The blockchain ecosystem stands at a pivotal moment in its evolution, where the promise of decentralized finance meets the practical challenges of scalability and interoperability. Atomic swaps across Layer-2 networks represent a groundbreaking advancement in this journey, offering a solution that combines the security of trustless transactions with the efficiency of modern scaling solutions. This technology enables users to exchange digital assets directly between different Layer-2 networks without relying on centralized intermediaries, wrapped tokens, or traditional bridge mechanisms that have historically presented significant security vulnerabilities. The concept builds upon years of blockchain innovation, merging cryptographic protocols with advanced scaling technologies to create a seamless exchange experience that maintains the core principles of decentralization while dramatically improving transaction speed and reducing costs.

The significance of atomic swaps in the Layer-2 context extends far beyond simple asset exchanges. These protocols address fundamental limitations that have plagued the cryptocurrency ecosystem since its inception, particularly the fragmentation of liquidity across different networks and the security risks associated with cross-chain bridges. Traditional approaches to cross-chain asset transfers have relied heavily on custodial solutions or smart contract bridges that hold assets in escrow, creating honeypots that have attracted billions of dollars in hacks and exploits over recent years. Atomic swaps eliminate these central points of failure by enabling peer-to-peer exchanges that either complete successfully in their entirety or fail completely, ensuring that no party can lose funds due to partial execution or malicious behavior. This atomic property, from which the technology derives its name, guarantees that transactions maintain their integrity across different blockchain environments, even when those environments operate under different consensus mechanisms and security models.

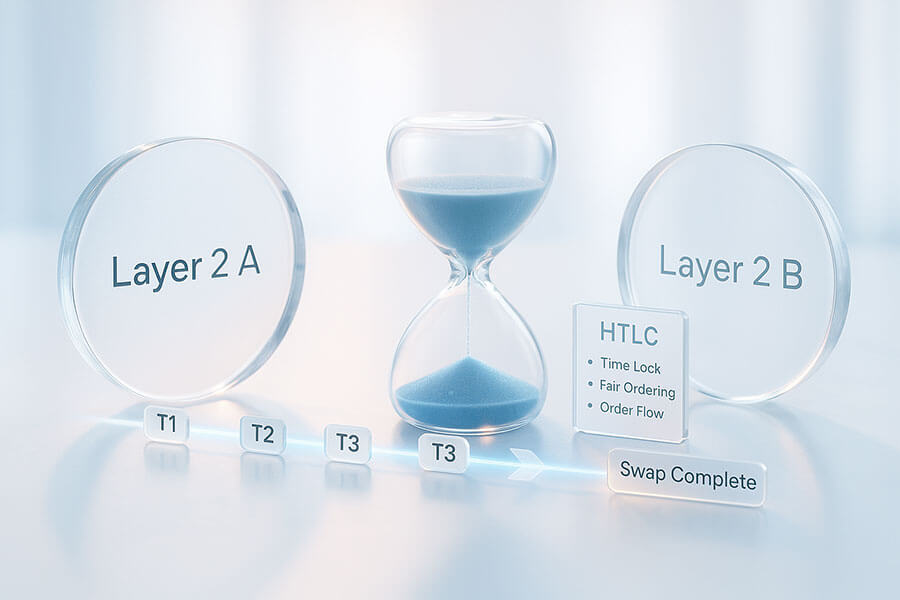

Understanding atomic swaps across Layer-2 networks requires appreciating the convergence of multiple technological innovations that have emerged over the past decade. The foundation lies in Hash Time-Locked Contracts (HTLCs), cryptographic constructs that enable conditional payments based on the revelation of secret information within specified time windows. When combined with the advanced capabilities of Layer-2 networks such as optimistic rollups, zero-knowledge rollups, state channels, and sidechains, these protocols create a robust framework for trustless exchange that operates at speeds and costs comparable to centralized exchanges while maintaining the security guarantees of blockchain technology. The implications of this technology reach into every corner of the decentralized finance ecosystem, from simple token swaps to complex multi-party transactions, derivatives trading, and cross-chain lending protocols. As we explore this transformative technology, we will uncover how atomic swaps across Layer-2 networks are not merely an incremental improvement but a fundamental reimagining of how value can flow through the decentralized web, creating new possibilities for financial inclusion, market efficiency, and economic innovation on a global scale.

Understanding the Fundamentals of Layer-2 Networks

Layer-2 networks have emerged as the critical infrastructure for scaling blockchain technology beyond its original limitations, representing a sophisticated approach to solving the trilemma of decentralization, security, and scalability that has challenged the industry since its inception. These secondary protocols operate on top of existing blockchain networks, processing transactions off the main chain while inheriting the security properties of the underlying Layer-1 blockchain. The fundamental innovation of Layer-2 solutions lies in their ability to aggregate multiple transactions into batches, compress data, or move computation off-chain, thereby reducing the burden on the main blockchain while maintaining cryptographic guarantees about transaction validity. This architectural approach allows Layer-2 networks to achieve transaction throughput that can be orders of magnitude higher than their underlying chains, with costs that are correspondingly lower, making blockchain technology practical for everyday transactions and complex financial operations that would be economically unfeasible on Layer-1 networks alone.

The relationship between Layer-1 and Layer-2 networks represents a delicate balance of trust, verification, and efficiency that has been refined through years of research and development. Layer-1 blockchains such as Ethereum, Bitcoin, and other major networks provide the ultimate source of truth and security, serving as the final arbiters of transaction validity and the guardians of user assets. Layer-2 networks build upon this foundation by creating alternative execution environments where transactions can be processed rapidly and cheaply, with periodic settlement to the Layer-1 chain ensuring that the overall system maintains its security properties. This hierarchical structure enables a division of labor where the Layer-1 chain focuses on consensus and security while Layer-2 networks handle the bulk of transaction processing, creating a scalable architecture that can support millions of users without compromising on the core principles of blockchain technology. The sophistication of modern Layer-2 networks extends beyond simple transaction processing to include complex smart contract execution, cross-chain communication protocols, and advanced cryptographic techniques that enable privacy, scalability, and interoperability simultaneously.

