The financial services industry stands at the precipice of a fundamental transformation in how creditworthiness is evaluated and lending decisions are made. For generations, traditional credit scoring models have served as the primary gatekeepers to financial opportunity, determining who receives loans, at what interest rates, and under what conditions. Yet these conventional systems, while familiar and seemingly objective, harbor a critical flaw that affects millions of potential borrowers worldwide. They rely almost exclusively on formal credit histories that many responsible individuals simply do not possess, creating an invisible barrier that locks vast segments of the population out of the financial mainstream.

More than forty-five million American consumers lack sufficient credit history to generate either a credit report or an accurate credit score, effectively rendering them invisible to traditional lenders despite potentially strong financial responsibility. This credit invisibility affects young adults beginning their financial journeys, immigrants establishing themselves in new countries, individuals who prefer cash transactions, and even financially responsible people who simply have not utilized traditional credit products. The consequences extend far beyond inconvenience, fundamentally limiting access to affordable housing, reliable transportation, educational opportunities, and the capital needed to start businesses or weather emergencies.

The limitations become even more pronounced when examined through the lens of equity and financial inclusion. Low-income and moderate-income individuals, along with historically underrepresented communities, find themselves disproportionately affected by credit invisibility. Approximately forty percent of low-income individuals and thirty percent of moderate-income individuals possess insufficient credit history to generate accurate credit scores, while more than half of Black Americans and over forty percent of Hispanic Americans report having no credit or poor to fair credit scores.

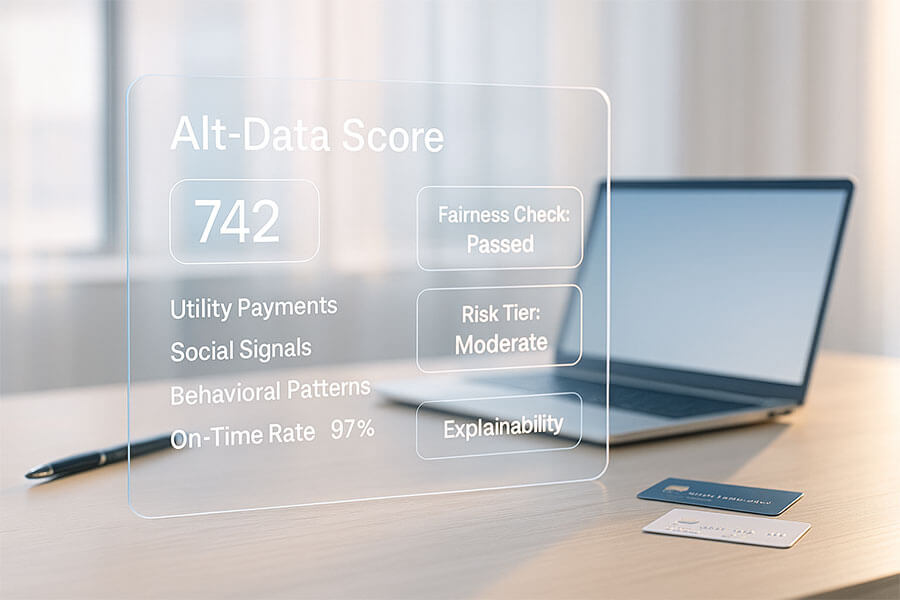

Enter alternative data in credit risk assessment, a revolutionary approach that leverages non-traditional information sources to paint more comprehensive and accurate pictures of borrower creditworthiness. Rather than relying solely on formal credit bureau data, alternative credit scoring methodologies incorporate diverse information streams including utility payment histories, rent payment records, mobile phone billing patterns, bank account transactions, educational backgrounds, employment stability, and behavioral indicators observable through digital interactions. These expanded data sources enable lenders to evaluate the financial responsibility of individuals who lack conventional credit histories while potentially improving risk assessment accuracy for all borrowers.

Advances in artificial intelligence and machine learning now allow lenders to process and analyze vast quantities of diverse data types with unprecedented speed and accuracy. Sophisticated algorithms can identify subtle patterns and relationships within alternative data that human underwriters might miss, while automated decision-making systems can evaluate loan applications in real time rather than through lengthy manual review processes.

The implications for financial inclusion are profound. Alternative data methodologies offer pathways for millions of credit-invisible consumers to access affordable financial services while maintaining or even improving lender profitability through more accurate risk assessment. Yet this transformation also raises important questions about privacy, algorithmic bias, and regulatory frameworks that must be thoughtfully addressed as these approaches gain mainstream adoption.

Understanding Traditional Credit Risk Assessment

Traditional credit risk assessment has evolved over more than a century into a sophisticated yet fundamentally constrained system for evaluating borrower creditworthiness. At its core, this conventional approach relies on standardized credit scores calculated by specialized algorithms that analyze information collected and maintained by credit bureaus. The most widely recognized credit scoring model, FICO, was introduced in 1989 and has since become synonymous with creditworthiness evaluation. FICO scores range from 300 to 850, with higher scores indicating lower perceived risk.

