The blockchain ecosystem has evolved into a complex landscape of isolated networks, each operating with its own protocols, consensus mechanisms, and native assets. This fragmentation presents one of the most significant challenges facing the widespread adoption of blockchain technology today. Zero-knowledge bridges have emerged as a groundbreaking solution to this challenge, offering a way to connect disparate blockchain networks while preserving the privacy and security that users have come to expect from decentralized systems.

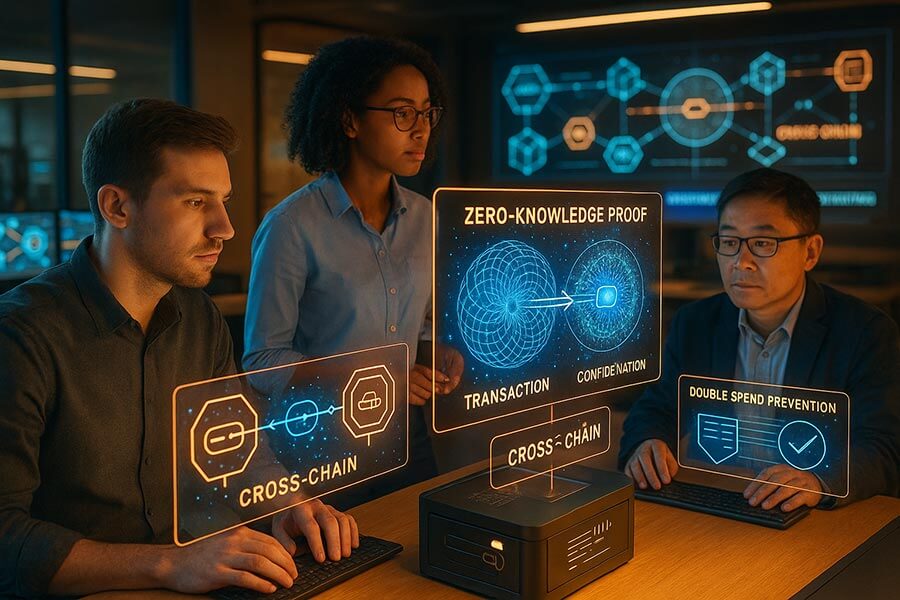

The concept of blockchain interoperability extends far beyond simple asset transfers between networks. Traditional approaches to cross-chain communication have often required users to trust intermediaries or reveal transaction details that could compromise their privacy. Zero-knowledge bridges represent a paradigm shift in how we approach these challenges, utilizing advanced cryptographic techniques to prove the validity of transactions without revealing their underlying details. This revolutionary approach maintains the decentralized ethos of blockchain technology while addressing the practical needs of users who operate across multiple networks.

Zero-knowledge proofs, the cryptographic foundation of these bridges, enable a prover to demonstrate knowledge of certain information without revealing the information itself. When applied to blockchain interoperability, this technology allows bridges to verify that assets have been properly locked on one chain and can be safely released on another, all without exposing sensitive transaction data. This privacy-preserving characteristic becomes increasingly important as blockchain technology moves into mainstream financial applications where confidentiality is not just desired but often legally required.

Understanding Blockchain Interoperability Fundamentals

Blockchain interoperability represents the capability of different blockchain networks to exchange information, assets, and value in a seamless and secure manner. This fundamental concept addresses one of the most pressing limitations in the current blockchain landscape where each network operates as an independent silo, unable to directly communicate or share resources with others. Without effective interoperability solutions, users and developers are forced to choose between networks rather than leveraging the combined strengths of multiple platforms.

The technical foundations of blockchain interoperability involve creating mechanisms that can verify and relay information between networks that may have completely different architectures, consensus mechanisms, and data structures. This challenge is compounded by the fact that blockchains are designed to be self-contained systems with their own rules and validation processes. The evolution from simple token swaps to complex cross-chain applications demonstrates the growing sophistication of interoperability solutions and their increasing importance in the blockchain ecosystem.

The Challenge of Isolated Blockchain Networks

The isolation of blockchain networks stems from their fundamental design principles, which prioritize security and consensus within a single network over external communication. Each blockchain maintains its own state, validates transactions according to its own rules, and operates independently of external systems. This isolation creates significant friction for users who need to move assets or data between different networks, often requiring them to rely on centralized exchanges or other intermediaries that introduce counterparty risk and potential points of failure.

The practical implications of blockchain isolation extend beyond mere inconvenience for users. Developers building decentralized applications face limitations in accessing liquidity, users, and functionality spread across different networks. This fragmentation also leads to inefficient capital allocation, as assets become trapped within specific ecosystems rather than flowing freely to where they can be most productively employed. Organizations attempting to implement blockchain solutions often find themselves having to choose between competing networks, each with its own trade-offs in terms of speed, cost, security, and functionality. The lack of interoperability means that organizations may need to maintain multiple blockchain implementations or accept the limitations of a single platform.

Traditional Cross-Chain Communication Methods

Traditional approaches to cross-chain communication have evolved through several generations of technology, each attempting to address the fundamental challenge of enabling different blockchains to interact. Atomic swaps allow users to exchange assets between different blockchains without trusting an intermediary, using hash time-locked contracts to ensure that either both parties receive their assets or neither does. While atomic swaps provide a trustless mechanism for asset exchange, they are limited to simple swap operations and cannot support more complex cross-chain interactions.

