The landscape of small business financing has undergone a profound transformation over the past decade, driven by technological innovation and changing expectations among entrepreneurs seeking capital. Traditional lending institutions, with their weeks-long approval processes and extensive documentation requirements, are increasingly being challenged by digital-first platforms that promise to deliver funding decisions in minutes rather than months. This shift represents more than mere convenience—it signals a fundamental reimagining of how financial institutions assess creditworthiness and distribute capital to the backbone of the global economy.

Small and medium-sized enterprises have long faced significant barriers when attempting to secure financing from conventional banks. The application process typically involves submitting extensive financial documentation, enduring multiple meetings with loan officers, and waiting anxiously through approval cycles that can stretch beyond a month. During this waiting period, business opportunities may evaporate, seasonal inventory needs may pass, or urgent operational challenges may compound. For many entrepreneurs, particularly those operating businesses in underserved communities or industries considered high-risk by traditional standards, rejection rates from conventional lenders hover above fifty percent, creating a persistent capital access crisis that limits economic growth and opportunity.

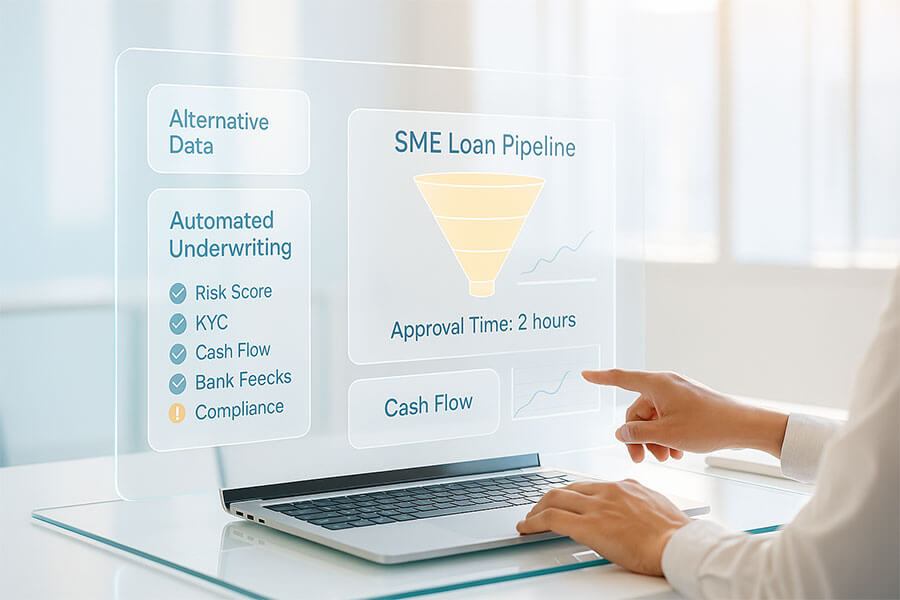

Digital-first small business lending platforms have emerged as a compelling alternative, leveraging advanced technologies including artificial intelligence, machine learning, and sophisticated data analytics to revolutionize every aspect of the lending process. These platforms analyze alternative data sources beyond traditional credit scores, examining real-time business performance metrics including cash flow patterns, customer payment histories, point-of-sale transaction volumes, and even social media engagement to develop more nuanced and accurate assessments of creditworthiness. By automating underwriting processes and eliminating much of the manual oversight that slows conventional lending, digital platforms can evaluate applications and deliver funding decisions in timeframes previously considered impossible.

The implications of this technological revolution extend far beyond speed and convenience. Digital lending platforms are fundamentally expanding access to capital for businesses that traditional financial institutions have historically underserved or ignored entirely. Entrepreneurs without perfect credit scores, businesses operating in emerging industries without established lending precedents, and owners lacking substantial collateral are finding that algorithm-driven platforms can evaluate their true business potential in ways that conventional credit scoring systems cannot. This democratization of capital access has profound economic and social implications, potentially unlocking entrepreneurial talent and innovation that has been constrained by outdated financial gatekeeping mechanisms.

The rise of digital-first lending also reflects broader shifts in how businesses operate and how entrepreneurs prefer to interact with financial services. Modern business owners, particularly those from younger generations, expect seamless digital experiences that match the convenience they encounter in other aspects of their lives. The ability to apply for a business loan using a smartphone during a lunch break, connecting existing business accounts to streamline documentation, and receiving approval notifications within hours aligns with contemporary expectations for financial services. This shift in user experience standards is forcing even traditional lenders to invest heavily in digital transformation initiatives, though many struggle to match the speed and simplicity that digital-native platforms offer.

Understanding this transformation requires examining not only the technologies that enable digital lending but also the business models, regulatory considerations, and real-world outcomes that define this rapidly evolving sector. The following analysis explores how digital-first platforms are reshaping small business finance, the benefits they deliver to entrepreneurs and economies, the challenges and risks they present, and the future trajectory of this crucial component of the global financial ecosystem.

Understanding Traditional Small Business Lending Challenges

The traditional small business lending ecosystem has operated according to fundamentally similar principles for decades, relying heavily on established credit scoring methodologies, extensive documentation requirements, and relationship-based assessment processes that favor businesses with long operating histories and strong connections to local banking institutions. While this model has successfully channeled capital to countless enterprises over the years, it contains inherent structural limitations that create systematic barriers for significant segments of the small business community.

Conventional banks typically require business loan applicants to submit comprehensive documentation including multiple years of tax returns, detailed financial statements, business plans with revenue projections, personal financial information, and evidence of collateral that can secure the loan. Gathering and organizing these materials demands substantial time and expertise that many small business owners lack, particularly those operating in cash-intensive industries or early-stage ventures without established accounting systems. The documentation burden alone creates a selection bias that favors more sophisticated businesses while discouraging applications from entrepreneurs who might represent excellent credit risks but lack the administrative capacity to navigate complex application processes.

