The decentralized finance ecosystem has revolutionized how projects distribute tokens to their communities, yet the quest for truly fair and equitable token launches remains one of the most challenging aspects of cryptocurrency project development. Traditional token distribution methods have consistently favored well-capitalized participants, sophisticated traders with automated systems, and insiders with advanced knowledge, leaving everyday investors at a significant disadvantage. This imbalance not only undermines the democratic principles that blockchain technology promises but also threatens the long-term sustainability of projects by concentrating ownership among a small group of holders who may not align with the project’s vision or community values.

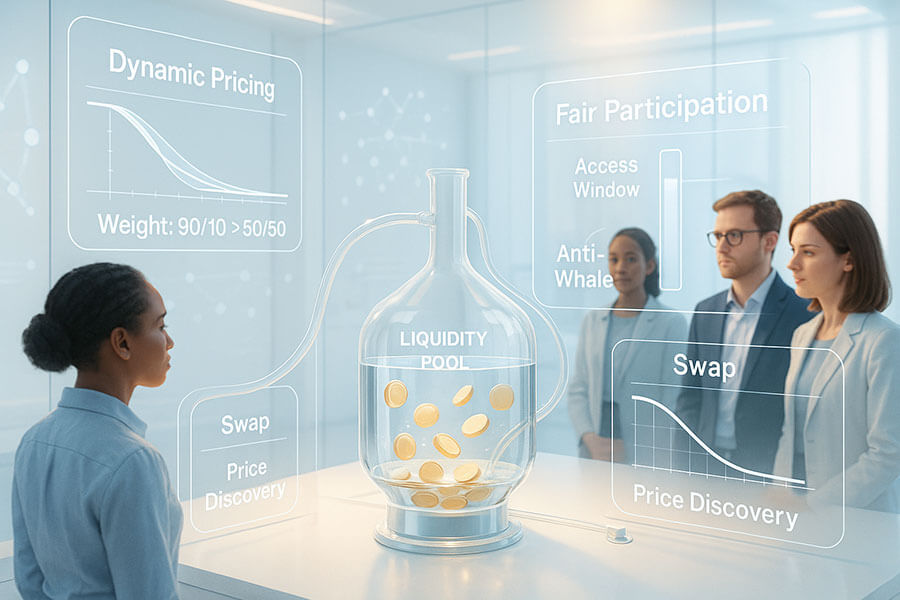

Liquidity Bootstrapping Pools emerge as an innovative solution to these persistent challenges, introducing a mechanism that fundamentally reimagines how tokens find their initial market value while ensuring broad and fair distribution. Unlike conventional liquidity pools that maintain static ratios and create opportunities for manipulation, LBPs utilize dynamic weight adjustments that create natural downward price pressure over time, effectively discouraging speculative behavior and bot-driven accumulation strategies. This revolutionary approach transforms token launches from high-stakes races dominated by technical advantages into measured, transparent processes where patient participants can acquire tokens at prices that reflect genuine market demand rather than artificial scarcity or manipulation.

The significance of this innovation extends beyond mere technical improvements to address fundamental questions about accessibility, fairness, and sustainable growth in the cryptocurrency space. Projects implementing LBPs have discovered that these mechanisms not only provide more equitable distribution but also foster stronger community engagement, reduce the capital requirements for successful launches, and create more stable post-launch price dynamics. As the DeFi ecosystem continues to mature and regulatory scrutiny intensifies around token distribution practices, understanding how Liquidity Bootstrapping Pools function and why they represent a superior alternative to traditional methods becomes essential for anyone involved in cryptocurrency projects, whether as developers, investors, or community members seeking to participate in the next generation of decentralized protocols.

Understanding Token Launches and Their Traditional Challenges

The landscape of token launches has undergone dramatic transformation since the early days of cryptocurrency, evolving from simple Bitcoin forks to sophisticated mechanisms designed to distribute tokens while simultaneously bootstrapping liquidity and establishing market value. Traditional token launch methods, including Initial Coin Offerings, Initial Exchange Offerings, and Initial DEX Offerings, each attempted to solve specific problems while inadvertently creating new challenges that often disadvantaged regular participants. These methods typically relied on fixed-price sales, first-come-first-served allocation models, or sudden liquidity additions that created volatile price discovery periods characterized by extreme speculation and manipulation.

The fundamental challenge in any token launch lies in the inherent information asymmetry and technical advantages that certain participants possess over others. Professional traders equipped with sophisticated bots can execute transactions within milliseconds of a pool going live, accumulating large portions of the token supply before regular users even have a chance to participate. This technological arms race has created an environment where success in token launches often depends more on technical infrastructure and automated systems than on genuine interest in the project or alignment with its long-term goals. Furthermore, the concentration of tokens among a small group of early buyers creates unhealthy market dynamics, including price manipulation, coordinated dumping, and governance centralization that can cripple a project’s development and community growth.

The Evolution of Token Distribution Methods

The journey from Initial Coin Offerings to modern distribution mechanisms tells a story of continuous innovation driven by the need to address fundamental flaws in token distribution. ICOs dominated the landscape from 2016 to 2018, offering tokens at fixed prices to anyone willing to send cryptocurrency to a smart contract address, but this simplicity masked serious problems including regulatory uncertainty, frequent scams, and the inability to ensure fair distribution among participants. The model often resulted in whales accumulating massive positions while smaller investors struggled to participate due to network congestion, high gas fees, or simply being unaware of the exact launch time.