Centralized exchanges have long served as the de facto solution for moving assets between blockchains, providing liquidity and price discovery while handling the technical complexity. However, this approach fundamentally contradicts the decentralized nature of blockchain technology and introduces significant risks including exchange hacks and regulatory actions. Federation-based bridges and sidechains represent another category of traditional interoperability solutions, where a group of validators manage the movement of assets between chains. These systems typically involve locking assets on one chain and minting representative tokens on another, with the federation responsible for maintaining the peg between the original assets and their representations.

Evolution Toward Privacy-Preserving Solutions

The evolution toward privacy-preserving interoperability solutions reflects a growing recognition that transparency, while valuable for auditability, can be problematic for many blockchain use cases. Early blockchain bridges operated with full transparency, broadcasting all transaction details across multiple networks and creating permanent records of cross-chain movements that could be analyzed by anyone. This transparency enables chain analysis firms and potentially malicious actors to track asset movements across chains, linking addresses and potentially identifying users. The need for privacy in cross-chain transactions became particularly apparent in enterprise use cases where business confidentiality is essential and in personal transactions where users have legitimate privacy concerns.

The development of privacy-preserving bridges has been driven by advances in cryptographic techniques, particularly zero-knowledge proofs, that enable verification without revelation. These technologies allow bridges to prove that certain conditions have been met, such as assets being properly locked on a source chain, without revealing details about the specific transactions or the parties involved. This evolution represents a significant technical achievement, requiring the integration of complex cryptographic protocols with the already challenging task of cross-chain communication. The result is a new generation of bridges that can provide the benefits of interoperability without sacrificing the privacy that many users consider essential.

The transition from transparent to private cross-chain solutions reflects a broader maturation of the blockchain industry’s understanding of privacy requirements. While early blockchain adopters often celebrated radical transparency as a feature, real-world adoption has highlighted the need for selective disclosure and confidentiality in many applications. Privacy-preserving bridges enable use cases that would be impossible with fully transparent systems, such as cross-chain transfers of sensitive financial instruments, private supply chain data, or confidential business transactions that span multiple blockchain networks.

Zero-Knowledge Proofs in Blockchain Technology

Zero-knowledge proofs represent one of the most significant cryptographic innovations in modern computer science, offering the seemingly paradoxical ability to prove knowledge of information without revealing the information itself. In the context of blockchain technology, zero-knowledge proofs enable a new paradigm of privacy-preserving computation where transactions can be validated and consensus can be achieved without exposing sensitive data. The mathematical foundations of zero-knowledge proofs date back to the 1980s, but their practical application to blockchain systems has only become feasible in recent years due to advances in proof generation efficiency and the development of specialized cryptographic frameworks.

The application of zero-knowledge proofs to blockchain systems extends far beyond simple privacy protection. These cryptographic techniques enable scalability improvements through rollups, enhance the security of cross-chain bridges, and facilitate complex multi-party computations where participants need to collaborate without revealing their individual inputs. In the context of blockchain interoperability, zero-knowledge proofs provide the crucial capability to verify that assets have been properly handled on one chain without revealing transaction details to validators on another chain. This capability transforms bridges from simple message-passing systems into sophisticated protocols that can maintain privacy while ensuring security across multiple independent networks.

Fundamentals of Zero-Knowledge Cryptography

Zero-knowledge cryptography operates on three fundamental principles that must be satisfied for a proof to be considered valid: completeness, soundness, and zero-knowledge. Completeness ensures that if a statement is true, an honest prover can convince an honest verifier of its truth. Soundness guarantees that if a statement is false, no dishonest prover can convince an honest verifier that it is true, except with negligible probability. The zero-knowledge property ensures that the verifier learns nothing beyond the truth of the statement being proved.

To understand how zero-knowledge proofs work in practice, consider the analogy of proving you know the solution to a maze without revealing the path. Instead of showing the actual route through the maze, you could demonstrate your knowledge by consistently entering at the start and emerging at the exit, even when the maze is randomly modified in ways that preserve the solution. This concept translates to blockchain applications where a prover can demonstrate possession of valid transaction data, ownership of assets, or completion of computations without revealing the specific details that would compromise privacy.

The mathematical construction of zero-knowledge proofs involves complex algebraic structures and cryptographic assumptions that ensure the security of the system. Modern zero-knowledge proof systems typically rely on elliptic curve cryptography, polynomial commitments, and various hardness assumptions from computational complexity theory. The practical implementation of zero-knowledge proofs in blockchain systems requires careful consideration of performance trade-offs. Proof generation can be computationally intensive, requiring significant processing power and time, while proof verification is typically very efficient. This asymmetry makes zero-knowledge proofs particularly well-suited for blockchain applications where many nodes need to verify transactions but only a few parties generate proofs.

Types of Zero-Knowledge Proof Systems

Zero-knowledge proof systems have evolved into several distinct categories, each with its own trade-offs in terms of proof size, generation time, verification time, and cryptographic assumptions. ZK-SNARKs represent one of the most widely deployed categories, offering very small proof sizes and fast verification times. The succinct nature of SNARKs makes them ideal for blockchain applications where proof data must be stored on-chain and verified by many nodes. However, SNARKs typically require a trusted setup ceremony where public parameters are generated.

ZK-STARKs address the trusted setup requirement of SNARKs by using publicly verifiable randomness instead of a ceremony-generated common reference string. STARKs offer transparency and post-quantum security but produce larger proofs than SNARKs, which can impact their efficiency in bandwidth-constrained blockchain environments. Bulletproofs represent another category that offers short proofs without requiring a trusted setup, making them suitable for range proofs and other specific applications in blockchain systems.

