopters to mainstream users seeking superior financial services. Composable protocols abstract away technical complexity, presenting simple interfaces where users achieve sophisticated outcomes through minimal clicks. This simplification reduces learning curves, eliminates opportunities for costly mistakes, and enables users to focus on strategic decisions rather than tactical execution details.

Challenges exist across security, scalability, regulatory, and user education dimensions that could limit adoption or introduce risks requiring careful management. Smart contract vulnerabilities in composable systems affect not just individual protocols but potentially entire chains of dependent protocols, amplifying security risks compared to isolated implementations. The complexity of composable smart contracts makes comprehensive security auditing more difficult while creating larger attack surfaces that sophisticated adversaries might exploit. Gas cost limitations on some blockchain networks restrict the complexity of strategies that can execute economically, potentially limiting the sophistication of automation that protocols can deliver practically.

Regulatory uncertainty creates compliance challenges for protocols implementing sophisticated financial strategies through automated systems. Traditional financial regulations often assume centralized intermediaries who can be held accountable for compliance with securities laws, anti-money laundering requirements, and consumer protection regulations. The decentralized, autonomous nature of composable DeFi protocols challenges these regulatory frameworks, creating legal ambiguity about which entities bear responsibility for compliance and how existing regulations apply to algorithmic financial services operating without centralized control.

User education barriers persist despite interface improvements, as many potential users lack understanding of fundamental DeFi concepts needed to evaluate risks or make informed decisions about strategy selection. While composable protocols hide technical complexity, users still must understand concepts like impermanent loss, liquidation risks, and smart contract security to assess whether specific strategies align with their risk tolerance and financial objectives. The rapid innovation pace in DeFi makes maintaining current knowledge challenging even for engaged participants, potentially leading to poor decision-making or exposure to risks users don’t fully comprehend.

Performance limitations emerge during periods of high network activity when gas fees spike and transaction confirmation times increase. Composable strategies that rely on executing complex multi-step operations within single transactions may become economically unviable during network congestion, forcing users to choose between paying extremely high gas fees or waiting for conditions to improve. The sensitivity to network conditions introduces timing risks where optimal strategies may not be executable precisely when users need them most, such as during market volatility when network activity typically peaks.

The complexity of troubleshooting issues when composable strategies fail or produce unexpected outcomes creates support challenges for protocols and confusion for users. When a strategy involving multiple protocols reverts due to failures at any step, identifying the root cause requires technical expertise that many users lack. The opacity of failed transactions can leave users uncertain whether problems stem from strategy design, insufficient gas fees, changed market conditions, or protocol bugs, making it difficult to determine appropriate corrective actions.

Despite these challenges, the trajectory of composable DeFi development suggests that ongoing innovation will address many current limitations while unlocking new capabilities that further expand the technology’s practical utility. The benefits demonstrated by successful implementations provide strong incentives for continued development, while the challenges identified through real-world usage inform prioritization of improvements that will enhance security, scalability, and user experience in future protocol iterations.

Final Thoughts

The emergence of composable DeFi strategies through automation represents a pivotal evolution in decentralized finance, transforming the ecosystem from isolated protocols into integrated financial infrastructure where sophisticated capabilities become accessible to anyone regardless of technical expertise or capital scale. This transformation extends beyond technological advancement to embody a fundamental reimagining of how financial systems can operate when built on open, permissionless foundations that prioritize transparency, efficiency, and inclusive access.

The democratization of sophisticated financial strategies through automated composability addresses longstanding inequities in traditional financial systems. Institutional investors have always enjoyed access to professional portfolio management, optimal trade execution, and sophisticated risk management tools that retail participants can only access through intermediaries charging substantial fees. Composable DeFi protocols level this playing field by encoding professional-grade optimization into smart contracts that serve all users equivalently, delivering institutional execution quality at retail-accessible costs.

The intersection of technology and social responsibility becomes particularly pronounced when considering how composable automation could expand financial inclusion globally. Billions of people worldwide lack access to basic financial services due to geographic, economic, or regulatory barriers that exclude them from traditional banking systems. DeFi’s permissionless nature theoretically enables anyone with internet connectivity to access sophisticated financial tools, but practical barriers around complexity, costs, and technical knowledge have limited this potential. Composable automation addresses these barriers by making DeFi genuinely accessible, abstracting complexity while reducing costs to levels that enable participation even for users with modest capital.

The evolution toward more accessible DeFi carries profound implications for global financial participation and wealth creation opportunities. When sophisticated yield optimization, efficient trading, and professional risk management become available to global populations previously excluded from advanced financial services, the potential for wealth accumulation and economic mobility expands dramatically. The compounding effects of superior returns and reduced costs generate substantial differences in outcomes over time, with these benefits now accessible to participants worldwide rather than concentrated among wealthy individuals and institutions in developed markets.