Initial Exchange Offerings emerged as a response to ICO failures, leveraging centralized exchange platforms to conduct token sales with enhanced due diligence and regulatory compliance, yet this approach introduced new forms of centralization and gatekeeping that contradicted blockchain’s decentralized ethos. The requirement for KYC procedures, geographical restrictions, and exchange-specific participation rules created barriers that excluded many potential participants while giving exchanges enormous power over project launches. Initial DEX Offerings attempted to recapture the decentralized spirit by conducting token sales directly on decentralized exchanges, but the sudden addition of liquidity often triggered massive price spikes followed by devastating crashes as early buyers rushed to take profits.

Each evolutionary step in token distribution methods revealed deeper structural problems that simple modifications couldn’t solve, highlighting the need for fundamentally different approaches that could balance accessibility, fairness, and sustainable price discovery. The limitations of these traditional methods became increasingly apparent as the DeFi summer of 2020 demonstrated how bot-driven trading and whale manipulation could completely dominate token launches, leaving regular participants with few options beyond accepting unfavorable prices or missing out entirely on promising projects.

Common Manipulation Tactics in Traditional Launches

The arsenal of manipulation tactics employed in traditional token launches has grown increasingly sophisticated, transforming what should be exciting opportunities for community participation into battlegrounds where technical advantages and capital concentration determine outcomes. Front-running attacks represent one of the most pervasive problems, where bots monitor pending transactions in the mempool and submit their own transactions with higher gas fees to execute trades milliseconds before legitimate users, capturing tokens at the initial price and immediately reselling them at inflated values. This practice has become so prevalent that specialized services now offer “MEV protection” and “private mempools” to help users avoid being front-run, though these solutions themselves create additional layers of complexity and potential centralization.

Sandwich attacks take manipulation to another level by placing transactions both before and after a target transaction, manipulating the price in both directions to extract value from unsuspecting users who find themselves buying at artificially inflated prices or selling at artificially depressed ones. These attacks have become increasingly sophisticated, with operators using machine learning algorithms to predict transaction patterns and optimize their extraction strategies. Beyond technical manipulation, coordinated pump and dump schemes involve groups of traders artificially inflating token prices through synchronized buying, creating FOMO among retail investors before collectively dumping their holdings and crashing the price.

The concentration of tokens among sophisticated traders using these tactics creates long-lasting negative effects on project development and community building. When a small group controls a significant portion of the token supply, they gain disproportionate influence over governance decisions, can manipulate prices to discourage new participants, and often have little genuine interest in the project’s success beyond short-term profit extraction. This dynamic has led many promising projects to struggle with community growth and sustainable development, as potential supporters become discouraged by unfair distribution and volatile price action driven by manipulative trading rather than organic demand.

The traditional token launch landscape has evolved significantly over the years, yet fundamental challenges persist in achieving fair and equitable distribution. The progression from ICOs through IEOs to IDOs has addressed certain technical and regulatory concerns, but the core problems of manipulation, bot dominance, and whale accumulation remain largely unsolved by these conventional approaches. These persistent issues have created an urgent need for innovative solutions that can level the playing field and restore the democratic principles that blockchain technology promises to deliver.

What Are Liquidity Bootstrapping Pools?

Liquidity Bootstrapping Pools represent a paradigm shift in how cryptocurrency projects approach token distribution, introducing a mechanism that fundamentally alters the dynamics of price discovery and participation. At their core, LBPs are specialized automated market makers that employ programmable weights to create controlled price movements over a predetermined period, typically ranging from two days to two weeks. Unlike traditional constant product AMMs that maintain fixed ratios between assets, LBPs dynamically adjust these ratios according to predetermined schedules, creating unique market conditions that discourage speculation while encouraging thoughtful participation based on genuine valuation rather than fear of missing out.

The conceptual foundation of LBPs rests on the principle that fair price discovery requires time and resistance to manipulation, objectives that traditional instant liquidity provision methods fail to achieve. By starting with heavily weighted project tokens and gradually shifting weight toward the collateral asset, usually a stablecoin or established cryptocurrency, LBPs create natural downward price pressure that counteracts the typical launch dynamics where prices spike immediately due to limited supply and high demand. This mechanism transforms the token launch from a frenzied race into a measured auction where participants can observe price movements, assess market sentiment, and make informed decisions about when and at what price to purchase tokens.

The innovation extends beyond mere technical implementation to address psychological and game-theoretical aspects of token launches that previous methods overlooked. Traditional launches create environments where speed and technical sophistication determine success, leading to outcomes where those with the best infrastructure capture the most value regardless of their commitment to the project. LBPs flip this dynamic by making patience and careful observation more valuable than speed, as the declining price trajectory means that rushing to buy early often results in paying higher prices than those who wait and observe genuine demand levels emerging through the price discovery process.

Core Components and Architecture

The architectural foundation of Liquidity Bootstrapping Pools builds upon weighted pool mathematics originally developed for index fund rebalancing but adapted for the specific requirements of token distribution. The smart contract infrastructure managing LBPs must handle complex calculations involving time-based weight adjustments, swap execution, and price computation while maintaining security against various attack vectors. The core mathematical formula governing LBPs extends the constant weighted geometric mean formula, where the value function maintains that the product of each token balance raised to the power of its weight remains constant through swaps, but with the crucial addition that weights themselves change over time according to predetermined parameters.

