The landscape of retirement planning has undergone a profound transformation with the emergence of robo-advisory services, representing one of the most significant technological disruptions in the financial services industry. These automated investment platforms leverage sophisticated algorithms and artificial intelligence to manage retirement portfolios, offering a level of precision and consistency that was once exclusively available to high-net-worth individuals through traditional wealth management firms. The convergence of advanced computing power, machine learning capabilities, and financial theory has created a new paradigm where retirement planning becomes accessible, affordable, and remarkably efficient for millions of savers who previously navigated these complex waters alone or simply avoided investing altogether. The timing of this innovation could not be more critical, as demographic shifts, economic uncertainties, and the erosion of traditional retirement safety nets have created an urgent need for accessible, effective retirement planning solutions that can serve the masses rather than just the wealthy few.

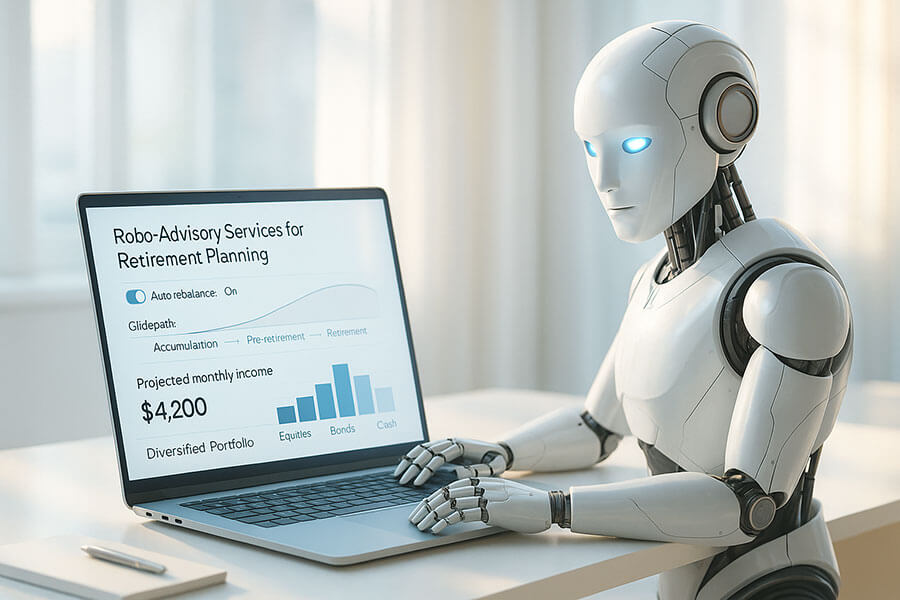

At its core, a robo-advisor serves as a digital wealth management platform that provides automated, algorithm-driven financial planning services with minimal human supervision. These platforms collect information about clients’ financial situations and future goals through online questionnaires, then use this data to offer advice and automatically invest client assets in diversified portfolios tailored to individual risk tolerances and retirement timelines. The automation extends beyond initial portfolio construction to encompass ongoing management activities such as rebalancing, tax-loss harvesting, and strategic asset allocation adjustments as market conditions change and retirement approaches. This technological innovation has democratized access to sophisticated investment strategies that were traditionally the domain of wealthy investors who could afford personal financial advisors charging substantial fees for their expertise and time. The sophistication of these platforms continues to evolve rapidly, incorporating advances in behavioral finance, predictive analytics, and personalization technologies that enable increasingly nuanced and effective retirement planning strategies tailored to individual circumstances and preferences.

The significance of robo-advisory services in retirement planning cannot be overstated, particularly as we face a global retirement crisis characterized by inadequate savings, longer life expectancies, and the decline of traditional pension systems. These platforms address several critical challenges simultaneously: they lower the barriers to entry for retirement investing, reduce the costs associated with professional portfolio management, and eliminate many of the behavioral biases that lead to poor investment decisions. For the generation of workers who will rely primarily on defined contribution plans and personal savings for retirement security, robo-advisors offer a structured, disciplined approach to long-term wealth accumulation that adapts automatically to changing life circumstances and market conditions without requiring constant attention or expertise from the investor. The psychological benefits of automated investing should not be underestimated either, as these platforms remove the emotional stress and decision fatigue associated with managing retirement portfolios, allowing individuals to focus on their careers and lives while their financial future is systematically secured through proven investment strategies.

The transformation extends beyond individual investors to reshape the entire retirement planning ecosystem, influencing how employers structure retirement benefits, how financial institutions deliver services, and how regulators approach investor protection in an increasingly digital world. Employers are increasingly partnering with robo-advisory platforms to provide comprehensive retirement planning services to their employees, recognizing that financial wellness directly impacts productivity, retention, and overall workforce satisfaction. Traditional financial institutions have been forced to reimagine their service models, either developing their own robo-advisory capabilities or acquiring innovative startups to remain competitive in a rapidly evolving marketplace where clients expect digital-first, low-cost, and highly personalized services. This widespread adoption and integration of robo-advisory services into mainstream financial services suggests that automated investment management is not merely a temporary disruption but rather a fundamental evolution in how retirement planning services are conceived, delivered, and experienced by millions of people worldwide.