These scores are calculated using five primary factors, each weighted differently. Payment history constitutes the most significant factor at approximately thirty-five percent, tracking whether borrowers have made payments on time for credit cards, installment loans, and mortgages. Credit utilization represents about thirty percent, measuring how much of available credit a borrower is currently using. Length of credit history contributes roughly fifteen percent, rewarding consumers who have successfully managed credit relationships over extended periods. Credit mix comprises about ten percent, considering the variety of credit types in a consumer’s portfolio. Finally, new credit inquiries account for approximately ten percent, with multiple recent applications potentially signaling financial stress.

Credit bureaus serve as the infrastructure backbone for traditional systems. The three major bureaus in the United States—Equifax, Experian, and TransUnion—each maintain extensive databases of consumer credit information reported by lenders, creditors, and collection agencies. When consumers apply for credit, lenders request credit reports from one or more bureaus and use the information contained therein along with proprietary scoring models to make lending decisions.

The standardization of traditional credit scoring provides certain advantages that have contributed to its widespread adoption. Lenders can quickly evaluate large volumes of loan applications with consistent methodologies that enable efficient risk stratification. Consumers who maintain positive credit histories benefit from automated approvals and favorable interest rates. The objective nature of credit scores, at least theoretically, reduces the influence of subjective factors that might introduce discrimination.

Limitations of Traditional Models

Despite their widespread use, traditional credit scoring models harbor significant limitations that restrict their effectiveness and fairness across diverse borrower populations. The most fundamental constraint stems from reliance on formal credit histories that many financially responsible individuals simply do not possess. Credit invisibility affects individuals who have never utilized traditional credit products, those who have used credit infrequently, and people whose credit histories have become stale due to extended periods without active credit use.

The financial exclusion resulting from credit invisibility extends disproportionately across demographic lines, creating and perpetuating systemic inequities. Communities of color experience higher rates of credit invisibility and lower average credit scores even when controlling for income. Geographic disparities compound these challenges, with rural areas and economically disadvantaged urban neighborhoods exhibiting higher concentrations of credit-invisible populations. The consequences ripple through multiple dimensions of economic life, affecting housing opportunities, employment prospects, insurance premiums, and even mobile phone contracts.

Traditional credit models also suffer from temporal limitations that reduce their effectiveness in capturing current financial circumstances. Credit scores typically reflect historical behavior over extended periods, meaning consumers who have recently improved their financial situations may continue to face consequences from past difficulties long after their circumstances have changed. This lag between actual financial condition and credit score representation can lead to both false positives and false negatives in risk assessment.

The traditional system’s narrow focus on credit-related behavior overlooks many other indicators of financial responsibility that could inform lending decisions. Individuals who consistently pay rent on time, maintain stable employment, manage utility bills responsibly, and accumulate savings demonstrate financial discipline that traditional credit scores fail to capture. Self-employed individuals and gig economy workers whose income streams do not conform to traditional employment patterns may appear riskier in conventional models despite strong and stable earnings.

What is Alternative Data?

Alternative data in the context of credit risk assessment encompasses any information sources beyond traditional credit bureau reports that can inform evaluations of borrower creditworthiness and repayment likelihood. This broad category includes diverse data types ranging from structured financial information not typically reported to credit bureaus to behavioral indicators observable through digital interactions. The defining characteristic is its exclusion from conventional credit reporting infrastructure, representing untapped information resources that technological advances have now made accessible and analyzable at scale.

The conceptual foundation rests on a straightforward observation about traditional credit assessment limitations. Absence of credit history does not equate to absence of financial responsibility or capacity. Millions of individuals demonstrate consistent payment discipline, stable income management, and sound financial decision-making through channels that traditional credit bureaus do not monitor. By expanding the information base to include these additional indicators, lenders can develop more complete pictures of borrower financial behavior while potentially improving risk assessment accuracy even for individuals with existing credit histories.

Regulatory perspectives on alternative data have evolved considerably as these practices have gained prominence. The Fair Credit Reporting Act governs the collection, use, and protection of consumer credit information in the United States, establishing requirements for accuracy, privacy, consumer rights, and permissible purposes. When alternative data sources are used for credit decisions, they may fall under FCRA regulations depending on how the data is collected, processed, and applied. Financial institutions must navigate complex compliance considerations including ensuring that alternative data usage does not result in unlawful discrimination and maintaining data security and privacy protections.