Credit scoring systems used by traditional lenders place heavy emphasis on factors including personal credit history, time in business, annual revenue figures, and debt-to-income ratios. While these metrics provide useful signals about creditworthiness, they necessarily overlook businesses that fall outside conventional parameters. A promising startup with less than two years of operating history may be automatically excluded regardless of its growth trajectory or market potential. An entrepreneur with past personal financial challenges may find doors closed even if their current business demonstrates strong cash flow and customer demand. These rigid criteria create systematic disadvantages for businesses owned by women, minorities, and entrepreneurs from communities with limited access to traditional banking relationships.

The Legacy Lending Process and Its Limitations

The journey from loan application to funding through traditional banking channels follows a predictable but time-consuming pathway that reflects both institutional risk management practices and outdated operational infrastructures. Once an applicant submits their documentation, loan officers must manually review materials, verify information through various channels, assess business viability based on subjective judgment informed by experience, and shepherd applications through multiple layers of approval authorities. Each step introduces delays that accumulate into approval timelines stretching from three weeks to several months depending on loan size and institutional complexity.

Manual underwriting processes introduce human judgment into lending decisions, which can be beneficial when experienced loan officers recognize unique strengths in unconventional businesses but equally creates opportunities for bias and inconsistency. Studies have documented that loan officers at traditional banks often demonstrate unconscious biases that disadvantage applicants from certain demographic groups or industries, even when objective financial metrics would support approval. The lack of algorithmic consistency means that identical businesses applying to different branches of the same bank might receive dramatically different treatment based solely on the particular loan officer reviewing their application.

Traditional lending institutions also struggle with scalability challenges that limit their capacity to serve the vast small business market efficiently. Each loan application requires substantial human labor for review and processing, creating fixed costs that make smaller loan amounts economically unattractive for banks. Consequently, many financial institutions impose minimum loan sizes of fifty thousand dollars or more, effectively excluding the millions of small businesses that need smaller amounts of working capital for inventory purchases, equipment repairs, or bridging temporary cash flow gaps. This leaves a substantial portion of the small business financing market underserved by conventional providers.

The emphasis on collateral requirements creates additional barriers for businesses lacking significant physical assets to pledge as security. Traditional lenders typically require real estate, equipment, or other tangible assets valued at percentages ranging from fifty to one hundred percent of the loan amount, providing security in case of default but simultaneously excluding service businesses, digital enterprises, and startups that operate with minimal physical asset bases. This collateral-centric approach may have made sense when manufacturing and retail businesses dominated the economy, but it poorly serves the contemporary business landscape where intellectual property, digital platforms, and service capabilities represent primary value drivers for many successful enterprises.

The cumulative effect of these limitations manifests in persistently high rejection rates and widespread frustration among small business owners seeking capital. Federal Reserve survey data consistently shows that fewer than half of small businesses applying to large banks receive full approval for requested financing, with many approved applicants receiving only partial funding at terms they consider unfavorable. This supply-demand mismatch creates what economists term a “credit gap”—a substantial pool of creditworthy businesses unable to access capital they need for growth and stability, representing billions in unrealized economic potential.

The Evolution of Digital-First Lending Platforms

Digital lending platforms emerged from the convergence of several technological and market trends that created both the capability and necessity for reimagined approaches to small business financing. The proliferation of cloud computing infrastructure provided scalable, cost-effective processing power that enabled real-time analysis of vast data sets. Advances in machine learning and artificial intelligence offered tools for identifying patterns in complex financial data that human analysts might overlook. Meanwhile, the widespread adoption of digital business tools including online banking, accounting software, and payment processing systems generated rich streams of business performance data that could be accessed and analyzed with proper permissions. These technological capabilities arrived precisely as growing frustration with traditional lending created market demand for faster, more accessible financing alternatives.

The early pioneers in digital lending, emerging in the mid-to-late 2000s, recognized that the bottleneck in traditional lending was not insufficient capital availability but rather inefficient processes for matching available capital with creditworthy borrowers. By reimagining underwriting from first principles using available technology, these innovators developed platforms that could evaluate loan applications in minutes using automated algorithms that analyzed data points far beyond what traditional credit reports contained. This fundamental insight—that better data intelligently analyzed could enable both faster decisions and more accurate risk assessment—formed the foundation for an industry that has since channeled hundreds of billions of dollars to small businesses worldwide.

The business models adopted by digital lending platforms vary considerably but generally fall into several categories. Some platforms operate as direct lenders, using their own balance sheets or secured credit lines to fund approved loans. Others function as marketplaces connecting business borrowers with institutional investors seeking returns from small business debt. Still others partner with traditional banks, providing the technology platform and underwriting algorithms while the partner bank holds the actual loan on its balance sheet, leveraging existing banking licenses and regulatory frameworks. Each model presents distinct advantages and trade-offs regarding risk management, regulatory oversight, and scalability potential.

Technology Infrastructure and Alternative Data

The technological backbone of digital lending platforms consists of sophisticated software systems that integrate multiple data sources, apply machine learning models for risk assessment, and automate decision-making workflows that traditionally required substantial human intervention. At the application stage, platforms typically request permission to connect directly to applicants’ business checking accounts, accounting software, payment processors, and other digital tools that contain relevant performance data. This connectivity, enabled through application programming interfaces that allow secure data sharing between systems, eliminates the need for manual document submission while providing more current and comprehensive information than tax returns or financial statements that may be months or years old.

