The emergence of non-fungible tokens has revolutionized digital ownership, creating unprecedented opportunities for artists, creators, and collectors to engage with unique digital assets. However, as the blockchain ecosystem continues to expand with multiple competing networks, each offering distinct advantages and capabilities, a critical challenge has emerged: the inability of NFTs to move freely between different blockchain platforms. This limitation fragments the market, restricts liquidity, and ultimately diminishes the utility of digital assets that should, by their very nature, transcend the boundaries of individual networks. Cross-chain NFT standards and portability represent the technological evolution necessary to address these constraints, enabling digital assets to maintain their integrity, ownership history, and metadata while traversing diverse blockchain architectures.

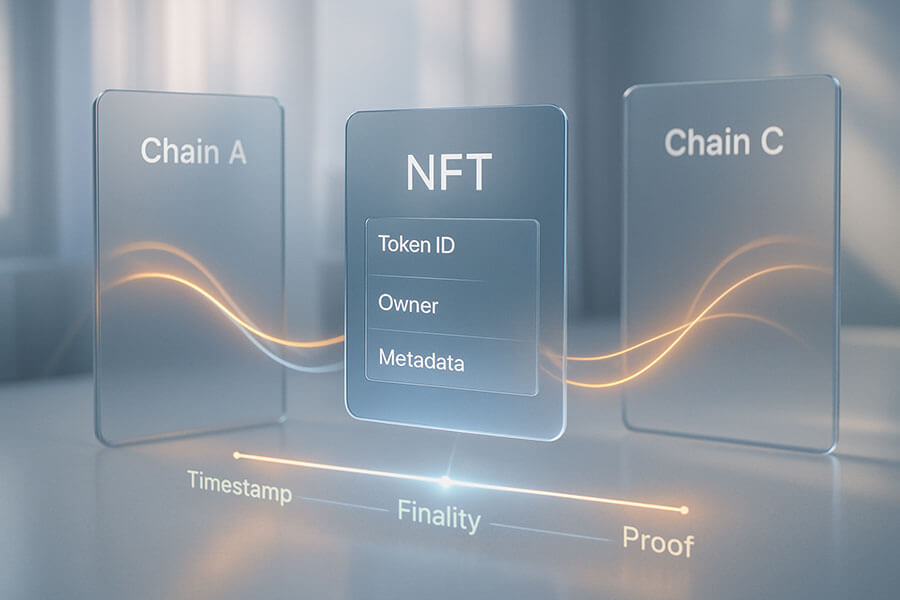

The concept of cross-chain NFT portability extends far beyond simple token transfers, encompassing a complex ecosystem of protocols, standards, and technologies designed to preserve the essential characteristics that make each NFT unique. When an NFT moves from Ethereum to Polygon, or from Solana to Avalanche, it must retain not just its visual representation but also its provenance, smart contract functionality, and the rich metadata that defines its attributes and history. This preservation requires sophisticated technical solutions that can translate between different programming languages, consensus mechanisms, and data structures while maintaining the security and decentralization principles that underpin blockchain technology. The development of these cross-chain standards represents a collaborative effort among blockchain developers, protocol designers, and industry stakeholders who recognize that true digital ownership cannot be confined to isolated technological silos.

Understanding cross-chain NFT standards requires appreciating both the technical complexities involved and the broader implications for the digital economy. These standards are not merely technical specifications but foundational infrastructure that will determine how digital assets function in an increasingly interconnected world. They address fundamental questions about digital ownership, asset portability, and the interoperability of decentralized systems that operate with different rules, speeds, and capabilities. As we explore the various protocols and technologies enabling cross-chain NFT movement, we discover a landscape of innovation where competing approaches vie to become the dominant standard, each offering unique solutions to the challenge of blockchain interoperability. This comprehensive examination will illuminate how these technologies work, why they matter, and what they mean for the future of digital assets in an multi-chain world.

Understanding NFT Standards and Blockchain Ecosystems

The foundation of cross-chain NFT portability rests upon understanding the fundamental architecture of NFT standards and the diverse blockchain ecosystems they inhabit. Each blockchain network operates as an independent universe with its own rules, programming languages, and technical specifications that govern how digital assets are created, stored, and transferred. These differences create natural barriers to interoperability, as an NFT minted on Ethereum using the ERC-721 standard exists in an entirely different technical context than one created on Solana using its Metaplex standard. The challenge of cross-chain portability begins with reconciling these fundamental differences while preserving the unique characteristics that define each NFT.

The proliferation of blockchain networks has created a rich but fragmented ecosystem where each platform offers distinct advantages tailored to specific use cases. Ethereum remains the dominant force in the NFT space, providing robust smart contract capabilities and the largest ecosystem of tools and users, though its high gas fees and network congestion have driven many projects to seek alternatives. Networks like Polygon and Arbitrum offer Ethereum compatibility with improved scalability, while chains like Solana and Avalanche provide high-speed transactions at minimal cost. Each network’s architecture reflects different design priorities, from maximizing decentralization to optimizing for speed or minimizing transaction costs. These variations in blockchain design directly impact how NFTs function on each platform, creating unique challenges for achieving true interoperability.