What Are Layer-2 Networks and Why Do They Matter

The concept of Layer-2 networks originated from the recognition that blockchain technology’s greatest strength, its decentralized consensus mechanism, also represents its most significant limitation when it comes to scalability. Every transaction on a traditional blockchain must be processed, verified, and stored by every node in the network, creating a fundamental bottleneck that limits transaction throughput to the speed at which the slowest nodes can process and propagate information. Layer-2 networks address this limitation by moving the majority of transaction processing off the main chain, using the Layer-1 blockchain primarily for dispute resolution and final settlement rather than for every individual transaction. This approach dramatically reduces the computational and storage requirements for running a blockchain node while maintaining the security guarantees that make blockchain technology valuable in the first place.

The importance of Layer-2 networks becomes even more apparent when considering the practical requirements of a global financial system. Traditional payment networks process thousands of transactions per second, with major credit card networks handling peak loads of tens of thousands of transactions per second during busy shopping periods. First-generation blockchains, by contrast, typically process between 7 and 15 transactions per second, with even the most advanced Layer-1 chains struggling to exceed a few hundred transactions per second without significant trade-offs in decentralization or security. Layer-2 networks bridge this gap by enabling transaction throughput that rivals or exceeds traditional payment systems while maintaining the trustless, permissionless nature of blockchain technology. The impact extends beyond simple payments to encompass complex financial instruments, decentralized exchanges, gaming applications, and any other use case that requires high-frequency transactions with low latency and minimal costs.

The architectural diversity of Layer-2 solutions reflects the multifaceted nature of the scalability challenge, with different approaches optimizing for different use cases and trade-offs. Some Layer-2 networks prioritize maximum throughput and minimal latency, making them ideal for high-frequency trading and gaming applications. Others focus on minimizing trust assumptions and maximizing security, suitable for high-value transfers and financial settlements. Still others emphasize privacy and confidentiality, enabling use cases that require transaction details to remain hidden from public view. This diversity of approaches has created a rich ecosystem of Layer-2 networks, each with its own strengths and specializations, but also introducing new challenges around interoperability and liquidity fragmentation that atomic swaps are uniquely positioned to address.

Popular Layer-2 Solutions and Their Unique Characteristics

Optimistic rollups have emerged as one of the most widely adopted Layer-2 scaling solutions, operating on the principle of optimistic execution where transactions are assumed to be valid unless proven otherwise through a fraud proof mechanism. Networks like Arbitrum and Optimism have pioneered this approach, processing transactions off-chain in a virtual machine environment that closely mimics the Ethereum Virtual Machine, enabling near-perfect compatibility with existing smart contracts and development tools. The optimistic model allows these networks to achieve significant scalability improvements while maintaining a relatively simple security model, though the challenge period required for withdrawals back to Layer-1 can introduce delays of up to a week in some implementations. The success of optimistic rollups has demonstrated the viability of Layer-2 scaling, with billions of dollars in total value locked and thousands of decentralized applications deployed across these networks.

Zero-knowledge rollups represent the cutting edge of cryptographic innovation in the Layer-2 space, using sophisticated mathematical proofs to demonstrate transaction validity without revealing transaction details. Networks like zkSync, StarkNet, and Polygon zkEVM leverage different types of zero-knowledge proof systems to achieve instant finality and enhanced privacy while maintaining the security properties of the underlying blockchain. The computational intensity of generating zero-knowledge proofs has historically limited the throughput of these systems, but recent advances in proof generation hardware and algorithms have enabled ZK-rollups to achieve performance that rivals or exceeds optimistic rollups while offering superior security properties and faster withdrawal times. The ability of ZK-rollups to provide mathematical certainty about transaction validity without requiring challenge periods makes them particularly attractive for high-value transfers and cross-chain interactions.

State channels and Plasma chains represent earlier approaches to Layer-2 scaling that continue to play important roles in specific use cases. State channels, exemplified by Bitcoin’s Lightning Network and Ethereum’s Raiden Network, enable participants to conduct unlimited transactions off-chain with instant finality and minimal fees, making them ideal for micropayments and frequent interactions between known parties. Plasma chains, while less prominent today, introduced important concepts around hierarchical blockchain structures and mass exits that have influenced the design of modern rollup systems. Sidechains like Polygon PoS (formerly Matic Network) occupy a unique position in the Layer-2 ecosystem, operating as independent blockchains with their own consensus mechanisms while maintaining strong bridges to Ethereum and other networks. Each of these Layer-2 solutions brings unique capabilities and trade-offs to the table, creating a diverse ecosystem where atomic swaps can facilitate seamless value transfer across different scaling paradigms.

The evolution of Layer-2 networks has been marked by continuous innovation and refinement, with each generation of solutions building upon the lessons learned from previous implementations. Modern Layer-2 networks incorporate advanced features such as decentralized sequencers, cross-layer messaging protocols, and native interoperability standards that make them increasingly sophisticated platforms for decentralized applications. The maturation of Layer-2 infrastructure has also led to the development of specialized networks optimized for specific use cases, from high-frequency trading platforms that prioritize speed and throughput to privacy-focused networks that enable confidential transactions and private smart contracts. This specialization has created a rich tapestry of Layer-2 networks, each serving different user needs and market segments, but also highlighting the critical importance of interoperability solutions like atomic swaps that can connect these disparate ecosystems into a unified liquidity network.