Alternative data sources analyzed by digital platforms extend far beyond traditional credit reports to encompass real-time operational metrics that reflect current business health and momentum. Bank account transaction data reveals cash flow patterns including revenue consistency, seasonal variations, and expense management. Point-of-sale system data from credit card processors shows sales trends, average transaction values, and customer return rates. Accounting software provides detailed insight into accounts receivable aging, vendor payment patterns, and profitability margins. Some platforms even incorporate social media engagement metrics, online customer reviews, and website traffic patterns as supplementary signals of business viability and growth trajectory.

Machine learning algorithms process these diverse data streams to identify patterns that correlate with loan performance, continuously refining their predictive accuracy as they analyze outcomes from thousands of previous loans. Unlike rules-based underwriting systems that apply fixed criteria to all applicants, machine learning models can recognize nuanced interactions between multiple variables that signal creditworthiness. For example, an algorithm might identify that businesses in certain industries with specific seasonal cash flow patterns represent excellent credit risks despite factors that traditional scoring would flag negatively. This more sophisticated pattern recognition enables more accurate risk assessment while identifying creditworthy businesses that conventional methods would reject.

The speed advantage of automated underwriting stems from eliminating the sequential manual steps that consume time in traditional lending. Rather than waiting for loan officers to review documents during business hours, algorithms can analyze connected data sources instantly at any hour. Complex calculations that might take human underwriters hours to complete are performed in milliseconds. Credit decisions that required multiple approval levels can be automated based on confidence scores, with only edge cases requiring human review. This end-to-end automation enables platforms to deliver preliminary approval decisions within minutes of application submission, with funds often disbursed within twenty-four hours for approved applicants.

Automated Underwriting Systems

Automated underwriting systems represent the intellectual core of digital lending platforms, embodying years of data science expertise and continuous algorithmic refinement. These systems must balance competing objectives including maximizing approval rates to serve more businesses, maintaining default rates within acceptable thresholds to ensure platform sustainability, meeting regulatory requirements for fair lending practices, and delivering consistent decisions that avoid arbitrary discrimination. Achieving this balance requires sophisticated modeling that accounts for industry-specific risk factors, geographic economic conditions, seasonal business patterns, and countless other variables that influence loan performance.

The training process for machine learning models begins with historical loan data that includes both successful repayments and defaults, allowing algorithms to identify characteristics that distinguish good credits from bad. As platforms accumulate lending history, their models become increasingly accurate by learning from actual outcomes rather than relying on assumptions about which factors matter most. This continuous learning capability gives established digital platforms significant advantages over both traditional lenders using fixed underwriting criteria and newer entrants lacking sufficient historical data to train robust models. Some leading platforms have analyzed millions of loans, providing data sets that enable detection of subtle patterns no human underwriter could recognize.

Risk-based pricing represents another area where automated systems deliver advantages over traditional approaches. Rather than categorizing businesses into broad approval or rejection buckets, algorithms can calculate precisely calibrated risk scores that inform customized pricing. A business presenting moderate risk factors might receive approval at a higher interest rate that compensates the lender for increased default probability, whereas the same business might simply be rejected under traditional binary decision-making. This granular risk assessment expands access to capital by enabling more approvals while maintaining appropriate risk-adjusted returns across the loan portfolio.

Automated systems also enhance consistency and reduce bias compared to human underwriting processes. While machine learning models can potentially incorporate biases present in historical training data, properly designed systems focus exclusively on variables with demonstrated predictive value for loan performance while excluding prohibited factors such as race, gender, or age. Ongoing monitoring and testing help identify and correct any patterns suggesting unfair treatment of protected groups. The algorithmic approach, when implemented thoughtfully, offers potential for more equitable lending than human judgment susceptible to unconscious biases and inconsistent application of underwriting standards.

The technological infrastructure and automated underwriting systems that power digital lending platforms represent fundamental departures from traditional banking operations, enabling the speed, scale, and accessibility advantages that define this sector. By leveraging alternative data sources and machine learning algorithms, these platforms can evaluate creditworthiness more accurately and efficiently than conventional methods while expanding access to businesses that traditional scoring systems would overlook. As these technologies continue advancing, they promise even more sophisticated assessment capabilities that will further democratize small business capital access.

Key Players and Real-World Implementations

The digital small business lending sector has matured significantly since its inception, with numerous platforms now serving millions of businesses across diverse industries and geographies. While hundreds of companies operate in this space globally, several major players have distinguished themselves through scale, innovation, or specialized approaches that demonstrate the varied strategies for addressing small business financing needs.

The competitive landscape includes pure-play fintech companies that built digital lending platforms from inception, traditional financial institutions that have launched or acquired digital lending capabilities, and various hybrid models that combine elements of both approaches. Some platforms focus on serving specific industries or business types, while others pursue broad horizontal strategies attempting to serve any creditworthy small business regardless of sector. Loan products range from traditional term loans providing lump-sum capital repaid over fixed periods to revolving lines of credit offering flexible access to capital as needed. Understanding how different platforms approach the market provides insight into the diversity of business models and technological approaches driving this sector.

Competition among digital lending platforms has intensified as the market has grown, driving continuous innovation in areas including approval speed, user experience design, interest rate competitiveness, and service features beyond basic capital provision. Leading platforms increasingly offer integrated financial management tools, educational resources, and advisory services that position them as comprehensive financial partners rather than simple capital providers. This expansion reflects recognition that small business owners value relationships and support beyond transactional lending, creating opportunities for platforms that can deliver holistic value propositions.