Core Components of NFT Standards

NFT standards serve as the technical blueprints that define how non-fungible tokens operate within a blockchain ecosystem, establishing the rules for creation, ownership, transfer, and interaction with these unique digital assets. The ERC-721 standard on Ethereum pioneered the concept of non-fungible tokens by introducing a standardized interface that allows each token to have unique properties and metadata. This standard defines essential functions such as transferring ownership, checking balances, and approving third-party transfers, creating a common language that smart contracts and applications can use to interact with NFTs. The specification includes methods for tracking token ownership through unique identifiers, ensuring that each NFT maintains its distinct identity and cannot be replicated or divided.

Building upon the foundation of ERC-721, the ERC-1155 standard introduced a more flexible approach that allows for both fungible and non-fungible tokens within the same smart contract. This multi-token standard enables more efficient batch transfers and reduces the gas costs associated with deploying multiple contracts, making it particularly suitable for gaming applications where users might own multiple instances of certain items alongside unique collectibles. The standard’s ability to handle semi-fungible tokens, which can transition from fungible to non-fungible states, adds another layer of complexity to cross-chain portability considerations. These tokens might represent limited edition items that become unique once claimed or game assets that gain individual characteristics through use.

The metadata structure associated with NFT standards forms the crucial layer that gives meaning and context to what would otherwise be simple blockchain entries. This metadata typically includes descriptive information about the asset, links to media files, attributes that define rarity or characteristics, and provenance data that tracks the asset’s history. Standards specify how this metadata should be structured and accessed, though implementation details can vary significantly between projects. The challenge for cross-chain portability lies in ensuring that this rich metadata layer remains intact and accessible when an NFT moves between blockchains with different storage solutions and data formats. Some chains store metadata directly on-chain for permanence, while others rely on distributed storage systems like IPFS or centralized servers, each approach presenting unique challenges for cross-chain compatibility.

Blockchain Ecosystem Diversity and Incompatibility

The technological diversity among blockchain platforms extends well beyond surface-level differences in transaction speed or cost, encompassing fundamental architectural decisions that affect every aspect of how NFTs function. Consensus mechanisms vary dramatically, from Ethereum’s proof-of-stake system to Solana’s proof-of-history approach, each creating different security models and finality guarantees that must be reconciled when moving assets between chains. The programming languages used for smart contract development differ significantly across platforms, with Ethereum using Solidity, Solana employing Rust, and chains like Cardano utilizing Haskell-based languages. These linguistic differences mean that smart contract logic cannot simply be copied between chains but must be reimplemented or translated, potentially introducing discrepancies in functionality.

The account models employed by different blockchains create another layer of incompatibility that affects NFT portability. Ethereum and similar chains use an account-based model where addresses can hold both tokens and execute smart contracts, while Bitcoin-derived chains employ UTXO models that treat each transaction output as a discrete unit. Some newer chains like Algorand implement hybrid models that combine elements of both approaches. These structural differences affect how ownership is tracked, how transactions are processed, and how smart contracts interact with NFTs, requiring sophisticated bridging mechanisms to translate between different paradigms while maintaining consistency and security.

Virtual machine architectures represent perhaps the most significant technical barrier to seamless NFT portability between blockchains. The Ethereum Virtual Machine has become a de facto standard adopted by many chains seeking compatibility, but platforms like Solana’s Sealevel runtime, Cosmos’s CosmWasm, and Polkadot’s WebAssembly-based system each offer different execution environments with unique capabilities and limitations. These virtual machines determine how smart contracts are executed, how state is managed, and how resources are allocated, creating fundamental incompatibilities that cannot be easily bridged without sophisticated translation layers or wrapper protocols that can interpret and execute code across different environments.

The diversity in blockchain ecosystems reflects the ongoing experimentation and innovation in distributed ledger technology, with each platform representing different hypotheses about the optimal balance between decentralization, scalability, and security. This experimentation has produced remarkable innovations but has also created a fragmented landscape where assets and applications remain isolated within their native ecosystems. Cross-chain NFT standards must navigate this complexity, creating abstraction layers that can accommodate diverse technical approaches while maintaining the integrity and functionality of digital assets as they move between chains.

The Need for Cross-Chain NFT Portability

The imperative for cross-chain NFT portability emerges from the fundamental tension between the promise of blockchain technology as an open, interoperable system and the reality of isolated blockchain networks that cannot easily communicate or share assets. Digital ownership should not be constrained by the technical limitations of individual platforms, yet the current state of blockchain technology creates artificial boundaries that limit the utility and value of NFTs. Artists who mint their work on one blockchain find their audience limited to users of that specific network, while collectors face the challenge of managing assets scattered across multiple incompatible platforms. This fragmentation undermines the vision of a truly decentralized digital economy where assets can flow freely according to market demands and user preferences.