The Evolution and Mechanics of Atomic Swaps

The journey of atomic swaps from theoretical concept to practical implementation represents one of the most significant achievements in blockchain technology, embodying the pursuit of true peer-to-peer value exchange without intermediaries or counterparty risk. The concept originated in 2013 when developer Tier Nolan first described a protocol for trustless cross-chain trading on the BitcoinTalk forum, introducing the revolutionary idea that cryptographic primitives could enable secure asset exchanges between parties who neither knew nor trusted each other. This initial proposal laid the groundwork for what would become a fundamental building block of decentralized finance, demonstrating that the same cryptographic techniques that secured individual blockchains could also enable secure interactions between different blockchain networks. The evolution of atomic swaps has been driven by the recognition that true decentralization requires not just distributed ledgers but also distributed exchange mechanisms that eliminate the need for trusted third parties in any form.

The theoretical elegance of atomic swaps lies in their ability to guarantee fairness through cryptographic enforcement rather than legal or social mechanisms. Traditional exchange systems, whether for cryptocurrencies or traditional assets, rely on trusted intermediaries to ensure that both parties fulfill their obligations, creating central points of failure and extracting fees for this service. Atomic swaps eliminate this requirement by leveraging time-locked cryptographic puzzles that ensure either both parties receive their expected assets or the transaction reverses completely, with no possibility of one party absconding with funds while leaving the other empty-handed. This property of atomicity, borrowed from database theory where transactions must be all-or-nothing, provides a level of security and fairness that surpasses even the most reputable centralized exchanges, as it relies on mathematical certainty rather than institutional trust.

From Traditional Exchanges to Atomic Swaps

The cryptocurrency ecosystem’s early years were dominated by centralized exchanges that replicated the traditional financial system’s custodial model, requiring users to deposit their assets into exchange-controlled wallets and trust the exchange to execute trades fairly and secure funds adequately. The catastrophic failures of exchanges like Mt. Gox, which lost 850,000 Bitcoin in 2014, and the more recent collapses of FTX and other major platforms have repeatedly demonstrated the risks inherent in this centralized model. These failures resulted not just in billions of dollars in losses but also in a fundamental questioning of whether the cryptocurrency ecosystem was truly delivering on its promise of decentralization and individual sovereignty over assets. The development of atomic swaps emerged as a direct response to these failures, offering a vision of exchange that aligned with the original cypherpunk ideals of trustless, permissionless interaction.

The transition from centralized to decentralized exchange mechanisms has been gradual and complex, with atomic swaps representing just one approach among many attempts to solve the exchange problem. Early decentralized exchanges operated entirely on-chain, suffering from high gas costs and poor user experience compared to their centralized counterparts. The introduction of automated market makers (AMMs) like Uniswap revolutionized decentralized trading for assets on the same blockchain but did nothing to address the challenge of cross-chain exchanges. Wrapped tokens and bridge protocols emerged as interim solutions, creating synthetic representations of assets on different chains, but these approaches reintroduced centralization and security risks that atomic swaps were designed to eliminate. The evolution toward atomic swaps on Layer-2 networks represents the convergence of these various approaches, combining the security of atomic swaps with the efficiency of Layer-2 scaling and the liquidity of modern decentralized finance protocols.

The economic implications of transitioning from centralized to atomic swap-based exchange extend far beyond individual user security. Centralized exchanges extract billions of dollars annually in trading fees, custody fees, and spreads, representing a significant tax on the cryptocurrency ecosystem that ultimately reduces the value available to end users. Atomic swaps enable peer-to-peer exchange with minimal fees, limited only by the underlying blockchain transaction costs and any liquidity provider fees in automated implementations. This reduction in exchange costs has profound implications for financial inclusion, enabling economically viable transactions for smaller amounts that would be prohibitive on centralized platforms. Furthermore, the elimination of custody requirements removes barriers to entry for users in jurisdictions with limited access to traditional financial services or where centralized exchanges are restricted or unavailable.

How Atomic Swaps Work: The Technical Foundation

Hash Time-Locked Contracts (HTLCs) form the cryptographic backbone of atomic swap protocols, creating a secure mechanism for conditional payments that can span different blockchains without requiring trust between parties. An HTLC combines two critical components: a hashlock that requires the revelation of a secret preimage to unlock funds, and a timelock that ensures funds are returned to their original owner if the swap doesn’t complete within a specified period. The brilliance of this construction lies in how it leverages the properties of cryptographic hash functions, which are easy to compute in one direction but computationally infeasible to reverse, creating an asymmetric information scenario where one party holds a secret that both parties need for the swap to complete. The process begins when the initiating party generates a random secret and shares only its hash with their counterparty, creating a cryptographic puzzle that links both legs of the swap together.

The execution of an atomic swap follows a carefully choreographed sequence of steps that ensures fairness even in the presence of malicious actors attempting to subvert the protocol. First, Alice, who wants to exchange her assets on Network A for Bob’s assets on Network B, generates a secret value and computes its hash. She then creates an HTLC on Network A that locks her assets with two conditions: Bob can claim them by revealing the secret within a specified time window, or Alice can reclaim them after the timeout expires. Bob, seeing Alice’s contract on-chain and verifying its terms, creates a corresponding HTLC on Network B using the same hash but with a shorter timeout period. This timeout differential is crucial for security, ensuring that Bob must act first to claim his funds, thereby revealing the secret that Alice needs to complete her side of the swap. Once Bob claims Alice’s assets by revealing the secret, that revelation becomes visible on the blockchain, allowing Alice to use the same secret to claim Bob’s assets before her timeout expires.