Understanding Robo-Advisory Services

Robo-advisory services represent a fundamental reimagining of how investment management and financial planning services are delivered to consumers, combining decades of financial theory with cutting-edge technology to create intelligent systems capable of managing complex investment portfolios. These platforms operate on the principle that successful retirement investing doesn’t require constant human intervention but rather systematic application of proven investment strategies, disciplined rebalancing, and consistent adherence to long-term financial plans. The sophistication of modern robo-advisors extends far beyond simple automation; they incorporate dynamic risk assessment models, predictive analytics, and adaptive algorithms that learn from market patterns and individual investor behaviors to optimize portfolio performance while maintaining appropriate risk levels throughout the retirement planning journey.

The architecture of robo-advisory platforms integrates multiple technological components working in harmony to deliver comprehensive wealth management services. At the foundation lies the client interface, typically a web or mobile application where investors complete detailed questionnaires about their financial goals, risk tolerance, investment timeline, and current financial situation. This information feeds into sophisticated profiling algorithms that categorize investors and match them with appropriate investment strategies. The investment engine, powered by quantitative models and optimization algorithms, then constructs diversified portfolios using exchange-traded funds (ETFs) or other low-cost investment vehicles, selecting specific assets and weightings based on modern portfolio theory principles and the individual’s risk profile. Continuous monitoring systems track portfolio performance, market conditions, and client circumstances, triggering automatic adjustments when predetermined thresholds are crossed or when rebalancing is needed to maintain target allocations.

Core Technology and Algorithms

The technological foundation of robo-advisory services rests on sophisticated algorithms that synthesize multiple disciplines including financial economics, computer science, and behavioral finance to create intelligent investment management systems. Modern Portfolio Theory, developed by Harry Markowitz and refined over decades, provides the mathematical framework for constructing efficient portfolios that maximize expected returns for a given level of risk. Robo-advisors implement these principles through optimization algorithms that analyze thousands of potential portfolio combinations, considering factors such as historical returns, volatility, correlation coefficients, and forward-looking market expectations to identify optimal asset allocations. These systems go beyond simple mean-variance optimization to incorporate more advanced concepts such as Black-Litterman models, which blend market equilibrium returns with investor views, and factor-based investing strategies that target specific risk premiums across asset classes. The implementation of these theoretical concepts in practical investment management requires sophisticated computational infrastructure capable of processing vast amounts of market data in real-time, executing complex calculations instantaneously, and adapting to changing market conditions with precision that would be impossible for human advisors to replicate consistently.

Machine learning and artificial intelligence capabilities have elevated robo-advisory services from rule-based systems to adaptive platforms capable of learning and improving over time. Natural language processing enables these platforms to analyze vast amounts of financial news, earnings reports, and economic data to gauge market sentiment and identify potential risks or opportunities. Deep learning neural networks process historical market data to identify patterns and relationships that might not be apparent through traditional statistical analysis, helping to refine asset allocation models and improve risk prediction accuracy. Reinforcement learning algorithms optimize trading strategies by learning from past decisions and their outcomes, continuously refining execution algorithms to minimize transaction costs and maximize tax efficiency. These AI-driven enhancements allow robo-advisors to provide increasingly personalized and sophisticated investment management services while maintaining the scalability and cost-effectiveness that make them accessible to mass-market investors. The integration of ensemble learning methods combines multiple algorithmic approaches to create more robust and reliable investment strategies that perform well across various market conditions, reducing the risk of model overfitting and improving long-term performance stability.

The algorithmic rebalancing mechanisms employed by robo-advisors represent a critical technological advantage over traditional investment management approaches. These systems continuously monitor portfolio allocations across multiple dimensions, including asset class weights, geographic exposure, sector concentration, and factor tilts, comparing actual positions against target allocations established during the portfolio construction phase. When deviations exceed predetermined thresholds, which might be triggered by market movements, dividend payments, or client deposits and withdrawals, the rebalancing algorithm calculates the optimal trades needed to restore target allocations while minimizing transaction costs and tax implications. Advanced robo-advisors employ dynamic rebalancing strategies that consider market volatility, correlation changes, and momentum factors to determine optimal rebalancing frequencies and thresholds, avoiding unnecessary trading during periods of high market noise while ensuring portfolios don’t drift too far from their intended risk profiles during trending markets. The sophistication of these rebalancing algorithms extends to consideration of tax implications, with systems capable of coordinating rebalancing activities with tax-loss harvesting opportunities to maximize after-tax returns while maintaining desired risk exposures.