Looking toward the future, composable DeFi strategies will likely continue evolving in sophistication and accessibility as protocols refine optimization algorithms, improve interfaces, and expand financial activities that can be automated. The integration of artificial intelligence into strategy optimization promises even more adaptive systems that learn from market patterns. Cross-chain composability may enable strategies that seamlessly span multiple blockchain ecosystems, accessing liquidity regardless of which networks host them.

The ongoing challenges around security, scalability, and regulatory clarity require sustained attention. Smart contract security must continue improving through better development practices, comprehensive auditing, and formal verification techniques. Blockchain scalability improvements through layer-2 solutions and optimized execution environments will be essential to maintain economic viability as adoption scales. Regulatory frameworks need to evolve to protect consumers while preserving innovation and accessibility benefits that decentralized systems provide.

The responsibility for shaping this technological evolution extends across the entire ecosystem including protocol developers, security researchers, users, and policymakers. Developers must prioritize security and user experience alongside innovative features, ensuring that new capabilities don’t introduce vulnerabilities or complexity that undermines accessibility. Users must engage thoughtfully with these powerful tools, taking time to understand risks even as interfaces simplify interactions. Policymakers need to craft regulatory approaches that protect consumers without stifling innovation or recreating the exclusionary barriers that decentralized systems aim to eliminate.

Innovation and accessibility must remain balanced as composable DeFi matures, ensuring that increasing sophistication doesn’t reintroduce complexity barriers. The most advanced optimization algorithms provide little value if users can’t effectively access them or understand their risk characteristics. Success requires not just technical excellence but also thoughtful interface design, comprehensive educational resources, and community support systems enabling users of all sophistication levels to benefit from composable automation while understanding and managing associated risks.

Ultimately, the value of composable DeFi strategies will be measured by practical impact on financial outcomes for diverse global populations. If these technologies successfully deliver superior financial services to broader populations at lower costs while maintaining security, they will represent genuine innovation improving human welfare. The trajectory toward this outcome appears promising based on demonstrated benefits, but sustained commitment to addressing existing challenges will determine whether composable automation fulfills its transformative potential.

FAQs

- What exactly are composable DeFi strategies and how do they differ from regular DeFi activities?

Composable DeFi strategies involve chaining multiple protocol operations together into single automated transactions that execute atomically, meaning all steps either complete successfully together or the entire transaction reverts without any changes. This differs from regular DeFi activities where users manually execute each step separately, paying gas fees for each transaction and accepting risks that prices might change between steps or strategies might fail partially. Composable strategies use smart contracts to coordinate operations across multiple protocols automatically, optimizing execution paths, minimizing gas costs, and eliminating many risks associated with manual multi-step processes. - How much money do I need to start using composable DeFi protocols effectively?

The minimum capital requirements vary by protocol and strategy type, but composable DeFi actually makes sophisticated strategies more accessible by socializing gas costs across multiple users. Some yield optimization vaults accept deposits as small as 100 dollars, though depositors should consider that gas fees for deposits and withdrawals might consume a significant percentage of very small positions. For most protocols, having at least 1,000 to 5,000 dollars enables cost-effective participation where gas fees represent reasonable percentages of expected returns. Users with larger capital naturally benefit more from optimization, but composability specifically aims to make professional-grade strategies accessible at scales that would be economically unviable through manual execution. - What are the main risks I should understand before using automated DeFi strategies?

The primary risks include smart contract vulnerabilities where bugs in protocol code could result in loss of funds, though reputable protocols undergo extensive security audits to minimize this risk. Market risks remain present as automated strategies cannot eliminate exposure to asset price movements, impermanent loss in liquidity positions, or liquidation risks in leveraged strategies. Composability introduces additional complexity where issues in any protocol within a strategy chain could affect the entire strategy’s performance. Users should also understand that historical returns don’t guarantee future performance and that DeFi protocols generally lack the insurance protections and regulatory oversight present in traditional financial systems. Starting with small amounts and using well-established protocols with strong security track records helps manage these risks while gaining experience. - How do composable protocols minimize gas fees compared to executing strategies manually?

Composable protocols reduce gas fees through several mechanisms including transaction batching where multiple operations share fixed transaction overhead costs rather than paying them repeatedly, optimized smart contract code that minimizes computational complexity, and socialization of costs across multiple users in vault-style strategies. When protocols execute complex strategies involving many steps, they can combine these operations into single transactions that cost perhaps thirty to fifty percent more gas than simple transactions but far less than executing each step separately. For strategies requiring ten or more individual operations, the gas savings from composability can easily reach seventy to eighty percent compared to manual execution, making sophisticated approaches economically viable even for users with modest capital. - Can I lose more money than I invest when using leveraged composable strategies?