The choice of zero-knowledge proof system for a blockchain bridge depends on multiple factors including the expected transaction volume, the complexity of cross-chain operations, and the security model of the connected blockchains. Some bridges implement multiple proof systems to provide flexibility and optimize for different use cases, while others focus on a single system that best matches their specific requirements.

Integration with Blockchain Architecture

Integrating zero-knowledge proofs into blockchain architecture requires careful consideration of how proof generation and verification fit into the consensus process and transaction lifecycle. The computational requirements of proof generation often necessitate off-chain computation, where provers generate proofs using private data and submit only the proof and public outputs to the blockchain. This architecture separates the privacy-preserving computation from the public verification, allowing blockchains to maintain their transparency and auditability while enabling private transactions. The integration must also account for the storage requirements of proofs and the gas costs associated with on-chain verification.

The consensus layer of a blockchain must be modified or extended to support zero-knowledge proof verification as part of transaction validation. This typically involves implementing specialized opcodes or precompiled contracts that can efficiently verify proofs within the constraints of blockchain execution environments. The verification logic must be deterministic and efficient enough to be executed by all nodes in the network without creating bottlenecks in block production or validation. Modern blockchains increasingly include native support for zero-knowledge proof verification, recognizing the importance of privacy-preserving applications and the role of zero-knowledge proofs in scaling solutions.

Smart contract platforms face unique challenges in integrating zero-knowledge proofs, as the proof verification must be compatible with the existing execution model and gas metering system. The implementation often involves creating libraries and frameworks that abstract the complexity of proof verification, allowing developers to incorporate zero-knowledge proofs into their applications without deep cryptographic expertise. These frameworks must handle the nuances of different proof systems, manage the lifecycle of proof generation and verification, and provide appropriate interfaces for integration with other blockchain components. The development of standardized interfaces and protocols for zero-knowledge proof integration is ongoing, with efforts to create interoperable systems that can work across different blockchains and proof systems.

Architecture of Zero-Knowledge Bridges

The architecture of zero-knowledge bridges represents a sophisticated integration of cryptographic protocols, distributed systems, and blockchain technology designed to enable secure and private cross-chain asset transfers. These bridges must coordinate activities across multiple independent blockchains while maintaining the security properties of each network and adding privacy guarantees through zero-knowledge proofs. The architectural design must address numerous challenges including different block times, finality mechanisms, and consensus protocols across chains, while ensuring that the bridge itself does not become a centralized point of failure or trust. Modern zero-knowledge bridges employ layered architectures that separate concerns such as proof generation, relay operations, and settlement, allowing for modularity and upgradability.

The technical architecture of a zero-knowledge bridge typically consists of several key components working in concert to facilitate cross-chain transfers. At the core, smart contracts on each connected blockchain handle the locking and releasing of assets, while a proof generation layer creates zero-knowledge proofs attesting to the validity of transfers. A relay network transmits proofs and messages between chains, and verification contracts validate proofs before executing transfers. This architecture must be resilient to various attack vectors including eclipse attacks, censorship, and attempts to generate false proofs. The design must also consider economic incentives to ensure that bridge operators and validators are properly motivated to maintain security and availability.

Core Components and Protocol Design

The core components of a zero-knowledge bridge begin with the source chain contracts that handle asset deposits and generate commitments that can be proven without revealing transaction details. These contracts must implement robust mechanisms for locking assets, generating merkle roots or other accumulator structures, and creating the necessary public inputs for zero-knowledge proof generation. The design of these contracts is critical for security, as they represent the entry point for assets into the bridge system and must prevent double-spending, front-running, and other attacks.

The proof generation infrastructure represents one of the most complex components of a zero-knowledge bridge, requiring significant computational resources and sophisticated software systems. Provers must monitor source chain events, gather the necessary witness data, and generate proofs that attest to valid deposits or burns on the source chain. This process often involves maintaining merkle trees or other cryptographic accumulators, managing nullifier sets to prevent double-spending, and coordinating with other bridge components to ensure timely proof generation.

The relay network serves as the communication layer between blockchains, transmitting proofs and auxiliary data needed for cross-chain transfers. Relayers must monitor multiple blockchains simultaneously, detecting relevant events and ensuring that proofs are submitted to destination chains in a timely manner. The destination chain contracts represent the final component in the bridge architecture, responsible for verifying zero-knowledge proofs and executing asset releases or minting operations. These contracts must implement efficient proof verification algorithms, maintain state consistency with the source chain, and handle edge cases such as proof replay attacks or attempts to claim assets multiple times.

The coordination between these components requires sophisticated protocol design that ensures atomicity and consistency across chains. The protocol must handle various failure scenarios, such as proof generation failures, relay network partitions, or temporary unavailability of either blockchain. Many bridges implement fallback mechanisms and emergency procedures that can be activated in case of detected attacks or system failures.

Privacy-Preserving Asset Transfer Mechanisms

Privacy-preserving asset transfers through zero-knowledge bridges involve sophisticated cryptographic protocols that hide transaction details while maintaining verifiability and preventing double-spending. The process begins when a user initiates a transfer by depositing assets into the bridge contract on the source chain. Instead of publicly recording all transaction details, the bridge generates a cryptographic commitment to the deposit that includes the asset amount, recipient information, and a unique nullifier.