The security of atomic swaps derives from the careful interplay of cryptographic and game-theoretic elements that make cheating economically irrational and technically infeasible. The hashlock ensures that both parties must use the same secret, creating an unbreakable link between the two transactions. The timelocks create a defined window for action, preventing indefinite locks on funds and ensuring that failed swaps resolve cleanly with funds returned to their original owners. The timeout differential between the two contracts prevents race conditions and ensures that the initiating party cannot be griefed by a non-responsive counterparty. Modern implementations of atomic swaps on Layer-2 networks enhance this basic protocol with additional features such as partial fills, where swaps can complete for less than the full amount if desired, and multi-party swaps that enable complex trading arrangements between multiple participants. These advanced features are made possible by the increased computational flexibility and lower transaction costs of Layer-2 networks compared to their Layer-1 counterparts.

The adaptation of atomic swaps to Layer-2 networks has introduced new technical considerations and opportunities that extend beyond simple replication of Layer-1 protocols. Layer-2 networks often provide additional cryptographic primitives and computational capabilities that enable more sophisticated swap constructions, such as zero-knowledge proofs that can hide transaction amounts or participant identities while still ensuring swap validity. The faster block times and lower costs of Layer-2 networks also enable more interactive protocols with multiple rounds of communication between parties, opening up possibilities for negotiation, price discovery, and complex multi-asset swaps that would be impractical on Layer-1 networks. Some Layer-2 implementations leverage the unique properties of their consensus mechanisms to provide instant finality for swaps or to enable swaps between assets that exist only on Layer-2 without requiring interaction with the underlying Layer-1 chain. These innovations demonstrate how atomic swaps on Layer-2 networks are not merely faster and cheaper versions of their Layer-1 counterparts but represent a fundamental evolution in the technology’s capabilities and potential applications.

Technical Architecture of Cross-Layer Atomic Swaps

The architectural complexity of enabling atomic swaps across different Layer-2 networks represents one of the most challenging problems in blockchain engineering, requiring sophisticated solutions that bridge not just different chains but different scaling paradigms, security models, and execution environments. Unlike atomic swaps between Layer-1 blockchains, which operate in relatively homogeneous environments with similar transaction finality and security guarantees, cross-Layer-2 atomic swaps must accommodate the diverse characteristics of different scaling solutions while maintaining the atomicity and security properties that make these swaps valuable. The technical architecture must account for differences in block production mechanisms, with some Layer-2 networks using centralized sequencers while others employ decentralized consensus, and differences in finality guarantees, where optimistic rollups require challenge periods while ZK-rollups provide instant cryptographic finality. These variations necessitate careful protocol design that can adapt to different network characteristics while maintaining consistent security properties across all supported platforms.

The implementation of cross-layer atomic swaps requires sophisticated coordination mechanisms that go beyond simple HTLCs to encompass cross-layer messaging, state verification, and dispute resolution protocols. Modern architectures leverage a combination of on-chain smart contracts, off-chain relay networks, and cryptographic proofs to enable seamless interaction between different Layer-2 networks. The smart contracts on each Layer-2 network handle the locking and releasing of assets according to the atomic swap protocol, while relay networks facilitate communication between different chains, monitoring events on one network and triggering corresponding actions on another. Advanced implementations incorporate merkle proofs and state commitments that allow one Layer-2 network to verify the state of another without requiring trust in intermediaries, creating a trustless bridge specifically designed for atomic swap execution. The architecture must also handle edge cases such as network congestion, sequencer failures, and chain reorganizations that could potentially disrupt swap execution, implementing robust fallback mechanisms that ensure user funds remain safe even in adverse conditions.

Protocol Design and Implementation Strategies

The design of cross-layer atomic swap protocols begins with establishing a common framework for representing and verifying transactions across heterogeneous Layer-2 networks, creating an abstraction layer that masks the underlying complexity while preserving essential security properties. This framework typically includes standardized interfaces for swap initiation, execution, and settlement, allowing different Layer-2 networks to participate in swaps regardless of their internal architecture. The protocol must define clear specifications for timeout periods that account for the different finality characteristics of various Layer-2 solutions, ensuring that timeout windows are long enough to accommodate network delays and dispute periods while short enough to prevent capital from being locked indefinitely. Modern protocols implement adaptive timeout mechanisms that adjust based on network conditions and historical swap completion times, optimizing for both security and capital efficiency.

Implementation strategies for cross-layer atomic swaps vary significantly depending on the specific Layer-2 networks involved and the desired trade-offs between security, speed, and complexity. Some implementations prioritize simplicity and security by requiring all swaps to settle through the underlying Layer-1 blockchain, using it as a common ground for dispute resolution and final settlement. This approach provides maximum security but introduces additional latency and cost, particularly for smaller swaps where Layer-1 transaction fees might exceed the value being exchanged. Other implementations leverage direct communication channels between Layer-2 networks, establishing peer-to-peer connections that enable faster swaps with lower costs but potentially introducing additional trust assumptions about relay operators or bridge protocols. The most sophisticated implementations combine multiple strategies, using direct communication for normal operation while maintaining Layer-1 settlement as a fallback option for dispute resolution or when direct channels are unavailable.

The role of liquidity providers and market makers in cross-layer atomic swap protocols has evolved significantly from early peer-to-peer implementations to modern automated systems that provide instant liquidity and competitive pricing. Professional market makers deploy sophisticated algorithms that monitor multiple Layer-2 networks simultaneously, identifying arbitrage opportunities and providing liquidity where it’s most needed. These systems must maintain inventory across multiple networks, carefully balancing assets to ensure they can fulfill swap requests while minimizing capital requirements and exposure to price volatility. The protocol architecture must support these professional participants while remaining accessible to individual users who want to perform direct peer-to-peer swaps, creating a hybrid system that combines the efficiency of automated market making with the flexibility of peer-to-peer exchange. Advanced implementations incorporate dynamic fee mechanisms that adjust based on network congestion, swap size, and liquidity availability, ensuring that the protocol remains economically sustainable while providing competitive rates for users.