The evolution of the NFT market has highlighted the critical importance of liquidity and accessibility in determining asset value and market efficiency. When NFTs are locked within single blockchain ecosystems, they suffer from reduced liquidity as potential buyers and sellers are limited to those operating on the same network. This constraint becomes particularly problematic during periods of network congestion or high gas fees, when users might prefer to trade on alternative platforms but cannot easily move their assets. The inability to arbitrage price differences between markets on different chains creates inefficiencies that benefit sophisticated traders with technical resources while disadvantaging average users who lack the tools or knowledge to navigate complex bridging solutions.

Market Fragmentation and User Experience Challenges

The proliferation of blockchain networks has created a paradox where increased choice has led to decreased accessibility and user confusion. New users entering the NFT space must navigate a complex landscape of different wallets, exchanges, and platforms, each specific to particular blockchain networks. This fragmentation manifests in practical challenges that significantly degrade the user experience and create barriers to mainstream adoption. A collector interested in purchasing NFTs might need to maintain separate wallets for Ethereum, Solana, and Tezos, manage different native tokens for transaction fees, and learn the unique interfaces and procedures of each ecosystem. This complexity transforms what should be simple transactions into multi-step processes fraught with potential for error and loss.

The fragmentation of NFT markets across different blockchains creates artificial scarcity and pricing inefficiencies that harm both creators and collectors. An artist who chooses to mint on Ethereum might miss potential buyers who prefer the lower fees of Polygon or the speed of Solana, while splitting releases across multiple chains dilutes brand presence and complicates marketing efforts. Secondary markets suffer from reduced depth and liquidity when potential traders are segregated by blockchain boundaries, leading to wider bid-ask spreads and less efficient price discovery. These market inefficiencies are particularly pronounced for less popular or niche NFT collections that might struggle to achieve critical mass on any single platform but could thrive in a unified cross-chain marketplace.

The technical challenges of managing NFTs across multiple blockchains extend beyond simple inconvenience to create real risks for users. Private key management becomes exponentially more complex when users must secure multiple wallets, increasing the likelihood of loss through user error or security breaches. The lack of standardized tools for cross-chain asset management means users often resort to manual tracking methods or rely on third-party services that may compromise security or privacy. Smart contract risks multiply when users interact with bridge protocols or wrapped token systems they may not fully understand, potentially exposing them to exploits or loss of funds through improperly executed transactions. These challenges create a significant barrier to entry for mainstream users accustomed to the seamless experiences provided by traditional digital platforms.

Economic and Technical Benefits of Interoperability

The economic advantages of cross-chain NFT portability extend far beyond simple convenience, fundamentally altering the dynamics of digital asset markets by creating larger, more liquid trading pools that benefit all participants. When NFTs can move freely between blockchains, market makers can provide liquidity more efficiently, reducing spreads and improving price discovery across the entire ecosystem. This enhanced liquidity translates directly into value for NFT holders, who can access broader markets for their assets and achieve better prices through increased competition among buyers. The ability to move assets to chains with lower transaction costs during periods of high network congestion provides economic flexibility that can significantly reduce the total cost of ownership and trading.

Cross-chain portability unlocks new use cases and business models that are impossible within isolated blockchain ecosystems. Gaming projects can create truly interoperable assets that function across multiple game worlds hosted on different chains, allowing players to carry their achievements and possessions between experiences. Decentralized finance protocols can accept NFTs as collateral regardless of their origin chain, expanding lending markets and creating new financial products. Metaverse platforms can become blockchain-agnostic, allowing users to bring their digital identities and possessions from any source into virtual worlds. These expanded use cases create network effects that increase the utility and value of NFTs, driving adoption and innovation across the entire blockchain ecosystem.

The technical benefits of interoperability include improved resilience and flexibility for NFT projects and platforms. When assets can move between chains, projects gain protection against network-specific risks such as congestion, attacks, or technical failures. If one blockchain experiences problems, users can evacuate their assets to alternative networks, preserving value and maintaining continuity of service. This optionality creates competitive pressure on blockchain platforms to maintain high performance and reasonable costs, benefiting users through improved service quality. Development teams gain flexibility to deploy on multiple chains simultaneously or migrate between platforms as technical requirements evolve, reducing vendor lock-in and enabling more agile responses to changing market conditions.

The standardization required for cross-chain portability drives improvements in NFT technology that benefit even single-chain applications. Creating interoperable standards forces developers to think more carefully about metadata structures, storage solutions, and smart contract interfaces, leading to more robust and well-designed systems. The abstraction layers necessary for cross-chain communication often reveal inefficiencies or limitations in existing approaches, spurring innovation in areas like state management, cryptographic proofs, and consensus mechanisms. These technological advances create positive spillovers that improve the entire blockchain ecosystem, accelerating the maturation of NFT technology and bringing it closer to mainstream readiness.