The security and reliability infrastructure underlying robo-advisory platforms represents another crucial technological component that enables these services to manage billions of dollars in retirement assets. These platforms employ military-grade encryption protocols to protect sensitive financial data, multi-factor authentication systems to prevent unauthorized access, and redundant data storage across geographically distributed servers to ensure business continuity even in the face of natural disasters or cyber attacks. Real-time monitoring systems detect and respond to potential security threats, unusual trading patterns, or system anomalies that could indicate technical problems or malicious activity. The integration with established custodial institutions and clearing houses ensures that client assets are properly segregated and protected, while automated compliance monitoring systems ensure adherence to regulatory requirements across multiple jurisdictions, adapting to changing regulations without manual intervention.

Evolution and Market Growth

The evolution of robo-advisory services traces back to the aftermath of the 2008 financial crisis, when a confluence of factors created the perfect conditions for disrupting traditional wealth management. The crisis exposed widespread conflicts of interest in the financial advisory industry, eroded trust in traditional financial institutions, and highlighted the need for more transparent, cost-effective investment solutions. Simultaneously, advances in cloud computing, API development, and mobile technology made it possible to deliver sophisticated financial services directly to consumers without the overhead of traditional brick-and-mortar operations. The first generation of robo-advisors, launched between 2008 and 2010 by pioneers like Betterment and Wealthfront, focused primarily on simple portfolio construction and automated rebalancing, targeting tech-savvy millennials who were comfortable with digital-only services and skeptical of traditional financial advisors. These early platforms faced significant challenges in gaining consumer trust, navigating regulatory requirements, and achieving the scale necessary for profitability, with many skeptics dismissing them as toys for young investors rather than serious alternatives to traditional wealth management.

The robo-advisory industry has experienced explosive growth, evolving from a niche service for early adopters to a mainstream financial product offered by both innovative startups and established financial institutions. Assets under management by robo-advisors globally have grown from virtually nothing in 2010 to over $2.9 trillion by the end of 2024, with projections suggesting this figure could exceed $5 trillion by 2027. This growth has been driven by several factors including increasing consumer comfort with digital financial services, the maturation of the millennial generation into their peak earning years, and the entry of traditional financial institutions into the space with hybrid models that combine automated investment management with human advisory services. The competitive landscape has evolved from a handful of pure-play robo-advisors to a diverse ecosystem that includes independent platforms, bank-affiliated services, brokerage-based offerings, and hybrid models that blend human and algorithmic advice. The proliferation of robo-advisory services has created a virtuous cycle of innovation, competition, and improvement that benefits consumers through better features, lower costs, and more sophisticated investment strategies.

The sophistication and capabilities of robo-advisory platforms have expanded dramatically since their inception, evolving from basic portfolio management tools to comprehensive financial planning platforms. Early robo-advisors primarily offered simple strategic asset allocation based on age and risk tolerance, using a limited selection of broad market ETFs to construct diversified portfolios. Today’s platforms incorporate sophisticated features such as direct indexing, which allows for greater customization and tax optimization, ESG (Environmental, Social, and Governance) investing options that align portfolios with personal values, and multi-goal planning capabilities that optimize for various financial objectives simultaneously. The integration of banking services, including high-yield cash accounts, debit cards, and lending products, has transformed many robo-advisors into comprehensive digital wealth management platforms that address multiple aspects of clients’ financial lives, creating sticky relationships that extend beyond simple investment management. The evolution toward more sophisticated services reflects both technological advancement and a deeper understanding of client needs, with platforms increasingly focusing on holistic financial wellness rather than narrow investment management.

The geographical expansion of robo-advisory services has transformed retirement planning on a global scale, with platforms adapting to local regulations, investment products, and cultural preferences across different markets. European markets have seen particularly strong adoption, with countries like the United Kingdom and Germany developing robust robo-advisory ecosystems that cater to local retirement planning needs while complying with stringent regulatory requirements. Asian markets, particularly China and Japan, have witnessed explosive growth in robo-advisory adoption, driven by high smartphone penetration, digital-native populations, and government initiatives to address retirement savings gaps. The cross-pollination of ideas and technologies across global markets has accelerated innovation, with successful features and strategies quickly spreading across platforms and regions. This global expansion has also highlighted the importance of localization, as platforms must adapt their investment strategies, user interfaces, and communication styles to resonate with diverse cultural attitudes toward money, retirement, and technology.