The standardization efforts around cross-layer atomic swap protocols have led to the emergence of common patterns and best practices that improve interoperability and reduce implementation complexity. Organizations like the Interledger Protocol Foundation and various Ethereum Improvement Proposal (EIP) authors have proposed standards for cross-layer communication, asset representation, and swap execution that enable different implementations to interact seamlessly. These standards define common message formats, event structures, and verification mechanisms that allow atomic swap protocols from different developers to interoperate, creating network effects that benefit the entire ecosystem. The adoption of these standards has accelerated the development of cross-layer atomic swap infrastructure, with libraries, frameworks, and tools emerging that simplify the implementation process for developers while ensuring consistent security properties across different deployments.

Security Models and Trust Assumptions

The security model of cross-layer atomic swaps must account for the unique vulnerabilities that arise from coordinating transactions across different Layer-2 networks, each with its own consensus mechanism, validator set, and potential attack vectors. Unlike single-chain atomic swaps where security derives primarily from the underlying blockchain’s consensus, cross-layer swaps must consider the possibility that one Layer-2 network could be compromised while others remain secure. This necessitates a defense-in-depth approach where multiple layers of security mechanisms work together to protect user funds even in the presence of sophisticated attacks. The security model must address threats ranging from simple denial-of-service attacks that attempt to grief users by locking their funds, to complex attacks that exploit timing differences between networks or vulnerabilities in cross-layer communication protocols.

The trust assumptions underlying cross-layer atomic swaps vary depending on the specific implementation and the Layer-2 networks involved, with different approaches making different trade-offs between trustlessness and efficiency. Fully trustless implementations require no trust in any party beyond the consensus mechanisms of the underlying blockchains, but these often come with higher costs and longer settlement times. Semi-trusted implementations might rely on reputation systems, economic incentives, or cryptographic techniques like threshold signatures to reduce trust requirements while improving performance. The security analysis must consider not just the technical properties of the protocol but also the economic incentives of various actors, ensuring that the cost of attacking the system exceeds any potential profits. This economic security is particularly important for cross-layer swaps where the value being exchanged might exceed the economic security of some participating Layer-2 networks.

The verification mechanisms employed in cross-layer atomic swaps represent a critical component of the security architecture, determining how each network can verify that conditions on other networks have been met without trusting intermediaries. Advanced protocols leverage various cryptographic techniques including merkle proofs, which allow efficient verification of transaction inclusion, zero-knowledge proofs, which enable verification without revealing transaction details, and threshold cryptography, which distributes trust among multiple parties. The choice of verification mechanism impacts both security and performance, with more sophisticated techniques generally providing stronger security guarantees at the cost of increased computational complexity. Some implementations use optimistic verification where transactions are assumed valid unless challenged, similar to optimistic rollups, while others require explicit cryptographic proof of validity for every swap.

The handling of edge cases and failure scenarios in cross-layer atomic swaps requires careful consideration of all possible states and transitions, ensuring that the protocol remains safe even when things go wrong. Network partitions, where one Layer-2 network becomes temporarily unreachable, must be handled gracefully without locking user funds indefinitely. Chain reorganizations, where recent blocks are replaced due to consensus issues, could potentially reverse one leg of a swap while the other remains complete, requiring sophisticated detection and recovery mechanisms. The protocol must also handle cases where Layer-2 networks upgrade or change their protocols, ensuring backward compatibility or graceful migration paths that don’t disrupt ongoing swaps. Modern implementations include comprehensive monitoring and alerting systems that detect anomalous behavior and can trigger emergency procedures to protect user funds, such as pausing new swaps or initiating emergency withdrawals to Layer-1 networks. These safety mechanisms must be carefully balanced to avoid creating new attack vectors where malicious actors could trigger emergency procedures to disrupt normal operation.

Benefits and Real-World Applications

The transformative potential of atomic swaps across Layer-2 networks extends far beyond theoretical advantages, manifesting in tangible benefits that are reshaping how value flows through the decentralized ecosystem. The immediate and most visible benefit is the dramatic reduction in transaction costs, where swaps that might cost hundreds of dollars on Ethereum mainnet can be executed for pennies on Layer-2 networks, making decentralized exchange accessible to users who were previously priced out of the market. This cost reduction is not merely incremental but transformative, enabling new use cases like high-frequency trading, micro-transactions, and dollar-cost averaging strategies that require frequent small trades. The speed improvements are equally impressive, with atomic swaps on Layer-2 networks completing in seconds rather than minutes or hours, providing a user experience that rivals centralized exchanges while maintaining the security and sovereignty of decentralized systems. These performance improvements have catalyzed a new generation of decentralized applications that leverage atomic swaps as a primitive for more complex financial operations, from automated portfolio rebalancing to cross-chain yield farming strategies.

The elimination of counterparty risk through atomic swaps represents a fundamental advancement in financial security, removing the need to trust exchanges, bridge operators, or any other intermediaries with custody of funds. This trustless nature becomes particularly valuable in emerging markets and developing economies where traditional financial infrastructure may be unreliable or inaccessible. Users in these regions can now participate in global financial markets without needing to establish relationships with international banks or comply with complex regulatory requirements that might be impossible to meet. The atomic property ensures that trades either complete successfully or fail entirely, eliminating the complex dispute resolution processes and legal frameworks required in traditional finance. This simplification reduces operational overhead and enables automated systems to handle millions of transactions without human intervention, creating efficiencies that benefit all participants in the ecosystem.