The generation of zero-knowledge proofs for asset transfers involves proving several statements without revealing the underlying data. The prover must demonstrate that they know a valid path in the merkle tree to their commitment, that the commitment has not been previously spent, and that the transfer parameters match the public inputs required by the bridge protocol. The transfer mechanism must also handle the complexity of different asset types and transfer patterns, supporting multiple asset types within a single privacy pool and various transfer patterns including splits and joins.

The privacy guarantees of the transfer mechanism depend on the size and diversity of the anonymity set, which includes all deposits that could potentially be the source of a given withdrawal. The finalization of transfers on the destination chain involves verifying the zero-knowledge proof and executing the asset release or minting operation. The entire process maintains privacy by ensuring that observers cannot link deposits on the source chain to withdrawals on the destination chain.

Security Models and Trust Assumptions

The security model of zero-knowledge bridges encompasses multiple layers of protection against various attack vectors, combining cryptographic security from zero-knowledge proofs with distributed systems security from the bridge architecture. The fundamental security assumption is that the zero-knowledge proof system itself is sound, meaning that it is computationally infeasible to generate a valid proof for a false statement. This assumption relies on well-studied cryptographic hardness assumptions such as the discrete logarithm problem or the existence of collision-resistant hash functions. The security of the bridge also depends on the correct implementation of the proof generation and verification algorithms, requiring extensive testing and formal verification.

Trust assumptions in zero-knowledge bridges vary depending on the specific architecture and implementation choices. Some bridges require trust in a committee of validators or operators who manage the bridge operations, while others aim for trustless designs where security depends only on cryptographic assumptions and the security of the underlying blockchains. The trusted setup requirement of some zero-knowledge proof systems introduces an additional trust assumption, requiring users to believe that the setup ceremony was conducted honestly and that the toxic waste was properly destroyed. Transparent proof systems like STARKs eliminate this assumption but may introduce other trade-offs in terms of proof size or generation time.

The bridge must also consider the security models of the connected blockchains and ensure that the bridge security is not weaker than either chain. This involves understanding the finality guarantees of each blockchain, the potential for reorganizations, and the consensus mechanisms that determine transaction validity. The bridge design must account for scenarios where one blockchain experiences a deep reorganization or where there are conflicting views of the blockchain state. Many bridges implement confirmation delays or challenge periods to provide time for detecting and responding to such events, trading off transfer speed for additional security.

Economic security plays a crucial role in the overall security model, with many bridges requiring validators or operators to stake collateral that can be slashed in case of misbehavior. The economic incentives must be carefully designed to ensure that honest behavior is more profitable than attacks, considering factors such as the value locked in the bridge, the potential profit from attacks, and the cost of mounting attacks. The security model must also consider the potential for collusion among validators or operators and implement mechanisms such as random selection or rotation to mitigate these risks.

The privacy aspects of zero-knowledge bridges introduce additional security considerations beyond those of traditional bridges. The bridge must ensure that privacy cannot be broken even by colluding validators or through side-channel attacks. This requires careful implementation of the cryptographic protocols, secure management of private keys and witness data, and protection against timing attacks or other information leakage. The security model must also consider the long-term privacy implications, ensuring that advances in computing power or cryptanalysis do not retroactively compromise the privacy of past transactions.

Preventing Double-Spending and Ensuring Security

Double-spending prevention represents one of the most critical security requirements for any blockchain bridge, and zero-knowledge bridges face unique challenges in preventing double-spending while maintaining privacy. The fundamental challenge is ensuring that assets cannot be withdrawn multiple times from the bridge or spent on multiple chains simultaneously, all while keeping transaction details private. Zero-knowledge bridges address this challenge through sophisticated cryptographic mechanisms including nullifiers, commitment schemes, and merkle tree accumulators that enable the bridge to track spent assets without revealing which specific assets have been spent. These mechanisms must be carefully designed to prevent various attack vectors while maintaining the efficiency and privacy guarantees that make zero-knowledge bridges valuable.

The security architecture of zero-knowledge bridges must address threats from multiple angles, including attacks on the cryptographic protocols, the bridge infrastructure, and the underlying blockchains. The bridge must be resilient to attacks from malicious users attempting to steal funds, compromised validators or operators, and even potential quantum computing threats in the future. This comprehensive security approach requires multiple layers of defense, including cryptographic security from the zero-knowledge proofs, economic security from staking and slashing mechanisms, and operational security from monitoring and incident response procedures. The integration of these security measures must be seamless and not compromise the user experience or the privacy guarantees of the bridge.

Double-Spending Prevention Mechanisms

The primary mechanism for preventing double-spending in zero-knowledge bridges involves the use of nullifiers, which are unique identifiers derived from each deposit that can be revealed during withdrawal without compromising privacy. When a user makes a deposit into the bridge, they generate a commitment that includes a secret nullifier. During withdrawal, the user reveals this nullifier and provides a zero-knowledge proof that it corresponds to a valid, unspent deposit. The bridge maintains a nullifier set, tracking all previously revealed nullifiers to ensure that each deposit can only be withdrawn once.

The implementation of nullifier-based double-spending prevention requires careful cryptographic design to ensure that nullifiers cannot be predicted or forged. Typically, nullifiers are generated using cryptographic hash functions applied to secret random values chosen by the depositor. The zero-knowledge proof must demonstrate that the revealed nullifier corresponds to a commitment in the bridge’s accumulator without revealing which specific commitment it corresponds to. The bridge must also handle edge cases and potential attack vectors in the double-spending prevention mechanism, ensuring that nullifiers are properly synchronized across any redundant infrastructure to prevent race conditions.