Machine learning technologies serve as essential enablers of alternative data approaches by providing the computational capabilities needed to process, analyze, and extract meaningful patterns from diverse and often unstructured information sources. Traditional statistical models used in conventional credit scoring typically operate on relatively limited numbers of well-defined variables with clear relationships to default risk. Alternative data approaches may incorporate hundreds or thousands of variables spanning multiple data types and requiring sophisticated algorithms to identify relevant signals amid noise.

Types of Alternative Data in Credit Assessment

The landscape of alternative data encompasses diverse information categories, each offering unique insights into borrower financial behavior and creditworthiness. Financial alternative data includes information about monetary transactions and relationships that do not typically appear in traditional credit bureau reports. Bank account transaction histories reveal detailed patterns of income, expenditure, savings, and cash flow management that can illuminate financial stability beyond what credit account data alone captures. Analysis of checking and savings account activity can identify consistent income deposits suggesting employment stability, recurring bill payments demonstrating financial discipline, and savings accumulation indicating financial planning capacity.

Digital Footprint Data

Digital footprint data encompasses the traces that individuals leave through their online activities, device usage, and digital service interactions. While social media activity has been discussed as potential credit data, significant ethical and practical concerns have limited mainstream adoption. The correlation between social media behavior and loan repayment proves less robust than initially hypothesized, while privacy invasiveness and potential for discrimination have raised regulatory red flags.

Online shopping behavior provides less controversial digital footprint indicators. E-commerce transaction histories reveal spending patterns, merchant selection, and purchase timing that correlate with financial circumstances. Consumers who regularly compare prices and utilize discount codes may exhibit different risk profiles than those who make impulsive buying decisions. The frequency of returns, choice between expedited and standard shipping, and tendency to purchase during sales events can all provide insights into financial planning and decision-making styles. Lenders analyze whether consumers shop at premium retailers versus discount outlets, though such patterns must be evaluated carefully to avoid socioeconomic bias. The timing of purchases relative to payday cycles can indicate cash flow management effectiveness, while abandoned shopping carts might suggest price sensitivity and careful financial consideration before committing to purchases. However, reliance on shopping data introduces potential biases related to internet access and digital literacy.

Mobile device usage patterns offer another dimension of digital footprint analysis. The type of device owned and application installations reveal lifestyle characteristics and financial priorities. Location data from mobile devices can confirm stated addresses and reveal employment locations. Communication patterns including call frequency and contact diversity have been explored as potential indicators of social capital and stability, though ethical considerations surrounding mobile data usage are substantial.

Digital service subscriptions constitute increasingly relevant digital footprint indicators. Consistent subscription payments to streaming platforms or software applications demonstrate regular payment discipline similar to utility payments. The types of subscriptions maintained may correlate with income levels, though these signals must be interpreted cautiously.

Utility and Payment History

Utility and recurring payment histories represent some of the most valuable and widely accepted forms of alternative data. Electricity, gas, water, and internet service payments occur regularly and provide direct evidence of payment discipline over extended periods. Unlike discretionary credit usage, utility payments typically represent essential expenses that most consumers prioritize, potentially offering strong signals about financial responsibility. The predictive value of utility payment history has been demonstrated across multiple studies, with on-time utility payments correlating with lower default rates.

Rent payment histories have gained particular attention given that housing costs typically represent the largest regular expense for many households, yet rental payments have historically not been reported to credit bureaus unless accounts become delinquent. Several initiatives and services now enable reporting of positive rent payment histories. The challenge lies in data collection and verification, as rental markets include diverse arrangements from formal leases with property management companies to informal agreements with individual landlords. Rent reporting services have emerged using various models, some partnering directly with property management companies to access verified payment records, while others allow tenants to self-report by connecting bank accounts or uploading documentation. The National Multifamily Housing Council estimates that approximately forty-four million households rent their homes in the United States, representing a massive pool of payment data that could significantly expand credit files if systematically captured and reported.

Telecommunications and mobile phone bill payments provide another well-established category. Phone service represents an essential utility for most modern consumers, with payment patterns potentially reflecting financial priorities. Some telecommunications providers furnish payment data to specialized alternative data credit bureaus, though comprehensive reporting across all carriers remains incomplete.

Insurance premium payment histories and subscription service payments for products ranging from gym memberships to streaming platforms offer additional payment pattern data points. While individually these may represent small obligations, collectively they can demonstrate consistent payment behavior across multiple vendors over time.

Behavioral and Psychometric Data

Behavioral and psychometric data represent perhaps the most innovative yet controversial categories of alternative information. Application completion behaviors offer subtle signals that some lenders analyze during the credit application process itself. The time taken to complete forms, patterns of field navigation, and the completeness of provided details may correlate with conscientiousness. However, these signals must be interpreted cautiously as they may also correlate with digital literacy or language proficiency.

Response consistency analysis evaluates whether information provided across multiple fields aligns logically. Significant inconsistencies might indicate dishonesty, carelessness, or potentially fraudulent applications. However, legitimate variations in how individuals describe information must be distinguished from concerning inconsistencies.