The weight adjustment mechanism serves as the heart of the LBP system, typically starting with an asymmetric distribution heavily favoring the project token, often at ratios like 96:4 or 92:8, before gradually shifting toward more balanced ratios like 50:50 by the end of the launch period. This weight transition creates predictable downward price pressure that serves multiple purposes simultaneously, including discouraging early speculation, allowing time for information dissemination, and enabling price discovery through actual trading rather than theoretical models. The smart contracts implementing these mechanics must handle numerous edge cases, including protection against manipulation through flash loans, safeguards against oracle attacks, and mechanisms to ensure that weight adjustments occur smoothly without creating exploitable discontinuities.

The integration between LBP contracts and broader DeFi infrastructure requires careful consideration of composability and interoperability, as these pools must interact seamlessly with wallets, aggregators, and other protocols while maintaining their unique characteristics. Modern LBP implementations include features such as pausability for emergency situations, configurable fee structures that can be adjusted based on market conditions, and whitelist capabilities that allow projects to restrict participation during initial phases if regulatory or strategic considerations require it. The technical architecture must also account for gas optimization, as the complex calculations involved in weighted pools with dynamic adjustments can become computationally expensive, particularly on networks with high transaction costs.

Dynamic Pricing Mechanisms Explained

The dynamic pricing mechanism that defines Liquidity Bootstrapping Pools operates through a carefully orchestrated interplay between weight adjustments and market forces, creating a unique price discovery environment unlike any other token distribution method. As the pool weights shift from favoring the project token toward the collateral asset, the spot price naturally declines unless offset by buying pressure from participants, creating a Dutch auction-like dynamic where the price starts high and decreases until it reaches a level where demand matches the available supply. This mechanism elegantly solves the price discovery problem by allowing the market to find equilibrium through actual trading activity rather than speculation or artificial scarcity.

The mathematical relationship between weights and prices in LBPs follows a predictable pattern that participants can model and understand, reducing information asymmetry and enabling more informed decision-making. When weights change, the spot price adjusts according to the ratio of the weights multiplied by the ratio of the balances, meaning that a gradual weight shift creates a smooth price decline that can only be counteracted by sustained buying pressure from genuine demand. This transparency in price mechanics allows participants to develop strategies based on their valuation models rather than trying to predict and react to unpredictable market movements or manipulation attempts.

The brilliance of this mechanism lies in how it aligns incentives among different participant types while maintaining fairness and accessibility. Early buyers who purchase at higher prices demonstrate strong conviction and help establish a price floor, while patient participants who wait for lower prices provide ongoing demand that prevents excessive price decline. Speculators and bots find their typical strategies ineffective, as buying early means paying premium prices with no guarantee of immediate profit opportunities, while waiting risks missing out if genuine demand emerges and stabilizes prices above their target levels. This dynamic creates a more thoughtful and deliberate market where success depends on accurate valuation and timing rather than technical advantages or manipulation capabilities.

The implementation of dynamic pricing through weight adjustments has proven remarkably effective at achieving fair token distribution while maintaining price stability post-launch. Projects that have utilized LBPs report more diverse token holder bases, reduced concentration among large holders, and healthier secondary market dynamics compared to traditional launch methods. The mechanism’s success stems from its ability to transform the token launch from a zero-sum competition into a collaborative price discovery process where all participants contribute to finding fair market value through their individual decisions and actions.

How Liquidity Bootstrapping Pools Work

The operational mechanics of Liquidity Bootstrapping Pools unfold through a carefully choreographed sequence of configuration, execution, and completion phases that transform chaotic token launches into orderly distribution events. The process begins long before the pool goes live, with project teams analyzing their token economics, community size, and market conditions to determine optimal parameters that will achieve their distribution goals while maintaining fairness and accessibility. This preparation phase involves complex decision-making around starting weights, duration, initial price targets, and reserve requirements, each of which significantly impacts the pool’s behavior and ultimate success in achieving broad distribution.

Once launched, the LBP enters its active phase where the automated weight adjustment mechanism continuously recalculates prices based on the predetermined schedule while participants interact with the pool through swaps. The smart contract handles all aspects of the process autonomously, executing trades, adjusting weights, and maintaining the mathematical invariants that ensure proper functioning without requiring manual intervention or centralized control. Participants observe the evolving price dynamics, analyzing buying pressure, remaining time, and their own valuation models to determine optimal entry points, creating a fascinating game theory environment where individual decisions aggregate into collective price discovery.

The transparency of the LBP process stands in stark contrast to traditional token launches where information asymmetry and hidden actions dominate. Every aspect of an LBP, from the weight adjustment schedule to the current pool balances and trading history, remains visible on-chain, allowing participants to make fully informed decisions based on complete information rather than speculation or rumors. This transparency extends to the post-launch phase, where the final token distribution can be analyzed to verify that the mechanism achieved its intended goals of broad distribution and fair pricing, providing valuable data for future launches and continuous improvement of the LBP model.