The accumulator structure used by the bridge plays a crucial role in double-spending prevention while maintaining privacy. Most zero-knowledge bridges use merkle trees as accumulators, where each leaf represents a commitment and the root provides a succinct representation of all deposits. The bridge must ensure that the accumulator is updated atomically and consistently, preventing scenarios where different views of the accumulator state could enable double-spending.

Cryptographic Commitments and Verification

Cryptographic commitments form the foundation of privacy-preserving asset transfers in zero-knowledge bridges, allowing users to lock in transaction parameters without revealing them until withdrawal. A commitment scheme must be both hiding and binding. In the context of bridges, commitments typically include the asset amount, type, recipient address, and a secret nullifier. The Pedersen commitment scheme and its variants are commonly used due to their homomorphic properties, which enable efficient zero-knowledge proofs about committed values.

The verification process for cryptographic commitments involves multiple stages of validation to ensure security while preserving privacy. First, the bridge must verify that incoming deposits create valid commitments according to the bridge protocol. During withdrawal, the verification process requires validation of a zero-knowledge proof that demonstrates knowledge of a valid commitment without revealing it. The commitment and verification scheme must also support various types of assets and transfer patterns while maintaining security and privacy.

The efficiency of commitment verification is crucial for the practical viability of zero-knowledge bridges, particularly on blockchains with high gas costs. Modern bridges employ various optimization techniques to reduce verification costs, including batched verification where multiple proofs are verified together and optimized proof formats that minimize the data that must be processed on-chain.

Attack Vectors and Mitigation Strategies

Zero-knowledge bridges face a unique set of attack vectors that combine traditional bridge vulnerabilities with additional challenges arising from the privacy-preserving nature of the system. Front-running attacks, where malicious actors observe pending transactions and submit their own transactions with higher fees to be processed first, can be particularly problematic for bridges. In the context of zero-knowledge bridges, front-running might involve attempting to claim withdrawals using observed proofs or manipulating the order of deposits and withdrawals to gain an advantage. Mitigation strategies include commit-reveal schemes where withdrawal requests are submitted in two phases, and the use of encryption or time-locks to prevent proofs from being used by unauthorized parties.

Griefing attacks represent another category of threats where attackers aim to disrupt bridge operations rather than steal funds directly. These might include spamming the bridge with invalid proofs that consume verification resources, submitting deposits with malformed commitments that cannot be withdrawn, or attempting to fill the accumulator with useless entries to degrade performance. Mitigation strategies include requiring deposits to include fees that cover verification costs, implementing rate limiting and spam prevention mechanisms, and designing accumulator structures that can efficiently handle large numbers of entries without performance degradation.

Privacy-specific attack vectors must also be considered, including attempts to deanonymize users through traffic analysis, timing correlation, or amount correlation. Attackers might analyze patterns in deposits and withdrawals to link transactions, potentially revealing user identities or transaction relationships. Mitigation strategies include implementing mixing periods where withdrawals are delayed and batched, supporting variable withdrawal amounts that don’t directly correspond to deposit amounts, and encouraging users to follow privacy best practices such as using fresh addresses and avoiding distinctive transaction patterns. Some bridges also implement decoy traffic or dummy transactions to obscure real user activity.

The bridge must also defend against attacks on the underlying infrastructure and smart contracts. This includes potential vulnerabilities in the proof generation and verification code, attacks on the relay network that could prevent legitimate transactions from being processed, and attempts to exploit bugs in smart contracts to steal funds or corrupt bridge state. Mitigation strategies include extensive testing and formal verification of critical components, bug bounty programs to incentivize security researchers to find and report vulnerabilities, and upgrade mechanisms that allow for patching vulnerabilities while maintaining bridge security. Many bridges also implement emergency pause mechanisms that can halt bridge operations if an attack is detected, providing time for investigation and response.

Real-World Implementations and Case Studies

The theoretical foundations of zero-knowledge bridges have been successfully translated into practical implementations that are currently processing significant transaction volumes across multiple blockchain networks. These real-world deployments have provided valuable insights into the challenges and opportunities of privacy-preserving cross-chain infrastructure. The evolution from experimental prototypes to production-ready systems has required solving numerous technical challenges including proof generation optimization, gas cost reduction, and user experience improvements. The implementations range from specialized bridges focusing on specific asset types or blockchain pairs to general-purpose platforms that aim to connect multiple networks through a unified protocol.

The deployment of zero-knowledge bridges in production environments has revealed both the strengths and limitations of current technology. Performance metrics from these implementations show that while zero-knowledge proofs add computational overhead compared to traditional bridges, the privacy benefits and security improvements justify this cost for many use cases. The real-world usage patterns have also influenced the design of newer bridge implementations, with developers learning from early deployments to create more efficient and user-friendly systems. These implementations have demonstrated that zero-knowledge bridges can handle significant transaction volumes while maintaining security and privacy, validating the theoretical promise of the technology.

Leading Zero-Knowledge Bridge Protocols

Succinct Labs’ Telepathy bridge represents one of the most advanced implementations of zero-knowledge bridge technology, utilizing a light client approach that verifies consensus proofs from source chains using zero-knowledge proofs. Launched in 2023, Telepathy enables trustless communication between Ethereum and multiple other networks by generating SNARKs that prove the validity of block headers and state transitions. The protocol has processed over $500 million in cross-chain transfers as of early 2025, demonstrating the viability of zero-knowledge bridges for high-value transactions. The system achieves proof generation times of under 30 seconds for typical transfers, making it practical for real-world usage.