Case Study Examples and Industry Implementations

The implementation of atomic swap technology by Connext Network in 2023 demonstrated the practical viability of cross-Layer-2 exchanges at scale, processing over $2 billion in volume across Arbitrum, Optimism, and Polygon networks within its first year of operation. Connext’s approach utilized a novel state channel-based architecture that enabled instant swaps between major Layer-2 networks without requiring users to wait for challenge periods or pay high gas fees. Their system achieved average swap completion times of under 30 seconds with fees averaging $0.50 per swap, compared to traditional bridge transfers that could take hours and cost $50 or more. The success of Connext’s implementation validated the demand for trustless cross-Layer-2 exchanges and inspired numerous other projects to develop similar solutions. By March 2024, Connext had expanded to support eight different Layer-2 networks and was processing over 10,000 swaps daily, with institutional traders using the platform for arbitrage and liquidity provisioning across different markets.

StarkWare’s deployment of atomic swap capabilities within StarkNet in September 2024 showcased how zero-knowledge proof technology could enhance the security and privacy of cross-layer exchanges. Their implementation leveraged STARK proofs to enable atomic swaps between StarkNet and other Layer-2 networks while maintaining complete privacy about transaction amounts and participants. The system processed a notable $500 million institutional swap between StarkNet and zkSync in November 2024, demonstrating the protocol’s ability to handle large-value transactions that would traditionally require OTC desks or custodial services. StarkWare reported that their atomic swap protocol reduced settlement risk for institutional traders by 95% compared to traditional bridge-based transfers, while maintaining transaction privacy that enabled competitive trading strategies without information leakage.

The integration of atomic swap technology into Uniswap’s cross-chain protocol in January 2025 marked a watershed moment for decentralized finance, bringing trustless cross-Layer-2 swaps to millions of retail users. Uniswap’s implementation aggregated liquidity from multiple Layer-2 networks, allowing users to seamlessly swap assets across Arbitrum, Optimism, Base, and Polygon without leaving the familiar Uniswap interface. Within the first month of launch, the protocol facilitated over $1 billion in cross-Layer-2 volume with an average trade size of $500, demonstrating strong retail adoption. The system’s sophisticated routing algorithm automatically selected the optimal path for each swap, considering factors like liquidity depth, network fees, and slippage across multiple networks. Uniswap reported that their atomic swap integration reduced failed transactions by 80% compared to traditional bridge-based approaches while providing price improvements of 2-3% on average due to aggregated liquidity access.

The practical applications of atomic swaps extend into numerous sectors beyond traditional cryptocurrency trading, with implementations in gaming, supply chain, and decentralized identity systems demonstrating the technology’s versatility. Gaming platforms have leveraged atomic swaps to enable players to trade in-game assets across different games and networks without relying on centralized marketplaces that typically charge fees of 10-30%. Supply chain applications use atomic swaps to coordinate payments and asset transfers across different blockchain networks used by various participants in global trade. Decentralized identity systems employ atomic swaps to enable privacy-preserving credential exchanges where users can prove attributes without revealing underlying data. These diverse applications demonstrate that atomic swaps are not merely a financial tool but a fundamental primitive for coordinating value transfer in any multi-blockchain environment. The success of these implementations has attracted significant investment and development resources, with major technology companies and financial institutions exploring how atomic swaps can enhance their blockchain strategies.

Challenges and Current Limitations

Despite the remarkable progress in atomic swap technology, significant challenges remain that prevent widespread adoption and limit the protocol’s effectiveness in certain scenarios. The liquidity fragmentation across different Layer-2 networks creates a chicken-and-egg problem where users are reluctant to move assets to networks with limited liquidity, while liquidity providers hesitate to deploy capital on networks with few users. This fragmentation means that even with perfect atomic swap protocols, users might face significant slippage or be unable to execute large trades without breaking them into multiple smaller transactions across different networks. The complexity of managing liquidity across multiple Layer-2 networks requires sophisticated infrastructure and substantial capital, creating barriers to entry for smaller market makers and potentially leading to centralization around a few large liquidity providers. Current solutions attempt to address this through liquidity aggregation protocols and cross-chain automated market makers, but these add additional layers of complexity and potential points of failure to the system.

The technical complexity of implementing and using atomic swaps presents a significant barrier to mainstream adoption, requiring users to understand concepts like hash time-locked contracts, timeout periods, and cross-chain verification that are far removed from the simple buy and sell interfaces of centralized exchanges. Even with user-friendly interfaces, the underlying complexity occasionally surfaces when swaps fail or require manual intervention, creating frustrating experiences that drive users back to centralized alternatives. The need to maintain wallets and gas tokens on multiple Layer-2 networks adds operational overhead that many users find burdensome, particularly when they need to bridge assets just to pay for transaction fees on a new network. Development teams must balance the desire for simplicity with the need to maintain security and decentralization, often resulting in compromises that satisfy neither power users who want full control nor casual users who want simplicity.

The lack of standardization across different Layer-2 networks and atomic swap implementations creates interoperability challenges that fragment the ecosystem and increase development costs. Each Layer-2 network has its own unique characteristics, APIs, and security models, requiring atomic swap protocols to implement custom adapters and verification mechanisms for each supported network. This heterogeneity makes it difficult to achieve the network effects that would drive adoption and liquidity, as users and developers must choose between incompatible systems rather than benefiting from a unified ecosystem. The absence of widely adopted standards for cross-layer communication, asset representation, and swap execution means that different protocols cannot easily interact, reducing liquidity and creating inefficiencies that sophisticated actors can exploit through arbitrage. While standardization efforts are underway, the rapid pace of innovation in the Layer-2 space means that standards often lag behind implementation, creating a moving target for developers and users alike.