Case Study Examples

American Express’s acquisition and integration of Kabbage demonstrates how traditional financial institutions are embracing digital lending technologies to serve small business customers more effectively. Founded in 2006 as an independent fintech pioneer, Kabbage developed automated underwriting capabilities that analyzed real-time business data to deliver funding decisions in minutes. Following its acquisition by American Express in 2020, Kabbage was integrated into American Express Business Blueprint, a comprehensive digital platform launched in February 2023 that combines business lines of credit, checking accounts, and financial management tools in a unified digital experience. The American Express Business Line of Credit maintains Kabbage’s original automated underwriting approach, analyzing data from connected business checking accounts, accounting software, or payment processing systems to evaluate creditworthiness without requiring manual document submission. Applicants can receive credit lines ranging from two thousand to two hundred fifty thousand dollars with repayment terms of six, twelve, eighteen, or twenty-four months. The platform has served hundreds of thousands of small businesses, demonstrating how technology-enabled lending can operate successfully within the regulatory and operational framework of a major financial institution while maintaining the speed and user experience advantages that characterized the original fintech platform.

OnDeck Capital represents another pioneering force in digital small business lending, having provided over fifteen billion dollars in funding to more than one hundred fifty thousand businesses since its founding in 2006. Operating as part of Enova International, OnDeck developed proprietary underwriting technology called the OnDeck Score that evaluates credit applications using data analytics and machine learning algorithms trained on millions of previous loan outcomes. The platform offers both term loans up to two hundred fifty thousand dollars and business lines of credit up to one hundred thousand dollars, with approval decisions delivered within minutes and funding available as quickly as the same business day for qualified applicants. OnDeck’s approach focuses particularly on serving businesses that might not qualify for traditional bank financing, accepting applicants with personal credit scores as low as six hundred twenty-five and requiring only one year in business with one hundred thousand dollars in annual revenue. Quarterly reporting from OnDeck and its research partner Ocrolus has tracked how seventy-six percent of small businesses now bypass traditional banks entirely when seeking financing, citing excessive paperwork and expected rejection as primary reasons for turning directly to alternative lenders. This data underscores the market gap that digital platforms are filling and validates the significant demand for faster, more accessible financing options among the small business community.

Funding Circle, a United Kingdom-based platform that expanded to the United States market before that division was acquired by iBusiness Funding in 2024, provides a compelling case study in the global growth of digital small business lending. The platform operates a marketplace model connecting small business borrowers with institutional investors seeking returns from small business loans, having facilitated over twenty billion dollars in total lending since its inception. Research conducted by the Bank for International Settlements and the Federal Reserve Bank of Philadelphia using Funding Circle’s proprietary loan data demonstrated that fintech lending platforms serve businesses in zip codes with higher unemployment rates and higher business bankruptcy filings compared to traditional banks, providing empirical evidence that digital platforms expand access to underserved communities. The study also found that Funding Circle’s internal credit scoring models predicted loan performance more accurately than conventional FICO or VantageScore methodologies, validating the superior predictive power of alternative data and machine learning approaches. In 2024, Funding Circle reported lending growth of forty-seven percent year-over-year in the United Kingdom market, extending approximately two billion pounds in credit while achieving profitability that marked a significant turnaround from previous losses, demonstrating that digital lending platforms can achieve sustainable business models while expanding access to capital for small businesses that traditional banks might reject.

These real-world implementations share common themes including the use of alternative data sources beyond traditional credit reports, automated underwriting systems that deliver rapid approval decisions, focus on serving businesses underserved by conventional banks, and business models that have scaled to serve hundreds of thousands of businesses while collectively channeling tens of billions of dollars to the small business economy. The success of these platforms has validated the digital-first lending model and inspired countless competitors entering the market with variations on similar technological and business approaches.

Benefits and Opportunities

The transformation from traditional to digital-first lending creates substantial value across multiple dimensions for diverse stakeholders including small business owners seeking capital, financial institutions providing funding, investors seeking returns, and the broader economy that benefits from improved capital allocation efficiency. Understanding these benefits requires examining impacts on different constituencies and considering both quantitative metrics like approval speed and qualitative factors like user experience and psychological impacts on entrepreneurs.

Small business owners represent the primary beneficiaries of digital lending platforms, gaining access to capital with unprecedented speed and convenience compared to traditional alternatives. The ability to complete a loan application in minutes using a smartphone or computer, often without leaving business premises or interrupting operational responsibilities, reduces the friction and opportunity cost of seeking financing. Entrepreneurs no longer need to schedule multiple meetings with bank officers, gather extensive documentation over days or weeks, or endure anxious waiting periods wondering whether approval will arrive in time to address pressing business needs. This streamlined experience respects the time constraints facing busy business owners while delivering capital when it can have maximum impact on addressing opportunities or challenges.

Beyond convenience, digital platforms expand approval opportunities for businesses that traditional lenders would reject based on factors including limited operating history, imperfect credit scores, lack of substantial collateral, or operation in industries that banks consider risky. By evaluating creditworthiness based on actual business performance data rather than proxies like time in business or personal credit history, automated underwriting systems identify strong credit risks that conventional criteria would overlook. A restaurant with consistent cash flow and growing customer traffic might receive approval despite operating for only eighteen months, whereas the same business would automatically fail traditional minimum requirements for two or three years operating history. This expansion of credit access has particular significance for businesses owned by women, minorities, and entrepreneurs from underserved communities who face disproportionate rejection rates from traditional lenders even when controlling for objective risk factors.

Transparency represents another advantage that distinguishes many digital platforms from conventional lending. Applicants typically receive clear information about interest rates, fees, repayment schedules, and total cost of capital upfront, enabling informed decision-making without hidden charges emerging later. Automated pricing based on risk algorithms produces consistent treatment across applicants, reducing opportunities for arbitrary or discriminatory pricing that can occur in relationship-based lending. Some platforms provide upfront indication of likely approval and pricing before formal application, allowing businesses to assess options without impacting credit scores through multiple hard inquiries.