How Robo-Advisors Transform Retirement Planning

The transformation of retirement planning through robo-advisory services represents a fundamental shift in how individuals approach long-term wealth accumulation and financial security in their later years. Traditional retirement planning often suffered from several critical shortcomings including high costs that eroded returns over decades, inconsistent advice quality depending on the advisor’s expertise and incentives, and limited accessibility for those without substantial assets. Robo-advisors address these challenges by providing consistent, evidence-based investment strategies that automatically adapt to changing circumstances without the emotional biases and conflicts of interest that can compromise human decision-making. The systematic nature of algorithmic retirement planning ensures that every investor receives institutional-quality portfolio management, regardless of account size, while the automated execution eliminates the procrastination and inertia that prevent many people from taking necessary actions to secure their financial future.

The integration of sophisticated retirement planning tools within robo-advisory platforms has revolutionized how individuals visualize and work toward their retirement goals. These platforms employ Monte Carlo simulations that run thousands of potential market scenarios to calculate the probability of achieving specific retirement income targets, providing users with realistic assessments of their retirement readiness rather than simplistic linear projections. Dynamic planning algorithms adjust savings recommendations and investment strategies based on changing life circumstances such as salary increases, family additions, or unexpected expenses, ensuring that retirement plans remain relevant and achievable despite life’s uncertainties. The continuous optimization of retirement portfolios considering factors such as Social Security optimization, tax-efficient withdrawal strategies, and longevity risk management creates comprehensive retirement solutions that address the full spectrum of challenges retirees face, from accumulation through decumulation phases.

Automated Portfolio Management

Automated portfolio management through robo-advisory platforms revolutionizes the retirement planning process by implementing sophisticated investment strategies that would be impractical or impossibly expensive for individual investors to execute manually. These systems construct globally diversified portfolios using modern portfolio theory principles, typically allocating assets across domestic and international equities, government and corporate bonds, real estate investment trusts, commodities, and alternative investments to achieve optimal risk-adjusted returns for each investor’s specific retirement timeline and risk tolerance. The selection of specific investment vehicles, predominantly low-cost index ETFs, is based on rigorous quantitative analysis considering factors such as expense ratios, tracking error, liquidity, and tax efficiency, ensuring that investors capture market returns while minimizing the drag from fees and taxes that can significantly impact long-term wealth accumulation.

The continuous monitoring and adjustment capabilities of automated portfolio management systems ensure that retirement portfolios remain optimally positioned regardless of market conditions or changing investor circumstances. These platforms employ sophisticated risk management algorithms that dynamically adjust portfolio exposures based on market volatility, correlation changes, and macroeconomic indicators, potentially reducing downside risk during market turbulence while maintaining upside participation during bull markets. Tax-loss harvesting algorithms continuously scan portfolios for opportunities to realize losses that can offset capital gains or ordinary income, potentially adding significant value over time through tax savings that compound throughout the accumulation phase. The automation of dividend reinvestment, cash sweep operations, and strategic asset location decisions across taxable and tax-advantaged accounts maximizes the efficiency of every dollar invested, ensuring that retirement savings grow as efficiently as possible without requiring constant attention or expertise from the investor.

The scalability and consistency of automated portfolio management deliver institutional-quality investment management to retirement savers regardless of account size or investment knowledge. Unlike human advisors who might manage hundreds of accounts with varying degrees of attention and expertise, robo-advisory platforms can simultaneously optimize millions of portfolios with the same level of precision and care, ensuring that every investor benefits from best practices in portfolio construction and management. The elimination of human emotion from investment decisions prevents costly behavioral mistakes such as panic selling during market downturns or excessive risk-taking during bull markets, maintaining disciplined adherence to long-term investment strategies that are essential for successful retirement planning. This systematic approach to portfolio management also ensures compliance with fiduciary standards, as every investment decision is based on quantitative models and documented processes rather than subjective judgments or conflicts of interest that might influence human advisors.

Life-Stage Investment Adjustments

The implementation of life-stage investment adjustments through robo-advisory platforms represents one of the most significant innovations in automated retirement planning, addressing the critical need for portfolios to evolve as investors progress through different phases of their lives and careers. These sophisticated systems employ glide path strategies that systematically shift asset allocations from growth-oriented investments to more conservative holdings as retirement approaches, but unlike static target-date funds, robo-advisors can customize these transitions based on individual circumstances such as risk tolerance changes, wealth accumulation progress, and expected retirement lifestyle requirements. The algorithms consider multiple variables simultaneously including current age, planned retirement date, existing savings, contribution rates, and outside assets to create personalized glide paths that optimize the probability of achieving specific retirement income goals while managing sequence-of-returns risk that can devastate portfolios in the years immediately before and after retirement.