Psychometric questionnaires have been employed in some markets, particularly in developing countries where traditional credit data is scarce, to assess personality traits and attitudes that correlate with loan repayment. These assessments may ask questions about financial attitudes, risk preferences, and planning horizons. Critics raise concerns about cultural bias, the potential for applicants to game responses, and ethical implications of evaluating character traits rather than financial capacity.

The integration of behavioral and psychometric data into credit assessment requires extraordinary care to avoid introducing discriminatory practices while respecting privacy boundaries. Transparency about what behaviors are being analyzed and how they influence decisions becomes crucial for maintaining trust and enabling appropriate oversight.

Benefits and Opportunities

The adoption of alternative data in credit risk assessment creates substantial benefits and opportunities extending across multiple dimensions. Financial inclusion represents the most frequently cited and perhaps most significant benefit. By enabling creditworthiness evaluation for individuals who lack traditional credit histories, alternative data methodologies open doors to affordable financial services for millions of previously excluded consumers. Young adults can demonstrate responsibility through utility payments and rent histories rather than waiting years to accumulate sufficient traditional credit history. Recent immigrants can leverage payment records or demonstrate financial discipline through U.S.-based payment patterns.

The gig economy and alternative employment arrangements have created entire categories of workers whose income patterns do not conform to traditional credit scoring expectations. Freelancers, independent contractors, and platform-based workers may have substantial and stable incomes that appear irregular to conventional underwriting models. Alternative data including bank account deposit patterns and payment platform transaction histories can better capture the financial reality of these modern work arrangements.

Underserved and marginalized communities stand to gain substantially from alternative data adoption when implemented thoughtfully and equitably. Research by companies implementing alternative data approaches has documented significant increases in approval rates and reductions in interest rates for minority applicants when compared to traditional credit models, though these improvements require careful validation and monitoring.

Lenders benefit substantially from the enhanced risk assessment accuracy that comprehensive alternative data analysis enables. By incorporating additional information streams, machine learning algorithms can identify subtle patterns and relationships that improve default prediction. This enhanced accuracy allows lenders to simultaneously expand approval rates and reduce loss rates. Lenders implementing sophisticated alternative data models have reported significant improvements in portfolio performance while serving broader customer bases.

Operational efficiency gains emerge from the automation enabled by alternative data platforms and machine learning systems. Alternative data systems can automatically retrieve, verify, and analyze information from multiple sources, providing instant or near-instant lending decisions without human intervention. This automation reduces per-loan processing costs while accelerating approval timelines, improving customer experience through faster access to funds. Traditional manual underwriting processes that might take days or weeks can be compressed to minutes or even seconds when alternative data feeds directly into automated decision engines. The cost savings prove substantial, with some lenders reporting reductions of fifty to seventy percent in per-application processing expenses. These efficiency gains allow lenders to profitably serve smaller loan amounts and broader customer segments that would be uneconomical under traditional high-touch underwriting models. The speed advantage also reduces customer abandonment rates, as borrowers increasingly expect instant decisions and same-day funding in the digital age. Lenders implementing real-time alternative data decisioning report significantly higher application completion rates compared to processes requiring extensive documentation submission and manual review delays.

Innovation in financial product design becomes possible when lenders possess richer information about borrower circumstances. Rather than offering standardized products, lenders using alternative data can create more tailored offerings matching loan amounts, repayment schedules, and pricing to individual circumstances. This product innovation can improve matches between financial services and consumer needs while enabling more precise risk management.

Consumer empowerment emerges as an often-overlooked benefit. When positive financial behaviors beyond traditional credit usage contribute to creditworthiness evaluation, consumers gain more pathways to demonstrate responsibility. Individuals can take concrete actions knowing these efforts will be recognized by lenders, providing more inclusive pathways to financial success.

Challenges and Limitations

Despite substantial benefits, alternative data approaches face significant challenges that must be carefully addressed. Privacy concerns represent perhaps the most fundamental challenge, as alternative data involves collecting and analyzing information about consumer behavior and characteristics beyond the traditional financial realm. Consumers may not realize their utility payment histories, mobile device usage patterns, or online shopping behaviors are being used for credit decisions. The aggregation of diverse data sources into comprehensive consumer profiles creates additional privacy risks beyond those associated with any single data type.

Privacy and Ethical Concerns

Data consent practices present ongoing tensions between practical implementation requirements and meaningful consumer choice. Obtaining truly informed consent for alternative data usage requires explaining what specific information will be collected, how it will be analyzed, and what decisions it will influence. The complexity of modern machine learning systems makes comprehensive explanation challenging. Lengthy consent disclosures risk becoming meaningless boilerplate, while simplified explanations may omit important details.