For Small Business Owners

The psychological and emotional benefits of accessible financing options deserve recognition alongside practical advantages. Small business owners face constant pressure managing daily operations while planning for growth, and capital constraints create persistent stress that affects decision-making and well-being. Knowing that financing can be accessed quickly when needed provides valuable peace of mind, allowing entrepreneurs to pursue opportunities more confidently and weather unexpected challenges without desperate scrambling for emergency funds. This psychological security has tangible economic value through better business decisions and reduced owner burnout.

Digital platforms also enable more strategic use of leverage by making capital available for shorter terms and smaller amounts than traditional loans typically provide. Rather than borrowing fifty thousand dollars for two years because that represents the minimum viable loan from a bank, a business might access fifteen thousand dollars through a digital platform for six months to fund a specific inventory purchase or equipment repair. This precision in matching capital needs with financing terms reduces interest costs and debt burden while providing exactly the funding needed for particular business purposes. Revolving lines of credit offered by many platforms provide even greater flexibility, allowing businesses to draw funds only when needed and repay quickly when cash flow permits, minimizing interest expense.

The twenty-four-seven accessibility of digital platforms means that business owners can apply for financing whenever suits their schedule, rather than conforming to bank branch hours or waiting for meetings with loan officers. An entrepreneur working evening hours can complete an application at ten o’clock at night, receiving approval notification the next morning and funds in their account by afternoon. This around-the-clock availability particularly benefits businesses operating non-traditional hours or owners juggling multiple responsibilities who struggle to accommodate conventional banking schedules.

For Financial Institutions

Financial institutions embracing digital lending technologies gain significant operational efficiencies and market advantages that justify the substantial investments required to develop or acquire these capabilities. Automated underwriting dramatically reduces the labor cost per loan originated, allowing profitable lending at smaller loan amounts that would be uneconomical using manual processes. A digital platform might process thousands of loan applications weekly with a team of dozens, whereas traditional operations might require hundreds of staff to evaluate equivalent volumes. This scalability enables financial institutions to serve broader segments of the small business market including the millions of businesses seeking loans under fifty thousand dollars.

Data advantages accumulated through digital lending operations create competitive moats that strengthen over time. Each loan originated generates performance data that refines underwriting algorithms, making risk assessment increasingly accurate and enabling more precise pricing that optimizes the trade-off between approval rates and default risk. Institutions with millions of historical loan records possess data assets that newer entrants cannot quickly replicate, establishing barriers to competition that protect market positions. This data-driven continuous improvement contrasts with traditional lending where institutional knowledge resides primarily in experienced loan officers who may leave the organization, taking expertise with them.

Digital platforms also generate valuable business relationships that can be monetized beyond initial loan transactions. A small business that successfully obtains and repays financing becomes a candidate for additional products including business checking accounts, payment processing services, business credit cards, and advisory services. By delivering positive initial experiences, digital lenders can position themselves as primary financial partners for growing businesses, capturing increasing wallet share as those businesses mature and their financial needs become more sophisticated. This relationship value multiplies the profitability beyond single loan transactions.

Risk management capabilities improve through digital lending technologies that provide real-time monitoring of borrower financial health throughout loan terms rather than periodic manual reviews. Connected account data allows automated flagging of concerning patterns including declining revenues, increasing expenses, or irregular payment behaviors that might signal future default risk. Early warning systems enable proactive intervention, potentially helping borrowers avoid financial distress while protecting lender interests. This continuous monitoring surpasses traditional approaches that essentially ignore borrowers between origination and maturity aside from collecting scheduled payments.

The combined benefits for small business owners and financial institutions create a powerful value proposition that explains the rapid growth of digital-first lending platforms. Business owners gain unprecedented access to capital with speed and convenience that transforms how they manage financing needs, while lenders achieve operational efficiencies and competitive advantages that justify technology investments. These mutual benefits suggest that digital lending will continue expanding its role in the small business financing ecosystem, complementing rather than completely replacing traditional banking relationships while serving market segments that conventional lenders have historically underserved.

Challenges and Considerations

Despite substantial benefits and rapid market growth, digital-first small business lending faces significant challenges and limitations that require careful consideration by both platform operators and business owners evaluating financing options. These obstacles span technical, regulatory, economic, and ethical dimensions, presenting risks that could limit the sector’s positive impact if not properly addressed. Understanding these challenges provides necessary perspective for balanced assessment of digital lending’s role in the small business financing ecosystem.

The most frequently cited concern regarding digital lending involves pricing, as many platforms charge higher interest rates and fees than traditional bank loans. While this premium reflects the higher-risk profile of businesses served and the costs of technology development and operation, it nonetheless creates debt service burdens that some businesses struggle to manage, particularly if revenues fall short of projections. Annual percentage rates on digital platform loans commonly range from twenty to over one hundred percent depending on risk factors, compared to single-digit rates available to the strongest credits at traditional banks. These cost differentials mean that businesses qualifying for conventional bank financing often find better value there, with digital platforms serving primarily those unable to access traditional capital regardless of cost.

Data privacy and security concerns accompany the extensive information access that digital platforms require for automated underwriting. Businesses must grant permissions allowing platforms to access sensitive financial data including bank account details, customer information, and operational metrics that represent competitive intelligence if mishandled. While platforms implement security measures including encryption and access controls, the concentration of sensitive data creates attractive targets for cybercriminals. Breaches exposing customer financial information could devastate affected businesses while eroding trust in digital lending generally. Regulatory frameworks governing data handling continue evolving, creating compliance challenges that platforms must navigate carefully.