Core Technologies Enabling Cross-Chain NFT Movement

The technical infrastructure supporting cross-chain NFT movement represents a complex orchestration of cryptographic protocols, distributed systems, and economic mechanisms designed to maintain security while enabling interoperability. These technologies must solve fundamental challenges in distributed computing, including the problem of atomicity across independent systems, the verification of events on external blockchains, and the preservation of asset properties during cross-chain transfers. The solutions developed for these challenges draw from decades of research in distributed systems, cryptography, and game theory, adapted to the unique constraints and requirements of blockchain networks. Understanding these core technologies provides insight into both the capabilities and limitations of current cross-chain NFT solutions.

The architecture of cross-chain communication systems must balance multiple competing demands, including security, decentralization, speed, and cost-effectiveness. Each design decision involves trade-offs that affect the overall functionality and trustworthiness of the system. Some approaches prioritize maximum security through extensive validation and lengthy confirmation periods, while others optimize for user experience with faster transfers at the cost of additional trust assumptions. The diversity of approaches reflects the early stage of cross-chain technology development, where optimal solutions have yet to emerge and different use cases may require different trade-offs. This technological landscape continues to evolve rapidly as new research emerges and practical experience reveals the strengths and weaknesses of various approaches.

Bridge Technologies and Wrapped NFT Mechanisms

Bridge technologies serve as the fundamental infrastructure connecting isolated blockchain networks, enabling the transfer of assets and information between incompatible systems through sophisticated cryptographic and economic mechanisms. At their core, bridges operate by creating representations of assets on destination chains while ensuring that the total supply remains constant across all connected networks. This process typically involves locking or burning the original NFT on its source chain and minting a corresponding wrapped or synthetic version on the destination chain, with the bridge protocol managing the coordination between these actions. The complexity of this process increases dramatically when dealing with NFTs compared to fungible tokens, as each NFT’s unique properties, metadata, and associated smart contract logic must be preserved or appropriately translated.

The security model of bridge protocols represents one of the most critical and challenging aspects of cross-chain NFT transfers. Trust-minimized bridges attempt to rely primarily on cryptographic proofs and economic incentives rather than trusted intermediaries, using techniques such as light client verification, merkle proofs, and fraud proofs to validate cross-chain events. These systems require validators or relayers to stake collateral that can be slashed if they attempt to facilitate invalid transfers, creating economic security through aligned incentives. However, the security of these bridges often depends on assumptions about the behavior of validators, the economic value of staked assets, and the reliability of the underlying blockchains, creating potential attack vectors that have been exploited in several high-profile bridge hacks resulting in hundreds of millions of dollars in losses.

The wrapped NFT mechanism introduces additional layers of complexity when preserving the full functionality of NFTs across chains. Unlike fungible tokens where wrapped versions are interchangeable, each wrapped NFT must maintain its unique identity and properties while potentially adapting to different technical standards on the destination chain. This preservation requires sophisticated mapping systems that can translate between different metadata formats, storage systems, and smart contract interfaces. Some bridges implement lazy minting approaches where the wrapped NFT is only created when first accessed on the destination chain, reducing costs but potentially creating delays. Others maintain synchronized state across chains, ensuring that any updates to metadata or properties are reflected across all representations, though this approach significantly increases complexity and cost.

The economic mechanisms underlying bridge operations create important considerations for NFT portability. Bridge operators must be incentivized to maintain infrastructure and provide security, typically through fees charged on transfers or through token rewards from bridge protocols. These costs can accumulate significantly for users who frequently move assets between chains, potentially negating some economic benefits of cross-chain portability. Some bridges implement liquidity pools or automated market makers specifically for NFTs, allowing for instant transfers without waiting for cross-chain confirmation but requiring sophisticated pricing mechanisms for unique assets. The sustainability of these economic models remains an open question, particularly as competition between bridges intensifies and users become more price-sensitive.

Interoperability Protocols and Messaging Systems

Interoperability protocols represent the next evolution in cross-chain technology, moving beyond simple asset transfers to enable complex interactions and communications between blockchain networks. These protocols establish standardized methods for blockchains to exchange messages, verify states, and coordinate actions, creating a foundation for truly interoperable applications that can seamlessly operate across multiple chains. The development of these protocols requires solving fundamental problems in distributed systems, including consensus on the ordering of cross-chain events, handling of network partitions or failures, and maintaining consistency across systems with different finality guarantees. The solutions developed for these challenges often involve sophisticated cryptographic techniques such as threshold signatures, zero-knowledge proofs, and secure multi-party computation.