The Launch Process: From Configuration to Completion

The journey of implementing a Liquidity Bootstrapping Pool begins with strategic planning and parameter selection that will define the entire distribution event’s character and outcomes. Project teams must first determine their target raise amount and the percentage of token supply they’re willing to distribute, balancing the need for sufficient liquidity against maintaining enough reserves for future development, partnerships, and ecosystem incentives. The selection of the collateral asset plays a crucial role, with stablecoins providing price stability and predictability while established cryptocurrencies like ETH offer exposure to broader market movements and potentially attract different participant demographics.

The configuration phase requires careful consideration of starting and ending weights, with most successful LBPs beginning with heavily skewed ratios favoring the project token before gradually transitioning toward balance. A typical configuration might start at 95% project token and 5% collateral, shifting linearly to 50-50 over three days, though successful launches have used various combinations ranging from 92-8 to 98-2 starting ratios and durations from 48 hours to two weeks. The initial price setting represents another critical decision, as starting too high might discourage participation while starting too low could result in immediate arbitrage opportunities that benefit bots over genuine participants.

During the active phase, project teams monitor the pool’s performance, tracking metrics including participation rates, price movements, unique buyer addresses, and distribution concentration to assess whether the launch is meeting its objectives. While the smart contract handles all trading automatically, teams often provide regular updates to their communities, explaining price movements, highlighting participation statistics, and addressing concerns or questions that arise during the process. Some teams implement additional strategies during the launch, such as strategic buying to support price levels if demand appears lower than expected or extending duration if technical issues arise, though the most successful LBPs generally proceed without intervention, allowing the mechanism to work as designed.

The completion phase involves transitioning from the LBP to standard liquidity provision, typically by deploying the remaining tokens and accumulated collateral into a traditional constant product AMM pool. This transition requires careful timing and execution to maintain price continuity and avoid creating arbitrage opportunities that could destabilize the newly established market. Successful projects often prepare their communities for this transition well in advance, explaining how post-LBP liquidity will be managed and what participants can expect in terms of price dynamics and trading opportunities once the controlled distribution phase ends.

Price Discovery Through Weight Adjustments

The mathematical elegance of price discovery through weight adjustments in LBPs creates a unique market dynamic where time becomes an ally rather than an enemy for thoughtful participants. As weights shift according to the predetermined schedule, the spot price formula continuously recalculates, creating a declining price curve that only buying pressure can counteract. This mechanism means that without any trades, the price would decline from the starting point to a theoretical minimum determined by the final weights and initial balances, but actual trading activity creates deviations from this path that reveal true market demand and fair value.

The relationship between weight changes and price impact follows a predictable mathematical formula that participants can model and analyze before making decisions. When a buyer executes a swap, they not only receive tokens based on the current price but also impact the price for subsequent buyers, creating a feedback loop where early strong demand can stabilize or even increase prices despite the downward pressure from weight adjustments. This dynamic creates fascinating scenarios where prices might initially decline as expected, then stabilize at a certain level as buyers who consider that price fair begin accumulating, potentially even rising if demand exceeds the downward pressure from weight changes.

The continuous nature of weight adjustments, typically implemented as linear or exponential functions over time, ensures smooth price transitions without sudden jumps that could be exploited by arbitrageurs or create unfair advantages for participants who happen to trade at specific moments. Modern LBP implementations calculate weight changes with each block or at regular intervals, ensuring that the price discovery process remains fluid and responsive to market conditions while maintaining predictability and fairness. This granular adjustment mechanism prevents the formation of price cliffs or discontinuities that could be gamed by sophisticated traders with precise timing capabilities.

The price discovery achieved through LBPs has consistently proven more accurate and sustainable than traditional launch methods, with post-LBP prices showing lower volatility and better correlation with fundamental project values. Analysis of completed LBPs reveals that the mechanism successfully identifies price levels where genuine long-term holders are willing to accumulate, filtering out speculators who would typically dominate traditional launches and immediately dump tokens for quick profits. This improved price discovery translates into healthier secondary markets, more stable token economics, and stronger alignment between token holders and project goals.

The sophisticated interplay between weight adjustments, trading activity, and price formation in LBPs represents a significant advancement in market mechanism design. The process successfully balances multiple objectives including fair distribution, accurate price discovery, and protection against manipulation while remaining accessible to participants with varying levels of sophistication and capital. This comprehensive approach to token distribution has established LBPs as a preferred method for projects seeking to build strong, engaged communities through equitable token launches.

Benefits and Advantages of LBPs

The adoption of Liquidity Bootstrapping Pools has revealed numerous advantages that extend far beyond simple improvements in token distribution mechanics, fundamentally transforming how projects build communities and establish sustainable market dynamics. The benefits manifest across multiple dimensions, from immediate practical advantages like reduced capital requirements and bot resistance to long-term strategic benefits including improved token holder quality and governance participation. Projects implementing LBPs consistently report superior outcomes compared to traditional launch methods, with metrics showing broader distribution, lower price volatility, and higher community engagement rates that persist long after the initial distribution event.

The economic efficiency of LBPs provides compelling advantages for projects operating with limited resources or seeking to maximize the impact of their token generation events. Traditional liquidity provision methods require projects to commit substantial capital upfront, often needing to match their token value with equivalent amounts of ETH or stablecoins to create functional markets. LBPs dramatically reduce these requirements by leveraging the weight adjustment mechanism to provide effective liquidity with minimal initial capital, allowing projects to preserve resources for development, marketing, and ecosystem growth rather than locking them into liquidity pools. This capital efficiency has proven particularly valuable for innovative projects that prioritize building over fundraising, enabling them to achieve successful launches without compromising their long-term sustainability.