The automated nature of digital underwriting, while providing speed and consistency advantages, also raises concerns about transparency and accountability in lending decisions. When machine learning algorithms reject loan applications, explaining precisely why can be challenging since decisions emerge from complex interactions among hundreds or thousands of variables rather than simple rules. This “black box” problem frustrates rejected applicants who want to understand denial reasons and potentially address deficiencies for future applications. It also complicates regulatory oversight intended to prevent discriminatory lending, as regulators struggle to audit algorithmic decision-making that lacks the straightforward paper trails generated by traditional underwriting.

Market structure dynamics in digital lending raise questions about long-term sustainability and competitive dynamics. Many platforms operated at substantial losses during growth phases, subsidizing loan volumes through venture capital funding while building market share and refining underwriting models. As these companies mature and investors demand profitability, pricing may need to increase or credit standards tighten, potentially reducing the access benefits that attracted businesses to these platforms initially. Consolidation through acquisitions, as exemplified by American Express’s purchase of Kabbage and iBusiness Funding’s acquisition of Funding Circle’s U.S. operations, could reduce competition and choice available to borrowers.

Regulatory arbitrage concerns arise when digital platforms operate under different regulatory frameworks than traditional banks, potentially avoiding consumer protections and supervisory requirements that apply to conventional lenders. While many platforms voluntarily adhere to responsible lending principles, the absence of comprehensive regulation creates opportunities for predatory practices including deceptive marketing, hidden fees, or lending to obviously over-leveraged borrowers unlikely to successfully repay. As the sector has matured, regulatory attention has increased, with various state and federal authorities exploring appropriate oversight frameworks that protect consumers without stifling innovation.

The relationship between digital and traditional lending raises questions about whether these channels serve complementary or competing functions in the small business financing ecosystem. Some analysts view digital platforms primarily as higher-risk, higher-cost capital sources for businesses unable to access bank financing, creating a two-tiered system where underserved businesses pay premium rates. Others see digital lending as competitive pressure forcing traditional banks to improve service quality and accessibility, ultimately benefiting all small businesses. The reality likely involves elements of both dynamics, with outcomes depending on specific market contexts and competitive behaviors.

Default rates on digital platform loans deserve careful monitoring, as limited historical data makes it difficult to predict performance through economic cycles. Many platforms originated significant loan volumes during the economic recovery following the 2008 financial crisis and through the post-pandemic recovery period, benefiting from generally favorable business conditions. How these loan portfolios perform during recession or economic stress remains somewhat uncertain, though early indications from the 2020 pandemic showed mixed results with some portfolios experiencing elevated defaults while others proved surprisingly resilient. The extensive data analyzed by modern underwriting systems may provide some protection against economic downturn compared to traditional methods, but this hypothesis requires longer track records to fully validate.

Future Trends and Innovation Outlook

The trajectory of digital small business lending suggests continued rapid evolution driven by technological advancement, regulatory development, changing business needs, and competitive dynamics that will reshape the sector substantially over coming years. Several emerging trends appear poised to significantly influence how digital platforms operate and the value they deliver to small business customers.

Embedded lending represents perhaps the most transformative trend, integrating capital access directly into business software platforms and tools that entrepreneurs use daily. Rather than leaving their accounting software or e-commerce platform to visit a lender’s website and apply for financing, business owners increasingly encounter lending offers embedded within their existing workflows, pre-approved based on data those platforms already possess. An accounting software provider might offer working capital loans directly within their interface, with approval based on financial data they already manage. An e-commerce platform might provide inventory financing automatically based on sales patterns and supplier payment terms. This embedded approach dramatically reduces friction in accessing capital while enabling even faster decision-making based on comprehensive business data. Industry projections suggest embedded lending could account for twenty-five percent of all small business and retail lending by 2030, growing from only five to six percent in 2023, representing a massive shift in how businesses discover and access financing.

Artificial intelligence and machine learning capabilities continue advancing rapidly, promising even more sophisticated credit assessment and risk management. Next-generation algorithms can analyze unstructured data including email communications, shipping records, and customer service interactions to develop richer understanding of business operations beyond numerical financial metrics. Natural language processing enables analysis of business plans, customer reviews, and industry research to assess market positioning and competitive strengths. Computer vision technologies can evaluate inventory levels, facility conditions, and operational processes captured in photos or videos. As these advanced AI capabilities mature, they will enable increasingly precise risk assessment while identifying creditworthy businesses that current systems might overlook.

Open banking initiatives mandated by regulators in various jurisdictions are creating standardized frameworks for secure data sharing between financial institutions and authorized third parties. These regulations require banks to provide application programming interfaces that allow customers to share their account data with other service providers including lending platforms, creating more comprehensive data access that improves underwriting accuracy. Open banking standards also enhance data portability, allowing businesses to more easily switch between financial service providers and compare offerings. While implementation varies by country, the general trend toward open banking will likely expand data availability for digital underwriting while increasing competition among lenders.

Blockchain technologies and decentralized finance concepts are beginning to influence small business lending, though practical implementations remain early-stage. Distributed ledger systems could enable more transparent lending markets, automated smart contracts that execute loan terms without intermediary oversight, and tokenization of loan assets that creates new funding sources for small business credit. While significant technical and regulatory challenges must be resolved before blockchain-based lending achieves mainstream adoption, the technologies offer intriguing possibilities for increasing transparency, reducing costs, and expanding investor participation in small business lending markets.

Alternative revenue-based financing models that tie repayment to business performance are gaining traction as alternatives to traditional amortization schedules. Rather than fixed monthly payments regardless of business conditions, these arrangements automatically adjust payment amounts based on revenue levels, providing flexibility during slow periods while accelerating repayment when sales are strong. Revenue-based financing aligns lender and borrower interests by making repayment sustainable across business cycles while enabling faster payoff during high-growth phases. Digital platforms are particularly well-positioned to offer these products since their real-time data access enables automated payment adjustments based on actual revenue.