The zkBridge protocol, developed by researchers at Stanford and Berkeley and deployed in production in 2023, takes a different approach by using recursive proof composition to enable efficient verification across multiple chains. The protocol has been successfully deployed connecting Ethereum, BNB Chain, and other major networks, processing thousands of transactions daily with a total value locked exceeding $200 million as of January 2025. zkBridge achieves gas costs of approximately 200,000 gas for proof verification on Ethereum, making it economically viable even during periods of high network congestion.

Polymer Labs’ IBC-ZK bridge brings zero-knowledge proofs to the Inter-Blockchain Communication protocol, enabling privacy-preserving transfers between Cosmos ecosystem chains and external networks. Deployed in late 2024, the bridge has facilitated over 50,000 private cross-chain transactions, primarily focused on enterprise use cases where transaction confidentiality is crucial. Aztec Network’s bridge infrastructure, while primarily focused on privacy within Ethereum, has expanded to support cross-chain capabilities through zero-knowledge proofs. As of early 2025, Aztec’s bridge has processed over $1 billion in private cross-chain transfers, with a particular focus on DeFi applications.

The Semaphore bridge, developed by the Ethereum Foundation and deployed across multiple testnets before its mainnet launch in 2024, focuses on identity privacy in cross-chain transfers. The protocol has been adopted by several DAOs for cross-chain governance, processing over 10,000 anonymous voting transactions across different networks.

Enterprise and DeFi Applications

JPMorgan’s Onyx Digital Assets platform has integrated zero-knowledge bridge technology to enable private cross-border payments between different blockchain networks used by financial institutions. In a pilot program conducted throughout 2024, the platform successfully processed over $2 billion in private cross-chain transfers between permissioned blockchain networks operated by different banks. The implementation uses zero-knowledge proofs to verify compliance with regulatory requirements without revealing transaction details to intermediate parties. The system achieves settlement times of under 2 minutes for international transfers while maintaining full audit trails that can be selectively disclosed to regulators.

The Aave Protocol has implemented zero-knowledge bridge functionality to enable private cross-chain lending and borrowing, allowing users to maintain privacy while accessing liquidity across different blockchain networks. Deployed in Q4 2024, this feature has facilitated over $300 million in private cross-chain loans, with users able to deposit collateral on one chain and borrow assets on another without revealing their positions. The implementation uses recursive SNARKs to prove solvency and collateralization ratios without revealing specific positions, enabling efficient risk management while preserving user privacy.

Chainlink’s Cross-Chain Interoperability Protocol has integrated zero-knowledge proof capabilities in collaboration with multiple bridge providers, enabling private oracle data delivery across chains. This implementation, which went live in early 2025, allows price feeds and other oracle data to be transmitted between chains with cryptographic proofs of authenticity. Over 100 DeFi protocols have adopted this private oracle bridge functionality, processing millions of private data requests monthly. Supply chain management platforms have begun adopting zero-knowledge bridges to enable private tracking of goods across different blockchain networks. Maersk’s TradeLens platform integrated zero-knowledge bridge capabilities in 2024, allowing shipping data to be verified across different port authority and customs blockchains without revealing commercially sensitive information.

Benefits and Challenges of Zero-Knowledge Bridges

The adoption of zero-knowledge bridges brings transformative benefits to the blockchain ecosystem while also introducing new technical and operational challenges that must be carefully addressed. These bridges fundamentally change the privacy and security dynamics of cross-chain interactions, offering users and developers capabilities that were previously impossible with traditional bridge designs. The benefits extend beyond simple privacy protection to include improved security through reduced trust assumptions, enhanced composability through privacy-preserving smart contract interactions, and new use cases that require confidentiality. However, these advantages come with trade-offs in terms of computational complexity, implementation difficulty, and operational considerations that must be weighed against the specific requirements of each use case.

The evaluation of zero-knowledge bridges must consider the perspectives of different stakeholders in the blockchain ecosystem, each with their own priorities and constraints. Users value privacy and security but also require reasonable transaction costs and processing times. Developers need robust tooling and clear documentation to integrate zero-knowledge bridges into their applications. Validators and infrastructure providers must balance the computational requirements of proof generation and verification with economic sustainability. Regulators seek to maintain oversight capabilities while respecting legitimate privacy needs. Understanding these diverse perspectives is crucial for assessing the overall impact and adoption potential of zero-knowledge bridge technology.

Advantages for Users and Developers

Users of zero-knowledge bridges gain unprecedented privacy protection for their cross-chain transactions, shielding their activities from surveillance and analysis that could reveal trading strategies, wealth levels, or personal information. This privacy extends beyond simple anonymity to include confidentiality of transaction amounts, asset types, and timing patterns. The privacy guarantees are particularly valuable for institutional users who need to move large amounts of assets without triggering market reactions. The cryptographic nature of the privacy protection means that it does not depend on trusting bridge operators or validators to keep information confidential.

The security improvements offered by zero-knowledge bridges provide users with stronger guarantees about the safety of their assets during cross-chain transfers. Unlike traditional bridges that require trusting a set of validators, zero-knowledge bridges can provide cryptographic proofs that transfers are valid without requiring trust in intermediaries. This reduction in trust assumptions significantly decreases the risk of funds being stolen due to compromised or malicious bridge operators.