The dynamic nature of life-stage adjustments in robo-advisory platforms extends beyond simple age-based reallocation to incorporate real-time adaptations based on changing personal circumstances and market conditions. When investors experience major life events such as marriage, divorce, job changes, inheritances, or health issues, the platforms can immediately recalibrate investment strategies to reflect new financial realities and adjusted retirement goals. Market-aware algorithms modify glide paths based on valuation metrics, interest rate environments, and economic indicators, potentially accelerating or decelerating the shift to conservative investments depending on market conditions and the investor’s funded status relative to retirement goals. These systems also incorporate longevity risk management, adjusting strategies based on health data, family history, and actuarial projections to ensure portfolios can sustain retirement income throughout increasingly longer lifespans, potentially maintaining higher equity allocations for investors with greater longevity expectations or substantial wealth relative to spending needs.

The sophistication of modern robo-advisory platforms in managing life-stage transitions includes consideration of complex factors that traditional approaches often overlook or simplify. The algorithms account for human capital considerations, recognizing that younger investors with stable careers in growing industries can tolerate more investment risk than those in declining industries or with variable income streams. Social Security optimization is integrated into the life-stage adjustment process, with algorithms calculating optimal claiming strategies and adjusting portfolio allocations to coordinate with expected benefit streams. The platforms also consider tax implications of life-stage transitions, strategically locating assets across taxable and tax-advantaged accounts to maximize after-tax wealth accumulation and retirement income, while planning for required minimum distributions and potential estate planning considerations that become increasingly important as investors approach and enter retirement.

Benefits and Implementation

The implementation of robo-advisory services for retirement planning delivers transformative benefits that extend far beyond simple cost savings, fundamentally democratizing access to sophisticated investment strategies and professional portfolio management. These platforms have eliminated traditional barriers to quality financial advice, making institutional-caliber investment management available to individuals with modest account balances who were previously underserved or completely excluded from traditional wealth management services. The consistency and objectivity of algorithmic advice ensures that every investor receives recommendations based on empirical evidence and proven investment principles rather than the varying quality and potential conflicts of interest that can influence human advisors. The transparency of robo-advisory platforms, with clear fee structures, documented investment methodologies, and real-time reporting, empowers investors to understand exactly how their money is being managed and what they’re paying for services, fostering greater trust and engagement in the retirement planning process.

The practical implementation of robo-advisory services has proven remarkably successful across diverse demographic groups and economic circumstances, with platforms adapting their services to meet the unique needs of different investor segments. Young professionals entering the workforce benefit from automated savings programs that gradually increase contribution rates as salaries grow, building retirement savings habits without requiring constant decision-making or willpower. Mid-career investors with complex financial situations utilize sophisticated planning tools that optimize across multiple goals including retirement, education funding, and major purchases, with algorithms automatically prioritizing and balancing competing objectives. Pre-retirees and retirees leverage advanced features such as tax-efficient withdrawal strategies, Social Security optimization, and dynamic spending rules that adjust for market conditions and longevity risk, ensuring sustainable income throughout retirement while maximizing wealth transfer to heirs.

Cost Efficiency and Accessibility

The cost efficiency of robo-advisory services has fundamentally disrupted traditional wealth management economics, reducing investment management fees by an order of magnitude while simultaneously improving service quality and accessibility. Traditional financial advisors typically charge annual fees ranging from 1% to 2% of assets under management, with additional costs for fund expenses, trading commissions, and financial planning services that can push total costs above 2% annually. Robo-advisors have compressed these fees to typically 0.25% to 0.50% annually for comprehensive investment management services, including portfolio construction, rebalancing, tax-loss harvesting, and financial planning tools, with many platforms offering fee waivers for small accounts or providing basic services at no cost. The compound effect of these fee savings over a multi-decade retirement planning horizon can result in hundreds of thousands of dollars in additional retirement wealth, as lower fees mean more money remains invested and compounding over time rather than being extracted as compensation for advisory services.

The accessibility revolution sparked by robo-advisory platforms extends beyond mere cost considerations to encompass the complete democratization of professional investment management services. Traditional wealth management firms typically require minimum account balances of $250,000 to $1 million or more, effectively excluding the vast majority of retirement savers who most need professional guidance during their wealth accumulation years. Robo-advisors have obliterated these barriers, with many platforms accepting accounts with no minimum balance or requiring just $500 to get started, making professional portfolio management accessible to young workers just beginning their careers, gig economy participants with variable incomes, and lower-income individuals who were completely shut out of traditional advisory services. The digital-first nature of these platforms ensures 24/7 accessibility from anywhere with an internet connection, eliminating geographical barriers and the need for in-person meetings that can be intimidating or inconvenient for many investors.