Industry-specific lending platforms are emerging to serve particular business verticals with specialized underwriting that accounts for unique operational characteristics and risk factors. A platform serving restaurants might evaluate factors including table turnover rates, online review scores, and menu pricing strategies that generic lenders would overlook. A healthcare-focused lender might specialize in medical equipment financing and understand reimbursement cycles from insurance companies. This specialization enables more accurate risk assessment and better-tailored financing products compared to horizontal platforms attempting to serve all industries with generalized approaches.

Regulatory evolution will significantly shape digital lending’s future as authorities work to balance innovation encouragement against consumer protection imperatives. Comprehensive federal regulation of fintech lenders could establish uniform standards that protect borrowers while providing regulatory clarity that facilitates responsible innovation. Alternatively, continued state-by-state regulation could create fragmented compliance requirements that advantage larger platforms with resources to navigate complex multi-jurisdiction obligations. International regulatory harmonization remains distant but could eventually facilitate cross-border lending platforms serving businesses globally. How these regulatory questions resolve will substantially impact competitive dynamics and market structure.

Final Thoughts

The emergence of digital-first small business lending platforms represents far more than incremental improvement in financial services delivery—it embodies a fundamental democratization of capital access that holds profound implications for economic development, entrepreneurial opportunity, and social equity. By leveraging technology to evaluate creditworthiness based on actual business performance rather than proxies that favor established entities and privileged demographics, these platforms are beginning to dismantle barriers that have systematically excluded talented entrepreneurs from accessing the capital necessary to build successful enterprises.

The transformation occurring in small business lending intersects powerfully with broader conversations about financial inclusion and the role of technology in creating more equitable economic systems. Traditional lending institutions, despite generally good intentions, have perpetuated advantage for businesses that already possess wealth, established credit histories, and connections to banking relationships while systematically disadvantaging entrepreneurs from underserved communities who lack these inherited privileges. Digital platforms, by focusing algorithmic assessment on forward-looking business potential rather than backward-looking credit history, create pathways for capable entrepreneurs to access capital based on merit rather than pedigree. This shift has particular significance for businesses owned by women, minorities, and immigrants who face disproportionate rejection rates from conventional lenders even when objective metrics suggest strong credit quality.

The intersection of technology and social responsibility in digital lending raises important questions about how innovation can be harnessed to serve public good alongside private profit. The most successful platforms recognize that sustainable business models depend on genuinely serving customer interests rather than extracting value through predatory practices that trap borrowers in unsustainable debt. Responsible lending principles including transparent pricing, appropriate credit limits that consider repayment capacity, and support services that help borrowers succeed create aligned incentives where platform profitability depends on customer success. This alignment contrasts with certain traditional lending models where profits derived partly from penalty fees and default-related charges created misaligned incentives. As the sector matures, distinguishing responsible platforms from potentially predatory operators becomes increasingly important for protecting vulnerable businesses while preserving innovation benefits.

Looking forward, the most promising vision for small business lending involves healthy ecosystems where digital platforms and traditional institutions each serve appropriate roles based on their respective strengths. Conventional banks will likely continue providing the most competitive pricing for established businesses with strong credit profiles and substantial capital needs that justify the costs of relationship-based underwriting. Digital platforms will excel at serving businesses requiring speed, smaller loan amounts, or accessibility for borrowers outside traditional approval criteria. Embedded lending will integrate capital access seamlessly into business operations, making financing available precisely when needed without requiring dedicated applications. This pluralistic approach maximizes benefits for the diverse small business community whose financing needs span wide spectrums of size, urgency, creditworthiness, and business models.

The ongoing challenge involves ensuring that technological advancement genuinely expands access and improves outcomes rather than merely repackaging existing inequities in digital form. Machine learning algorithms trained on historical lending data risk perpetuating biases embedded in that history, potentially denying credit to creditworthy businesses for reasons correlating with protected characteristics even if those characteristics are not explicitly considered. Platform operators must actively monitor algorithmic decisions for potential bias, test for disparate impact across demographic groups, and remediate systems showing concerning patterns. Regulatory frameworks must evolve to ensure that digital lenders operate under appropriate oversight that protects consumers while avoiding prescriptive requirements that prevent beneficial innovation.

The economic implications of expanded small business capital access extend far beyond individual enterprises receiving loans. Small businesses collectively employ approximately half of all private sector workers in the United States and generate substantial portions of economic output in most developed economies. When creditworthy businesses cannot access capital due to systemic failures in financial markets, the economic cost includes not only immediate lost opportunities for those specific businesses but also ripple effects through communities losing potential jobs, suppliers losing customers, and economies forgoing innovation. Digital lending platforms that successfully expand capital access to previously underserved businesses generate positive externalities benefiting entire economic systems.

Innovation in small business lending exemplifies how technology can address genuine social needs while creating sustainable business opportunities. The companies succeeding in this space recognize that doing well and doing good are not contradictory objectives but rather complementary goals that reinforce each other. Platforms delivering genuine value to customers through fair pricing, transparent practices, and supportive relationships build sustainable competitive advantages based on reputation and customer loyalty. Those pursuing short-term extraction through predatory practices may achieve temporary profits but face long-term reputational damage and regulatory intervention that ultimately proves self-defeating.