Regulatory uncertainty surrounding atomic swaps and cross-chain exchanges poses additional challenges that could limit adoption and development in certain jurisdictions. Regulators struggle to apply existing frameworks designed for centralized intermediaries to trustless protocols that operate without clear operators or responsible parties. Questions about the legal status of atomic swaps, whether they constitute securities transactions, and how anti-money laundering and know-your-customer requirements apply remain largely unresolved. Some jurisdictions have begun developing specific frameworks for decentralized finance, but the global nature of atomic swap protocols means they must navigate a complex patchwork of potentially conflicting regulations. The risk of regulatory action creates uncertainty for developers, users, and investors, potentially slowing innovation and driving activity to more permissive jurisdictions. The challenge is particularly acute for institutional participants who must comply with strict regulatory requirements but want to benefit from the efficiency and security of atomic swaps.

The performance limitations of current atomic swap implementations, while improved from early versions, still fall short of the microsecond latency and guaranteed execution of centralized systems that professional traders require. Network congestion on popular Layer-2 networks can delay swap execution and increase costs unpredictably, making it difficult for traders to execute time-sensitive strategies or guarantee execution prices. The atomic nature of swaps, while providing security, also means that partial fills are either impossible or require complex workarounds that reduce efficiency. Price discovery mechanisms in atomic swap protocols often lag behind centralized exchanges, creating arbitrage opportunities but also meaning that users might not get the best available prices. These performance limitations are particularly problematic for high-frequency trading and market-making strategies that require predictable execution and minimal latency. While ongoing improvements in Layer-2 technology and atomic swap protocols continue to close the performance gap, achieving parity with centralized systems while maintaining decentralization remains an active area of research and development.

Final Thoughts

The emergence of atomic swaps across Layer-2 networks represents a defining moment in the evolution of decentralized finance, marking the transition from experimental protocols to production-ready infrastructure capable of supporting a global, trustless financial system. This technology embodies the original vision of cryptocurrency as a peer-to-peer electronic cash system, extended now to encompass complex multi-asset exchanges across heterogeneous blockchain networks without requiring trust in any central authority. The convergence of atomic swap protocols with Layer-2 scaling solutions has created a powerful synergy that addresses both the scalability limitations of first-generation blockchains and the security vulnerabilities of centralized exchanges and bridge protocols. As these systems mature and interconnect, we are witnessing the formation of a new financial infrastructure that operates according to mathematical rules rather than institutional trust, creating unprecedented opportunities for financial inclusion and innovation on a global scale.

The implications of widespread atomic swap adoption extend far beyond the cryptocurrency ecosystem, potentially reshaping fundamental assumptions about how value is exchanged in the digital economy. Traditional financial systems rely on numerous intermediaries to facilitate transactions, verify identities, manage risk, and ensure settlement, extracting fees at each step and creating barriers that exclude billions of people from full participation in the global economy. Atomic swaps eliminate these intermediaries through cryptographic protocols that ensure fairness and security without human intervention, dramatically reducing costs while improving speed and accessibility. This transformation is particularly significant for cross-border transactions, where traditional systems can take days to settle and charge fees that make small transfers economically unviable. With atomic swaps across Layer-2 networks, a worker in one country can instantly exchange their earnings for their family’s local currency in another country, paying fees measured in cents rather than dollars and completing the transaction in seconds rather than days.

The social responsibility inherent in developing and deploying atomic swap technology cannot be overlooked, as these protocols have the potential to democratize access to financial services for populations that have been historically excluded or underserved. In regions where banking infrastructure is limited or unreliable, atomic swaps provide a pathway to participate in global markets without needing to establish relationships with financial institutions that might be physically distant or politically inaccessible. The trustless nature of these protocols is particularly valuable in environments where institutional trust has been eroded by corruption, instability, or historical injustices. By enabling individuals to maintain complete custody of their assets while still participating in sophisticated financial transactions, atomic swaps restore agency and autonomy to users who have traditionally been dependent on intermediaries that might not have their best interests at heart. The technology’s resistance to censorship and confiscation provides crucial protection for vulnerable populations, enabling them to preserve and transfer wealth even in challenging circumstances.

Looking toward the future, the trajectory of atomic swap technology points toward an increasingly interconnected and efficient blockchain ecosystem where the boundaries between different networks become largely irrelevant to end users. Current research focuses on extending atomic swaps beyond simple asset exchanges to encompass complex financial instruments, conditional payments, and multi-party transactions that could enable entirely new categories of decentralized applications. The integration of artificial intelligence and machine learning with atomic swap protocols promises to optimize routing, predict liquidity needs, and identify arbitrage opportunities in real-time, creating more efficient markets that better serve user needs. As quantum computing threatens the cryptographic foundations of current blockchain systems, researchers are already developing quantum-resistant atomic swap protocols that will ensure the technology remains secure in the face of evolving computational capabilities. The potential for atomic swaps to facilitate not just cryptocurrency exchanges but also tokenized real-world assets, digital identity credentials, and other forms of value suggests that we are only beginning to explore the technology’s full potential.

The ongoing evolution of atomic swaps across Layer-2 networks reflects broader themes of innovation, decentralization, and financial democratization that define the blockchain revolution. While challenges remain in areas such as user experience, regulatory compliance, and liquidity fragmentation, the fundamental value proposition of trustless, efficient, and accessible exchange continues to drive development and adoption forward. The collaboration between researchers, developers, and users in refining these protocols demonstrates the power of open-source development and community-driven innovation to solve complex technical and social challenges. As atomic swaps become more sophisticated and user-friendly, they will likely fade into the background of user experience, becoming invisible infrastructure that powers a new generation of financial applications. The true measure of success for atomic swap technology will not be its technical elegance or theoretical properties, but its ability to provide real value to real people, enabling economic opportunities and financial freedom for individuals and communities worldwide.

FAQs

- What exactly is an atomic swap and why is it called “atomic”?