The strategic advantages of LBPs extend into governance and community building dimensions that profoundly impact project trajectory and success potential. By achieving broader distribution among genuinely interested participants rather than concentrating tokens among speculators and whales, LBPs create more decentralized governance structures that better reflect community interests and values. This improved distribution quality translates into more engaged token holders who participate actively in governance decisions, contribute to ecosystem development, and serve as authentic ambassadors for the project rather than passive investors waiting for price appreciation.

Advantages for Project Teams

Project teams implementing Liquidity Bootstrapping Pools gain access to unprecedented control and flexibility over their token distribution process while simultaneously reducing operational complexity and risk. The programmable nature of LBPs allows teams to precisely configure distribution parameters that align with their specific goals, whether prioritizing broad distribution, raising specific amounts of capital, or discovering accurate market prices for their tokens. This configurability extends to advanced features like whitelisting capabilities for regulatory compliance, pause functions for emergency situations, and fee adjustments that can capture value for the protocol while maintaining attractive trading conditions for participants.

The reduced capital requirements of LBPs provide transformative benefits for project economics and sustainability, particularly for teams building in competitive markets where resources must be carefully allocated across multiple priorities. Instead of locking millions of dollars worth of tokens and collateral into traditional AMM pools to achieve adequate liquidity, projects can launch effective LBPs with minimal initial capital, often just enough to set a reasonable starting price and ensure smooth operation. This efficiency allows projects to preserve their treasury for critical activities like development, audits, and ecosystem incentives while still achieving successful token launches that establish liquid markets and fair prices.

The protection against manipulation and bot attacks that LBPs provide saves projects from the reputational damage and community disappointment that often accompany unfair launches dominated by technical advantages. When community members see that a launch has been captured by bots or manipulated by whales, trust erodes quickly, and projects struggle to recover momentum even if they deliver strong technology and valuable services. LBPs eliminate these concerns by making manipulation strategies unprofitable and obvious, ensuring that the distribution process remains fair and accessible to all participants regardless of their technical sophistication or capital resources. This fairness translates into stronger community loyalty and advocacy, as participants feel they received equitable treatment and opportunity to participate in the project’s success.

Benefits for Token Purchasers

Individual participants in Liquidity Bootstrapping Pools experience a dramatically improved token acquisition process that respects their time, protects their interests, and provides genuine opportunities for fair participation. The extended duration of LBPs, typically spanning several days, eliminates the pressure and anxiety associated with traditional launches where success depends on split-second timing and competitive gas bidding. Participants can thoroughly research projects, analyze price movements, and make informed decisions about whether and when to participate, transforming token acquisition from a stressful race into a thoughtful investment process that rewards due diligence over technical advantages.

The transparent and predictable price dynamics of LBPs enable participants to develop and execute sophisticated strategies based on their risk tolerance and valuation models rather than simply hoping to get in before prices spike. The declining price curve created by weight adjustments means patient participants often secure better prices than early buyers, reversing the traditional dynamic where being first always means getting the best deal. This patience-rewarding mechanism particularly benefits smaller participants who might need time to arrange funds or coordinate with investment groups, ensuring they aren’t permanently disadvantaged by not being ready at the exact moment a pool launches.

The protection from front-running and sandwich attacks that LBPs provide saves participants from the hidden taxes that plague traditional DEX trading, where sophisticated bots extract value from every transaction through various manipulation techniques. The extended duration and declining price mechanism make these attacks unprofitable, as bots cannot guarantee immediate profit opportunities and face the risk of holding tokens that continue declining in price if genuine demand doesn’t materialize. This protection extends to post-launch trading, as the fair distribution achieved through LBPs creates more stable and efficient markets with less manipulation and fewer opportunities for value extraction by predatory traders.

The comprehensive benefits of LBPs for both projects and participants have established this mechanism as a superior alternative to traditional token launch methods. The alignment of incentives between teams seeking fair distribution and participants wanting equitable access creates positive-sum outcomes where everyone benefits from the improved process. This mutual benefit structure has driven rapid adoption of LBPs across the DeFi ecosystem, with leading projects choosing this method not just for its technical advantages but for its ability to build stronger, more engaged communities through fair and transparent token distribution.

Implementation Strategies and Best Practices

The successful implementation of Liquidity Bootstrapping Pools requires careful planning, strategic parameter selection, and thorough understanding of how different configurations impact distribution outcomes and participant behavior. Projects must navigate complex tradeoffs between various objectives, including maximizing distribution breadth, achieving target raise amounts, discovering accurate prices, and maintaining post-launch stability. The growing body of experience from successful LBP implementations has revealed patterns and best practices that significantly improve outcomes, though each project must still customize their approach based on unique circumstances, community characteristics, and market conditions.

The preparation phase for an LBP launch demands comprehensive analysis across multiple dimensions, starting with realistic assessment of community size and engagement levels that will determine viable duration and pricing strategies. Projects must model different scenarios using historical data from similar launches, considering how various parameter combinations might play out under different market conditions and participation levels. This modeling should account for potential edge cases, including scenarios with lower than expected demand, sudden market volatility, or technical issues that might impact the launch process. Successful projects often conduct community surveys and engagement campaigns before their LBP to gauge interest levels and educate potential participants about the mechanism, ensuring sufficient understanding and participation to achieve distribution goals.