Standard composable DeFi strategies cannot result in losses exceeding your deposited capital since they only operate on assets you provide to protocols. However, leveraged strategies that borrow against collateral can theoretically result in complete loss of your collateral if positions are liquidated during adverse market movements. The structure of DeFi lending protocols prevents debt from exceeding collateral value, so you cannot incur negative balances beyond your deposits. Automated strategies often include safety mechanisms that adjust positions to prevent liquidation, but extreme market volatility can still result in substantial losses. Users should carefully review strategy documentation to understand whether leverage is involved and ensure they comprehend liquidation risks before committing capital to such strategies. - How do I evaluate which composable DeFi protocol is most trustworthy and secure?

Evaluating protocol trustworthiness requires examining multiple factors including security audit history from reputable firms like Trail of Bits, Consensys Diligence, or OpenZeppelin, with audit reports publicly available and recent relative to current code versions. Total value locked provides indication of community trust, though large TVL alone doesn’t guarantee security. Track record matters significantly, with protocols operating successfully for multiple years without security incidents demonstrating more proven reliability than newly launched alternatives. Open-source code enables community review and reduces risks of hidden vulnerabilities or malicious functionality. Active development communities, transparent governance, and responsive support channels indicate healthy project maintenance. Users should research multiple information sources including protocol documentation, community forums, security researchers’ opinions, and independent reviews before committing significant capital to any protocol. - What happens if network congestion makes gas fees too expensive to execute my strategy?

During periods of extreme network congestion when gas fees spike dramatically, users may need to wait for conditions to improve before executing strategies or be willing to pay substantially higher costs for immediate execution. Most composable protocols allow users to set maximum gas prices they’re willing to pay, with transactions remaining pending until network conditions meet those parameters or users cancel them. Some strategies may become economically unviable during severe congestion when gas fees exceed expected returns, requiring users to postpone execution. Layer-2 scaling solutions and alternative blockchain networks with lower fees are increasingly integrated into composable protocols to provide options during mainnet congestion. Users can also time their strategy execution during typically lower-congestion periods like weekends or late night hours when gas fees tend to be lower. - Do I need technical knowledge of blockchain or programming to use composable DeFi protocols?

Modern composable DeFi protocols are designed with user-friendly interfaces that don’t require technical knowledge of blockchain internals or programming skills. Users should understand basic concepts like cryptocurrency wallets, transaction confirmation, and fundamental DeFi principles like yields, liquidity pools, and collateralization, but don’t need to comprehend smart contract code or blockchain architecture details. Most protocols provide educational resources explaining their strategies in accessible terms, with interfaces designed around simple actions like depositing assets, selecting strategies, and withdrawing funds. That said, taking time to understand risks, reading protocol documentation, and starting with small amounts while learning helps ensure informed decision-making even when technical interfaces are simplified. - Can composable DeFi strategies guarantee returns or protect against losses?

No DeFi strategy can guarantee returns or protect completely against losses as these protocols face market risks, smart contract risks, and various other uncertainties inherent to cryptocurrency markets. Automated optimization aims to maximize risk-adjusted returns and minimize certain execution risks, but cannot eliminate exposure to asset price volatility, protocol failures, or adverse market conditions. Historical performance data shows that well-designed strategies often outperform manual approaches or simple passive holdings, but past results don’t guarantee future outcomes. Users should view composable DeFi as tools for improving risk-adjusted returns and execution efficiency rather than guaranteed profit mechanisms, maintaining diversification and only allocating capital they can afford to lose in accordance with their risk tolerance and financial situation. - How do I get started with composable DeFi strategies as a complete beginner?

Getting started requires first obtaining cryptocurrency, typically by purchasing stablecoins or major assets like ETH through reputable exchanges, then transferring these assets to a self-custody wallet like MetaMask that enables interaction with DeFi protocols. Begin by researching established composable protocols with strong track records, reading their documentation to understand available strategies and associated risks. Start with simple, conservative strategies like stablecoin yield vaults that offer lower returns but also lower risk compared to complex leveraged approaches. Deposit small amounts initially while learning how protocols work, monitoring performance, and understanding user interfaces. Many protocols offer testnet versions using fake money for risk-free practice. Gradually increase involvement as comfort and knowledge develop, always maintaining diversification across multiple protocols and strategies rather than concentrating all capital in single approaches.