An atomic swap is a peer-to-peer exchange of cryptocurrencies between two parties without using a centralized intermediary or exchange. The term “atomic” comes from computer science and means that the transaction is indivisible – it either completes entirely with both parties receiving their expected assets, or it fails completely with both parties keeping their original assets. This all-or-nothing property is enforced through smart contracts and cryptographic protocols that make it impossible for one party to receive assets without the other party also receiving theirs, eliminating the counterparty risk present in traditional exchanges. - How do atomic swaps on Layer-2 networks differ from those on main blockchains?

Atomic swaps on Layer-2 networks operate with significantly lower fees and faster execution times compared to main blockchain implementations, often completing in seconds rather than minutes and costing cents rather than dollars. Layer-2 atomic swaps also benefit from additional features like enhanced privacy through zero-knowledge proofs, more complex smart contract capabilities, and the ability to handle higher transaction volumes without congesting the network. However, they must also account for the unique characteristics of each Layer-2 network, such as different finality times and security models, requiring more sophisticated protocols to ensure safety across diverse environments. - What are the main risks involved in using atomic swaps?

While atomic swaps eliminate counterparty risk, users still face certain risks including technical complexity that could lead to user error, potential smart contract bugs that might lock funds temporarily, and time-based risks where network congestion could prevent swap completion within required timeframes. There’s also liquidity risk where large swaps might face significant price slippage, and the opportunity cost of locked funds during the swap process. Additionally, users must manage private keys and understand the protocols they’re interacting with, as there’s no customer service or recourse if mistakes are made, though these risks are generally lower than those associated with centralized exchanges or bridge protocols. - Can atomic swaps be reversed or cancelled once initiated?

Atomic swaps cannot be reversed once both parties have committed their transactions, but they include built-in cancellation mechanisms through timeout periods that allow participants to reclaim their funds if the swap doesn’t complete within a specified timeframe. Before the timeout, if one party hasn’t fulfilled their part of the swap, the other party’s funds will automatically be released back to them, ensuring that funds are never permanently locked. This timeout mechanism is essential for preventing griefing attacks where one party might intentionally delay to harm the other, and the specific timeout periods are carefully calibrated based on the networks involved and their finality characteristics. - What cryptocurrencies and Layer-2 networks currently support atomic swaps?

Major Layer-2 networks supporting atomic swaps include Arbitrum, Optimism, Polygon, zkSync, and StarkNet, with new networks regularly adding support as the technology matures and standards emerge. Most EVM-compatible tokens can participate in atomic swaps on these networks, including ETH, stablecoins like USDC and DAI, and thousands of ERC-20 tokens. Bitcoin’s Lightning Network supports atomic swaps with other Lightning-compatible networks, while cross-chain protocols are expanding support to include non-EVM chains like Solana and Cosmos, though the specific assets and networks available depend on the atomic swap protocol being used and its current implementations. - How much do atomic swaps typically cost compared to centralized exchanges?

Atomic swaps on Layer-2 networks typically cost between $0.10 and $2.00 per transaction depending on network congestion and swap complexity, compared to centralized exchanges that charge percentage-based fees usually ranging from 0.1% to 0.5% of the transaction value plus withdrawal fees. For large transactions, atomic swaps can be significantly cheaper since fees are generally fixed rather than percentage-based, while for very small transactions, the fixed network fees might be proportionally higher than centralized exchange fees. However, when considering the total cost including withdrawal fees, spread, and potential custody risks, atomic swaps often provide better value, especially for users who value self-custody and censorship resistance. - Do I need technical knowledge to use atomic swaps?

Modern atomic swap interfaces have significantly simplified the user experience, requiring no more technical knowledge than using a standard decentralized exchange like Uniswap, with many protocols offering one-click swap functionality through user-friendly web interfaces. However, users should understand basic concepts like gas fees, wallet management, and transaction confirmation to use these systems safely and effectively. While the underlying technology is complex, reputable platforms abstract away most complexity, though users benefit from understanding basics like why swaps have timeout periods and how to verify transaction status on block explorers to troubleshoot if issues arise. - How long does a typical atomic swap take to complete?

Atomic swaps on Layer-2 networks typically complete within 10 to 60 seconds under normal network conditions, with some zero-knowledge rollup implementations achieving near-instant finality in under 5 seconds. The exact timing depends on factors including the specific Layer-2 networks involved, current network congestion, and the protocol’s security parameters such as required confirmations. This represents a dramatic improvement over Layer-1 atomic swaps which could take 10-60 minutes, and is competitive with centralized exchanges for most use cases, though high-frequency traders requiring microsecond execution still rely on centralized systems for certain strategies. - What happens if there’s a network problem during an atomic swap?

Atomic swap protocols are designed with robust failure handling that ensures user funds remain safe even during network disruptions, with timeout mechanisms automatically returning locked funds to their original owners if swaps don’t complete within specified timeframes. If one network experiences congestion or downtime, the swap will fail safely rather than completing partially, and monitoring systems in modern implementations can detect issues and alert users to potential problems. Most protocols also include emergency recovery mechanisms that allow users to reclaim funds through alternative methods if primary systems fail, though these safety features mean that swaps might fail more often during network instability rather than completing with potential issues. - Are atomic swaps legal and how are they regulated?

The legal status of atomic swaps varies by jurisdiction, with most countries treating them similarly to other cryptocurrency transactions, though specific regulations are still evolving as authorities grapple with the implications of trustless, intermediary-free exchanges. In jurisdictions with clear cryptocurrency regulations, atomic swaps generally fall under existing frameworks for digital asset exchanges, though the absence of a central operator complicates traditional regulatory approaches. Users should research their local regulations and consider tax implications, as atomic swaps are typically treated as taxable events in countries that tax cryptocurrency transactions, and some jurisdictions may have specific requirements for reporting or restrictions on peer-to-peer exchanges that could affect atomic swap usage.