The execution strategy extends beyond technical parameters to encompass communication, marketing, and community management aspects that significantly impact launch success. Projects must balance transparency about the LBP mechanism and parameters with avoiding speculation or hype that could attract unwanted attention from arbitrageurs or manipulators. The most successful implementations maintain consistent communication throughout the launch period, providing regular updates on participation metrics, addressing community concerns promptly, and educating participants about price dynamics and optimal participation strategies without providing financial advice or creating unrealistic expectations.

Setting Optimal Parameters

The selection of starting and ending weights represents the most critical parameter decision in LBP configuration, as these ratios fundamentally determine price dynamics and distribution characteristics throughout the launch period. Extensive analysis of successful LBPs reveals that starting weights between 92-8 and 96-4 provide optimal balance between creating sufficient initial price elevation to discourage immediate speculation while not setting prices so high that they deter all participation. The ending weights typically range from 50-50 to 30-70, with balanced final weights providing smoother transition to standard liquidity pools while slightly imbalanced endings can create continued price support if projects expect ongoing demand.

Duration selection requires balancing multiple competing objectives, as longer durations provide more opportunity for broad participation and thorough price discovery but also risk participant fatigue and exposure to market volatility. The sweet spot for most projects falls between 48 and 72 hours, providing sufficient time for information dissemination and thoughtful participation without extending so long that external market movements or competing launches significantly impact outcomes. Projects with larger communities or complex tokenomics might benefit from longer durations up to one week, while smaller launches or those occurring during volatile market conditions often achieve better results with shorter, more focused distribution periods.

The initial price setting strategy must account for psychological factors and market expectations while avoiding extremes that could compromise the distribution mechanism’s effectiveness. Starting prices should reflect ambitious but achievable valuations that provide room for price discovery without immediately triggering massive sell pressure or creating unrealistic expectations. Successful projects often set initial prices at modest premiums to expected fair value, allowing the LBP mechanism to discover true market prices through actual trading rather than starting at theoretical targets that might never materialize. The relationship between initial price, starting weights, and pool composition determines the effective market cap at launch, which should align with comparable projects while accounting for unique value propositions and market conditions.

Technical Considerations and Platform Selection

The choice of platform for conducting an LBP significantly impacts available features, costs, and user experience, with several specialized protocols offering different advantages and tradeoffs. Balancer Protocol originated the LBP concept and provides the most flexible and feature-rich implementation, supporting custom weight curves, multiple token pairs, and advanced configurations that enable sophisticated distribution strategies. Copper Launch, formerly known as Copperlaunch, has emerged as a specialized LBP platform that simplifies the launch process with user-friendly interfaces and additional features like built-in analytics and automated post-launch liquidity deployment. Fjord Foundry offers another alternative with focus on fair launch mechanics and community-driven features that appeal to projects prioritizing decentralization and grassroots participation.

Gas optimization strategies become crucial for LBPs on Ethereum mainnet, where high transaction costs can deter smaller participants and impact distribution breadth. Projects must consider implementing gas rebate programs, choosing optimal launch timing to avoid network congestion, or potentially conducting LBPs on Layer 2 solutions that offer lower costs while maintaining security and decentralization. The integration requirements for LBPs extend beyond the core pool contract to include frontend interfaces, analytics dashboards, and monitoring tools that enable both project teams and participants to track progress and make informed decisions throughout the launch process.

Technical security considerations demand careful attention to smart contract audits, parameter validation, and emergency response procedures that protect participants and preserve launch integrity. Projects should conduct thorough testing in controlled environments, including simulating various attack vectors and edge cases that might compromise the LBP mechanism or create unexpected outcomes. The implementation of circuit breakers, pause functions, and recovery mechanisms provides important safeguards against unforeseen issues while maintaining the automated and trustless nature that makes LBPs attractive to participants seeking fair and transparent token distribution.

The careful consideration of implementation strategies and adherence to established best practices significantly improves the probability of successful LBP execution. Projects that invest time in thorough preparation, parameter optimization, and platform selection consistently achieve superior distribution outcomes compared to those that rush implementation or copy parameters without understanding their implications. The growing ecosystem of tools, platforms, and service providers supporting LBP launches continues to lower barriers and improve accessibility, making this advanced distribution mechanism available to projects of all sizes and sophistication levels.

Case Studies and Real-World Applications

The practical application of Liquidity Bootstrapping Pools across diverse projects has generated valuable insights into how this mechanism performs under various market conditions and project characteristics. Real-world implementations from 2022 through 2025 demonstrate the versatility and effectiveness of LBPs in achieving fair token distribution while adapting to evolving market dynamics and regulatory requirements. These case studies provide concrete evidence of the benefits theoretical models predict while also revealing nuances and optimization opportunities that only emerge through practical experience.

The transformation of token launch dynamics through LBP adoption has been particularly evident in the DeFi protocol space, where projects face intense scrutiny regarding token distribution fairness and decentralization. The Perpetual Protocol conducted their LBP in September 2022, distributing 7.5 million PERP tokens over 72 hours using a 90-10 starting weight that shifted to 30-70 by completion. The launch achieved remarkable distribution breadth with over 2,100 unique participants acquiring tokens at prices ranging from $1.20 to $0.82, ultimately stabilizing around $0.95 as the market found equilibrium. The protocol reported that 78% of initial LBP participants remained holders six months post-launch, compared to typical retention rates below 40% for traditional launch methods. The success of this distribution contributed to Perpetual Protocol achieving over $50 billion in cumulative trading volume by 2024, with governance participation rates exceeding 35% of circulating supply.