The comprehensive nature of services included in low-cost robo-advisory packages delivers exceptional value compared to traditional alternatives, with features that would typically require expensive specialists or sophisticated software now available to all investors. Tax-loss harvesting, once reserved for ultra-high-net-worth investors due to its complexity and labor intensity, is now automatically implemented for accounts of all sizes, potentially generating tax savings that exceed the annual advisory fees. Advanced planning tools including retirement calculators, Monte Carlo simulations, and goal-based planning systems that would cost thousands of dollars as standalone software or consulting services are integrated into robo-advisory platforms at no additional charge. The inclusion of banking services, budgeting tools, and consolidated financial reporting creates comprehensive financial management ecosystems that provide value far beyond simple investment management, helping investors optimize all aspects of their financial lives while working toward retirement goals.

Real-World Case Studies

The transformation of Vanguard Personal Advisor Services into a hybrid robo-advisory platform demonstrates the powerful impact of automated investment management on retirement planning outcomes at scale. Launched in 2020 and refined through 2024, Vanguard’s platform now manages over $270 billion in assets for more than 1.5 million clients, providing algorithm-driven portfolio management supplemented by access to human advisors for complex planning needs. Analysis of client outcomes from 2022 through 2024 reveals that investors using the automated rebalancing and tax-loss harvesting features achieved approximately 0.85% higher annual returns compared to self-directed investors with similar risk profiles, translating to significantly improved retirement readiness scores. The platform’s systematic approach to retirement planning helped clients increase their average savings rates from 6.8% to 9.2% over a two-year period through automated contribution escalation and behavioral nudges, with particular success among participants in employer-sponsored retirement plans who linked their 401(k) accounts for holistic portfolio management.

Betterment’s comprehensive retirement planning platform provides compelling evidence of how pure-play robo-advisors can deliver superior outcomes for everyday retirement savers. A longitudinal study of Betterment clients from January 2022 through December 2024 revealed that users of the platform’s RetireGuide feature, which provides personalized retirement planning projections and recommendations, increased their monthly contributions by an average of 36% after receiving automated advice about retirement savings gaps. The platform’s tax-coordinated portfolio strategy, which optimizes asset location across taxable and tax-advantaged accounts, generated an estimated 0.48% in additional annual after-tax returns for clients with both account types, while the automated tax-loss harvesting feature produced average annual tax savings of $1,847 per client with taxable accounts exceeding $50,000. During the market volatility of 2022, Betterment’s algorithmic rebalancing and behavioral coaching features prevented 78% of clients from making emotionally-driven portfolio changes, maintaining strategic allocations that positioned them for the subsequent market recovery in 2023 and 2024.

Charles Schwab Intelligent Portfolios, which launched its enhanced retirement planning features in 2022, illustrates how established financial institutions have successfully integrated robo-advisory capabilities to serve mass-affluent retirees and pre-retirees. The platform’s implementation of dynamic spending strategies for retirees, which automatically adjust withdrawal rates based on portfolio performance and longevity projections, helped clients maintain sustainable retirement income even during the challenging market conditions of 2022. Data from Schwab indicates that retirees using the automated withdrawal management system experienced 23% less income volatility compared to those using fixed withdrawal rates, while maintaining higher average portfolio balances three years into retirement. The integration of Social Security optimization algorithms helped clients identify claiming strategies that increased expected lifetime benefits by an average of $47,000, with the platform automatically adjusting portfolio withdrawal strategies to coordinate with benefit timing decisions, demonstrating the sophisticated retirement planning capabilities that robo-advisors can deliver at scale.

Challenges and Future Outlook

Despite the remarkable advancement and adoption of robo-advisory services for retirement planning, significant challenges remain that could impact their effectiveness and growth trajectory in the coming years. The inherent limitations of algorithmic decision-making become apparent during unprecedented market events or economic conditions that fall outside historical patterns used to train these systems. The COVID-19 pandemic and subsequent market volatility in 2020, followed by the inflation surge and interest rate adjustments of 2022-2023, tested the adaptability of robo-advisory algorithms in ways that revealed both strengths and weaknesses in automated investment management. While these platforms generally maintained disciplined investment approaches that benefited long-term investors, some struggled to communicate effectively with anxious clients or adapt quickly to rapidly changing economic paradigms that diverged from historical norms. The challenge of building truly adaptive algorithms that can handle black swan events while maintaining the consistency and objectivity that makes robo-advisors valuable remains an ongoing area of development and concern.

The regulatory landscape for robo-advisory services continues to evolve as regulators grapple with the unique challenges posed by algorithmic investment advice and the fiduciary responsibilities of automated platforms. The Securities and Exchange Commission has increased scrutiny of robo-advisors’ compliance with investment adviser regulations, particularly regarding the suitability of algorithmic recommendations, disclosure of conflicts of interest, and the adequacy of customer profiling questionnaires that drive investment decisions. The Department of Labor’s evolving stance on fiduciary standards for retirement advice has created uncertainty about how robo-advisors serving 401(k) participants and IRA investors must structure their services and fee arrangements. International regulatory divergence complicates the global expansion of robo-advisory platforms, with different jurisdictions imposing varying requirements for algorithmic transparency, data protection, and cross-border service provision that could fragment the market and increase compliance costs.