The potential for discrimination represents a critical ethical concern requiring vigilant attention. Machine learning algorithms learn patterns from historical data, meaning they can perpetuate and even amplify existing biases if those biases are reflected in training data. Alternative data sources that correlate with race, ethnicity, gender, or other protected attributes risk creating disparate impacts even without explicit consideration of prohibited factors. Location-based data might reflect residential segregation patterns, while educational background could serve as a proxy for socioeconomic status correlated with race.

Algorithmic bias can manifest in subtle ways that are difficult to detect without comprehensive fairness testing. Traditional methods for identifying discrimination focus on comparing outcomes across demographic groups, but this requires collecting demographic data that lenders may not have. The complexity of machine learning models makes it challenging to understand exactly why particular applicants receive specific decisions. Responsible alternative data usage requires proactive fairness testing, ongoing monitoring for disparate impacts, and willingness to adjust models even when doing so reduces predictive accuracy.

Transparency and explainability present significant challenges for alternative data credit scoring systems, particularly those employing sophisticated machine learning algorithms. Traditional credit scoring provides clear explanations of factors affecting scores. Alternative data models using hundreds or thousands of variables processed through complex neural networks may produce accurate predictions without offering simple explanations. This “black box” problem creates difficulties for adverse action notices, undermines consumer ability to understand and improve creditworthiness, and complicates regulatory oversight.

Technical and Regulatory Challenges

Data quality and standardization present substantial technical obstacles. Unlike traditional credit bureau data collected through standardized formats, alternative data comes from diverse sources with varying quality controls, formats, and meanings. Utility payment data from different providers may be reported inconsistently. Rent payment verification may depend on tenant-provided documentation subject to manipulation. These data quality issues can introduce noise into credit models, reducing accuracy and potentially creating unfair outcomes.

Model validation presents unique challenges for alternative data scoring systems. The novelty of many alternative data types means limited historical data exists to assess long-term predictive performance across full economic cycles. Traditional credit scoring has been refined over decades with extensive validation. Alternative data models may show strong performance on recent data but lack the track record to assess robustness during economic downturns. The rapid evolution of alternative data sources means models may require frequent updating, complicating validation processes. Financial institutions face particular challenges validating models when alternative data relationships may change as consumer behavior evolves. For example, streaming service subscription patterns that predicted creditworthiness in 2020 might hold different meanings in 2025 as these services have become ubiquitous across income levels. The seasonality and cyclicality of certain alternative data signals require multi-year observation periods to validate properly. Banks subject to regulatory model risk management requirements must document extensive testing and ongoing monitoring, but guidance developed for traditional credit models may not adequately address the unique characteristics of machine learning systems processing diverse alternative data. The lack of industry benchmarks and standardized performance metrics for alternative data models makes it difficult for institutions to assess whether their implementations achieve competitive or adequate performance levels.

Regulatory compliance creates significant challenges as existing frameworks were designed for traditional credit reporting rather than alternative data approaches. The Fair Credit Reporting Act and Equal Credit Opportunity Act impose requirements that must be interpreted and applied to new contexts where precedent may be limited. Determinations about whether specific alternative data usages fall under FCRA regulation and how adverse action requirements apply to complex machine learning models involve substantial uncertainty.

Integration with existing systems presents practical implementation challenges. Legacy core banking systems and loan origination platforms were designed around traditional credit bureau integrations and may require substantial modification to accommodate alternative data sources. The technical expertise needed to implement and maintain sophisticated machine learning systems may exceed in-house capabilities at smaller lenders.

Case Studies and Real-World Applications

Examining real-world implementations provides valuable insights into both the practical potential and ongoing challenges facing alternative data approaches. Three notable examples from recent years demonstrate different aspects of alternative data deployment across various contexts and lending scenarios.

Experian Boost represents one of the most widely adopted alternative data initiatives, launching in the United States in 2019 and expanding internationally in subsequent years. The service allows consumers to voluntarily connect their bank accounts through open banking technology, granting Experian permission to analyze utility payment histories, telecommunications bills, and streaming service subscriptions to identify positive payment patterns. By September 2024, Experian reported that users in the United Kingdom could potentially increase their Experian credit scores by up to 101 points, a significant enhancement from the previous maximum increase of 66 points. The company announced a partnership with Oakbrook, a non-bank consumer lender in the UK, to integrate Boost data into credit decisioning for personal loan applications.

Experian reported that Boost had helped UK customers save an estimated 1.3 million pounds through improved credit card and loan offers available on the Experian Marketplace in 2024. These savings resulted from lower interest rates and better terms that consumers qualified for with enhanced credit profiles. The breakdown showed approximately 853,000 pounds in credit card savings and 500,000 pounds in loan savings, demonstrating tangible financial benefits across multiple product categories. In Florida, Boost users saw an average credit score increase of 13 points, while nationally approximately 60 percent of users who connected accounts saw improvements. The voluntary nature addresses privacy concerns by giving consumers control over what payment histories are shared. The program’s success demonstrates that utility and telecommunications payment data holds genuine predictive value while providing a consumer-friendly approach to credit building. Experian has continued refining the algorithm that determines score boost magnitude, with the increase from a previous 66-point maximum to 101 points in 2024 representing improved modeling that better captures the creditworthiness signal contained in alternative payment histories.