Oracle networks play a crucial role in cross-chain communication by providing trusted information about events occurring on external blockchains. These decentralized oracle systems aggregate data from multiple sources to achieve consensus on the state of external chains, enabling smart contracts to react to cross-chain events without direct communication channels. The security of oracle networks depends on economic incentives that encourage honest reporting and penalize false information, typically through staking mechanisms and reputation systems. Advanced oracle protocols implement commit-reveal schemes and cryptographic proofs to prevent front-running and manipulation, though the challenge of achieving truly trustless cross-chain information remains an active area of research. The integration of oracle networks with NFT bridges enables more sophisticated functionality, such as conditional transfers based on external events or cross-chain auctions where bids can originate from multiple blockchains.

The messaging layer of interoperability protocols must handle the translation of data formats, function calls, and state updates between blockchains with different architectures and programming models. This translation requires sophisticated abstraction layers that can map between different data types, handle errors and exceptions across systems, and maintain consistency despite potential failures or delays. Some protocols implement universal messaging formats that all participating chains must support, while others use adapter patterns that allow custom translations for each blockchain pair. The challenge becomes particularly acute when dealing with NFT metadata that may include complex nested structures, binary data, or references to external resources that must be appropriately handled on each chain.

Cross-chain messaging systems must also address the challenge of transaction ordering and atomicity across independent blockchains that process transactions at different speeds and with different finality guarantees. Ensuring that a series of related transactions across multiple chains either all succeed or all fail requires sophisticated coordination mechanisms that can handle partial failures and rollbacks. Some protocols implement two-phase commit protocols adapted for blockchain environments, while others use eventual consistency models that allow for temporary inconsistencies that are later resolved. The choice of consistency model significantly impacts the user experience and the types of applications that can be built on top of the interoperability protocol, with stronger consistency generally requiring longer confirmation times and higher costs.

The evolution of cross-chain technologies continues to accelerate as new research emerges and practical deployments reveal both opportunities and challenges. Recent developments in zero-knowledge proof systems promise to enable more efficient and secure cross-chain verification, while advances in consensus mechanisms and cryptographic techniques open new possibilities for trust-minimized interoperability. The standardization efforts emerging from organizations like the Interchain Foundation and the Enterprise Ethereum Alliance are beginning to create common frameworks that could accelerate the development of interoperable systems. As these technologies mature, they lay the groundwork for a future where blockchain boundaries become increasingly transparent to users, enabling seamless interaction with digital assets regardless of their underlying technical infrastructure.

Major Cross-Chain NFT Protocols and Standards

The landscape of cross-chain NFT protocols represents a diverse ecosystem of competing and complementary solutions, each approaching the challenge of interoperability from different angles and with different priorities. These protocols range from generalized messaging systems that can handle any type of cross-chain communication to specialized NFT bridges designed specifically for transferring digital collectibles and their associated metadata. The evolution of these protocols reflects the broader maturation of the blockchain industry, moving from isolated experiments to production-ready systems handling billions of dollars in value. Understanding the strengths, limitations, and design philosophies of major protocols provides essential context for evaluating the current state and future direction of cross-chain NFT technology.

The competition between different cross-chain protocols has driven rapid innovation in areas such as security models, user experience, and economic efficiency. Each protocol’s approach reflects different assumptions about the future of blockchain technology and the requirements of cross-chain applications. Some protocols prioritize maximum decentralization and security, accepting higher costs and slower speeds as necessary trade-offs. Others focus on user experience and speed, implementing more centralized components or additional trust assumptions to achieve better performance. This diversity of approaches benefits the ecosystem by providing options for different use cases and risk tolerances, though it also creates fragmentation and complexity for developers and users who must choose between competing standards.

Layer Zero and Omnichain NFT Standards

LayerZero has emerged as one of the most significant protocols in the cross-chain NFT space, introducing the concept of omnichain applications that can natively operate across multiple blockchains without traditional bridging mechanisms. The protocol’s architecture centers on Ultra Light Nodes that enable efficient verification of cross-chain messages without requiring the storage of block headers from other chains. This approach significantly reduces the computational and storage requirements for cross-chain communication, making it economically viable for a broader range of applications. LayerZero’s design philosophy emphasizes composability and developer experience, providing simple interfaces that abstract away the complexity of cross-chain communication while maintaining security through a novel oracle and relayer system.

The Omnichain NFT (ONFT) standard developed by LayerZero represents a fundamental reimagining of how NFTs exist in a multi-chain world. Rather than creating wrapped versions or synthetic representations, ONFTs exist natively on multiple chains simultaneously, with the protocol managing the coordination to ensure only one active instance exists at any time. This approach preserves all the properties and functionality of the NFT regardless of which chain it currently resides on, eliminating the fragmentation and complexity associated with wrapped assets. The implementation of ONFT involves sophisticated state management that tracks the current location of each token and handles the atomic transfer of ownership across chains, including rollback mechanisms for handling failures or disputes.