The human element remains a critical consideration in the future evolution of robo-advisory services, as pure algorithmic approaches may struggle to address the full spectrum of emotional, behavioral, and complex planning needs that arise in retirement planning. Research indicates that while robo-advisors excel at portfolio management and systematic planning, many investors still desire human interaction during major life events, market crises, or when making irreversible retirement decisions such as pension elections or Social Security claiming strategies. The emergence of hybrid models that combine algorithmic portfolio management with human advisory services reflects this reality, but creating seamless integration between automated and human elements while maintaining cost efficiency presents operational and technological challenges. The question of how to scale human expertise efficiently while preserving the cost advantages and accessibility of robo-advisory platforms will likely shape the industry’s evolution over the next decade.

Looking toward the future, the integration of artificial intelligence advancements, particularly large language models and generative AI, promises to dramatically enhance the capabilities of robo-advisory platforms for retirement planning. Next-generation platforms are beginning to incorporate conversational AI interfaces that can engage in nuanced discussions about retirement goals, explain complex financial concepts in accessible terms, and provide personalized guidance that adapts to individual communication styles and knowledge levels. The development of explainable AI techniques will address current transparency concerns by enabling robo-advisors to clearly articulate the reasoning behind investment recommendations and planning decisions, building greater trust and understanding among users. Advances in predictive analytics and machine learning will enable more sophisticated modeling of individual behavior patterns, life events, and retirement needs, allowing platforms to proactively identify planning opportunities and risks before they become critical issues.

The convergence of robo-advisory services with broader financial technology ecosystems will create comprehensive digital wealth management platforms that address every aspect of retirement planning and financial life management. Integration with employer benefits platforms will enable holistic optimization across 401(k) plans, health savings accounts, stock compensation, and other workplace benefits, maximizing the value of total compensation packages for retirement security. Open banking initiatives and API standardization will facilitate seamless aggregation of financial data across institutions, providing robo-advisors with complete pictures of clients’ financial situations to enable truly comprehensive planning. The incorporation of alternative data sources such as spending patterns, health metrics, and career trajectories will enhance the personalization and accuracy of retirement projections and recommendations, though privacy and ethical considerations will need careful navigation.

The democratization of sophisticated investment strategies through robo-advisory platforms will likely accelerate as technology costs continue to decline and capabilities expand. Direct indexing, which allows investors to own individual securities rather than funds for greater customization and tax efficiency, is becoming economically viable for smaller accounts through fractional share trading and automated management systems. Access to alternative investments such as private equity, real estate, and cryptocurrencies through automated platforms will provide diversification opportunities previously reserved for institutional and ultra-high-net-worth investors. The development of personalized liability-driven investment strategies that match retirement assets with specific future spending needs will bring institutional pension management techniques to individual retirement savers, potentially improving retirement security through better risk management.

Final Thoughts

The emergence and evolution of robo-advisory services represents a transformative force in retirement planning that extends far beyond simple automation of investment processes, fundamentally reshaping how millions of individuals approach financial security in their later years. This technological revolution arrives at a critical moment in history when traditional pension systems are disappearing, life expectancies are extending, and the responsibility for retirement planning has shifted almost entirely to individuals who often lack the expertise, time, or resources to navigate complex financial markets effectively. The systematic, disciplined, and democratized approach that robo-advisors bring to retirement planning offers hope that technology can help bridge the growing retirement savings gap that threatens the financial security of current and future generations of retirees.

The intersection of artificial intelligence and financial planning embodied in robo-advisory platforms demonstrates how technology can serve as a powerful force for financial inclusion and social equity. By eliminating minimum balance requirements, reducing fees to fractional percentages, and providing institutional-quality investment management to anyone with internet access, these platforms have torn down barriers that kept professional financial advice exclusive to the wealthy. This democratization extends beyond simple access to encompass the quality and consistency of advice, ensuring that a teacher in rural America receives the same sophisticated portfolio management and planning tools as a technology executive in Silicon Valley, albeit scaled to their different financial circumstances and goals.

The broader implications of widespread robo-advisory adoption for retirement planning touch on fundamental questions about the role of technology in human decision-making and the nature of financial advice itself. As algorithms become increasingly sophisticated in their ability to model complex financial scenarios, optimize for multiple objectives, and adapt to changing circumstances, we must consider what aspects of retirement planning require human judgment, empathy, and wisdom that machines cannot replicate. The evolution toward hybrid models suggests that the future lies not in choosing between human and artificial intelligence but in finding optimal combinations that leverage the strengths of both to deliver comprehensive, accessible, and effective retirement planning solutions.