The Affirm and FICO partnership represents a significant development in incorporating buy-now-pay-later loans into traditional credit scoring frameworks. In May 2023, Affirm announced collaboration with FICO to develop a credit scoring model that would enable BNPL loans to be factored into lending decisions and reported to credit agencies. This partnership addressed growing concerns from the Consumer Financial Protection Bureau about lack of information furnished to credit bureaus regarding BNPL usage.

In a study examining over 500,000 Affirm customers, FICO found that new BNPL loans affected credit scores by approximately 10 points for more than 85 percent of borrowers, with movement more likely to be positive than negative. Consumers who had taken out five or more Affirm BNPL loans predominantly either saw scores increase or experienced no change. By early 2025, Affirm had begun reporting all pay-over-time loans including short-term interest-free plans to Experian and TransUnion. The incorporation of BNPL data represents alternative credit information capturing consumer payment behavior on small installment purchases that previously occurred outside credit bureau visibility.

Upstart Holdings represents another important case study, having pioneered artificial intelligence-powered credit assessment. The company’s platform uses machine learning algorithms to analyze over 1,600 data points beyond traditional credit scores, including education history, employment background, and various non-traditional indicators. According to data published through 2024, their AI-powered model approved 44 percent more borrowers than traditional models at 36 percent lower interest rates on average.

Analysis conducted in 2023 showed the Upstart model approved 116 percent more Black applicants at 36 percent lower average interest rates compared to traditional models, while Hispanic applicants saw approval rates 123 percent higher with 37 percent lower rates. Vantage West Credit Union’s partnership with Upstart illustrates practical benefits. The Tucson-based credit union used the platform to serve near-prime borrowers more effectively. After six months, they reported loss performance better than their target of 5 percent while growing membership by over 17,000 members. The credit union particularly valued the ability to lend to borrowers in the 620-680 credit score range who previously would have been declined or offered unfavorable terms. The partnership enabled geographic expansion beyond Arizona’s physical branch network, with the Upstart Referral Network providing access to qualified borrowers nationwide. The automation of loan decisioning also freed up staff to focus on more complex lending scenarios and member relationship building rather than routine application processing. The credit union’s chief lending officer emphasized that understanding risk appetite and working collaboratively with Upstart’s portfolio advisors proved essential to successful implementation, highlighting that technology adoption requires not just technical integration but also strategic alignment and ongoing partnership.

These real-world implementations reveal both substantial promise and practical challenges. Successful deployments require careful attention to consumer privacy protections, robust validation of model performance across diverse populations, transparent communication about data usage, and ongoing monitoring for unintended consequences.

Future Outlook and Recommendations

The trajectory of alternative data in credit risk assessment points toward continued growth, sophistication, and mainstream adoption, driven by technological advances, regulatory evolution, and growing recognition of traditional credit-only limitations. Open banking initiatives gaining traction globally will dramatically expand the availability and standardization of financial alternative data. The Consumer Financial Protection Bureau’s proposed Personal Financial Data Rights rule will establish comprehensive open banking requirements in the United States similar to frameworks already implemented in the United Kingdom, European Union, and Australia. Approximately 75 percent of surveyed lenders expect that open banking rules will eliminate data sharing obstacles.

Artificial intelligence capabilities will continue advancing rapidly, enabling analysis of increasingly complex alternative data sets with greater accuracy, explainability, and fairness. Explainable AI techniques will help address black box concerns by providing clearer insights into how specific data points influence credit decisions. Privacy-preserving machine learning approaches may enable sophisticated analyses while providing stronger data protection.

Regulatory frameworks will evolve to provide clearer guidance specifically addressing alternative data usage, reducing current uncertainties while establishing guardrails to protect consumer interests. Agencies including the CFPB and prudential banking regulators will likely issue additional guidance or regulations addressing appropriate alternative data sources, fairness testing requirements, and consumer disclosure obligations.

Lenders should approach alternative data adoption strategically through phased implementation beginning with lower-risk applications before expanding to broader usage. Initial deployments might focus on specific customer segments such as thin-file applicants where alternative data provides clear incremental value. Careful monitoring of early results including default performance and demographic impacts should inform decisions about expanding usage. Lenders should invest in building internal capabilities including data science expertise and model validation competencies.