Real-world implementations of LayerZero’s ONFT standard demonstrate the practical benefits and challenges of omnichain NFT technology. The Gh0stly Gh0sts project, launched in April 2022, became one of the first major NFT collections to implement true omnichain functionality, allowing holders to transfer their NFTs seamlessly between Ethereum, Polygon, Arbitrum, Optimism, Fantom, Avalanche, and BNB Chain. The project’s success demonstrated that users value the flexibility to move their assets based on factors like gas costs, transaction speed, or ecosystem-specific opportunities. During periods of high Ethereum gas fees, significant portions of the collection migrated to lower-cost chains, validating the economic benefits of cross-chain portability. By March 2024, data from LayerZero showed that over 40% of Gh0stly Gh0sts had been transferred at least once between chains, with some NFTs moving more than ten times as holders optimized for different market conditions or participation in chain-specific events.

The technical implementation of LayerZero’s protocol involves sophisticated mechanisms for ensuring message delivery and handling edge cases that could result in asset loss or duplication. The protocol employs a dual-validation system where both an oracle and a relayer must agree on the validity of cross-chain messages, creating redundancy that prevents single points of failure. This system handled over 2 million cross-chain NFT transfers by early 2025, processing approximately $500 million in NFT value across supported chains according to LayerZero Labs’ public metrics. The protocol’s approach to gas optimization has evolved significantly since launch, with version 2 reducing cross-chain transfer costs by an average of 60% through batching mechanisms and improved proof generation, making omnichain NFTs economically viable for lower-value collections.

Wormhole and Portal Bridge Solutions

Wormhole has established itself as a critical infrastructure provider in the cross-chain ecosystem, operating one of the highest-volume bridges for both tokens and NFTs across a diverse set of blockchains. The protocol’s guardian network, consisting of 19 validators including prominent organizations like Jump Crypto, FTX (prior to its collapse), and Certus One, provides the security backbone for cross-chain transfers. Wormhole’s approach to NFT bridging emphasizes speed and user experience, with most transfers completing in under three minutes, significantly faster than many competing solutions. The protocol’s architecture supports automatic metadata translation and storage redundancy, ensuring that NFT properties remain accessible even if original storage providers become unavailable.

The Portal Bridge, Wormhole’s user-facing interface for NFT transfers, has processed significant volumes since its launch, demonstrating the demand for user-friendly cross-chain solutions. In January 2024, the platform reported facilitating over 150,000 NFT transfers in a single month, with collections like Solana’s DeGods and y00ts utilizing the bridge for their migration to Ethereum and subsequent movements between chains. The DeGods migration in particular represented a landmark event in cross-chain NFT history, with over 10,000 NFTs successfully transferred from Solana to Ethereum in March 2023, maintaining all metadata and rarity attributes while adapting to Ethereum’s different technical standards. The migration’s success required extensive coordination between the project team, Wormhole developers, and marketplace platforms to ensure seamless functionality on the destination chain.

Wormhole’s NFT bridge implements sophisticated mechanisms for handling the differences between blockchain platforms, particularly the significant architectural differences between Solana and EVM-compatible chains. The protocol’s metadata translation layer converts between Solana’s account-based NFT model and Ethereum’s contract-based approach, preserving not just basic properties but also complex attributes like programmable royalties and dynamic metadata. This translation process involves multiple validation steps to ensure consistency, with the protocol maintaining a comprehensive mapping database that tracks the relationships between original and bridged assets. By December 2024, Wormhole’s system had successfully mapped over 500,000 unique NFT metadata structures across eight different blockchain networks, creating one of the most comprehensive cross-chain NFT databases in existence.

The security model of Wormhole has evolved significantly following the February 2022 exploit that resulted in a $326 million loss, though this primarily affected token bridges rather than NFT transfers. The protocol’s response to this incident included implementing additional validation layers, increasing guardian requirements, and introducing automatic circuit breakers that halt transfers if anomalous activity is detected. These improvements have been tested through subsequent high-volume events, including the migration of multiple major NFT projects and several chain-specific market disruptions. The protocol’s transparency reports, published quarterly since mid-2023, show that the enhanced security measures have prevented over $50 million in potentially fraudulent transfers while maintaining a 99.7% uptime for legitimate transactions.

IBC Protocol and Cosmos Ecosystem Standards

The Inter-Blockchain Communication (IBC) protocol represents a fundamentally different approach to cross-chain interoperability, designed from the ground up as a standard for sovereign blockchains to communicate without relying on trusted third parties. Within the Cosmos ecosystem, IBC has enabled a flourishing network of interconnected chains that can seamlessly transfer assets and data while maintaining their independence and unique characteristics. The protocol’s approach to NFT transfers, formalized in the ICS-721 specification, provides a standardized method for non-fungible tokens to move between IBC-enabled chains while preserving their complete metadata and functionality. This standardization has created a unified NFT ecosystem within Cosmos where assets can freely flow between chains like Stargaze, OmniFlix, and IRISnet without requiring chain-specific bridges or wrapper contracts.