Developers gain access to new primitives and capabilities that enable innovative applications spanning multiple blockchains while maintaining user privacy. The ability to prove computational statements about cross-chain state without revealing the underlying data opens up possibilities for complex multi-chain applications. The composability benefits of zero-knowledge bridges extend the concept of DeFi legos across multiple chains while preserving privacy. Smart contracts can interact with zero-knowledge bridges to enable complex financial operations that span multiple networks without revealing intermediate steps or exposing users to privacy risks. The economic benefits for users include reduced MEV extraction and front-running, as the privacy provided by zero-knowledge bridges makes it difficult for attackers to identify and exploit profitable opportunities.

Technical and Implementation Challenges

The computational complexity of zero-knowledge proof generation represents one of the most significant technical challenges facing bridge implementations. Generating proofs for complex statements about blockchain state requires substantial computational resources, often taking several seconds to minutes on powerful hardware. This computational burden increases the operational costs of running bridge infrastructure and can create bottlenecks during periods of high demand. While proof verification is typically efficient, the asymmetry between generation and verification costs means that bridge operators must invest in significant computational infrastructure.

The implementation complexity of zero-knowledge bridges requires specialized expertise in cryptography, distributed systems, and blockchain technology, creating a high barrier to entry for development teams. The correct implementation of zero-knowledge proof systems is notoriously difficult, with subtle bugs potentially compromising the security or privacy of the entire system. The need for extensive testing, formal verification, and security audits significantly increases the development time and cost compared to traditional bridges.

Standardization challenges arise from the diversity of zero-knowledge proof systems and the lack of common interfaces across different blockchain platforms. Each blockchain may have different capabilities for verifying proofs, different gas costs for verification operations, and different constraints on proof sizes and formats. This fragmentation makes it difficult to create universal bridge solutions that work efficiently across all platforms. The user experience challenges include longer transaction times due to proof generation, higher costs due to computational complexity, and the need for users to manage additional cryptographic material. The complexity of the underlying technology makes it difficult to provide clear error messages when transactions fail.

Scalability limitations arise from the need to maintain and update cryptographic accumulators, generate and verify proofs for increasing numbers of transactions, and coordinate activities across multiple blockchains with different performance characteristics. The operational challenges extend to key management, where bridge operators must securely manage cryptographic keys used for proof generation while ensuring availability and redundancy.

Final Thoughts

The emergence of zero-knowledge bridges represents a defining moment in the evolution of blockchain technology, marking the transition from isolated networks to an interconnected ecosystem that preserves the fundamental principles of privacy and decentralization. These bridges demonstrate that the seemingly contradictory goals of transparency for verification and privacy for users can be reconciled through advanced cryptographic techniques. The successful deployment of zero-knowledge bridges in production environments, processing billions of dollars in value while maintaining user privacy, validates the years of research and development invested in this technology. As blockchain adoption continues to expand beyond early adopters to mainstream financial institutions and enterprises, the privacy guarantees provided by zero-knowledge bridges become not just desirable but essential for many use cases.

The intersection of zero-knowledge cryptography and blockchain interoperability creates new possibilities for financial inclusion and economic empowerment. By enabling private cross-chain transactions, these bridges allow individuals and organizations in restrictive environments to access global financial services without exposing themselves to surveillance or censorship. Small businesses can participate in international trade without revealing competitive information, while individuals can preserve their financial privacy while accessing the best services across different blockchain networks. This technology has the potential to level the playing field between large institutions with private networks and individual users who previously had to choose between privacy and access to services.

The broader implications of zero-knowledge bridges extend beyond technical achievements to challenge our understanding of trust, privacy, and verification in digital systems. These bridges prove that we can build systems that are both transparent enough to prevent fraud and private enough to protect individual liberty. They demonstrate that mathematical proofs can replace institutional trust, enabling cooperation between parties who may not trust each other or even know each other’s identities. This paradigm shift has implications far beyond blockchain technology, potentially influencing how we design voting systems, supply chains, and other critical infrastructure that requires both accountability and privacy.

The development of zero-knowledge bridges also highlights the importance of interdisciplinary collaboration in solving complex technological challenges. The successful implementation of these systems required advances in theoretical cryptography, distributed systems engineering, economic mechanism design, and user experience design. The open-source nature of most zero-knowledge bridge development has fostered a collaborative environment where researchers, developers, and practitioners share knowledge and build upon each other’s work. This collaborative approach has accelerated innovation and helped establish best practices that benefit the entire ecosystem.

Looking toward the future, zero-knowledge bridges are likely to become increasingly sophisticated and efficient as the underlying technology continues to mature. Advances in proof generation hardware, more efficient proof systems, and better integration with blockchain platforms will reduce the current limitations and make zero-knowledge bridges accessible for a wider range of applications. The standardization of interfaces and protocols will enable greater interoperability between different bridge implementations, creating a more robust and resilient cross-chain infrastructure. As quantum computing threatens traditional cryptographic systems, the development of quantum-resistant zero-knowledge proofs ensures that these bridges can continue to provide security and privacy in the post-quantum era.

The ongoing evolution of zero-knowledge bridges reflects the broader maturation of the blockchain industry from experimental technology to critical infrastructure. These bridges represent a sophisticated solution to real-world problems, balancing the needs of different stakeholders while maintaining the core values of decentralization and user sovereignty. As we continue to build the infrastructure for a decentralized future, zero-knowledge bridges will play a crucial role in ensuring that this future preserves privacy and individual freedom while enabling the cooperation and coordination necessary for complex economic and social systems. The success of these bridges demonstrates that we can build technology that empowers users rather than subjugating them to surveillance and control.