Consumer communication represents a critical yet often under-emphasized aspect of responsible alternative data implementation. Lenders should provide clear, accessible explanations of what alternative data sources they use, how this information benefits consumers, and how consumers can improve creditworthiness through positive financial behaviors. Building consumer trust through transparency and demonstrable benefits will be essential for sustainable adoption.

Continuous monitoring and improvement of alternative data models should be embedded in operational practice. Machine learning models require ongoing validation as data patterns evolve and economic conditions change. Fairness testing should occur regularly using multiple methodologies to detect potential disparate impacts early. Establishing clear governance frameworks defining roles, responsibilities, and decision authority helps ensure appropriate oversight.

Policymakers and regulators should continue working to establish clear, balanced frameworks that encourage innovation while protecting consumer rights. Guidance providing safe harbors for specific alternative data practices could reduce uncertainty and facilitate responsible adoption. Supporting research into alternative data effectiveness and impacts through data access for qualified researchers could build evidence base informing policy development.

The future of credit risk assessment will almost certainly involve blended approaches combining traditional credit bureau data with complementary alternative information sources rather than wholesale replacement of existing systems. This hybrid model leverages the reliability and regulatory clarity of traditional credit data where available while incorporating alternative data to fill gaps, enhance accuracy, and expand inclusion.

Final Thoughts

The transformation underway in credit risk assessment through alternative data integration represents far more than a technical evolution in lending methodologies. It embodies a fundamental reconceptualization of how financial institutions can identify and serve responsible borrowers while managing risk appropriately in an increasingly digital, diverse, and economically complex world. The limitations of traditional credit scoring, made starkly visible by the tens of millions of credit-invisible consumers excluded from mainstream financial services, have created both moral imperatives and market opportunities that alternative data approaches promise to address.

The potential for genuine financial inclusion through alternative data extends beyond mere access to encompass the quality and fairness of that access. When individuals can demonstrate creditworthiness through the rent they pay faithfully each month, the utilities they manage responsibly, the employment they maintain steadily, and the financial discipline they exhibit across diverse obligations, the playing field shifts toward recognition of actual financial behavior rather than accidents of credit history availability. This shift holds particular significance for communities that have faced systemic disadvantages in traditional credit systems, offering pathways to economic participation and wealth building that previous generations found blocked by invisible but consequential barriers.

Yet realizing this potential requires more than deploying sophisticated algorithms and collecting diverse data streams. The intersection of technology and social responsibility demands careful attention to privacy protections that respect human dignity even as data analysis expands. It requires vigilance against algorithmic bias that could perpetuate historical discrimination through new mechanisms while claiming objectivity. It necessitates transparency that enables consumers to understand, contest, and benefit from the data-driven decisions affecting their financial lives. The technical capability to analyze alternative data creates possibilities, but the ethical frameworks, regulatory guardrails, and institutional commitments that govern its use will determine whether those possibilities yield genuine progress toward more equitable financial systems.

The financial services industry faces critical choices about how alternative data capabilities will be deployed and to whose benefit. Will these tools primarily serve to extract more profit from vulnerable populations through precise risk-based pricing? Or will they enable business models that expand affordable access by identifying responsible borrowers whom traditional systems failed to recognize? The answer lies not in the technology itself but in the values, incentives, and accountability structures that shape its application.

Policymakers and regulators play essential roles in shaping whether alternative data evolution serves broad public interests or narrows benefits to limited stakeholders. Regulatory frameworks that encourage innovation while enforcing strong anti-discrimination protections, mandate transparency while protecting legitimate business methods, and balance data access with privacy rights will determine the trajectory of development. The consumer voice must remain central in conversations that too often focus exclusively on technological capabilities and business opportunities.

Looking forward, the success of alternative data in credit risk assessment will be measured not merely by technical performance metrics or market adoption rates but by its contribution to more inclusive, fair, and efficient financial systems that serve human flourishing. The young adult able to finance education because utility payment history demonstrated responsibility. The immigrant entrepreneur who secures business capital based on comprehensive payment patterns. The gig worker receiving affordable auto financing due to income verification through payment platforms. These individual stories, multiplied across millions of people, represent the human impact that should guide alternative data development.

FAQs

- What exactly is alternative data in credit risk assessment?

Alternative data refers to any information beyond traditional credit bureau reports that lenders use to evaluate borrower creditworthiness. This includes utility payment histories, rent records, bank account transaction data, mobile phone bills, employment information, educational background, and behavioral patterns observable through digital interactions. The key distinction is that alternative data encompasses financial and non-financial information not typically captured by conventional credit reporting agencies, providing a more comprehensive view of an individual’s financial responsibility and capacity beyond just credit account payment histories. - How does alternative data improve credit access for people without credit histories?