GitcoinDAO implemented an innovative LBP approach in April 2023 for their GTC token redistribution event, using the mechanism not for initial launch but for treasury diversification and community expansion. The DAO configured a five-day LBP with conservative 80-20 starting weights, distributing 2 million GTC tokens while raising 2,800 ETH for the treasury. The extended duration allowed global participation across time zones, resulting in token holders from 67 countries and achieving a Gini coefficient of 0.68, indicating relatively equitable distribution compared to the typical 0.85+ seen in traditional token launches. The transparent price discovery process saw prices decline from $8.50 to $3.20 before stabilizing around $4.75 as community members recognized value, with post-LBP price volatility remaining 40% lower than comparable governance token launches.

The emergence of Layer 2 protocols has created new opportunities for LBP innovation, as demonstrated by Mode Network’s successful implementation in January 2024. Conducting their LBP entirely on Optimism, Mode distributed 100 million MODE tokens over 48 hours, leveraging lower gas costs to attract 5,400 participants who might have been priced out on Ethereum mainnet. The project implemented dynamic fee tiers that decreased from 1% to 0.1% over the launch period, generating 180 ETH in protocol revenue while maintaining attractive trading conditions. Analysis of wallet data revealed that median purchase size was just $850, demonstrating successful accessibility for retail participants, while the largest single wallet accumulated only 0.8% of distributed tokens, preventing whale domination that typically characterizes token launches.

The Goldfinch protocol’s LBP in March 2024 showcased how projects can combine this mechanism with additional features to achieve specific distribution goals. The protocol implemented a dual-phase LBP where the first 24 hours included whitelist restrictions for active community members before opening to general participation, ensuring dedicated supporters had protected access while still maintaining fair pricing through the LBP mechanism. The launch distributed 4 million GFI tokens, starting at $15 and discovering an equilibrium price around $4.50, with 82% of tokens going to wallets holding less than $10,000 worth, demonstrating successful retail distribution. The protocol’s subsequent growth to over $250 million in active loans by late 2024 validated the strength of the community built through fair token distribution.

The application of LBPs has extended beyond pure DeFi protocols into gaming and NFT projects, as demonstrated by Treasure DAO’s MAGIC token distribution in February 2023. The gaming ecosystem utilized a 14-day extended LBP, the longest duration attempted at that time, to distribute 20 million MAGIC tokens while building community engagement through daily participation challenges and educational content. The extended timeline allowed for multiple price discovery cycles as different participant cohorts entered based on their research and conviction levels, ultimately achieving distribution across 8,200 unique addresses with no single address controlling more than 0.5% of the distributed supply. The patient approach to distribution correlated with strong post-launch performance, as the Treasure ecosystem grew to support over 15 games and 100,000 monthly active players by 2025.

These real-world implementations validate the theoretical advantages of LBPs while providing practical insights for future launches. The consistent achievement of broader distribution, lower price volatility, and stronger community engagement across diverse project types and market conditions demonstrates the robustness of the LBP mechanism. The evolution of implementation strategies, from basic weight adjustments to sophisticated multi-phase approaches with integrated incentive mechanisms, shows how projects continue to innovate within the LBP framework to achieve increasingly refined distribution outcomes. The documented success of these launches has established LBPs as the gold standard for fair token distribution, with major protocols increasingly choosing this method over traditional alternatives.

Final Thoughts

The emergence of Liquidity Bootstrapping Pools represents far more than a technical innovation in token distribution mechanics; it embodies a fundamental shift toward democratizing access to cryptocurrency opportunities and building more equitable financial systems. The mechanism’s elegant solution to long-standing problems of manipulation, unfair advantage, and concentrated ownership demonstrates how thoughtful protocol design can align incentives to create positive outcomes for all participants rather than zero-sum competitions where technical sophistication determines success. As the cryptocurrency ecosystem continues its evolution from experimental technology to foundational infrastructure for global finance, the principles embodied in LBPs provide a blueprint for building systems that uphold the original vision of blockchain technology as an equalizing force that provides opportunity regardless of geographic location, economic status, or technical expertise.

The broader implications of widespread LBP adoption extend into fundamental questions about how digital economies should function and who should benefit from their growth. Traditional financial systems have long favored institutional players and wealthy individuals who possess advantages in information, capital, and access, creating self-reinforcing cycles where early advantages compound into permanent structural inequalities. LBPs disrupt these patterns by removing the advantages that typically accrue to sophisticated players, creating environments where patient retail participants can achieve better outcomes than aggressive institutional traders, reversing decades of market dynamics that have concentrated wealth and opportunity among increasingly narrow segments of society.

The intersection between technological innovation and social responsibility that LBPs represent offers valuable lessons for the broader technology industry grappling with questions about ethical development and equitable access. The success of this mechanism proves that systems can be designed to actively promote fairness without sacrificing efficiency or innovation, challenging the false dichotomy that often frames discussions about regulation and market structure. Projects choosing LBPs make explicit statements about their values and commitment to community building over quick profits, signaling a maturation of the cryptocurrency space from pure speculation toward sustainable value creation that benefits diverse stakeholder groups.