As digital lending platforms continue maturing and expanding their reach, maintaining focus on the fundamental purpose—connecting creditworthy small businesses with capital they need to grow and thrive—remains essential. The technological capabilities enabling faster decisions, more precise risk assessment, and broader access represent powerful tools that must be wielded thoughtfully in service of genuine financial inclusion. Success ultimately must be measured not merely in loan volumes originated or platform revenues generated but in small businesses successfully funded, jobs created, communities strengthened, and entrepreneurial dreams realized that would have remained fantasies under previous paradigms. This higher purpose should guide ongoing innovation and competitive strategies as the sector continues its remarkable evolution.

FAQs

- How quickly can I actually receive funding from a digital lending platform?

Approval timelines vary by platform and loan complexity, but many digital lenders deliver preliminary approval decisions within minutes of application submission, with complete underwriting finalized within several hours. For approved applicants, funding typically arrives within twenty-four to forty-eight hours after final approval, with some platforms offering same-day funding for smaller loan amounts to qualified businesses. The fastest timelines apply when applicants have clean data in connected accounts and meet clear approval criteria, while applications requiring manual review for unusual situations may take several days. - What are the typical eligibility requirements for digital small business loans?

Digital platforms generally require businesses to have operated for at least six months to one year, generate minimum annual revenues ranging from fifty thousand to one hundred thousand dollars depending on the platform, and maintain personal credit scores above approximately six hundred to six hundred twenty-five. Most platforms require applicants to connect business bank accounts or accounting software to verify revenue and cash flow. Requirements are typically more flexible than traditional banks, with many platforms approving businesses that conventional lenders would reject based on limited operating history or imperfect credit scores. - How do interest rates on digital platforms compare to traditional bank loans?

Interest rates and fees on digital lending platforms typically exceed traditional bank loan costs, sometimes substantially, reflecting the higher-risk borrowers these platforms serve and the costs of technology operations. Annual percentage rates commonly range from twenty to over one hundred percent depending on business risk factors, compared to single-digit rates available to the strongest credits at conventional banks. However, businesses that qualify for both options often find traditional banks offer better pricing, with digital platforms providing value primarily through faster approval and greater accessibility for businesses that banks would reject. - What happens to my business data when I connect accounts to a lending platform?

When you grant permissions for a lending platform to access your business bank accounts, accounting software, or payment processors, the platform can view transaction histories, account balances, revenue patterns, and expense details necessary for underwriting decisions. Reputable platforms implement security measures including encryption and access controls to protect this sensitive information and typically specify in their privacy policies how data will be used, stored, and protected. Most platforms use data solely for credit assessment and ongoing loan monitoring, though some may aggregate anonymized data for analytical purposes or marketing. - Can I use digital lending platforms to build business credit?

Many digital lending platforms report loan payments to commercial credit bureaus, allowing businesses to build credit history through successful repayment, though reporting practices vary by platform. Successfully managing and repaying a loan from a digital platform can improve your business credit profile, making it easier to qualify for larger loans or better terms in the future. Some businesses intentionally use smaller digital platform loans as credit-building tools before applying for traditional bank financing, though you should verify that your chosen platform reports to credit bureaus if building credit is a primary objective. - What should I do if my application is rejected by a digital platform?

If a digital platform rejects your loan application, request specific information about the denial reasons to understand what factors influenced the decision. Common issues include insufficient time in business, revenue below platform minimums, negative items on credit reports, or concerning patterns in connected account data such as frequent overdrafts or declining revenues. Address any correctable issues, consider applying to alternative platforms with different underwriting criteria, or wait several months to establish stronger financial patterns before reapplying. Some platforms offer feedback specifically designed to help rejected applicants understand what they might improve. - Are digital lending platforms regulated like traditional banks?

Digital lending platforms face a patchwork of state and federal regulations that varies depending on their specific business model and legal structure. Many platforms operate under state lending licenses rather than federal bank charters, resulting in compliance requirements that differ from traditional banking regulation. Some platforms partner with licensed banks that originate loans while the platform provides technology and servicing, bringing those arrangements under banking regulation. While major platforms generally adhere to responsible lending principles and comply with applicable laws, the regulatory framework remains less comprehensive than banking oversight, with ongoing policy discussions about appropriate standards for fintech lenders. - What types of loans or financing products do digital platforms typically offer?

Digital lending platforms commonly offer business term loans providing lump-sum capital repaid over fixed periods typically ranging from three months to five years, and business lines of credit allowing flexible borrowing up to approved limits with interest charged only on drawn amounts. Some platforms specialize in particular products such as invoice financing where businesses receive immediate cash for outstanding receivables, merchant cash advances where repayment is tied to daily credit card sales, or equipment financing for specific asset purchases. Product availability varies by platform, with some offering multiple options while others focus on specific lending types. - How do digital platforms determine how much I can borrow?

Digital platforms analyze connected account data to assess your business’s revenue, cash flow patterns, existing debt obligations, and expense levels to determine how much additional debt your business can sustainably service. Most platforms use algorithms that calculate maximum loan amounts based on factors including average monthly revenue, cash flow consistency, and industry-specific benchmarks. The offered amount typically represents what the platform’s models predict you can comfortably repay while maintaining adequate working capital for operations. You often can choose to borrow less than the maximum approved amount, and responsible platforms won’t approve amounts that would create unsustainable debt burdens even if you request them. - Should I use a digital lending platform if I could potentially qualify for a traditional bank loan?

If you have strong credit, substantial time in business, and meet traditional bank lending criteria, it’s worth comparing options since bank loans often offer significantly lower interest rates than digital platforms. However, digital platforms may still provide value if you need funding faster than banks can deliver, prefer the convenience of digital application processes, or want to avoid the documentation requirements and multiple meetings that traditional lending involves. Consider total cost of capital including interest and fees, funding timing requirements, application convenience, and relationship preferences when choosing between traditional and digital lenders. Some businesses maintain relationships with both types of lenders for different financing needs.