The implementation of NFT transfers via IBC demonstrates the benefits of having interoperability built into the blockchain architecture rather than added through external bridges. Stargaze, the Cosmos ecosystem’s primary NFT marketplace chain, has leveraged IBC to create a multi-chain NFT economy where creators can mint on specialized chains optimized for their specific needs while still accessing liquidity across the entire Cosmos ecosystem. By January 2025, Stargaze reported that over 30% of NFT trades on their platform involved assets originally minted on other Cosmos chains, with seamless IBC transfers enabling arbitrage and collection building across the ecosystem. The BadKids NFT collection, launched simultaneously on Stargaze and Juno in September 2023, demonstrated this capability by allowing holders to move their NFTs between chains based on market conditions, with over 2,000 cross-chain transfers recorded in the first month alone.

The technical architecture of IBC’s NFT standard incorporates lessons learned from earlier cross-chain protocols while leveraging the unique capabilities of the Cosmos SDK. The protocol uses a combination of light clients and cryptographic proofs to verify the state of remote chains without requiring external validators or oracles, achieving trust-minimized transfers that rely only on the security of the participating blockchains. This approach eliminates many attack vectors associated with bridge protocols, though it requires chains to implement IBC compatibility at the protocol level. The packet-based communication model allows for sophisticated error handling and recovery mechanisms, with failed transfers automatically reverting without risk of asset loss. Real-world stress tests during NFT marketplace launches and high-volume trading periods have validated the protocol’s ability to handle thousands of concurrent transfers without congestion or security incidents.

The Cosmos ecosystem’s approach to cross-chain NFT standards extends beyond simple transfers to enable complex multi-chain applications. IRISnet’s implementation of NFT modules includes support for fractional ownership and dynamic metadata that can be updated based on cross-chain events, enabling use cases like tokenized real-world assets that require regular updates from oracle data. The Uptick Network, launched in October 2023, specialized in NFT infrastructure and processed over 1 million NFT-related IBC transactions in its first year, demonstrating the scalability of the IBC approach. These implementations showcase how standardized cross-chain protocols can enable innovation beyond what’s possible in isolated blockchain environments, with developers able to compose functionality across multiple specialized chains to create novel NFT applications.

The success of IBC within the Cosmos ecosystem has influenced broader discussions about blockchain interoperability standards, with several non-Cosmos chains exploring IBC integration to access this growing network. Polkadot’s development of XCM (Cross-Consensus Messaging) and Near Protocol’s Rainbow Bridge have incorporated concepts pioneered by IBC, while maintaining compatibility where possible to enable future interconnection. The standardization efforts led by the Interchain Foundation have produced comprehensive specifications that other ecosystems can adopt or adapt, potentially creating a future where IBC serves as a universal protocol for blockchain communication. This vision of standardized interoperability represents a significant evolution from the current landscape of proprietary bridges and isolated protocols, though achieving widespread adoption remains a significant challenge given the technical and political barriers to coordination across competing blockchain ecosystems.

Final Thoughts

The evolution of cross-chain NFT standards represents more than a technical achievement; it embodies a fundamental shift in how we conceptualize digital ownership and value exchange in an increasingly interconnected digital economy. The ability to move NFTs seamlessly between blockchains transforms them from isolated digital artifacts into truly portable assets that can adapt to changing technological landscapes and user preferences. This transformation has profound implications for creators, collectors, and developers who are no longer constrained by the limitations of individual blockchain platforms. The emergence of robust cross-chain protocols signals the maturation of blockchain technology from experimental networks to production-ready infrastructure capable of supporting complex, multi-chain applications that were previously impossible.

The democratization of access through cross-chain portability addresses one of the most significant barriers to mainstream NFT adoption by reducing the technical complexity and economic friction that have historically limited participation. When users can freely move their assets to chains with lower fees during periods of high congestion, or access marketplace liquidity across multiple networks, the NFT ecosystem becomes more inclusive and accessible to participants with varying technical expertise and economic resources. This accessibility extends to creators who can reach audiences across different blockchain communities without fragmenting their work or maintaining multiple platform presences. The economic efficiency gained through unified liquidity pools and cross-chain arbitrage opportunities benefits all market participants through tighter spreads, better price discovery, and reduced transaction costs.

The intersection of cross-chain NFT technology with broader trends in decentralized finance, gaming, and the metaverse creates compounding network effects that amplify the value of interoperability. As DeFi protocols increasingly accept NFTs as collateral, the ability to move these assets to chains with more favorable lending terms or deeper liquidity becomes economically significant. Gaming ecosystems that embrace cross-chain standards enable players to truly own their digital assets, carrying achievements and items between games and platforms in ways that mirror physical ownership. The vision of an open metaverse, where users control their digital identities and possessions independent of any single platform, depends fundamentally on the cross-chain portability standards being developed today.