Alternative data enables lenders to evaluate creditworthiness for individuals who lack traditional credit histories by analyzing other indicators of financial responsibility. Someone who has never had a credit card but consistently pays rent, utilities, and phone bills on time can demonstrate reliability through these alternative payment records. Young adults, recent immigrants, and individuals who primarily use cash can establish creditworthiness without first obtaining credit products, breaking the circular barrier where credit history is required to access credit. This expanded evaluation framework potentially brings millions of credit-invisible consumers into the financial mainstream with access to affordable loan products. - Does using alternative data mean my social media will affect my credit score?

While social media analysis was explored in early alternative credit scoring experiments, mainstream lenders in developed markets generally do not use social media activity for credit decisions due to privacy concerns, limited predictive validity, and discrimination risks. Most alternative data approaches focus instead on financial behaviors including payment histories for utilities, rent, subscriptions, and bank account management patterns. Lenders must disclose what data sources they use and obtain appropriate consent, so consumers should carefully review privacy policies and terms when applying for credit products using alternative data methodologies. - Can alternative credit scoring hurt my credit score?

The impact depends on implementation design. Services like Experian Boost only add positive payment information, so they cannot lower scores and can only help or leave scores unchanged. However, if lenders incorporate alternative data sources that include negative information such as late utility payments, evictions, or overdrafts, this could potentially lower credit scores or reduce approval chances. Consumers should understand what specific alternative data sources lenders are accessing and whether both positive and negative information will be considered before consenting to alternative data usage. - How do lenders ensure alternative data usage doesn’t discriminate?

Responsible lenders employ multiple fairness testing methodologies to detect and prevent discrimination in alternative data models. This includes comparing approval rates, interest rates, and default outcomes across demographic groups to identify disparate impacts. They validate that alternative data sources and algorithmic decisions do not serve as proxies for protected characteristics like race, ethnicity, or gender. Many lenders work with third-party auditors and comply with fair lending regulations including the Equal Credit Opportunity Act. However, ensuring fairness requires ongoing monitoring as models and data evolve, and regulatory oversight continues developing specifically for alternative data contexts. - Is my data secure when using alternative credit scoring services?

Reputable alternative data providers and lenders employ strong security measures including encryption, secure data transmission protocols, access controls, and regular security audits. However, any data collection and sharing involves some risk. Consumers should research providers’ security practices, understand what data is collected and how long it is retained, and know their rights if breaches occur. Financial institutions using alternative data must comply with data security regulations including the Gramm-Leach-Bliley Act and various state data protection laws. Reading privacy policies and understanding data sharing practices helps consumers make informed decisions about which services to use. - Will traditional credit scores become obsolete?

Traditional credit scores are unlikely to disappear but rather will evolve to incorporate alternative data elements. Credit bureaus including Experian, Equifax, and TransUnion are already expanding their data collection to include alternative payment histories, BNPL loans, and other non-traditional information. The future likely involves hybrid models that combine traditional credit account data with complementary alternative information, providing more comprehensive evaluations while retaining the reliability and regulatory clarity of established credit scoring frameworks. Different lending contexts may emphasize traditional versus alternative data differently based on applicant profiles and risk management needs. - How can I improve my creditworthiness using alternative data?

Consumers can proactively build alternative credit histories by ensuring timely payment of utilities, rent, phone bills, and subscription services that may be reported to alternative data platforms. Maintaining healthy bank account balances and avoiding overdrafts demonstrates financial management. Some services allow consumers to voluntarily report positive payment histories including Netflix subscriptions or gym memberships. Stable employment and building savings also contribute to comprehensive financial profiles. Consumers should research which alternative data services and credit products recognize these behaviors and consider enrolling in programs like Experian Boost that incorporate alternative payment histories into credit reports. - What regulations govern alternative data use in lending?

Alternative data usage is governed by multiple regulations including the Fair Credit Reporting Act which regulates consumer reports and credit information, the Equal Credit Opportunity Act prohibiting discriminatory lending, and various privacy laws including the Gramm-Leach-Bliley Act and state-level privacy statutes. The Consumer Financial Protection Bureau provides oversight and guidance on alternative data practices. However, regulatory frameworks were designed primarily for traditional credit reporting and are still evolving to address alternative data specifically. Lenders must ensure compliance with anti-discrimination requirements, provide adverse action notices explaining credit denials, and protect consumer data security regardless of whether using traditional or alternative information sources. - What should I look for when choosing a lender using alternative data?

Consumers should evaluate lenders’ transparency about what alternative data sources they use and how this information influences decisions. Reputable lenders clearly explain their evaluation processes and provide opportunities for consumers to correct inaccurate information. Compare interest rates and loan terms across multiple lenders to ensure competitive pricing. Research lenders’ privacy practices and data security measures. Check whether the lender reports to major credit bureaus, as this affects your ability to build traditional credit history. Read customer reviews regarding application experiences and responsiveness to questions. Verify that lenders are properly licensed and comply with applicable lending regulations in your jurisdiction.