FAQs

- What exactly is a zero-knowledge bridge and how does it differ from a regular blockchain bridge?

A zero-knowledge bridge is a specialized type of blockchain bridge that enables the transfer of assets and data between different blockchain networks while maintaining complete privacy of transaction details. Unlike regular bridges that publicly record all transaction information on both source and destination chains, zero-knowledge bridges use advanced cryptographic proofs to verify that transfers are valid without revealing sensitive information such as the sender, recipient, amount, or asset type. This privacy protection is achieved through zero-knowledge proofs, which allow the bridge to mathematically verify that all necessary conditions for a transfer are met without actually seeing the underlying data. - How long does it take to transfer assets through a zero-knowledge bridge compared to traditional bridges?

Transfer times through zero-knowledge bridges typically range from a few minutes to around 30 minutes, depending on the specific implementation and network conditions. The additional time compared to traditional bridges comes primarily from the proof generation process, which can take 10-60 seconds on modern hardware, plus the time needed for transaction confirmation on both source and destination blockchains. While this is slower than some traditional bridges that can complete transfers in under a minute, the privacy and security benefits often justify the additional time. Recent improvements in proof generation technology and hardware acceleration are continuously reducing these times. - Are zero-knowledge bridges more expensive to use than regular bridges?

Zero-knowledge bridges generally have higher transaction costs than basic traditional bridges, typically 20-50% more expensive due to the computational resources required for proof generation and verification. On Ethereum, for example, verifying a zero-knowledge proof might cost 200,000-500,000 gas compared to 50,000-100,000 gas for a simple bridge transaction. However, these costs must be weighed against the significant privacy and security benefits provided. Additionally, as proof systems become more efficient and layer 2 solutions reduce verification costs, the price gap is narrowing. - What happens if there’s a bug in the zero-knowledge proof system of a bridge?

Bugs in zero-knowledge proof systems can have serious consequences, potentially allowing attackers to generate false proofs and steal funds or compromise privacy. To mitigate these risks, production zero-knowledge bridges undergo extensive testing, formal verification, and multiple security audits before deployment. Most bridges also implement additional safety mechanisms such as withdrawal delays, multi-signature controls, and emergency pause functions that can halt operations if suspicious activity is detected. The open-source nature of most implementations allows for community review and bug bounty programs that incentivize security researchers to find and report vulnerabilities. - Can zero-knowledge bridges be used for all types of blockchain assets?

Zero-knowledge bridges can theoretically support any type of blockchain asset, including native tokens, ERC-20 tokens, NFTs, and even more complex assets like tokenized real-world assets. However, the specific implementation determines which assets are supported. Some bridges focus on fungible tokens where privacy is most valuable, while others extend support to NFTs with specialized proof systems that handle unique identifiers. The main limitation is that adding support for new asset types may require modifications to the proof circuits and smart contracts, which undergoes careful testing before deployment. - How do zero-knowledge bridges prevent money laundering if transactions are private?

Zero-knowledge bridges can implement selective disclosure mechanisms that allow users to prove compliance with regulations without revealing all transaction details. For example, users can generate proofs that their transactions are below certain thresholds, originate from verified sources, or comply with sanctions lists, all without revealing their actual identity or transaction amounts to the public. Many implementations also include provisions for authorized parties such as law enforcement to access transaction information under specific legal circumstances, balancing privacy with regulatory compliance. - What blockchain networks currently support zero-knowledge bridges?

As of 2025, major networks including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, and several Cosmos chains have operational zero-knowledge bridges. Ethereum has the most mature ecosystem with multiple zero-knowledge bridge implementations, while other networks are rapidly developing support. The availability of zero-knowledge bridges for a particular network depends on factors including the network’s ability to verify zero-knowledge proofs efficiently, the availability of developer tools, and market demand for private cross-chain transfers to and from that network. - Do I need special software or technical knowledge to use a zero-knowledge bridge?

Most zero-knowledge bridges are designed to be accessible through standard web interfaces and popular wallet applications like MetaMask, requiring no special technical knowledge for basic use. Users interact with these bridges similarly to traditional bridges, with the complexity of proof generation handled automatically in the background. However, users should understand basic privacy practices, such as using fresh addresses for withdrawals and avoiding patterns that could link their transactions. Advanced users may benefit from understanding the privacy model to maximize their anonymity. - Can zero-knowledge bridges be upgraded or modified after deployment?

The upgradeability of zero-knowledge bridges depends on their specific design and governance model. Some bridges implement upgradeable proxy contracts that allow for improvements and bug fixes, while others use immutable contracts for maximum security and trust minimization. Upgradeable bridges typically require multi-signature approval or governance votes for changes, balancing flexibility with security. The zero-knowledge proof circuits themselves may also be upgradeable, allowing for improvements in efficiency or the addition of new features, though this requires careful handling to maintain security and backward compatibility. - What happens to my privacy if I withdraw funds from a zero-knowledge bridge to a regular transparent blockchain address?

When withdrawing from a zero-knowledge bridge to a transparent blockchain address, the withdrawal transaction becomes visible on the destination chain, potentially compromising privacy if not handled carefully. To maintain privacy, users should withdraw to fresh addresses not linked to their identity and avoid patterns that could connect deposits and withdrawals. Some bridges implement additional privacy features like withdrawal delays and mixing to make correlation more difficult. Users should also be aware that subsequent transactions from the withdrawal address are transparent and could potentially be traced back to compromise the privacy gained from using the zero-knowledge bridge.