The ongoing development of cross-chain NFT standards also raises important questions about governance, standardization, and the balance between innovation and stability. As protocols compete to become dominant standards, the risk of fragmentation remains, with different approaches potentially creating new forms of incompatibility. The challenge facing the blockchain industry is to achieve sufficient standardization to enable seamless interoperability while maintaining the permissionless innovation that has driven rapid advancement. This balance requires coordination between competing projects, thoughtful governance mechanisms that can evolve standards without creating disruption, and careful consideration of how technical decisions impact the broader ecosystem.

Looking forward, the trajectory of cross-chain NFT standards points toward a future where blockchain boundaries become increasingly invisible to end users, much as internet protocols abstract away the complexity of network routing and data transmission. The continued advancement of zero-knowledge proofs, light client technology, and consensus mechanisms promises even more efficient and secure methods for cross-chain communication. As these technologies mature and standardize, we can expect to see new categories of applications that leverage the unique capabilities of different blockchains while presenting unified experiences to users. The true measure of success for cross-chain NFT standards will not be the volume of assets transferred or the number of chains connected, but rather the degree to which they enable new forms of creativity, commerce, and community that transcend the limitations of isolated technological platforms.

FAQs

- What exactly is a cross-chain NFT and how does it differ from a regular NFT?

A cross-chain NFT is a non-fungible token designed to operate across multiple blockchain networks while maintaining its unique properties, metadata, and ownership history. Unlike regular NFTs that exist solely on the blockchain where they were created, cross-chain NFTs can move between different platforms through specialized protocols and standards, allowing owners to transfer their digital assets to whichever blockchain best suits their needs at any given time. - How long does it typically take to transfer an NFT from one blockchain to another?

Transfer times vary significantly depending on the protocol and blockchains involved, ranging from as fast as 30 seconds for some optimized bridges to over 30 minutes for more security-focused solutions. Most modern cross-chain protocols like LayerZero and Wormhole complete NFT transfers within 3-5 minutes under normal conditions, though periods of network congestion or additional security validations can extend these timeframes. - What are the risks involved in moving NFTs across different blockchains?

The primary risks include potential smart contract vulnerabilities in bridge protocols, the possibility of temporary or permanent asset loss if transfers fail, and the challenge of maintaining metadata integrity across different storage systems. Users should also be aware of the economic risks from bridge fees and gas costs on multiple chains, as well as the potential for receiving a wrapped or synthetic version of their NFT that might not have the same utility or value as the original. - How much does it cost to transfer NFTs between blockchains?

Costs typically include gas fees on both the source and destination chains plus bridge protocol fees, with total expenses ranging from a few dollars on low-cost chains to potentially hundreds of dollars when involving Ethereum during high congestion periods. Some protocols charge percentage-based fees on NFT value while others use flat rates, and users should factor in these costs when considering whether cross-chain transfers make economic sense for their specific situation. - Do NFTs maintain their value and functionality when moved to a different blockchain?

While cross-chain protocols strive to preserve all NFT properties, the practical reality depends on factors like marketplace support, smart contract compatibility, and community recognition on the destination chain. Well-implemented standards like ONFT maintain full functionality, but some features might not translate perfectly between chains with different technical architectures, potentially affecting utility or specialized functions tied to the original blockchain’s unique capabilities. - Which blockchains currently support cross-chain NFT transfers?

Major blockchains supporting cross-chain NFT transfers include Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, Solana, and the Cosmos ecosystem chains, though the specific pairs and protocols available vary. Support continues to expand rapidly, with new chains regularly adding compatibility through protocols like LayerZero, Wormhole, or IBC, though not all combinations of chains have direct bridges available. - Can gaming NFTs and their associated properties transfer between different blockchain games?

Gaming NFT interoperability remains limited primarily to basic asset transfers, with full functionality transfer depending on explicit support from game developers on both chains. While standards enable moving the NFT itself, game-specific attributes, levels, or abilities often require coordinated implementation between games to maintain functionality, making true gaming interoperability more complex than simple collectible transfers. - What happens if a cross-chain transfer fails or gets stuck?

Most modern protocols include automatic recovery mechanisms that either complete the transfer after delays or revert the transaction, returning the NFT to its original location. Users experiencing stuck transfers should first check the bridge protocol’s status page for known issues, then follow the specific protocol’s support procedures, which might include manual intervention for recovery, though reputable bridges maintain insurance funds or recovery processes for handling such situations. - How do cross-chain NFT standards handle royalties and creator fees?

Royalty handling varies significantly between protocols and destination chains, with some maintaining creator fee structures while others might not support them due to technical limitations or different marketplace standards. Creators should verify that their chosen cross-chain solution preserves royalty mechanisms on the destination chain, as this remains an area of active development with no universal standard yet established. - Will cross-chain NFT technology eventually make individual blockchains irrelevant?

Rather than making blockchains irrelevant, cross-chain technology enables specialization where different chains can focus on their unique strengths while remaining connected to the broader ecosystem. This interoperability allows blockchains to compete on features, performance, and cost while giving users the freedom to choose platforms based on their specific needs, ultimately strengthening the entire blockchain ecosystem through healthy competition and innovation.