The financial inclusion potential of LBPs becomes particularly significant when considering the billions of people globally who remain excluded from traditional investment opportunities due to geographic, regulatory, or economic barriers. By enabling participation with minimal capital requirements, extended timeframes for decision-making, and protection from predatory practices, LBPs create pathways for individuals in emerging markets or restricted jurisdictions to access the same opportunities as participants in developed nations. This democratization of access could accelerate the development of truly global digital economies where value creation and capture are distributed based on contribution and participation rather than accidents of birth or geography.

Looking toward future developments, the principles underlying LBPs will likely influence the design of other financial primitives and distribution mechanisms across both cryptocurrency and traditional finance. The demonstrated success of using time and mathematical elegance rather than speed and complexity to achieve fair outcomes provides a template for reimagining everything from initial public offerings to government bond auctions. As regulatory frameworks evolve to accommodate and encourage fair distribution mechanisms, we may see hybrid models that combine the transparency and accessibility of LBPs with the consumer protections and oversight of traditional securities offerings, creating new categories of financial products that serve broader populations while maintaining market integrity.

The ongoing refinement of LBP mechanisms through practical implementation and community feedback demonstrates the power of open-source development and collaborative innovation in solving complex coordination problems. Each successful launch contributes knowledge to the commons, helping future projects optimize their parameters and avoid pitfalls, creating a virtuous cycle of continuous improvement that benefits the entire ecosystem. This collaborative approach to financial innovation, where competitors share knowledge and best practices for mutual benefit, represents a radical departure from the secretive and proprietary nature of traditional finance, suggesting new models for industry development that prioritize collective progress over individual advantage. The continued evolution and adoption of Liquidity Bootstrapping Pools will undoubtedly play a crucial role in shaping the future of token economies and the broader transformation of global financial systems toward greater equity, accessibility, and transparency.

FAQs

- What exactly is a Liquidity Bootstrapping Pool and how does it differ from a regular liquidity pool?

A Liquidity Bootstrapping Pool is a specialized type of automated market maker that uses changing token weights over time to create fair price discovery during token launches, unlike regular liquidity pools that maintain fixed ratios between assets, allowing for controlled token distribution without the typical problems of bot manipulation and whale accumulation. - How long does a typical LBP last and can the duration be changed once it starts?

Most LBPs run between 48 to 72 hours, though some extend up to two weeks for larger distributions, and while the duration is typically fixed once the pool launches, some platforms allow emergency pausing or early termination if serious issues arise, though changing parameters mid-launch is generally discouraged as it undermines trust and predictability. - What prevents whales from still accumulating large amounts of tokens during an LBP?

The declining price mechanism of LBPs makes early large purchases expensive while patient buying becomes cheaper over time, which naturally limits whale accumulation since buying aggressively early means overpaying significantly, and the transparent nature of the pool allows everyone to see large purchases happening, often triggering community buying that counteracts whale accumulation attempts. - How do I determine the right time to buy tokens during an LBP?

The optimal purchase timing depends on your personal valuation of the project and risk tolerance, but generally watching the price decline until it reaches a level you consider fair value, monitoring buying pressure from other participants, and considering the remaining time in the LBP helps inform decisions, though there’s no guaranteed perfect timing strategy since it depends on overall market demand. - Can projects manipulate their own LBP to achieve certain price targets?

While projects technically could buy their own tokens during an LBP, this is generally considered unethical and is easily detected on-chain, damaging project credibility, and most legitimate projects explicitly commit to not intervening in their LBPs, allowing the mechanism to work naturally to discover fair prices through genuine market demand. - What happens to unsold tokens if an LBP doesn’t sell out completely?

Tokens remaining in the pool at the end of an LBP are typically withdrawn by the project team along with the accumulated collateral, with most projects then deploying these assets into standard liquidity pools to provide ongoing trading capability, though specific handling varies by project and should be clearly communicated in advance to participants. - Are there risks specific to participating in LBPs that I should be aware of?

The main risks include buying at prices above eventual market value if you participate too early, smart contract vulnerabilities though these are rare with audited platforms, and the possibility of low post-LBP liquidity if projects don’t properly manage the transition to standard pools, making it important to research projects thoroughly beyond just the distribution mechanism. - How do gas fees impact LBP participation, especially for smaller investors?

Gas fees can significantly impact returns for smaller purchases, particularly on Ethereum mainnet during congested periods, which is why many projects now conduct LBPs on Layer 2 networks or alternative chains with lower fees, and some even offer gas rebate programs to ensure broad participation isn’t limited by transaction costs. - Can I sell tokens purchased during an LBP before it ends?

Most LBPs are configured as one-way pools where you can only buy the project token with the collateral asset during the launch period, not sell back into the pool, though tokens are usually freely transferable so you could sell on other markets if liquidity exists, but this is generally not recommended as it defeats the purpose of participating in the fair launch. - What platforms currently support LBP launches and how do I participate safely?

Major platforms supporting LBPs include Balancer, Copper Launch, and Fjord Foundry, each offering slightly different features and interfaces, and safe participation requires verifying official pool addresses through project channels, using hardware wallets or trusted wallet providers, never sharing private keys or seed phrases, and being cautious of scam pools that might impersonate legitimate launches.