Looking forward, the continued advancement of robo-advisory services will likely reshape not just how we save and invest for retirement but how we conceptualize retirement itself in an era of longer lifespans, changing work patterns, and evolving social structures. As these platforms become more sophisticated in modeling different retirement scenarios and optimizing for various lifestyle objectives, they may enable more flexible and personalized approaches to retirement that move beyond the traditional binary of working versus retired. The integration of health data, longevity projections, and lifestyle preferences could enable truly personalized retirement planning that adapts to individual circumstances and aspirations rather than forcing everyone into standardized retirement models based on chronological age.

The responsibility that comes with automating financial decisions affecting millions of people’s retirement security cannot be understated, requiring continuous vigilance from platform providers, regulators, and users themselves to ensure these powerful tools are used ethically and effectively. As robo-advisory platforms become the primary interface through which many people interact with financial markets and make critical retirement planning decisions, questions of algorithmic transparency, data privacy, and fiduciary responsibility become paramount. The challenge for the industry will be maintaining the innovation and efficiency that makes robo-advisors valuable while building in appropriate safeguards and human oversight to protect vulnerable investors and maintain market integrity.

The promise of robo-advisory services for retirement planning ultimately lies in their potential to help ordinary individuals achieve financial security and dignity in retirement through systematic, disciplined, and intelligent investment management that adapts to their unique circumstances and goals. As these platforms continue to evolve and improve, incorporating new technologies and addressing current limitations, they offer hope that the retirement crisis facing many developed nations can be mitigated through the thoughtful application of technology to one of humanity’s most fundamental challenges: ensuring financial security in our later years.

FAQs

- What exactly is a robo-advisor and how does it differ from a traditional financial advisor?

A robo-advisor is a digital platform that provides automated investment management services using algorithms and artificial intelligence to construct and manage investment portfolios. Unlike traditional financial advisors who personally meet with clients and make subjective decisions, robo-advisors use mathematical models and systematic rules to manage investments consistently and objectively, typically at a much lower cost. - How much money do I need to start using a robo-advisor for retirement planning?

Many robo-advisors have eliminated minimum balance requirements entirely or set them as low as $500, making them accessible to beginning investors. Some platforms like Betterment and Wealthfront allow you to start with any amount, while others like Vanguard Personal Advisor Services require $50,000 for their hybrid human-robo service. - Are robo-advisors safe and secure for managing retirement savings?

Robo-advisors operated by registered investment advisers are regulated by the SEC and must adhere to strict security standards and fiduciary duties. They use bank-level encryption, two-factor authentication, and are typically members of SIPC, which protects securities up to $500,000 if the firm fails, though this doesn’t protect against market losses. - Can a robo-advisor really replace human financial advice for retirement planning?

While robo-advisors excel at portfolio management, rebalancing, and systematic planning, they may not fully replace human advisors for complex situations involving estate planning, tax strategies, or major life transitions. Many platforms now offer hybrid models that combine automated investing with access to human advisors when needed. - How do robo-advisors handle market downturns and protect retirement portfolios?

Robo-advisors use diversification, automatic rebalancing, and age-appropriate asset allocation to manage risk during market downturns. They maintain disciplined investment strategies without emotional reactions, though they cannot prevent losses during market declines, focusing instead on long-term recovery and growth. - What are the typical fees charged by robo-advisors compared to traditional advisors?

Robo-advisors typically charge 0.25% to 0.50% of assets under management annually, compared to 1% to 2% for traditional human advisors. This fee usually includes portfolio management, rebalancing, and tax-loss harvesting, though fund expenses add approximately 0.10% to 0.20% to total costs. - How do robo-advisors determine the right investment strategy for my retirement goals?

Robo-advisors use detailed questionnaires to assess your age, income, retirement timeline, risk tolerance, and financial goals, then apply algorithms based on modern portfolio theory to create personalized investment strategies that automatically adjust as you approach retirement. - Can I use a robo-advisor to manage my 401(k) or just IRA accounts?

While robo-advisors primarily manage individual investment and IRA accounts directly, many platforms now offer 401(k) optimization services that provide recommendations for your employer plan allocations and coordinate overall retirement strategy across all accounts. - What happens to my robo-advisor account if the company goes out of business?

Your investments are held in custody at established financial institutions separate from the robo-advisor company, protected by SIPC insurance up to $500,000. If a robo-advisor fails, your assets remain safe and can be transferred to another broker or advisor. - How do robo-advisors handle tax-loss harvesting and is it worth the added complexity?

Robo-advisors automatically sell investments at a loss to offset capital gains taxes, immediately replacing them with similar investments to maintain portfolio allocation. Studies suggest this feature can add 0.25% to 0.85% in annual after-tax returns, particularly valuable for taxable accounts above $50,000.